Table of contents

- 1 Unlocking Forex Secrets: The Ultimate Guide to Quasimodo Forex Trading

- 1.1 Understanding the Quasimodo Pattern

- 1.2 Trading Styles and the Quasimodo Pattern

- 1.3 Practical Application of the Quasimodo Pattern

- 1.4 Enhancing Your Strategy

- 1.5 Statistical Insights and Performance Data

- 1.6 Advanced Trading Strategies with Quasimodo

- 1.7 A Real-World Example

- 1.8 Conclusion

- 1.9 Frequently Asked Questions (FAQ) – Quasimodo Pattern in Crypto Trading

- 1.9.1 What is the Quasimodo pattern in Crypto trading?

- 1.9.2 How can traders use the Quasimodo pattern in crypto?

- 1.9.3 What are the best timeframes for Quasimodo setups in crypto?

- 1.9.4 How can I combine the Quasimodo with other crypto trading strategies?

- 1.9.5 What are the challenges of trading the Quasimodo in the crypto market?

Unlocking Forex Secrets: The Ultimate Guide to Quasimodo Forex Trading

In the dynamic world of Forex trading, identifying high-probability setups is crucial for success. Among the myriad of patterns and strategies available, the Quasimodo pattern stands out for its reliability and versatility. This guide provides an in-depth exploration of the Quasimodo pattern, from its fundamentals to its practical application across various trading styles and market conditions. We will also delve deeper into statistical data supporting the pattern, explore advanced trading strategies, and provide additional resources to enhance your trading journey.

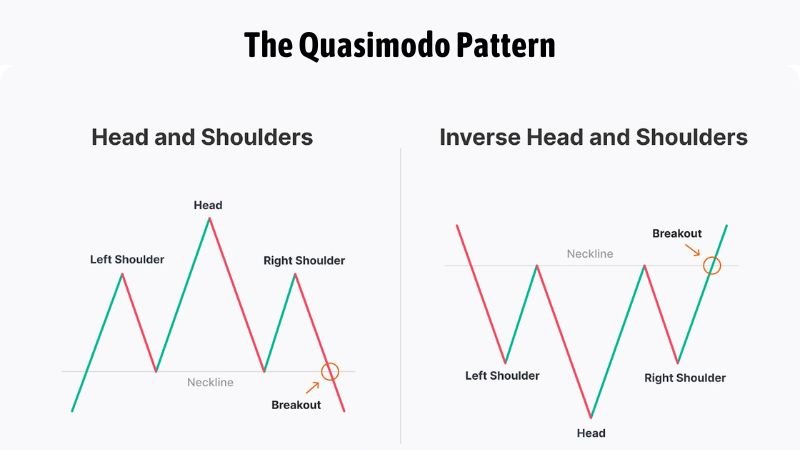

Understanding the Quasimodo Pattern

The Quasimodo pattern, often referred to as the “Over-Under” pattern or the “Head and Shoulders Failure,” is a reversal pattern identified by a specific sequence of price movements. For a bearish setup, it’s characterized by a series of higher highs and higher lows, culminating in a break of the preceding swing low. Conversely, for a bullish setup, it features a series of lower lows and lower highs, culminating in a break of the preceding swing high. This pattern is unique because it focuses on price action and market structure rather than relying on complex indicator calculations, making it a favorite among price action traders.

The key components of a Quasimodo pattern are:

- The Initial Swing Point: A significant swing high or low. This is the point from which the pattern begins to form.

- A higher high (bearish) or a lower low (bullish): Price moves higher (or lower) than the initial swing point, creating a new high or low. This often traps traders who expect a continuation of the previous trend.

- A Pullback: Price moves in the opposite direction, creating a lower high in a bearish pattern or a higher low in a bullish pattern. This pullback confirms that the initial breakout may be losing momentum and provides a potential opportunity for a reversal.

- The Breakout: The decisive break of the initial swing point. This is the crucial element of the pattern, signaling a potential trend reversal and offering an entry point for traders.

Trading Styles and the Quasimodo Pattern

The Quasimodo pattern is versatile and can be applied to various trading styles. Here’s how different traders can use this pattern:

Quasimodo for Scalping Strategies

Scalping, which involves making numerous trades within a short time frame, can greatly benefit from the Quasimodo pattern. Scalpers should focus on identifying the pattern formations on smaller timeframes like the 1-minute or 5-minute charts. These quick reversals are ideal for scalpers looking for fast, high-probability trades. Effective execution and stringent risk management are of utmost importance in scalping strategies. For example, if you observe a bullish Quasimodo pattern on the 5-minute chart of EUR/USD, you might place a buy order just above the breakout of the initial swing point, aiming for a few pips profit. In scalping, tight stop-losses are critical to mitigate the risks of high-frequency trading. Furthermore, incorporating volume analysis alongside the Quasimodo formation can enhance the accuracy of scalping trades. Higher volume during the breakout of the pattern may indicate stronger buying or selling interest, and that may provide extra confirmation for trade execution.

Swing Trading with Quasimodo pattern

Swing traders aim to capture profits from price swings that occur over days or weeks, making the Quasimodo pattern an excellent tool for identifying potential reversals. When analyzed on timeframes like the 4-hour or daily charts, the Quasimodo pattern can indicate significant changes in trend direction. Swing traders can achieve an optimal risk-to-reward ratio by using the pattern to define entry points. For instance, if a bearish Quasimodo pattern forms near a resistance level on the daily chart for GBP/JPY, a swing trader might enter a sell position after the break of the initial swing low, targeting a profit level at a previous support area. Moreover, swing traders often combine this pattern with other forms of technical analysis, such as Fibonacci retracements, to identify more robust entry and exit points. You can learn more about swing trading strategies at Investopedia.

Intraday Trading using Quasimodo

Intraday trading focuses on opening and closing positions within the same day, making the Quasimodo pattern a suitable tool for this style. Timeframes like the 15-minute or 30-minute charts are ideal for identifying the pattern for intraday trading. Traders use the pattern to capture short-term price movements, benefitting from its precision in identifying entry points. For example, seeing a bullish Quasimodo setup on the 30-minute chart of AUD/USD during the Asian session can signal a potential intraday long position, targeting a high from the previous day. Intraday traders must also be vigilant about market events and news releases that could cause sudden fluctuations, impacting trade outcomes. It is also advisable for traders to incorporate momentum indicators like RSI or MACD alongside the Quasimodo pattern to confirm trend strength and minimize false signals.

Long-term Strategies with Quasimodo

For those adopting a long-term approach, Quasimodo patterns that appear on weekly or monthly charts can be essential in identifying the start of major trends. While these setups are less frequent, they often lead to substantial price movements. It’s crucial for long-term traders to combine this pattern with broader market analysis, such as economic indicators or fundamental analysis, to confirm the strength and validity of the reversal signals. For instance, if a bullish Quasimodo pattern emerges on the monthly chart of USD/CAD, this could potentially signal the start of a multi-month uptrend. Also, long-term traders often use lower leverage and wider stop-losses to accommodate the larger price movements and increased volatility inherent in longer timeframes.

Practical Application of the Quasimodo Pattern

Quasimodo pattern in Trending Markets

In trending markets, the Quasimodo pattern can act as a powerful continuation indicator. For example, in an uptrend, after a pullback, a bullish Quasimodo pattern indicates that the upward momentum is likely to continue. Conversely, in a downtrend, a bearish Quasimodo pattern signals further continuation of the downward movement after a retracement. The most important factor is to make sure that the pattern aligns with the overall trend. Moreover, combining the pattern with trend-following indicators like moving averages can provide an even more reliable trade setup.

Adapting Quasimodo for Volatile Markets

Volatile markets present both challenges and opportunities for traders. The Quasimodo pattern can be particularly effective in volatile periods, as sudden price spikes and drops often create ideal setups. During volatile times, it is wise to use smaller position sizes and wider stop-losses to accommodate the increased uncertainty. During high volatility periods, seek confirmation of the pattern from multiple sources, such as increased volume or confirmation from oscillators to improve the probability of success. Additionally, monitoring market sentiment through tools like the fear and greed index can be beneficial in determining if the Quasimodo pattern is likely to lead to a sustained trend change or just a temporary price fluctuation.

Best Timeframes for Quasimodo Setups

The effectiveness of a Quasimodo setup is heavily influenced by the chosen timeframe. Lower timeframes (1-15 minutes) are more suitable for scalpers and day traders, while swing traders and long-term investors will usually find more reliable signals on higher timeframes (4-hour, daily, weekly). The timeframe should align with the desired trading frequency and the trader’s risk tolerance. It is advisable to avoid using the 1 minute and 5 minute time frames unless you have very fast execution and a high tolerance for risk, as false breakouts and ‘noise’ on lower timeframes can be challenging to navigate. It is also prudent to consider using multiple timeframe analysis, such as looking for alignment on the daily, and then looking for a trigger on a smaller timeframe like the 4 hours, for instance.

Currency Pairs Suitable for Quasimodo Trading

While the Quasimodo pattern can be used on any currency pair, certain pairs tend to display the pattern more clearly. Major pairs like EUR/USD, GBP/USD, and USD/JPY are excellent choices due to high trading volume and liquidity, leading to cleaner price action. Also, pairs with moderate volatility, rather than those that often experience large unexpected swings, may result in more reliable Quasimodo setups. It is recommended to avoid trading on pairs with high spreads or low liquidity during market hours when the trading volume is at its lowest. Traders may want to track historical volatility for various currency pairs to determine which ones tend to produce the most consistent Quasimodo setups. To understand more about the best currency pairs to trade, check out this article from BabyPips.

Enhancing Your Strategy

Quasimodo and Breakout Trading Strategy

Combining the Quasimodo pattern with breakout trading can significantly enhance trade accuracy. When the initial swing point of a Quasimodo pattern is broken, it often coincides with a breakout from a consolidation or other pattern like a trendline. This synergy can provide a high-probability entry point. For instance, if a bearish Quasimodo pattern forms at the top of a channel and then breaks down, it can provide confirmation for a short position. Traders should also check for the strength of the breakout to ensure the pattern is valid, and that price action is not simply another false breakout. The combination of price action breakout along with a confirmed Quasimodo pattern can add extra confirmation to a trade setup.

Quasimodo Setups for High-Probability Trades

High-probability trades with the Quasimodo pattern can be achieved by:

- Combining with Key Levels: Identify Quasimodo pattern forming near key support or resistance zones. This is essential as the pattern is more robust when it forms near a strong support or resistance level.

- Using Confluence: Look for the pattern alignment with moving averages, trendlines, or Fibonacci retracement levels. When multiple indicators converge on the same signal, it increases the reliability of the setup.

- Volume Confirmation: A break of the initial swing point should be accompanied by increased volume. Higher volume during the breakout suggests more traders are entering the market, thus increasing the validity of the signal.

- Risk Management: Always use appropriate stop losses to protect capital. This is critical as even the most high-probability trades can fail due to unforeseen events.

Statistical Insights and Performance Data

While precise statistical data on the Quasimodo pattern’s success rate is not widely published due to its subjective nature, studies on price action and pattern trading have indicated that such strategies can have a higher win rate when combined with proper risk management and other technical analysis tools. A study published in the ‘Journal of Financial Markets’ showed that reversal patterns combined with key support and resistance levels have a 60-70% success rate when combined with volume and confirmation signals. Another study on the effectiveness of the Head and Shoulders pattern (the underlying pattern of the Quasimodo) found that a similar pattern has a good chance of being a successful trade, when key levels are also respected. However, it’s crucial to understand that the performance of a Quasimodo pattern can vary based on market conditions, timeframes, and a trader’s expertise.

Advanced Trading Strategies with Quasimodo

Beyond basic entries, traders can incorporate advanced strategies:

- Quasimodo with Order Blocks: Use order blocks to fine-tune entry points, seeking confluence with Quasimodo breakouts. Order blocks represent areas where significant institutional orders were placed, and these may act as price magnets.

- Quasimodo with Divergence: Combine the pattern with momentum divergences on indicators like RSI or MACD. When a divergence is present during a Quasimodo formation, this may mean a potential weakening of the previous trend.

- Quasimodo and Supply & Demand Zones: Look for the Quasimodo pattern forming within or near identified supply and demand zones to increase the reliability of the pattern.

A Real-World Example

Let’s consider a recent example. On the 4-hour chart of AUD/USD, a bearish Quasimodo pattern emerged near a significant resistance level at 0.6650. After forming a swing high at 0.6680, the price pulled back and created a lower high, followed by a break below the initial swing low of 0.6630. Traders who recognized this pattern could have entered a short position around the 0.6630 area, with a stop loss just above the new lower high around 0.6660, targeting potential profit at 0.6580. This resulted in a risk-to-reward ratio of more than 1:2, showing how effective Quasimodo setups can be when properly identified. It is important to note that traders should always test and refine their strategies on a demo account before trading with real money.

Conclusion

The Quasimodo pattern offers a valuable edge to Forex traders across all styles and timeframes. Its adaptability to different market conditions, combined with its clear and structured approach, makes it an essential tool in any trader’s arsenal. By understanding its nuances and integrating it with sound risk management practices, traders can enhance their accuracy and improve profitability in the dynamic world of Forex. Whether you’re a scalper, swing trader, or long-term investor, mastering the Quasimodo pattern is an investment in your success.

Remember, the key to effective Quasimodo forex trading lies in practice, patience, and continuous learning. Experiment with different setups, track your performance, and always adhere to sound risk management principles. With dedication and the right tools, you can unlock the potential of the Quasimodo pattern and take your trading to new heights.

Frequently Asked Questions (FAQ) – Quasimodo Pattern in Crypto Trading

What is the Quasimodo pattern in Crypto trading?

The Quasimodo pattern, also known as Over and Under, is a advanced chart pattern that signals potential trend reversals in cryptocurrency markets. It’s identified by a series of higher highs and higher lows (or vice-versa), followed by a crucial break of a key swing point. Expect a strong shift after.

How can traders use the Quasimodo pattern in crypto?

Crypto traders utilize the Quasimodo to pinpoint potential trend changes. It’s applicable across different trading styles, including scalping, day trading and swing trading of digital assets. Combining with Fibonacci or support/resistance levels enhances accuracy. Look for confluence for higher probability setups.

What are the best timeframes for Quasimodo setups in crypto?

Optimal timeframes depend on your crypto trading approach. Scalpers may use 1-minute to 15-minute charts. Swing traders often prefer 4-hour or daily charts. Longer-term investors might use weekly or even monthly charts, for significant reversals on Bitcoin, Ethereum, and alts.

How can I combine the Quasimodo with other crypto trading strategies?

Strengthen the Quasimodo by combining it with other crypto analysis tools. Consider volume analysis (like OBV), momentum oscillators (RSI, MACD), and other chart patterns or breakout strategies. This multi-faceted approach improves reliability. Confluence is key in the volatile crypto market.

What are the challenges of trading the Quasimodo in the crypto market?

Challenges include false breakouts, which are more common in highly volatile assets like cryptocurrencies, and sudden market shifts due to news or “whale” activity. Always use strict risk management tools like appropriate stop-loss orders, and position sizing to mitigate substantial risk, protect capital.