Table of contents

- 1 Unlocking the Potential: A Deep Dive into Node Sales

- 1.1 I. Introduction

- 1.2 II. What Exactly is a Node Sale?

- 1.3 III. Types of Nodes in Blockchain

- 1.4 IV. Why Invest in Node Sales?

- 1.5 V. How to Participate in Node Sales

- 1.6 VI. Risks and Challenges of Node Sales

- 1.7 VII. Strategies for Successful Node Sale Investments

- 1.8 VIII. The Future of Node Sales

- 1.9 IX. Conclusion

- 1.10 Frequently Asked Questions (FAQ)

Unlocking the Potential: A Deep Dive into Node Sales

What is Node Sales? Node sales refer to the process where individuals can purchase and operate a node within a blockchain network. Owning a node grants you an active role in verifying transactions, maintaining network integrity, and contributing to decentralization. Unlike staking or rentals, node sales provide full ownership and control over the node.

In the ever-evolving landscape of cryptocurrency and blockchain technology, the concept of “Node Sale” has emerged as a significant area of interest for investors and enthusiasts alike. But what exactly are node sales, and why is everyone talking about them? This comprehensive guide will delve into the intricacies of node sales, exploring their significance, various types, and the opportunities and challenges they present. We will also incorporate data and external sources to give a better picture of the current node sales landscape.

I. Introduction

What are Node Sales?

Node sales represent the process of acquiring and owning a node within a blockchain network. Unlike simply using a blockchain, owning a node grants you a more active role in the network’s operation. These nodes are crucial for maintaining and validating transactions, contributing to the decentralization and security of the blockchain ecosystem. According to a report by CoinDesk, the demand for nodes is directly correlated with the growth of decentralized applications (dApps) and DeFi platforms, signaling the importance of node sales in scaling blockchain networks.

The rising interest in node sales stems from the desire for greater involvement in the blockchain space, the potential for passive income, and the opportunity to contribute directly to the networks.

Key Takeaway: Node sales offer a way to actively participate in blockchain networks, going beyond simple token holding. They represent an investment in the infrastructure of the network.

The Importance of Nodes in Decentralized Networks

Nodes are the backbone of any blockchain network. They are responsible for verifying transactions, storing copies of the blockchain, and maintaining network integrity. Their role is fundamental in ensuring decentralization, security, and efficiency of the network. Without a sufficient number of nodes, a blockchain network risks becoming centralized and vulnerable to manipulation, as highlighted in research from the Ethereum Foundation, which emphasizes the importance of a diverse and distributed set of nodes.

Why the Growing Interest in Node Sales?

Several factors contribute to the growing interest in node sales:

- Passive Income: Nodes can generate rewards through staking or transaction validation. Data from various blockchain projects shows that node operators can earn anywhere from 5% to 20% annual returns, depending on the network and its reward mechanism.

- Network Governance: Some node owners have a say in network upgrades and direction. For example, in the Polkadot network, validator nodes have governance rights, influencing the direction of the project through their votes. You can explore more about governance tokens to understand the importance of these tokens in blockchain networks.

- Technological Engagement: Owning a node allows a hands-on understanding of blockchain operations. This type of engagement is invaluable for those looking to deeply comprehend the underlying technology.

- Investment Opportunity: Nodes can be a long-term investment with potential capital appreciation. Certain early-stage node programs have shown an exponential growth rate in value, making them attractive as long-term investment options.

Why this Article Matters

This article aims to provide a comprehensive guide to node sales, covering the basics, types, benefits, risks, and strategies for success. By the end, you should have a strong understanding of node sales and be well-equipped to decide whether it’s a worthwhile investment for you.

II. What Exactly is a Node Sale?

Defining Node Sales

A node sale is the process through which a blockchain project offers individuals the opportunity to purchase and operate their own nodes. Owning a node means you become an active participant in the network’s infrastructure, taking part in maintaining and verifying its operations. In essence, it’s about buying into the operational structure of the blockchain itself.

Node Sales vs. Node Staking or Node Rental

It’s crucial to differentiate a node sale from node staking or node rental. In node staking, users lock their cryptocurrency to contribute to the network and earn rewards, but they don’t operate a full node. In node rental, users rent access to an already existing node. On the other hand, node sale means purchasing the node itself.

- Node Sale: Ownership of a node, with full responsibilities and rights.

- Node Staking: Contributing cryptocurrency to a network, without operating a full node.

- Node Rental: Paying for access to someone else’s node.

Key Takeaway: Unlike staking or rentals, node sales provide actual ownership of the node infrastructure, offering more control and responsibility.

The Role of Nodes in Blockchain

Nodes are crucial because they:

- Verify Transactions: Ensure each transaction is valid and in line with network rules.

- Maintain Ledger: Store a copy of the blockchain, thus ensuring transparency.

- Enhance Security: Contribute to the network’s overall security by validating and distributing data.

- Promote Decentralization: By having a wide network of nodes, no single entity has full control.

Benefits of Owning a Node

Owning a node can offer several advantages:

- Passive Income: Earn rewards for validating transactions and maintaining the network. According to the Messari, average annual returns for node operators vary from 5% to 20% depending on the network and type of node.

- Governance Rights: In some cases, node owners have voting power in network decisions. This allows for direct influence over the direction of the blockchain.

- Community Participation: Become a core participant in the blockchain ecosystem. This fosters a deeper connection with the project.

- Technological Insight: Gain hands-on experience with the inner workings of blockchain technology. This experience is invaluable for developing technical proficiency in blockchain.

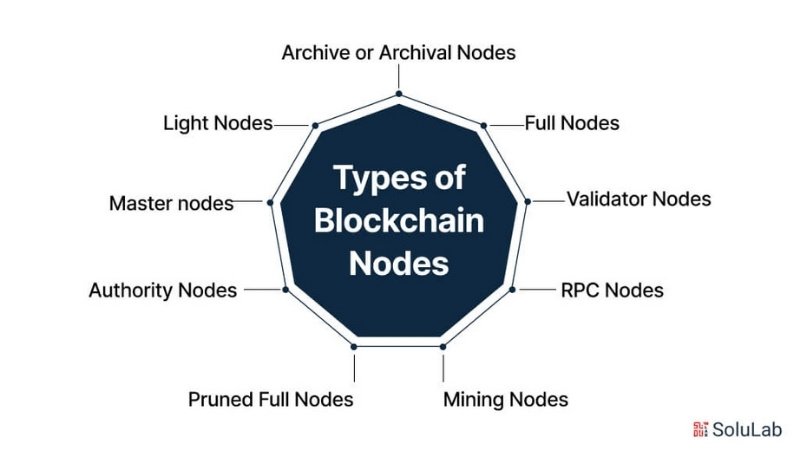

III. Types of Nodes in Blockchain

Classification of Nodes

Nodes can be categorized based on their functionality and resource requirements:

- Full Node: Stores the entire blockchain ledger, participates in transaction verification, and broadcasts new blocks to the network. It requires significant storage and processing power. Full nodes provide the highest degree of security and are critical for network health.

- Light Node: Also known as a Simplified Payment Verification (SPV) node, it only downloads a portion of the blockchain, usually block headers, which contain essential data about each block but not all transactions. Ideal for mobile devices.

- Masternode: Requires a significant investment and provides additional services to the blockchain, such as instant transactions, private transactions, and governance participation. Masternodes often have higher staking rewards. For example, Dash was one of the earlier cryptocurrencies to implement masternodes and offer additional functionalities.

Types of Nodes in Blockchain

Which Node is Right for You?

The best type of node depends on your:

- Budget: Full nodes and Masternodes usually require higher initial investments than light nodes.

- Technical Skills: Running a full node or masternode can be more complex than a light node.

- Investment Goals: If you’re looking for maximum governance rights, a masternode may be preferable. If you prefer easy set up and low maintenance, then a light node is better.

- Time Commitment: Some nodes require active maintenance, such as updates and security protocols.

Here’s a quick comparison table:

| Node Type | Storage Needs | Hardware Needs | Technical Skill | Rewards |

|---|---|---|---|---|

| Full Node | High | High | Medium to High | Moderate |

| Light Node | Low | Low | Low | Low |

| Masternode | High | High | High | High |

IV. Why Invest in Node Sales?

Financial Benefits

Node sales can provide significant financial opportunities:

- Staking Rewards: Earn rewards by participating in the network’s consensus mechanism (e.g., Proof of Stake). Some networks reward node operators for processing transactions. For example, Ethereum’s transition to Proof-of-Stake has created a significant market for validator node operators. You can learn more about what is cryptocurrency and how it is used in these networks.

- Long-Term Value: As the network grows and becomes more adopted, the value of your node may appreciate. Early node owners of successful projects have seen substantial returns on their initial investment.

- Multiple Earning Streams: Node owners may have opportunities to earn from transaction fees, governance participation, and other services they provide to the network.

For example, early investors in certain node programs have reported ROIs of 200-300% within the first year of operations. However, it’s crucial to note that these high returns are not always typical and are based on the success of individual blockchain projects.

Key Takeaway: Node sales offer potential passive income through rewards and the possibility of long-term value appreciation.

Enhancing Blockchain Knowledge and Skills

Investing in node sales is an opportunity to:

- Understand Blockchain: Gain a comprehensive view of how blockchain technology works at the infrastructural level. You can also expand your knowledge by reading about guide to cryptocurrency trading for more context.

- Participate in Community: Connect with other node operators, contributing to the growth and development of the network.

- Improve Technical Skills: Learn about node setup, security, and system administration.

This hands on experience is invaluable for anyone looking to understand the intricacies of blockchain beyond basic trading and speculation.

Node Sales: Trends and Forecasts

Looking ahead, we can see several key trends:

- Node sales in 2025: As blockchain technology matures, more projects will implement node sales to enhance decentralization. This is expected to lead to a wider range of opportunities for investors. A report by Deloitte suggests that more than 70% of companies will start using blockchain solutions by 2025, necessitating further development in node infrastructure.

- Growth in New Projects: A proliferation of new blockchain projects will require an increasing number of nodes, creating a continuous demand for node sales. According to a recent Gartner analysis, the number of active blockchain projects is projected to grow by 40% year-over-year.

In 2025, expect a surge in projects offering node sales as they look to decentralize and scale. With the growing emphasis on decentralization, the need for nodes will increase substantially.

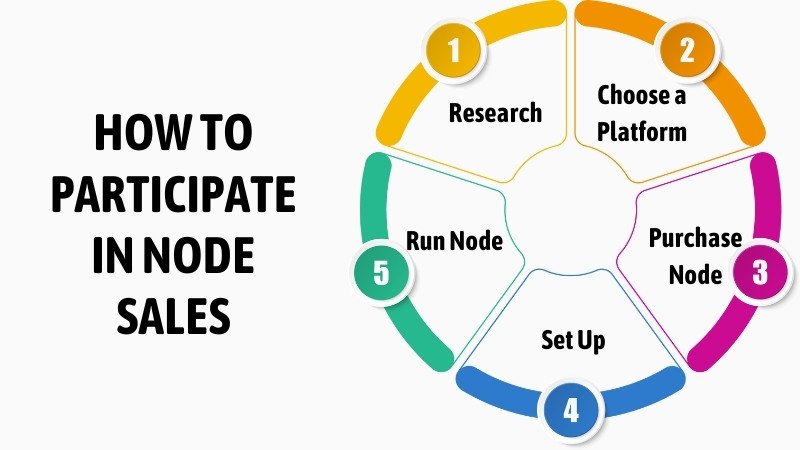

V. How to Participate in Node Sales

Basic Steps

Participating in a node sale generally involves these steps:

- Research: Identify blockchain projects that align with your goals and understanding. Study their whitepaper, roadmap, and community. Thorough research into the technological viability and team behind the project is crucial.

- Choose a Platform: Select a reliable platform that handles node sales. This ensures security and simplifies the process. Examples of such platforms include NOWNodes and Allnodes.

- Purchase Node: Follow the platform’s steps to acquire your node. Some platforms might require KYC (Know Your Customer) procedures.

- Set Up: Follow the specific setup instructions provided by the project, involving software installation and configuration. This step usually requires some technical proficiency.

- Run Node: Monitor your node’s performance, make necessary updates, and ensure it is running smoothly. Continuous monitoring and updates are crucial for maintaining a well-functioning node.

Popular Platforms and Projects

Some popular blockchains that support node sales include:

- Ethereum 2.0: Transition to Proof-of-Stake, which includes node staking requirements. Ethereum 2.0’s transition has led to high participation in its node staking ecosystem.

- Polkadot: Offers opportunities to run validator nodes, requiring staking and robust hardware. Polkadot’s validator nodes play a critical role in securing the network.

- Avalanche: Enables different types of node operators with various functionalities and earning opportunities. Avalanche’s approach to node participation has led to a highly scalable network.

- Cosmos: Supports validator nodes for its ecosystem of interconnected blockchains. Cosmos’s inter-blockchain communication protocol relies heavily on its validators.

Examples of node sales platforms include NOWNodes and Allnodes that facilitate node purchasing and management. These platforms simplify the process of setting up and running nodes, even for those with limited technical expertise. You can also enhance your knowledge by learning how to buy cryptocurrency, which is crucial to take part in Node sales

Important Considerations

Before diving into node sales, consider:

- Risk Assessment: Understand the operational costs, such as hardware, energy consumption, and maintenance. Also be aware that rewards are not guaranteed and can fluctuate based on the project and market conditions.

- Project Choice: Opt for projects with strong communities, a transparent roadmap, and solid technology. Check the project’s GitHub repository for development activity and community forums for active participation.

VI. Risks and Challenges of Node Sales

High Operational Costs

Operating a node can involve several expenses:

- Hardware: Significant investment in robust computers, hard drives and servers may be required.

- Electricity: Node operations consume a considerable amount of energy. This is particularly relevant for nodes that require constant operation.

- Maintenance: Hardware upkeep, updates and software patches are required. Proper maintenance is crucial for both security and performance.

Price Volatility

The market value of node reward tokens can fluctuate significantly, as they are subject to market conditions and the overall performance of the network. These fluctuations can significantly affect the profitability of operating a node. To understand this better, check out our article on cryptocurrency market crash and what causes these events.

Network Competition

As more participants join a network, the rewards for running a node may be reduced.

- Increased Participation: Increased competition can lead to reduced returns from node operations.

- Whale Influence: Large investors with multiple nodes can influence network decisions and rewards. This is a risk inherent to all blockchain networks, where wealthy individuals can have undue influence.

It’s essential to be aware of these risks before investing. A thorough risk analysis of each potential project is highly recommended before investing.

Key Takeaway: Investing in node sales comes with risks including high operational costs, reward volatility, and network competition.

VII. Strategies for Successful Node Sale Investments

Choosing High-Potential Projects

To maximize your investment success:

- Research the Team: Investigate the development team behind the project, looking for experience and expertise. Look at their past successful projects and contribution to the blockchain community.

- Review the Whitepaper: Ensure the project has a clear vision, achievable goals, and a sustainable business model.

- Community Involvement: Look for a strong, active community, indicating a loyal user base and a high probability for long-term success. An active Discord or Telegram channel usually shows commitment to a project.

- Roadmap Analysis: Ensure the project has a clear, executable plan with realistic milestones.

Diversifying Your Investments

Do not put all your eggs in one basket. Diversify by:

- Mixing Node Sales: Combine node investments with other strategies such as staking, yield farming, and long-term crypto holds.

- Multiple Networks: Invest in nodes across multiple blockchains to reduce risks associated with a single project.

Staying Updated with Market Trends

Continuous monitoring is key:

- Follow Industry News: Keep up-to-date on developments within blockchain and cryptocurrency. Reliable sources like CoinDesk, CoinTelegraph, and Messari can keep you informed.

- Use Analytics Tools: Track metrics such as staking rewards, price volatility, and network participation to optimize your strategies and make data-driven decisions. Platforms like Messari and Glassnode provide in-depth analytics.

VIII. The Future of Node Sales

Growth of Blockchain Technology

As blockchain technology advances, the importance of nodes will only grow:

- More Nodes Needed: As the industry continues to expand, more projects will need nodes to support their decentralized infrastructure.

- Investment Opportunities: This demand is projected to make node sales more prevalent as an investment strategy.

Nodes in Web3

Nodes are the cornerstones of Web3, which is the decentralized web:

- Foundation for dApps: Nodes are fundamental to running decentralized applications (dApps) and decentralized finance (DeFi) protocols. You might find our articles on AI wallets and what is a crypto wallet useful to understand better dApps and its infrastructure.

- Ecosystem Growth: Node sales will drive expansion in the Web3 space, which is the next phase of the Internet. As Web3 continues to develop, it will create a huge market for nodes and node operators.

Node operators will be integral to the growth and success of Web3. Their role in maintaining the integrity of decentralized networks makes them critical to the future of the Internet.

Predictions for the Node Sale Market in 2025

In 2025, the node sale market is expected to show significant growth. We anticipate:

- Increased Node Numbers: An increased number of projects offering node sales. This is expected to lead to a diversification in types of nodes available.

- Higher Rewards: As networks become more established and critical, we will likely see increase reward values for node operators. However, with more participants, there may also be a balance in overall rewards distribution.

IX. Conclusion

The Role of Node Sales

Node sales present a unique investment opportunity in the blockchain ecosystem. They offer the potential for not only financial returns but also an active role in the development of decentralized technologies.

Key Takeaway: Node sales are a growing trend, offering both financial opportunities and participation in the growth of the decentralized web.

Investing in node sales is a strategic move that combines potential profits with contributing to the evolution of decentralized systems. It requires a good understanding of technology, risk tolerance, and continuous learning.

Frequently Asked Questions (FAQ)

What is a cryptocurrency market crash?

A cryptocurrency market crash refers to a sudden and severe drop in the overall crypto market valuation, typically triggered by mass sell-offs, regulatory actions, or macroeconomic instability.

How does a crypto crash affect blockchain projects?

A crash impacts blockchain projects by reducing funding, slowing development, and causing instability in decentralized networks dependent on node sales and active community support.

What are the main causes of crypto market crashes?

Common causes include macroeconomic changes like interest rate hikes, regulatory bans, market manipulation, and technological failures, such as major exchange hacks or protocol vulnerabilities.

How can investors protect their assets during a crash?

Investors can use strategies like diversification, dollar-cost averaging, and focusing on established cryptocurrencies to reduce risks and stabilize their portfolios during market crashes.

Can cryptocurrency markets recover after a crash?

Yes, crypto markets often recover, driven by technological innovations, increasing adoption, and renewed investor confidence. However, recovery can vary across projects and may take time.

Pingback: Cryptocurrency Market Crash: Insights and Tips for Investors CoinFxPro