Table of contents

- 1 What is Ripple Cryptocurrency? Unveiling the Digital Asset XRP

- 1.1 What is Ripple Cryptocurrency?

- 1.2 The Genesis of Ripple: From Real-Time Gross Settlement to Crypto Innovation

- 1.3 Ripple vs. Bitcoin: Key Differences & Strategic Results

- 1.4 Benefits of XRP for the Financial Ecosystem Ripple Cryptocurrency

- 1.5 Ripple Use Cases in Finance: Transforming Cross-Border Payments and Remittances

- 1.6 RippleNet Network and Strategic Allies in Banks

- 1.7 Ripple XRP Technical Analysis: Market Overview, Price Predictions, and Investment Highlights

- 1.8 Ripple SEC Lawsuit, Legal Challenges, and the Crypto Regulatory Landscape

- 1.9 Data and Analytics: XRP Transaction Speed, Fees, and Adoption Statistics

- 1.10 The story of the future of Ripple in the crypto space: innovations and global impact

- 1.11 Conclusion: Ripple Cryptocurrency – A Key Player in the Digital Finance Revolution

- 1.12 Key Takeaways

- 1.13 FAQ

- 1.14 References and Further Reading

What is Ripple Cryptocurrency? Unveiling the Digital Asset XRP

Ripple cryptocurrency: what is it?—a constant question in the changing world of digital currencies, both for beginners and those who have long been inside the crypto. Unlike Bitcoin or Ethereum, Ripple (and its native cryptocurrency XRP) actually finds itself in a unique position within the blockchain and financial space. To answer the question of what Ripple cryptocurrency is, we need to go beyond the Python the first time and uncover its nature, look into its clearly different purpose, and figure out how it changes the way money moves around the world.

At heart, Ripple is a tech company focused on developing payment solutions for corporate members, not just a cryptocurrency. So, XRP is a digital token designed for use on RippleNet, Ripple’s payment network. This distinction is one that one must grasp. They’re used interchangeably at times, but XRP is actually the coin that powers this ecosystem; Ripple is the company.

This is an in-depth analysis of what Ripple cryptocurrency is, including its technology, applications, advantages, and drawbacks. We’ll explore its role in cross-border payments, compare it to other cryptocurrencies (namely Bitcoin), and examine how it may impact finance in the future. Join us to untangle the mess that makes up XRP and Ripple so that you can have a complete understanding of this exciting digital asset.

What is Ripple Cryptocurrency?

Ripple cryptocurrency, or XRP, is a digital asset created by the company Ripple Labs. It is designed to facilitate fast, low-cost international money transfers, primarily for use by banks and financial institutions. Unlike other cryptocurrencies, XRP focuses on streamlining global payment systems.

The Genesis of Ripple: From Real-Time Gross Settlement to Crypto Innovation

To know its root is to know how to fully enjoy what Ripple cryptocurrency is today. Ripple did not start as a cryptocurrency; originally, it was an initiative to build a great payment platform. In 2004, Ryan Fugger developed Ripplepay, the concept of what we now consider Ripple. But Jed McCaleb and Chris Larsen created OpenCoin, which later morphed into Ripple Labs in 2012, taking Fugger’s idea to a completely new level. [1]

Intended to be quicker, cheaper, and more secure than traditional banking, they wanted to create a real-time gross settlement system (RTGS), currency exchange, and remittance networks. This ambition diverged from Bitcoin’s original purpose, which was a decentralized alternative to fiat currency. Ripple was never intended to be a public enemy, but a helpful tool for financial institutions. This difference at the most basic level is what helps you to comprehend what Ripple really is in the world of crypto.

The construction of XRP was imperative for this vision. Entailed to be a bridge currency, XRP tries to facilitate faster and more efficient cross-border trade. In contrast to Bitcoin, which relies upon a proof-of-work consensus system, Ripple benefits from a distinctive consensus process considerably faster and considerably more energy-efficient. This technological difference is what provides the practical use case for Ripple cryptocurrencies.

Ripple XRP Blockchain and Distributed Ledger Technology (DLT)

What is Ripple cryptocurrency, and how can the fundamental technology behind it be quite helpful here? Ripple’s solution is more accurately called distributed ledger technology (DLT), but its name sometimes is blockchain. The Ripple XRP blockchain is, to be more exact, a decentralized distributed cryptographic ledger. Just to be clear, it’s not a normal blockchain like Bitcoin or Ethereum. Instead, it is an open-source, permissionless DLT.

Ripple works through a network of independent validating servers that are constantly cross-checking transaction records. This consensus method is called the Ripple Protocol Consensus Algorithm, and it allows transactions to be settled in just seconds. Especially for the financial sector requiring rapid transaction confirmations, Ripple’s one-second transaction time is a clear asset compared to Bitcoin and Ethereum’s average transaction time of 10 minutes.

The XRP Ledger is maintained by a node network that anyone can set up. Ripple, on the other hand, has a specific set of validator nodes that are to be used, called Unique Node Lists (UNLs). This feature is key for Ripple’s compliance with global rules and functioning within a current financial framework.

This unique DLT design sets the stage for understanding Ripple ledger technology and its efficiency versus traditional blockchain platforms. Built with scalability, speed, and cost in mind—all essential for processing large volumes of overseas remittances—it’s also fairly interoperable.

Ripple vs. Bitcoin: Key Differences & Strategic Results

To truly appreciate what Ripple cryptocurrency is and what it represents in the cryptocurrency ecosystem, one has to directly compare Ripple to Bitcoin. Although they are cryptocurrencies, their uses and the ideas that run behind are different.

Intended as a peer-to-peer digital cash system that wanted to avoid traditional financial institutions, Bitcoin’s main goals were decentralization and store of value. Ripple is designed to enhance and streamline existing financial systems already in use with banks and payment providers. This fundamental difference in philosophy informs their technology, application cases, and regulatory challenges.

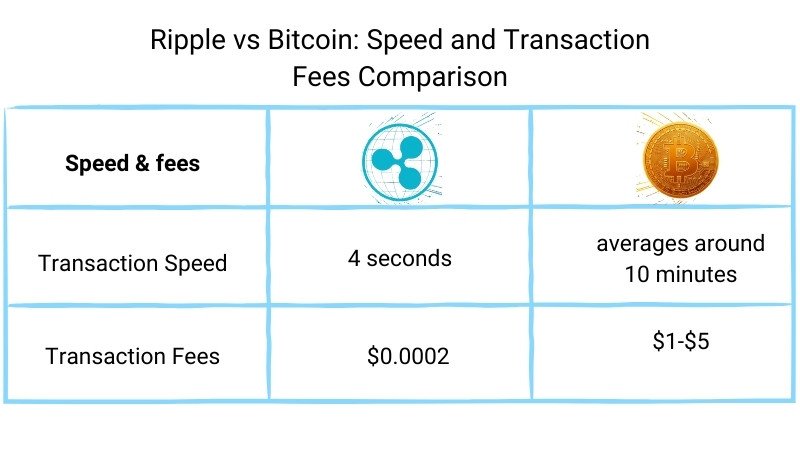

Here’s a table highlighting key differences:

| Feature | Ripple (XRP) | Bitcoin (BTC) |

|---|---|---|

| Purpose | Facilitate global payments for financial institutions | Decentralized peer-to-peer digital cash and store of value |

| Transaction Speed | ~4 seconds | ~10 minutes (average) |

| Transaction Cost | Very low (~$0.0002) | Higher and variable (can be several dollars) |

| Consensus Mechanism | Ripple Protocol Consensus Algorithm | Proof-of-Work |

| Supply | 100 billion XRP (pre-mined) | 21 million BTC (mined over time) |

| Target Audience | Banks, payment processors, financial institutions | Individuals, businesses, investors |

| Regulatory Stance | Working towards regulatory compliance, ongoing SEC lawsuit | Navigating regulatory landscapes, varied global acceptance |

Though Bitcoin pitches decentralization and aims to function as a store of value (and alternate currency), Ripple focuses on efficiency, speed, and affordability in international transfers within the present financial system. Such strategic differentiation is crucial no matter who the citizens are who form coins in both the crypto and financial worlds.

Benefits of XRP for the Financial Ecosystem Ripple Cryptocurrency

Ripple coins offer numerous advantages that result directly from their design and objective. XRP provides several advantages compared to traditional global payment and financial transaction systems in particular and even some other cryptocurrencies. Understanding these benefits helps to know why banks adopt Ripple technology.

- Speed: As mentioned above, when compared in terms of speed of transaction through Ripple, the settlement period is ~4 seconds, much quicker than SWIFT (days) or even Bitcoin (minutes). This speed is crucial for businesses that require quick finality of transactions.

- Low Cost: XRP fees vs Bitcoin fees: It was shocking to see fewer XRP fees compared to Bitcoin fees. XRP enjoys cheap transactions, usually costing fractions of a cent; Bitcoin fees can be on the order of many dollars, especially in a clogged network. This cost-effectiveness is a key draw for financial institutions handling large transaction volumes.

- Scalability: Since RippleNet and the XRP Ledger are designed to handle a high volume of transactions, they are highly scalable for global payment requirements. Even heavily loaded, Ripple transaction speed comparison remains consistently fast.

- Bridge Currency: As a bridge currency, XRP eliminates the need for pre-funded accounts in most other currencies. Formally known as xRapid, this ripple’s On-Demand Liquidity (ODL) enables financial institutions to obtain XRP on demand, thus reducing transaction costs and enhancing efficiency.

- Transparency and Traceability: XRP Ledger, on the other hand, provides both anonymity and transparency by allowing transactions to be followed, benefiting compliance and audit requirements.

These benefits of Ripple cryptocurrency position it as a powerful tool for modernizing global financial transactions, particularly in the realm of cross-border payments and remittances.

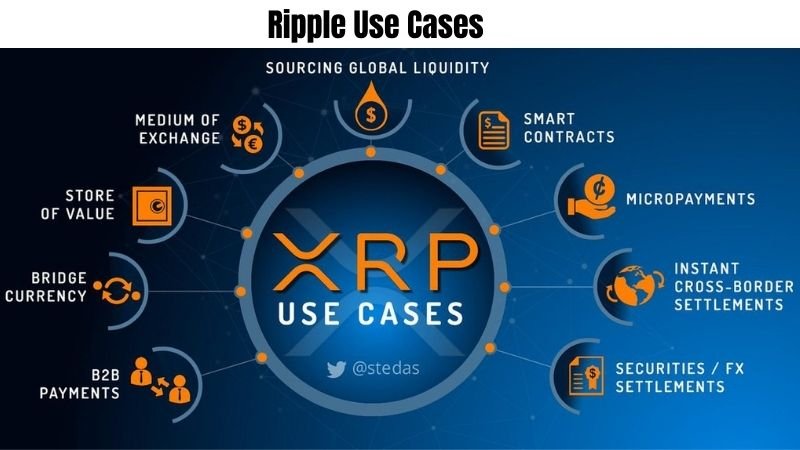

Ripple Use Cases in Finance: Transforming Cross-Border Payments and Remittances

The practical applications of what is Ripple cryptocurrency and its underlying technology are vast, particularly in the financial sector. Ripple use cases in finance are primarily focused on streamlining and enhancing cross-border payments and remittances, areas where traditional systems are often slow and expensive. Ripple’s role in cross-border payments is transformative.

- Cross-Border Payments: The main use case of Ripples is cross-border payments. RippleNet and XRP allow financial institutions to process foreign payments much more quickly and at a fraction of the cost of traditional systems, such as SWIFT. Ripple’s on-demand liquidity (ODL) exploits this process even more efficiently by eliminating pre-funding restrictions.

- Remittances: Ripple is very dramatically disrupting these payments. Remittance systems were slow and costly for migrant workers sending money home. By offering a quicker, cheaper, more transparent alternative, Ripple has a big impact on everyone and families that rely on these transactions.

- Interbank Settlements: RippleNet enables banks—both domestic and international—to settle transactions among one another efficiently and almost instantaneously. This reduces running costs and improves efficiency.

- Intra-company Transfers: RippleNet enables multinational corporations to transfer internal funds between branches and subsidiaries globally, rapidly, and inexpensively.

This is where Ripple applications in finance are far-reaching and highlights its practical significance to massively revolutionize the global financial system. The focus on efficiency and reductions in costs largely underpins Ripple’s connections with banks and monetary institutions.

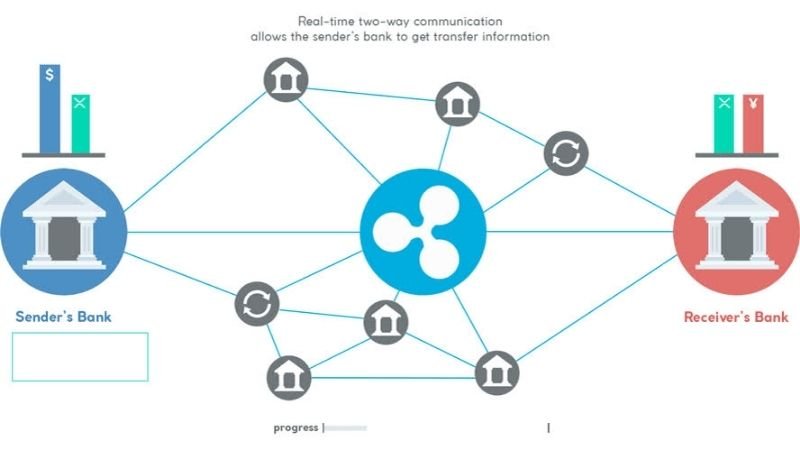

RippleNet Network and Strategic Allies in Banks

Ripple’s real strength lies in its broad network—RippleNet—not XRP. Powered by Ripple’s technology, RippleNet is a global network of financial institutions, payment processors, and others that enable seamless cross-border money transfers. Its approach and acceptance revolve mainly around Ripple projects with banks.

Below are the several reasons why banks trust the Ripple technology:

- Proven Technology: Ripple’s technology has been tested and proven in real-world applications with numerous financial institutions globally.

- Regulatory Focus: Ripple’s been very active in seeking clarity from regulators and strives to ensure compliance with rules around the world, which is a prerequisite for banks operating in a heavily regulated environment. World Standards—Ripple Adherence: Ripple is the top priority.

- Cost and Efficiency Savings: The tangible benefits of lower transaction costs and shorter settlement times are stark for banks attempting to optimize their operations and improve customer service.

- Existing Infrastructure Compatibility: Ripple’s technologies are designed to integrate with existing banking networks, allowing for easier transition and less disruption compared to completely new systems.

This is just one of many high-profile Ripple relationships with banks and financial institutions, others being Santander, American Express, and SBI. Remit to name just a few. Such partnerships exemplify how the industry realizes Ripple’s potential to revolutionize cross-border payments. The growth in the RippleNet network is proof of its value proposition and its place in the international banking sector.

Ripple XRP Technical Analysis: Market Overview, Price Predictions, and Investment Highlights

Investing in Ripple XRP If you are like anyone looking into purchasing some form of cryptocurrency, investing in XRP (the currency for Ripple) will be a highly argued topic. However, investing wisely is not only based on knowing Ripple cryptocurrency trends and XRP price predictions but also on conducting thorough Ripple market analysis in 2025 (and beyond).

Is a good investment Ripple? It’s a complicated question that has no absolute answer and largely depends on individual investment goals, risk appetites, and market conditions. These are some elements that should help you in thinking:

- Market Position: Ripple and XRP are consistently ranked among the top cryptocurrencies by market capitalization, and in the crypto space, they are already somewhat mainstream (at least more mainstream than, say, the Matic token). One key metric to monitor is Ripple’s market capitalization.

- Adoption and Partnerships: The value of XRP can increase as the RippleNet network expands and as new Ripple deals with banks are created.

- Regulatory Landscape: Ongoing updates in the Ripple SEC lawsuit and broader regulation rules in the XRP cryptocurrency space are substantially affecting investor mood and XRP price. It is absolutely crucial to solve these legal troubles Ripple is experiencing.

- Technological Advantages: SES faster, cheaper, and efficient value propositions for XRP will continue to correlate with future adoption and worth.

- Market Sentiment and Crypto Trends: XRP price is significantly affected by general trends on Ripple Bitcoin charts as well as more widescale crypto market cycles. There is also the wider impact Ripple has made on crypto being accepted.

Do your own study, check out market statistics, and decide the possible components with the dangerous ones before making investments. Ripple XRP. The spread of its 2025 predictions for the ripple industry also serves to illustrate the speculative nature of bitcoin data. Consult a financial adviser before making any investment decisions. You may also want to learn the art of starting bitcoin trading.

Ripple SEC Lawsuit, Legal Challenges, and the Crypto Regulatory Landscape

Most of the Ripple story is based on the regulatory aspect, particularly in terms of the regular updates on Ripple SEC lawsuits. To comprehend the current status and future prospects of XRP, it is essential to identify the legal challenges Ripple is combating against. XRP Cryptographic Laws are of Interest Worldwide

The U.S. Securities and Exchange Commission (SEC) sued Ripple Labs in December 2020, alleging XRP had been marketed and sold as an unregistered security. This makes it quite an important but changing part of any crypto portfolio and has affected the price and market attitude towards XRP a lot. The case raises broader questions about XRP coin regulation and digital asset classification.

Ripple’s compliance with global regulation has been the company’s number one concern, according to them. They argue XRP is money, not a security, and have been engaging with regulators globally. In conclusion, the implications of the Ripple SEC case updates could dramatically influence Ripple and XRP, as well as the broader cryptocurrency industry regarding regulatory clarity and precedent.

It navigates the legal hurdles faced by Ripple on an ongoing basis, and both financial institutions and the crypto community continue by the progress in the Ripple SEC complaint. The verdict will influence Ripple’s fate in terms of the crypto space and its ability to operate and scale its products overall.

Data and Analytics: XRP Transaction Speed, Fees, and Adoption Statistics

And a review of the key statistics and analytics points, focus on Ripple transaction speed comparison, Bitcoin fees vs XRP costs, and XRP adoption statistics can illuminate some of the characteristics of what is Ripple cryptocurrency, and XRP.

- Transaction Speed: A Ripple transaction speed comparison repeatedly slots settlement times in at around 4 seconds. In comparison, Bitcoin takes an average of around 10 minutes, while Ethereum’s time to finality can vary from minutes to hours depending on transactions at the time.

- Transaction Fees: XRP fees compared against Bitcoin fees are quite different. The average XRP transaction fee is a very tiny $0.0002 or less. While that varies significantly, bitcoin fees are on average much greater—on average between a few dollars and, during peak times, over $5. [3]

- Adoption metrics: Since XRP adoption data remains private and is not completely publicly shared, we can see that Ripple has already partnered with hundreds of financial institutions around the globe. Ripple is driving crypto adoption—particularly among financial institutions—as evidenced by the growing RippleNet network and increasing interest from banks and payment companies. You can also learn here how to buy cryptocurrencies.

- Market Capitalization: Ripple XRP’s market cap goes up and down with market sentiment but sports a market cap reflective of great market interest and investment in XRP (XRP). Market Supply: XRP fractionalizes units down to six decimal places.

As per these statistics and analytics points, XRP and Ripple’s technologies can win the operational argument for transactions occurring faster, cheaper, and more scalably, presenting a tangible alternative for financial transactions worldwide. These indices are studied to have an analysis on the actual power and potential of what is ripple cryptocurrency.

The story of the future of Ripple in the crypto space: innovations and global impact

Overall, Ripple is still pretty hot and can even seem to have a dynamic/hot future in the crypto scene. Despite legal challenges for Ripple, the underlying technology and demand for fast global payment solutions position Ripple for continued relevance and growth. The impact of Ripple on crypto adoption—particularly in the institutional space—will likely be magnified.

Why is Ripple different? Its focus on working with existing financial infrastructure rather than entirely disrupting it could give it a long-term strategic edge. Regulatory fundamentals are evolving and growing, making this an important differentiator later on with Ripple following global standards.

The narrative has been how Ripple is transforming cross-border payments and remittances. There is tremendous opportunity for further innovation and growth within the RippleNet ecosystem. Whether through new partnerships, technological advancements, or resolution of regulatory clarity, Ripple’s future in the cryptocurrency space is something to watch. Fueled by technology such as Ripple and XRP, the vision of smoother, less expensive, and more available global finance remains one of the most effective and impactful forces influencing the twenty-first century.

Conclusion: Ripple Cryptocurrency – A Key Player in the Digital Finance Revolution

In summary, Ripple cryptocurrency is much more than a digital asset; it is a complete technology solution designed to revolutionize world banking. Ripple has consistently pushed the boundaries of financial technology, from its original RTGS (real-time gross settlement) project to its current status as the leading provider of cross-border payment solutions.

We have explored various aspects of the Ripple XRP blockchain and its distributed ledger technology (DLT), compared it with Bitcoin, and discussed different benefits of Ripple coin. Over time we have seen ripple use cases in finance, with a particular focus on the transforming role of ripple in cross-border payments and remittances, and we have highlighted the significance of the rippleNet network and strategic ripple bank partnerships.

We considered the legal landscape and ongoing Ripple SEC case, analyzed key data and analytics demonstrating XRP efficiency and performance, and discussed the investment aspects of buying Ripple XRP. Finally, we reclined into the positive assurance of Ripple’s crypto-future, acknowledging its potential for continued innovation as well as its international presence.

What sets Ripple apart from the others is that any person attempting to understand the evolving landscape of digital finance would first need to understand who passes rely on Ripple technology. There still are hurdles, especially in the regulatory areas, but Ripple’s vision and tech firepower put it in a major position to shape the flow of money and world payments. As its impact on crypto adoption continues to strengthen, Ripple will undoubtedly remain a colossus of the ongoing digital revolution.

Key Takeaways

- Ripple (XRP) is designed for fast, low-cost international payments, targeting financial institutions.

- Ripple’s technology is a DLT, not a traditional blockchain, focusing on speed and scalability.

- Key advantages include near-instant transaction speed and very low fees compared to Bitcoin and traditional systems.

- RippleNet’s network and strategic partnerships are crucial to its adoption by banks.

- The ongoing SEC lawsuit is a significant factor affecting Ripple’s future.

FAQ

What is Ripple cryptocurrency?

How does Ripple differ from Bitcoin?

But Bitcoin is a decentralized digital currency focused on a store of value, while Ripple is best targeted at allowing financial institutions to make fast and low-cost payments. Ripple utilizes the XRP Ledger, and Bitcoin relies on a proof-of-work blockchain.

Is Ripple cryptocurrency a good investment?

Ripple investing depends on market behavior and adoption among financial institutions and regulations. Of course, while XRP is a relatively good payment solution, keep in mind the legal uncertainty and price volatility before investing in it.

What are Ripple’s key benefits for financial institutions?

Ripple is very useful to banks and payment service providers for very instant transaction settlement (~4 seconds), low costs (~$0.0002/transaction), excellent scalability, and the ability to link multiple fiat currencies.

What is Ripple’s SEC complaint about?

As per the SEC case against Ripple, XRP was sold as an unregistered security. The judicial outcome will influence Ripple’s operations and perhaps also cryptocurrency regulations more broadly.

Pingback: What is Blockchain Technology? A Comprehensive Guide - CoinFxPro

Pingback: History of Cryptocurrency: From Concept to Global Adoption

Pingback: Understanding Cryptocurrency Regulations and Their Importance