Table of contents

- 1 Decoding the Forex Market: A Comprehensive Guide

- 1.1 What is the Forex Market?

- 1.2 Forex Market Explained

- 1.3 How Does Forex Trading Work?

- 1.4 Diving Deeper into Forex Trading

- 1.5 The Mechanics of the Forex Market

- 1.6 Risk Management and Analysis in Forex

- 1.7 Forex Trading vs Stock Market

- 1.8 How to Invest in Forex

- 1.9 Conclusion

- 1.10 Frequently Asked Questions (FAQ)

Decoding the Forex Market: A Comprehensive Guide

Welcome to the exciting world of Forex, also known as foreign exchange – the largest and most liquid financial market globally. If you’ve ever been curious about how global currencies are traded, you’ve come to the right place. This guide will demystify what is Forex and provide a detailed overview of its workings. Whether you’re a curious beginner or a seasoned trader, this guide offers valuable insights.

What is the Forex Market?

The Forex market is a decentralized, global marketplace where currencies are traded. Unlike stock markets with centralized exchanges, Forex operates 24 hours a day, five days a week through a network of banks, financial institutions, and individual traders. While large international banks and financial firms are the primary participants, the market is also accessible to retail traders who contribute significantly to the trading volume. Let’s explore in more detail what is currency trading and its mechanisms.

The daily trading volume in the Forex market averages around $7.5 trillion, making it the world’s largest financial market. This huge volume ensures high liquidity, allowing traders to easily buy and sell currencies with minimal price slippage. This liquidity is a major advantage compared to other markets, such as the stock market, where large trades can sometimes significantly impact prices.

Forex Market Explained

Think of the Forex market as a vast auction house where currency prices fluctuate based on supply and demand. In Forex trading, you’re essentially speculating on whether one currency’s value will increase or decrease against another. Currencies are traded in pairs. For example, the EUR/USD (Euro vs. US Dollar) pair shows how many U.S. dollars are needed to buy one euro. If the euro strengthens against the dollar, the EUR/USD value increases. This exchange rate is fundamental to understanding what is exchange rate in Forex?

For example, if the EUR/USD rate is 1.10, it means 1 euro can be exchanged for 1.10 US dollars. If the rate later increases to 1.12, it shows that the euro has strengthened against the dollar, and you would now need 1.12 US dollars to buy 1 euro. Traders aim to profit by accurately forecasting these rate changes.

EUR/USD currency pair

How Does Forex Trading Work?

Understanding how Forex trading works is crucial for getting started. Forex trading isn’t about buying and holding currencies; it’s about speculation. Traders use leverage to control large positions with small capital, amplifying both potential profits and losses. For example, with a 1:100 leverage ratio, a $1,000 investment can control a $100,000 position, allowing traders to benefit from small price movements.

However, leverage is a double-edged sword. While it can increase profits, it can also magnify losses. Therefore, traders must always implement effective risk management strategies, such as setting stop-loss orders to limit potential losses.

Forex Trading for Beginners

Forex trading for beginners can initially seem complex, but understanding a few key concepts can make it more approachable. Forex is always traded in pairs, such as GBP/USD or USD/JPY. These pairs are quoted with two prices: the bid (the price at which you can sell) and the ask (the price at which you can buy). The difference between these is known as the spread, which represents a broker’s profit margin. To start, find a reputable broker, open an account, fund it, and start trading on a demo account to familiarize yourself with the platform.

For instance, if the bid price of the GBP/USD pair is 1.2500 and the ask price is 1.2503, the spread is 0.0003. This means if you were to buy and immediately sell the pair, you would incur a small loss equal to the spread. The broker is effectively making the spread their profit from your trading activity.

Understanding Forex Pairs

Forex pairs are categorized into majors, minors, and exotics. Major pairs, such as EUR/USD, GBP/USD, and USD/JPY, involve the US dollar and are the most actively traded. Minor pairs, or crosses, do not include the US dollar but involve other major currencies like EUR/GBP or AUD/JPY. Exotic pairs involve a major currency paired with the currency of an emerging market, such as USD/TRY or EUR/ZAR. The choice of pairs often depends on the trader’s knowledge and risk tolerance. Understanding these pairs is crucial for Forex trading.

For example, the EUR/USD pair is highly liquid, meaning large volumes can be traded without significant price impact. Conversely, exotic pairs like USD/TRY (US Dollar/Turkish Lira) may have lower liquidity and higher volatility. Therefore, trading exotic pairs can be riskier and isn’t typically recommended for novice traders.

Diving Deeper into Forex Trading

Let’s delve into the different aspects of trading, from the types available to potential strategies.

Types of Forex Trading

There are various types of Forex trading, each suited to different trading styles and time horizons. Scalping involves extremely short trades, often lasting just a few minutes, to profit from small price movements. Day trading involves trading within the same day, closing all positions before the end of the trading day. Swing trading focuses on capturing larger price moves over several days or weeks. Position trading is a long-term approach where traders hold positions for months or even years. Each style requires a unique approach to how to trade Forex successfully.

- Scalping: Making many trades per day to profit from small price movements. Requires quick decision-making.

- Day Trading: Opening and closing positions within the same day. Requires active chart monitoring.

- Swing Trading: Holding positions for several days to weeks, aiming to capture larger price swings.

- Position Trading: Holding trades for months or even years, based on fundamental analysis.

Forex Trading Strategies

Effective Forex trading strategies are crucial for success. Some popular strategies include trend following, where traders follow the direction of a market trend; range trading, where traders focus on price movements within a defined range; and breakout trading, where traders buy or sell when a price breaks out of a pattern. Strategies can be based on technical analysis, fundamental analysis, or a combination of both, which we’ll discuss later.

- Trend Following: Identifying and following market trends, buying when prices trend upwards and selling when they trend downwards.

- Range Trading: Trading within a specific price range, aiming to profit when prices bounce off support and resistance.

- Breakout Trading: Trading when the price breaks outside of a range, indicating a potential trend.

Best Forex Brokers

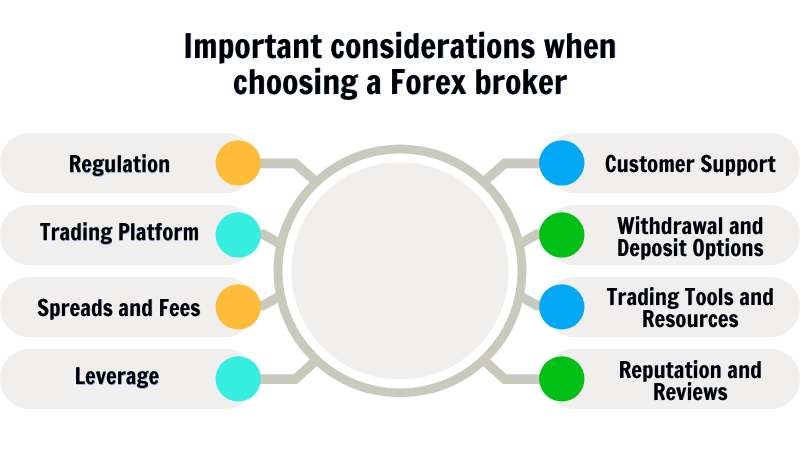

Selecting one of the best Forex brokers is a crucial first step. Consider factors such as regulation, trading platform, spreads, leverage, customer support, available tools, withdrawal and deposit options, and overall reliability. Reputable brokers are regulated by trusted authorities, ensuring the security of your funds. They offer multiple platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) and have competitive spreads and leverage options.

- Regulation: Ensure your broker is regulated by a reputable financial authority for security.

- Trading Platform: Choose user-friendly platforms with good tools. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and proprietary platforms.

- Spreads and Fees: Look for low spreads to increase profitability. Be aware of other trading and account maintenance fees.

- Leverage: Select brokers with flexible leverage options suitable for your strategy and risk tolerance.

- Customer Support: Choose brokers offering 24/5 or 24/7 support through live chat, phone, and email.

- Withdrawal and Deposit Options: Ensure brokers offer reliable methods for deposits and withdrawals with minimal fees.

- Trading Tools and Resources: Look for additional tools like economic calendars, market analysis, webinars, and educational resources.

- Reputation and Reviews: Research reviews to ensure a broker is reliable and transparent.

Choosing the right Forex broker lays the foundation for your trading journey. By carefully considering these factors, you can ensure a secure and efficient trading experience.

Important considerations when choosing a Forex broker.

Forex Trading Platforms

Forex trading platforms are software interfaces that allow you to place trades and monitor the market. Most brokers provide proprietary platforms along with popular ones like MT4 or cTrader. These platforms typically have charting tools, real-time quotes, and news feeds that are vital for effective trading. A platform’s user-friendliness and functionality are essential for both beginners and experienced traders.

Many platforms include technical indicators to form trading strategies, such as the Relative Strength Index, MACD, and various moving average tools.

The Mechanics of the Forex Market

Beyond basic trading concepts, it’s important to understand a few key mechanisms.

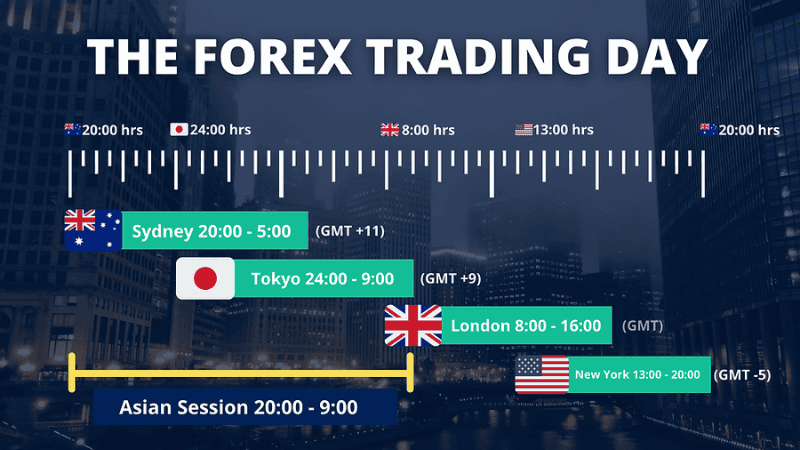

Forex Market Hours

One of Forex’s main advantages is that the market is open 24 hours a day during the week. However, trading volumes can vary significantly by time of day and session. The market operates across four major trading sessions: Sydney, Tokyo, London, and New York. The most active time is usually when the London and New York sessions overlap. Knowing the Forex market hours is vital for traders to plan their best trading times.

For example, the overlap between London and New York sessions, typically in the late afternoon GMT, usually sees the highest volume as both European and American traders are active. This period can provide the best chances for high liquidity and potential profit, but also carries greater risk.

The various market sessions and their overlap.

Forex Market Liquidity

Forex market liquidity refers to the ability to buy or sell currencies easily without significant price impact. The Forex market is the most liquid globally, with trillions of dollars traded daily. High liquidity ensures trades can be executed quickly and at fair prices. Major currency pairs like EUR/USD tend to be more liquid than exotic pairs, which can have higher spreads and price volatility.

For example, millions of dollars can be traded in the EUR/USD pair instantly without significantly impacting the price. On the other hand, trades in exotic currency pairs may not be as easily fulfilled or could see more price volatility. In general, the more liquid a currency pair, the easier it is to enter and exit trades.

Risk Management and Analysis in Forex

Effective risk management is the foundation of successful Forex trading. The Forex market offers significant opportunities, but also carries significant risks. To protect your capital and ensure long-term success, it’s vital to use robust risk management strategies. This involves understanding potential risks, taking preventive steps, and consistently analyzing market conditions to make informed decisions.

Forex Risk Management

Risk management in Forex involves techniques to minimize potential losses while maximizing profits. These methods protect your trading account from significant drawdowns and help you stay disciplined. Key components of Forex risk management include:

- Stop-Loss Orders: Automatically exit a trade when the price moves against you to a specified level. This protects your capital from substantial losses.

- Take-Profit Orders: Close a trade when it reaches a predetermined profit target, securing gains and preventing emotional decision-making.

- Position Sizing: Calculate the amount of capital to risk on a single trade, typically risking no more than 1-2% of your trading account. This helps preserve capital during losing streaks.

- Diversification: While challenging in Forex, spreading trades across different pairs can reduce exposure to risks associated with a single currency or economic event.

Practical Risk Management Tips

- Always use stop-loss orders to define the maximum amount you’re willing to lose per trade.

- Avoid overleveraging by using levels appropriate to your risk tolerance.

- Regularly review and adjust your risk management plan based on market conditions and trading performance.

- Maintain a trading journal to analyze past trades, identify patterns, and improve future decisions.

- Keep emotions in check and stick to your trading plan, even during market volatility.

By implementing these risk management techniques, you can navigate the Forex market with greater confidence and control. Successful trading is not only about maximizing profits, but also about protecting capital and achieving sustainable growth over time.

What Influences Forex Prices?

Many different economic and political factors affect what influences Forex prices. These include interest rate decisions, GDP data, employment numbers, and inflation figures. Political events like elections, trade deals, and geopolitical conflicts can also cause significant fluctuations. Expectations of traders regarding these factors are also crucial. Markets often react in anticipation of news, rather than the news itself.

For example, an unexpected interest rate hike by a central bank can increase the value of that country’s currency. Similarly, positive employment data signals a stronger economy, leading to an increase in currency value. Traders must be aware of the latest news and expectations to anticipate how the market might react.

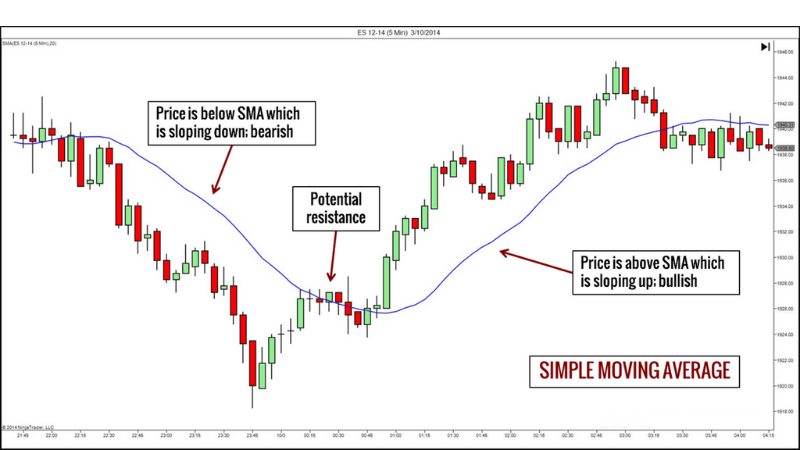

How to Use Technical Analysis in Forex

How to use technical analysis in Forex is a complex topic with an easy entry point. Technical analysis involves analyzing charts to identify patterns and trends to predict price movements. Common tools include trend lines, support and resistance levels, moving averages, Fibonacci retracements, and indicators like the RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence). This is the most common type of analysis used by retail traders.

- Trend Lines: Lines drawn on charts showing the direction of price movements.

- Support and Resistance Levels: Price levels where the price tends to stop and reverse. Support is where demand prevents further declines; resistance is where supply prevents further increases.

- Moving Averages: An indicator that smooths out price data by calculating an average price over a specific period.

- RSI and MACD: Technical indicators used to gauge momentum and identify potential buy or sell opportunities.

A chart with technical analysis indicators.

Fundamental Analysis in Forex

Fundamental analysis in Forex involves examining a country’s economic and political situation to determine its currency value. Factors include central bank policies, economic growth, employment figures, and government stability. Fundamental analysts try to understand the big picture and make long-term predictions. Fundamental and technical analysis are often used together for well-rounded predictions.

For example, an analyst might look at the central bank interest rate, inflation rate, and GDP of a country to determine the long-term strength of its currency. They would then determine if the economic data supports a long-term buy or sell opportunity for their desired currency.

Forex Trading vs Stock Market

While both involve trading financial assets, there are key differences between Forex vs stock market. Forex is mainly about trading currencies, while the stock market is about trading shares of company ownership. The stock market is generally more regulated and trades less frequently than the 24/5 Forex market. The stock market is also typically more suited to longer-term investments than Forex.

- Forex Market: Trades currency pairs, highly liquid, and operates 24/5. Generally higher risk.

- Stock Market: Trades ownership of companies, more regulated, trades during fixed hours. Generally lower risk.

How to Invest in Forex

Knowing how to get involved is the final step.

How to Invest in Forex

How to invest in Forex involves opening a trading account with a broker and funding it. Begin with a demo account to test your strategy without risking real money. After gaining confidence, switch to a live account and always practice risk management. Forex trading is not suited to all investors and carries significant risks, so proceed carefully.

First, research and choose a reputable broker. Next, open an account and start practicing in a demo environment. Once you are confident, start trading with a live account. Start with a small investment to test the waters and increase your investment slowly over time.

Forex Trading Tips

Here are some essential Forex trading tips for both new and experienced traders: start with a demo account, learn risk management, never trade more than you can afford to lose, choose a well-regulated broker, understand the platforms, be realistic about profits, continue learning, and do not be emotional when trading.

- Start with a demo account to practice without risking capital.

- Prioritize risk management. Set stop-losses, take profits, and risk an appropriate percentage of your account per trade.

- Choose a well-regulated broker to ensure the safety of your funds.

- Continue learning to improve and adapt your strategies.

- Avoid emotional decision-making and stick to your plan.

Conclusion

Understanding the Forex market is a journey requiring dedication, education, and practice. Knowing the main market mechanics is essential, whether one is interested in technical or fundamental analysis. Starting with a demo account is crucial for testing strategies. Forex trading is risky, but with research and risk management tools, you will be more prepared to start trading.

This guide has covered essential concepts of the Forex market, including its structure, operation, and strategies. Whether you’re just starting or looking to refine your skills, a solid understanding of these principles is fundamental to navigating the world of currency trading.

Frequently Asked Questions (FAQ)

What is the Forex market?

The Forex (foreign exchange) market is a global, decentralized marketplace where currencies are traded. It’s the largest and most liquid financial market, operating 24/5, involving banks, institutions, and individual traders exchanging currencies for various purposes, like commerce, investing, and hedging.

How does Forex trading work?

Forex trading involves buying and selling currency pairs (e.g., EUR/USD) based on predicted price changes. Traders profit from the difference between the buying and selling prices. Leverage can amplify gains and losses, making risk management crucial. Analysis of economic and political factors is key.

What are the main Forex trading strategies?

Common Forex strategies include trend following (capitalizing on market momentum), scalping (profiting from small price changes), day trading (short-term trades), and swing trading (holding positions for several days). Strategies often combine technical analysis (chart patterns) and fundamental analysis (economic indicators).

What is the best Forex trading platform?

The “best” platform depends on individual needs. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely popular for their robust charting, automated trading (Expert Advisors), and numerous indicators. cTrader is another strong contender, known for its depth of market (DOM) features. Consider your trading style and experience when selecting.

Pingback: MetaTrader 4 Review: The Ultimate Guide for Forex Traders - CoinFxPro

Pingback: Mastering the Forex Market: A Deep Dive into Major Pairs - CoinFxPro

Pingback: What is Netdania Charts? A Complete Guide for Forex Traders - CoinFxPro

Pingback: Quasimodo Forex Trading: A Reliable and Versatile Pattern

Pingback: Uncle Ted Forex: Exploring Proven Trading Strategies CoinFxPro Learn Forex

Pingback: Understanding Pips in Forex: A Trader's Essential Guide - CoinFxPro

Pingback: What is Ripple Cryptocurrency? Discover XRP’s Role in Finance

Pingback: Decoding EUR/USD: A Comprehensive Guide with MarketWatch

Pingback: Mastering Forex: A Guide to Currency Pairs CoinFxPro

Pingback: Best Forex Brokers for January 2025: A Comprehensive Guide - CoinFxPro

Pingback: The Professional Trader's Guide to Forex Risk Management - CoinFxPro

Pingback: What Is a Trading Strategy? A Deep Dive into Forex Trading - CoinFxPro