Table of contents

- 1 What Causes Crypto to Go Up and Down? An In-Depth Analysis

- 1.1 Availability and Demand

- 1.2 Market Sentiment and Investor Behavior

- 1.3 Macroeconomic Factors

- 1.4 Regulatory News and Government Policies

- 1.5 Technological Developments and Network Upgrades

- 1.6 Whale Movements and Market Manipulation

- 1.7 Security Concerns and Hacks

- 1.8 The Role of Speculation and Media Influence

- 1.9 Conclusion

- 1.10 FAQ – Frequently Asked Questions

- 1.11 Further Reading:

- 1.12 References & Sources

What Causes Crypto to Go Up and Down? An In-Depth Analysis

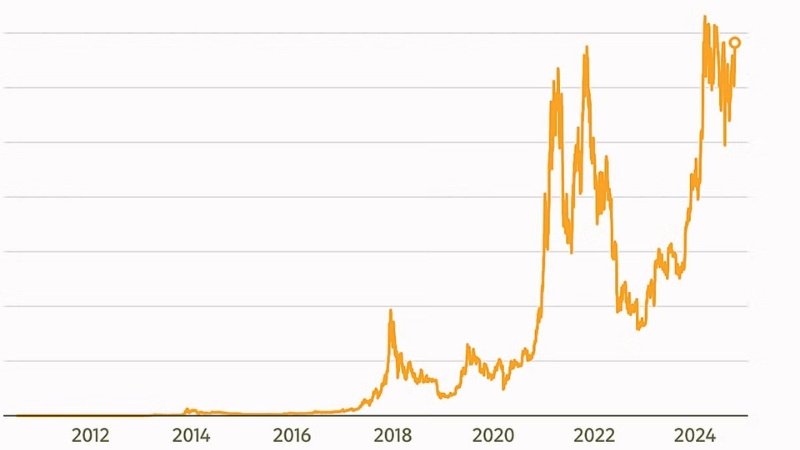

The prices of cryptocurrencies are highly volatile, and major price fluctuations occur in an hour or even minute. This built-in uncertainty raises a key question: what causes crypto to go up and down? Unlike traditional financial markets, where the rules are set and there’s a central authority that governs the whole aspect of it, cryptocurrencies operate in a decentralized and highly speculative environment. That is to say, they are sensitive to susceptible to a unique set of influencing factors.

What Causes Crypto to Go Up and Down? These key cryptocurrency price drivers include supply/demand, market sentiment (FOMO and FUD), regulatory news, macroeconomics (interest rates, inflation), technological progress (network upgrades), whale activity, network security incidents, and media coverage. It is the interplay between these forces that causes the volatility of the crypto market—not any single one of them.

There are many interconnected reasons why the price in the crypto market justifies the often dramatic price movements. Some of them are fundamental economic principles such as supply and demand, the sometimes illogical shifts in investor sentiment, the broader macroeconomic picture, the evolving regulatory environment, large trades made by larger holders called “whales,” such fears of security, and the quarterly results of news in the media also have a significant impact on trends in the market.

This article details the key factors in very broad terms that cause crypto to go up and down. We’ll give a closer look at each of these risk factors with real-world data, trusted research studies, and expert opinions to support our findings. Now the reason we’re here is to help you to understand the forces that are at play in this fast-moving market. Read our post, What Is Cryptocurrency? to understand what it is about.

Availability and Demand

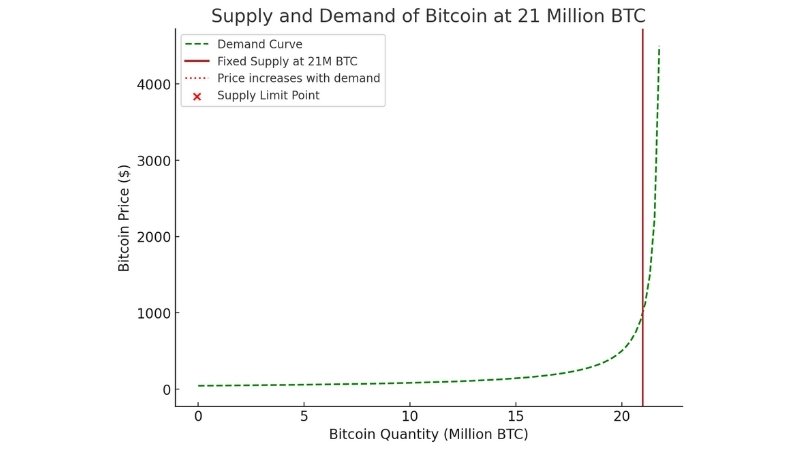

Just like it does on the values of other assets, one of the most basic ideas in economics—the law of supply and demand—directly and powerfully affects the value of cryptocurrencies. The market value of a cryptocurrency depends on its interaction with the demand for it and its accessible supply.

Restricted Availability

Most famously, Bitcoin, among many cryptocurrencies, is built with a predefined maximum supply. What is Bitcoin? One hard cap for Bitcoin, for example, is 21 million coins. This shortage is a fundamental characteristic that contrasts dramatically with fiat money, which central banks can create if they so want. All else being equal, the circulating quantity available for purchase declines as more investors buy and hang onto BTC, hence driving upward pressure on the price.

Important events on the protocol of a cryptocurrency, such as “halved Bitcoin,” impact supply even more. The incentive paid to Bitcoin miners for validating transactions is roughly half every four years. This programmable slowing down of the rate of fresh Bitcoin production so limits the incoming supply. Halving events have historically usually been accompanied by positive developments since the limited supply meets either steady or rising demand.

Growing Demand Elements

Demand for cryptocurrencies is motivated by several elements, mostly classified as:

Demand has been driven in great part by institutional investors joining the crypto market. Two such companies are MicroStrategy and Tesla, adding Bitcoin to their balance sheets. These big acquisitions inspire more institutional involvement and indicate confidence in the asset class.

Development in Crypto Payment Solutions: The more cryptocurrencies are included in popular payment systems, the more their accessibility and value improve. Companies like PayPal and Visa allowing crypto payments increase demand and widen the customer base.

Individual investors, especially in times of notable price rises (bull runs), greatly influence demand. Often driving fast purchase activity is the fear of missing out (FOMO).

Key Takeaways:

- Cryptocurrency prices are primarily driven by the fundamental economic principle of supply and demand.

- Limited supply, as seen in Bitcoin’s 21 million coin cap, can create upward price pressure when demand increases.

- Demand is influenced by institutional adoption, payment solution integration, and retail investor interest.

Market Sentiment and Investor Behavior

You know, market sentiment—it’s kind of like the collective emotions & attitudes of investors. This plays a BIG and quite often jumpy role in those cryptocurrency price fluctuations. With the highly speculative crypto market, it’s super sensitive to any shifts in investor confidence. One popular way to measure this vibe is by using the “Fear and Greed Index.” It gauges the market’s mood on a scale from “Extreme Fear” to “Extreme Greed.” This index is like a contrarian indicator sometimes, hinting at potential market tops or bottoms.

The Role of Social Media and Hype

Let’s talk about social media now. It’s got a HUGE influence on the crypto market. Influencers, big names, and online communities—they can really crank up or dampen down sentiment fast. For instance, when Elon Musk tweets, it’s been known to cause hefty price swings in Bitcoin & Dogecoin. That’s just one example of how powerful a single strong voice can be. (Source: CoinDesk)

Viral trends spread like wildfire on platforms such as Reddit. Communities like r/WallStreetBets & r/CryptoMoonshots can spark speculative price spikes. They often target specific cryptocurrencies, creating intense (though pretty short-lived) buying pressure.

FOMO (Fear of Missing Out) & FUD (Fear, Uncertainty, Doubt)

There are these two major psychological forces—FOMO & FUD—that just hang around the crypto market:

- FOMO (Fear of Missing Out): This drives those quick price hikes as investors scramble to nab an asset that’s rapidly rising in value, afraid they’ll miss out on gains. Look at the 2021 crypto bull run—Bitcoin hit an all-time high near $69,000, thanks mostly to FOMO.

- FUD (Fear, Uncertainty, Doubt): On the flip side, Fear, Uncertainty, Doubt (that’s FUD) can spur significant sell-offs. Bad news or rumors or even worries about regulations spark fear & uncertainty, pushing investors to offload their holdings fast. Remember the 2022 collapse of Terra (LUNA)? It wiped out billions in market value! That was a stark example of FUD’s destructive potential. (Source: Bloomberg)

Macroeconomic Factors

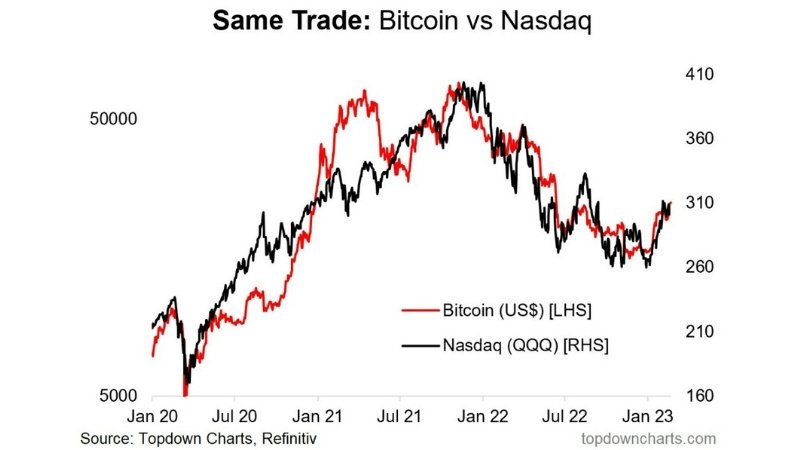

Cryptocurrency markets definitely don’t operate all by themselves. Nope, they’re swayed a lot by the big-picture economic stuff happening around us. Things like global economic conditions, what central banks are doing with interest rates, and inflation numbers—all these factors can change how much risk investors are willing to take & ultimately shake up crypto prices.

Interest Rates & Inflation

What central banks decide on interest rates? Oh, it matters a lot for crypto land. If they crank up rates, like the Federal Reserve did in 2022, folks usually get a bit scared of putting money in risky stuff (such as cryptocurrencies) because safer bets like bonds start looking good. The catch is, Bitcoin is sometimes seen as a way to fight inflation. During high inflation, some people think of it as a place to park cash safely since it’s like “digital gold.” They hope it saves them from their money buying less & less stuff. There was a time this thinking sent Bitcoin prices flying high. But hey! Lots of people argue about this and say Bitcoin doesn’t always behave how folks expect when inflation’s raging.

Stock Market Correlation

Lately, we’re seeing more connection between how cryptocurrencies and regular stock markets behave, especially tech stocks (think NASDAQ). What does this mean? Well, when the stock market takes a nosedive, crypto prices tend to slide down too since everyone gets nervous & cuts down risky investments. Want to know more about market slumps? Check out our piece on the cryptocurrency market crash. According to reports like those from CoinMetrics, in 2022, we saw Bitcoin’s link with the S&P 500 hit a 0.64 level, showing they moved in sync. (Remember, a correlation of 1 means they move perfectly together, -1 means they move opposite ways, & zero means no link at all.)

Key Takeaways:

- Macroeconomic factors, such as interest rates and inflation, significantly impact cryptocurrency prices.

- Higher interest rates often reduce investor appetite for risk assets like cryptocurrencies.

- A growing correlation exists between crypto prices and the performance of traditional stock markets.

Regulatory News and Government Policies

The world of cryptocurrency is ever-changing, especially when it comes to regulations. Government moves—or even just whispers of them—can really shake up prices. Without a global set of rules, there’s a lot of guessing & nervousness around regulatory news. To keep in the loop, you might want to look into cryptocurrency regulations.

Positive Regulation

Clear rules & good news in the regulatory world can boost institutional interest, making prices rise. Say, if the Securities and Exchange Commission (SEC) in the U.S. OKs Bitcoin ETFs, that would probably be seen as a big win, likely opening doors for more institutional cash to flow in.

When El Salvador decided to embrace Bitcoin as legal money back in 2021, it kicked off a quick price hike. This showed just how much government support can matter, though we’re still figuring out what it means in the long run.

Negative Regulation

On the flip side, tough regulations & government crackdowns can really hit the market hard. Take China’s 2021 ban on cryptocurrency mining—it sparked a big crash as miners had to either stop or pack up and move elsewhere. This action cut down a huge chunk of Bitcoin’s processing power.

Legal skirmishes by regulatory bodies—like when the SEC went after big shots like Binance & Ripple (related to XRP) in 2023—often stir up short-lived market freak-outs and price slumps. Investors scramble because of all the uncertainty and what’s at stake. (Source: CoinDesk)

Technological Developments and Network Upgrades

Cryptocurrency stuff is always changing, right? The tech is getting better, too. When a network does a big update or something new comes along, it can make investors feel all kinds of ways & push prices up or down. Curious about how all this works? Check out: What’s blockchain technology, anyway?

Now, take Ethereum switching to proof-of-stake in “The Merge” back in 2022. Big deal! This change meant Ethereum used way less energy. Lots of folks thought this was awesome, so ETH prices went up before and after that happened.

Then there was the Bitcoin Taproot upgrade in 2021. Maybe it wasn’t as wild as Ethereum’s thing, but it still helped. It made Bitcoin smarter with contracts & better with privacy. This put a spring in BTC investors’ steps.

Key Takeaways:

- Technological developments and network upgrades can significantly impact cryptocurrency prices.

- Major upgrades, like Ethereum’s “Merge,” can lead to increased investor confidence and price appreciation.

- Even smaller upgrades, like Bitcoin’s Taproot, can positively influence market sentiment.

Whale Movements and Market Manipulation

Cryptocurrency markets are kind of wild. ‘Cause they’re decentralized, that’s a big word for “not controlled by one place,” & they often have a few folks holding lots and lots of the stuff. We call these big holders “whales.” Think about it: they really can wiggle the market around, kind of like shaking a big jar of jellybeans. When they decide to buy or sell loads of bitcoin, it pushes prices up or down—a lot!

Take this, for instance: Imagine one big Bitcoin whale decides to move 20,000 BTC. Yeah, that’s huge! Depending on the market price, that’s worth a ton of money—like billions sometimes. This big move can make the price jump or drop pretty fast. And then what happens? Others spot it & start reacting. Some might sell quickly (afraid prices will fall), while others might buy more (hoping prices will soar).

Now, here’s the tricky part—while we can see these whale moves because blockchains show everything, the reasons behind them? Not always easy to figure out. So maybe it’s a sale… or maybe it’s just moving some coins around from one wallet to another (maybe a safety thing or just organization). This fuzziness makes everyone a bit nervous about what’ll happen next!

Security Concerns and Hacks

Let’s talk about the security side of cryptocurrency exchanges and platforms. It matters a whole lot! Big-time hacks can really mess things up, sending investors into a panic. When people lose trust, they start selling like crazy, which isn’t good for prices at all. So picking a trusty exchange? That’s super, super important. You might want to look into some options over here: Top Crypto Exchanges & Apps.

In the past, there’ve been some pretty big hacks that did a number on the market. Remember the Mt. Gox hack back in 2014? About $460 million in Bitcoin vanished into thin air. That one caused the exchange to crash and kept things in the red for quite some time. Fast forward to 2022, FTX took a nosedive too, with billions lost from customers’ funds—talk about shaking investor confidence! It sent the market spiraling downward pretty quickly. (You can check out more about this at CoinDesk.)

Now, here’s why security really counts for investors. Whenever a hack rears its ugly head, people tend to yank their funds out of exchanges ASAP. This affects liquidity and piles on downward pressure on prices. It’s a crystal-clear reminder that you have to do your homework—make sure you’re picking sturdy and dependable platforms.

The Role of Speculation and Media Influence

Speculation plays a pretty hefty role when it comes to the cryptocurrency market. Loads of folks dabble in leveraged trading—borrowing money to hopefully bump up their gains (and losses too). But this sort of trading can also cause heavy waves during price slumps, making crashes happen a lot faster. If prices drop, exchanges might automatically close those leveraged positions to recover borrowed money, forcing even more selling and eventually knocking prices down further. For some tips on how to handle these ups & downs, take a peek at our Guide to Cryptocurrency Trading.

The media also casts a big shadow over the market’s mood swings. Lots of buzz from mainstream media—be it good or bad—can change how investors feel real quick. Good news about institutions jumping on board or tech getting better can pull new folks in and push prices up. On the flip side, bad news about regulatory crackdowns, another security mess-up, or market hiccups can stir fear and lead to more panic selling.

Conclusion

The world of cryptocurrency is known for its wild ups and downs. Why? It’s not just one thing. It’s a mix (a big ol’ soup) of economic and tech stuff, people’s feelings, & what’s happening around the globe. Stuff like supply & demand, how investors feel ’cause of Twitter (or FOMO/FUD), big world money trends, new rules from regulators, network changes, movements by big players called “whales,” worries about hacks, and what the news says—all ganging up to cause big price jumps and dips in the crypto space.

It’s super important for traders & investors to get how all these things dance together if they want to do well in the crypto market. Being smart means checking out both the real facts and how people often act all crazy-like. No one thing tells you where prices will go; it’s the mash-up and dance of these many parts that make this market tricky but exciting.

Key Takeaways:

- Cryptocurrency price volatility is driven by a complex interplay of numerous factors.

- No single factor solely determines price movements; it’s the combination and interaction that matters.

- Understanding these dynamics is crucial for informed decision-making in the crypto market.

FAQ – Frequently Asked Questions

What causes crypto to go up and down?

Why is Bitcoin so volatile?

How does inflation affect crypto prices?

Can government regulations crash the crypto market?

Is crypto price manipulation real?

Further Reading:

- What Is Cryptocurrency? – A foundational understanding.

- Guide to Cryptocurrency Trading – Learn about trading strategies.

- Cryptocurrency Market Crash – Understand market downturns.

- Cryptocurrency Regulations – Stay informed on the legal landscape.

- What is Blockchain Technology? – Grasp the underlying tech.

- Top Crypto Exchanges and Apps – Find reliable trading platforms.

- What is Bitcoin? – Explore the most well-known cryptocurrency.