Table of contents

- 1 NFT Staking: Blending Digital Collectibles with Staking Rewards

- 1.1 Understanding NFT Staking

- 1.2 Why NFT Staking is Gaining Popularity

- 1.3 Key Concepts in NFT Staking

- 1.4 Exploring NFT Staking Platforms

- 1.5 The Future of NFT Staking

- 1.6 Examples of Success & Data Points

- 1.7 In-Depth Analysis of NFT Staking Mechanisms

- 1.8 The Regulatory Landscape of NFT Staking

- 1.9 Impact of NFT Staking on the Broader NFT Market

- 1.10 Risks and Mitigation Strategies

- 1.11 Emerging Trends in NFT Staking

- 1.12 Conclusion

- 1.13 Frequently Asked Questions (FAQ)

NFT Staking: Blending Digital Collectibles with Staking Rewards

The world of Non-Fungible Tokens (NFTs) has revolutionized digital ownership, transforming everything from art to in-game assets. But what if your prized digital collectibles could do more than just sit pretty in your wallet? Enter NFT Staking, a fascinating fusion of digital collection and staking rewards. This innovative concept is rapidly gaining traction, offering NFT holders the opportunity to earn passive income while retaining ownership of their unique assets.

Understanding NFT Staking

At its core, NFT staking involves locking up your NFTs in a platform or protocol to earn rewards, similar to staking traditional cryptocurrencies. This process not only allows you to generate income but also potentially enhances the value and utility of your digital assets. It’s a shift from mere ownership to active participation in the NFT ecosystem.

Unlike fungible tokens which are interchangeable, NFTs are unique and not interchangeable. This is key to how staking is implemented for NFTs, since they are not divisible and need a new mechanism for staking.

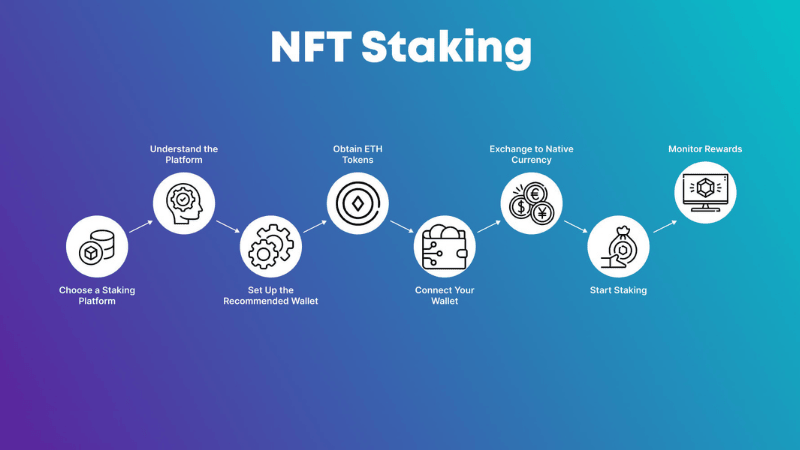

How NFT Staking Works

The specifics of NFT staking can vary depending on the platform. However, the basic mechanism is typically as follows:

- Locking NFTs: Users deposit their NFTs into a designated platform’s smart contract. This locks up the NFT for the duration of the staking period.

- Earning Rewards: In return for staking, users receive rewards, usually in the form of the platform’s native tokens or other cryptocurrencies. The amount of rewards is often determined by the rarity and value of the staked NFT, as well as the staking period.

- Unlocking NFTs: Once the staking period is over, users can withdraw their NFTs, along with any accrued rewards.

This model offers benefits to both NFT holders and the platforms providing staking services. For holders, it’s a way to make their digital assets productive, and for platforms, it incentivizes holding and participation within their ecosystem.

The image above shows the simple process of Staking NFTs to earn rewards. image: solulab

Why NFT Staking is Gaining Popularity

Several factors contribute to the increasing interest in NFT staking:

- Passive Income: The primary allure is the potential for passive income generation. NFT holders can earn a return on their investment without needing to sell their assets.

- Increased Utility: Staking adds a layer of functionality to NFTs beyond mere ownership, increasing their desirability and perceived value.

- Ecosystem Growth: It encourages long-term holding and active participation in the platform’s ecosystem, fostering a more vibrant and engaged community.

- Flexibility: NFT staking platforms usually offer a number of staking options with varied durations and returns. This gives users flexibility and choice in the staking process.

- Reduced Risk: Staking allows holders to generate yield from their NFTs without selling, which can be a risky endeavor. The value of an NFT can fluctuate wildly, depending on market conditions.

Key Concepts in NFT Staking

Annual Percentage Rate (APR) & Annual Percentage Yield (APY)

Like other forms of staking and investment, understanding the APR and APY associated with NFT staking is crucial. APR represents the annual interest rate, while APY accounts for the effects of compounding over time. It is crucial to understand what is the APR and APY of the staking platform before deciding to stake.

Lock-up Periods and Flexibility

Staking platforms usually offer varied lock-up periods. Shorter periods may offer lower rewards but provide more flexibility, while longer periods could mean higher returns but less liquidity. It’s also important to keep an eye out for platforms that allow for early unstaking, often with some fees associated.

Risks Involved

While NFT staking presents opportunities, it’s important to be aware of potential risks:

- Platform Risk: The security of the staking platform is paramount. Vulnerabilities in smart contracts could lead to loss of funds. It’s important to research thoroughly before choosing a platform.

- Price Volatility: The value of NFTs can be highly volatile. While staking can provide a return, a significant drop in an NFT’s price could offset any gains. You can learn more about the causes of a cryptocurrency market crash.

- Impermanent Loss: This risk is more specific to liquidity pool staking. If you are staking an NFT in a liquidity pool with other tokens, you may risk a different value of your token at time of unstaking.

- Lack of Regulation: The NFT space is largely unregulated, which means little to no protection for consumers and investors.

Exploring NFT Staking Platforms

Several platforms are now offering NFT staking services. Here are some examples to give you a sense of the landscape:

Top NFT Staking Platforms

Here are some of the platforms that have been gaining traction. It’s critical to do your own research to determine the suitability of each platform, as each offers different staking options and benefits.

- Splinterlands: This trading card game allows players to stake their in-game NFTs to earn rewards. This is one of the earliest examples of NFT staking that has become very popular.

- MOBOX: Offers staking for their MOMO NFTs, allowing holders to earn in-game rewards and tokens.

- Aavegotchi: Uses a unique staking mechanism where “Aavegotchis” (NFTs) can be staked to earn in-game currency and other perks.

- NFTX: A platform for creating and staking NFT-backed ERC-20 tokens that can be used for yield farming or staking.

- Binance NFT: A large marketplace for NFTs that also offers NFT staking options, usually for specific NFT collections listed on the platform. You can explore other options in our article about top crypto exchanges and apps.

These platforms show a variety of approaches to NFT staking, demonstrating the different ways NFT’s can be made productive.

The image above depicts examples of NFT staking platforms.

How to Choose an NFT Staking Platform

When choosing an nft staking platform, consider the following:

- Security Measures: Check the platform’s security record, their smart contract audit reports and history to protect your digital assets.

- Staking Terms: Review the staking periods, reward rates, and any associated fees.

- Platform Reputation: Look for platforms with a strong track record and a user-friendly interface.

- Supported NFTs: Ensure the platform supports the type of NFTs you want to stake.

- Community Support: A platform with an active and helpful community can greatly enhance the staking experience.

The Future of NFT Staking

NFT staking is still in its early stages, but its potential is vast. We can expect to see the following developments:

- Increased Adoption: As more NFT platforms and projects realize the benefits, staking will become a more common feature.

- Innovative Staking Models: We can anticipate the emergence of new, innovative mechanisms for staking, leading to more diversified and higher returns.

- Integration with DeFi: We will also likely see further integration between NFT staking and other decentralized finance applications.

- Greater Utility: NFTs that can be staked will likely become more valuable due to their additional utility.

NFT staking is poised to become a key element in the evolution of the digital ownership paradigm, adding value to digital collectibles, and enhancing their utility for their owners.

Intellectual Property and Royalties, Image: openware

Examples of Success & Data Points

While specific data on NFT staking returns is often dependent on the platform and the NFT, many early adopters have experienced significant rewards. For example, staking in popular NFT based games can provide rewards that can be used in-game or even sold in the market. Furthermore, some projects offer tiered staking programs, offering better returns for longer lock-up periods or more valuable NFTs.

Example Data Point: One report in early 2023 showed some popular NFT projects provided staking returns ranging between 5-20% APY, highlighting the potential of the staking for generating passive income. It is critical to note that the returns are highly volatile and can change quickly.

In-Depth Analysis of NFT Staking Mechanisms

Beyond the basic concepts, the mechanics of NFT staking can be quite varied and complex. Here’s an in-depth look at some of the mechanisms:

Proof-of-Stake (PoS) Integration

Some NFT staking mechanisms are integrated with Proof-of-Stake (PoS) blockchains. In this model, when you stake an NFT, you are effectively contributing to the network’s security, similar to how staking cryptocurrencies works in a PoS system. The rewards can be in the form of the blockchain’s native token or another cryptocurrency. This adds an extra layer of utility to NFTs, turning them into active participants in the blockchain’s infrastructure.

Liquidity Pool Staking

Another form of NFT staking involves participation in liquidity pools. In this scenario, users stake their NFTs alongside other tokens to provide liquidity for a decentralized exchange (DEX). The rewards are often the trading fees generated by the pool. This model introduces the concept of impermanent loss, where the value of staked assets can fluctuate, leading to potential losses if the relative values of the staked assets change significantly. However, the potential rewards can be higher, making this a more risky yet potentially more rewarding form of staking.

Tiered Staking Systems

Many platforms use tiered staking systems, where the rewards vary based on the attributes of the staked NFT. For example, rarer or more valuable NFTs may attract higher rewards than common ones. Staking durations also play a role; longer lock-up periods often yield higher returns. These tiered systems are designed to incentivize holding onto more valuable assets and long-term participation.

Staking as a Utility for Metaverse Assets

NFT staking is increasingly integrated into metaverse platforms. Staking in-game NFTs, such as land parcels or avatars, can provide access to exclusive areas, special features, or even in-game currencies. This approach not only provides staking rewards but also increases the utility of these NFTs within the metaverse ecosystem, boosting demand and value. You might be interested in learning more about metaverse coin list to find out more on this topic.

The Regulatory Landscape of NFT Staking

The regulatory aspect of NFT staking is largely undeveloped and varied across jurisdictions. Due to the novelty of the concept, regulators worldwide are still analyzing how to classify and regulate NFTs and related activities. This uncertainty poses a risk, as new regulations could dramatically affect how these platforms operate. It’s important to consider the lack of a clear legal framework for this activity, which can affect the safety of staking platforms and the security of staked assets.

Impact of NFT Staking on the Broader NFT Market

NFT staking has a significant impact on the overall NFT market. It increases the utility of NFTs, making them more than just digital collectibles, and turns them into productive assets. This can lead to more mature and stable markets. The increased engagement and participation also foster a more dynamic community.

Market Dynamics and NFT Prices

The ability to stake NFTs has also affected the market dynamics. NFTs that offer staking opportunities may see an increase in demand and, consequently, price. However, this can also create speculative bubbles. The returns from staking can also affect the overall market sentiment, as users balance the yield against the risk of price volatility. You can also learn more about NFT floor prices to help you understand the market better.

Community and Governance

Some platforms offer governance tokens to stakers, empowering them to participate in the platform’s decision-making process. This encourages community-driven growth and ensures that the platform develops according to the interests of the users. This is not always a direct aspect of staking, but platforms that have this tend to reward the users staking for their participation in the ecosystem.

Risks and Mitigation Strategies

While NFT staking provides opportunities for growth, it is important to understand the risks associated with it and strategies to mitigate them. This includes understanding the security measures, researching platforms and diversifying assets.

Security of Smart Contracts

The security of the platform’s smart contracts is paramount. A smart contract vulnerability could result in the loss of all staked assets. Therefore, it is imperative to research and ensure that the platform has undergone a thorough smart contract audit by a reputable third party.

Platform Risk and Diversification

The risks inherent in the platform itself are also present. The platform may face technical challenges, such as server downtimes or technical issues that may affect the staking process. It’s advisable to diversify assets across multiple platforms to reduce the potential losses from such risks. Always conduct a thorough review of the platform before committing any assets.

Price Volatility and Risk Management

The high volatility of the NFT market remains a major risk. While staking provides a method of earning from NFTs, it does not eliminate the inherent risk that the value of the asset could plummet drastically. Therefore, it is crucial to have a diversified portfolio and not solely rely on a single NFT. Understanding the historical price trends and the potential future value changes is essential before staking any asset.

Emerging Trends in NFT Staking

The field of NFT staking is continually evolving, with some trends starting to make their mark.

Dynamic APRs

Some platforms are experimenting with dynamic APRs. These are staking interest rates that can change based on market factors, such as the number of users staking or the overall demand for a given NFT. The advantage is a potentially higher return if the demand is high; the disadvantage is potential lower returns if demand is low, so it can add extra volatility to staking.

Cross-Chain Staking

Another emerging trend is cross-chain staking, where users can stake NFTs from one blockchain on another platform. This increases the utility of NFTs and creates new interoperability within the NFT space. This is currently not a common feature, but we will likely see it become more popular in the future.

Conclusion

NFT Staking represents a compelling evolution in the world of digital collectibles. By combining the allure of unique digital assets with the potential for staking rewards, it offers a new way for NFT holders to engage with their investments. As the space matures, we are likely to witness further innovation and the rise of sophisticated platforms that make staking more accessible and rewarding. Whether you are a seasoned crypto enthusiast or a casual collector, NFT staking offers a pathway to making your digital assets work harder for you. With its potential to revolutionize digital ownership, the intersection of collecting and earning makes NFT staking something worth following very closely.

Frequently Asked Questions (FAQ)

What is NFT staking?

NFT staking is locking up your Non-Fungible Tokens (NFTs) on a platform or protocol. You earn rewards, typically in cryptocurrency or tokens, for doing so, essentially turning your digital assets into income-generating investments. It provides passive income opportunities.

How does NFT staking work?

NFT staking involves locking your NFTs in smart contracts. Rewards, often cryptocurrency or tokens, are given based on several factors. These might include the NFT’s rarity, the staking duration, and the specific rules of the staking platform. You maintain ownership.

What are the benefits of NFT staking?

Key benefits of NFT staking include earning passive income and boosting the utility of your NFTs. It also encourages longer-term holding of these digital assets, while contributing and engaging more with the community. NFTs become dynamic, income-producing assets.

What are the risks of NFT staking?

Risks include smart contract vulnerabilities and market volatility, which impacts NFT value. Impermanent loss (if linked to liquidity pools) and limited regulatory clarity are to. Careful research and a diversified approach can help manage the potential risks.

How can I choose the best NFT staking platform?

Prioritize platform security and carefully review staking terms. Evaluate which NFTs are support, review security audit reports, lock-up periods, and reward rates. And also reputation, and community engagement. This helps ensure safety, security and return on your investment.

Pingback: Autonomous NFTs: Redefining Digital Ownership CoinFxPro Learn Crypto

Pingback: CoinStats Review: The Ultimate Tool for Crypto Portfolio Tracking

Pingback: What is Kraken Crypto: A Comprehensive Guide CoinFxPro Crypto Tools

Pingback: CoinTracker Reviews: Top Crypto Portfolio & Tax Tool CoinFxPro

Pingback: What is Blockchain Technology? A Comprehensive Guide - CoinFxPro

Pingback: The Fee Switch in Crypto: A Deep Dive into Revenue Sharing - CoinFxPro

Pingback: How Bubblemaps Crypto Tools Revolutionize Blockchain Analytics