Table of contents

- 1 Decoding NFT Floor Prices: A Deep Dive for Investors

- 1.1 I. Introduction

- 1.2 II. NFT Floor Price: Concept and Mechanics

- 1.3 III. Factors Influencing NFT Floor Price

- 1.4 IV. Analyzing NFT Floor Price

- 1.5 V. NFT Floor Price and Investment Strategies

- 1.6 VI. Top NFT Collections by Floor Price

- 1.7 VII. Comparing NFT Floor Price with Other Metrics

- 1.8 VIII. Common Mistakes When Using NFT Floor Price

- 1.9 IX. Future Trends in NFT Floor Price

- 1.10 X. Conclusion

- 1.11 XI. Frequently Asked Questions (FAQ) about NFT Floor Price

Decoding NFT Floor Prices: A Deep Dive for Investors

I. Introduction

1. What is an NFT?

Before diving into floor prices, it’s crucial to understand NFTs. An NFT is a unique digital asset representing ownership of a specific digital item or content, such as digital art or virtual real estate. Unlike cryptocurrencies, NFTs are unique and non-interchangeable, each holding distinct value. Stored on a blockchain for transparency and security, NFTs are like digital authenticity certificates, confirming ownership of a specific digital item. They have transformed how digital assets are perceived, allowing new forms of digital ownership and interaction. Artists can sell directly to fans, bypassing traditional intermediaries. NFTs have become integral to the blockchain and crypto space, redefining digital ownership and interactions.

2. What is an NFT Floor Price?

The NFT floor price is the lowest price at which an NFT in a particular collection can be purchased, marking the minimum market value of an NFT within that set. This metric is vital for anyone entering the market or making decisions about their current NFT holdings, acting as a reference point for buyers and sellers, and showing the general market sentiment of a collection. For instance, if you want to invest in an NFT collection, the floor price indicates the minimum you’d need to spend. Think of it as a baseline starting price, like the minimum asking price for a house in a neighborhood. Understanding the floor price is essential because it signals the perceived value, which may increase with the rarity of specific NFTs. Remember, it is just the starting point, and desirable NFTs in the collection could be worth more.

3. Why Understanding NFT Floor Price Matters

For any NFT investor or trader, tracking the floor price is key. It’s a fundamental tool for informed decision-making. Knowing the floor price helps in several ways:

- Assess risk: It shows the lowest entry point for a collection, which indicates the maximum potential loss. Investors can assess the downside risk of the investment.

- Determine value: It provides a benchmark to evaluate if an NFT is under or overvalued. An NFT at the floor price with unique attributes could be undervalued, or a rare NFT selling near the floor price could be a good entry point for a larger position.

- Gauge market sentiment: Changes in the floor price reflect market attitudes toward a collection. A drop in price might indicate declining interest, while a rise could indicate increasing demand. Monitoring these changes offers insights into market dynamics.

- Strategize investment: Investors can use floor price trends to effectively buy and sell NFTs. Buying when the floor is low and selling when the price has increased is a typical strategy.

II. NFT Floor Price: Concept and Mechanics

1. Defining NFT Floor Price

The floor price is the absolute lowest price at which an NFT in a collection is available for sale. If you want to buy an NFT from that collection, the floor price is the least amount you would need to spend. For example, if the Bored Ape Yacht Club (BAYC) collection has a floor price of 10 ETH, the cheapest Bored Ape costs 10 ETH. Not every NFT in the collection is worth 10 ETH and rare tokens might be worth much more. The floor price is a key indicator for investors to track sentiment and make decisions. This is a dynamic value that is constantly changing as tokens are sold.

2. How NFT Floor Price Works

The NFT floor price is determined by the lowest priced NFT for sale in a collection. If a new listing is lower than the current floor, that new listing sets the floor price. This is a dynamic value based on market behavior that can change very quickly depending on listings and transactions.

Here are some examples:

- Bored Ape Yacht Club (BAYC): If the lowest listed BAYC is at 10 ETH, that is the floor price. If someone lists their ape for 9.9 ETH, the floor price becomes 9.9 ETH.

- CryptoPunks: If the cheapest CryptoPunk is selling for 15 ETH, that is the floor price. As new listings come in, the price will fluctuate.

3. The Role of NFT Floor Price

The floor price plays an important role in the NFT market:

- Liquidity Indicator: A stable or rising floor price suggests good liquidity and demand for the collection. High liquidity makes it easier for investors to trade without affecting the price.

- Investment Value: It’s a reference to assess if an NFT is a good investment opportunity. A low floor can be an indication of undervaluation. If the floor is stable or trending upwards, that can also indicate a solid investment opportunity.

- Market Trend Analysis: Tracking floor price changes over time offers insights into the collection’s overall health. Declining floor prices suggest a downward trend, while a stable or rising floor price suggests a healthy project.

III. Factors Influencing NFT Floor Price

1. NFT Rarity

The rarity of an NFT within a collection significantly impacts its price, including the floor price. NFTs with unique attributes or rare traits are more valuable, impacting market prices above the floor, but can also set the floor for the entire collection. If a specific trait becomes popular, the floor price for similar NFTs can increase. Rarity varies significantly, from common to extremely scarce. For example, in a collection of 10,000 NFTs, those with specific accessories, color palettes, etc., might be more valuable, indirectly influencing the floor price. Sometimes, a rare NFT sold at a high price can lift the floor of an entire collection. This is why traders look for rare NFTs to profit.

2. Community and Support

The strength of the community around an NFT collection greatly impacts its floor price. An engaged community creates demand, which pushes prices up. A vibrant community promotes a project, driving interest and adding perceived value. Without a strong community, even rare NFTs can struggle. Communities give feedback and support to developers, which enhances project value. For example, a new update or feature that excites the community can increase the floor price. Community support is crucial for the long-term success of any NFT project.

3. Market Conditions

The overall health of the crypto market greatly influences NFT prices. Bullish (rising) crypto markets attract investors, increasing demand and the floor price of NFTs. Bearish (declining) markets can cause NFT floor prices to drop as people sell to cover losses or reduce exposure to volatile assets. This correlation is strong with NFTs denominated in cryptocurrencies like Ethereum. External factors, like major economic events, regulatory announcements, and technology trends, can have immediate effects on market sentiment. A positive trend in cryptocurrency prices often correlates with rising NFT floor prices, and vice-versa.

4. Liquidity

Liquidity refers to the ease with which an asset can be bought or sold without major price changes. NFT collections with high liquidity tend to have a healthier floor price because there is a constant flow of buyers and sellers. Less liquid NFTs might see wider price fluctuations and lower floor prices due to low trading activity. Liquidity is very important for investors, allowing them to enter and exit a market quickly without changing prices. High liquidity also indicates positive market sentiment towards a project. Low liquidity can signal decreased demand and a potential drop in floor price. Many investors consider liquidity to understand the level of active trading, and how easy it is to buy and sell in the market.

5. Project Credibility

The team’s reputation behind an NFT project is an important factor in determining the floor price. Projects led by experienced developers and designers often gain more trust, which leads to higher floor prices. A clear roadmap and transparent communication also signals stability and a higher chance of success. Investors favor projects with a clear vision and a solid team, which leads to higher investment and a higher floor price. Conversely, a project with a bad reputation or a team that fails to deliver will lead to a decline in floor price. Conduct due diligence to see who is behind a project, and what its track record is.

IV. Analyzing NFT Floor Price

1. Tools for Tracking Floor Prices

To analyze floor prices, use reliable tools and platforms. Here are some popular choices:

- OpenSea: The largest NFT marketplace, offering detailed data on floor prices and trading volume. OpenSea

- LooksRare: Another marketplace that provides real-time floor price tracking. LooksRare

- Rarible: A platform focused on creators and art-centric NFTs, with useful floor price data. Rarible

- Third-party Data Aggregators: Tools like Nansen and Dune Analytics offer deeper insights using data from multiple sources. These tools are used by advanced traders for market analysis and trend tracking.

2. Analyzing Historical Data

Historical floor price data is invaluable for identifying trends and patterns. Analyzing past price movements gives investors insight into volatility, stability, and market demand. Analyzing trends can show if the floor price is likely to continue on its current path, or if there is an upcoming change. This data can show investors how the project has performed in the past, and can help with investment decisions.

3. Risk Assessment Based on Floor Price

The floor price is a critical tool for risk assessment. A sharp decline in floor price can indicate a lack of interest in a project and may signal a good time to exit. A rising floor price might suggest an opportunity for investment. When combined with other factors, the floor price is one of the main tools for assessing the overall risk of a particular project. Investors should also pay attention to trading volume, community engagement, and market sentiment towards the project. Using all these factors together is essential for accurate risk assessment before investing in any NFT project.

V. NFT Floor Price and Investment Strategies

1. Buying Low

Buying NFTs when their floor price is low is a common strategy, with the idea that the price might recover or increase in the future. Thorough research and understanding the reasons for a low floor price are key before investing. Analyze the market, the community, and any news that might impact the price. This way, you are using data to back your investment decisions, and not simply based on speculation.

2. Flipping NFTs

Flipping involves quickly buying and reselling NFTs to profit from price differences. Investors buy NFTs below the floor price, or when they anticipate an increase, and resell at a higher price. This requires real-time market awareness and the ability to act quickly. This is a high-risk, high-reward strategy requiring fast reaction times and market knowledge. The goal is to acquire slightly undervalued NFTs and flip them for profit before the market has a chance to react.

3. Long-Term Investing

Investors who believe in a project’s long-term potential may hold NFTs, despite fluctuations in the floor price, often with well-established collections. The idea is that if the project grows in popularity, its floor price will likely increase over time. Long-term investors use the floor price as one factor in their decision to hold. They understand cycles, but believe in long-term value and potential, and their decision is based on these factors. They are less concerned with short-term fluctuations and are more focused on long-term growth.

VI. Top NFT Collections by Floor Price

1. Bored Ape Yacht Club (BAYC)

The Bored Ape Yacht Club is one of the most prestigious and expensive NFT collections. Known for their ape avatars, BAYC has a very high floor price, reflecting its community, celebrity appeal, and exclusive events. Holding a BAYC NFT grants access to a community with numerous benefits. As of today’s date (January 24, 2025), the floor price of BAYC can be anywhere from 60-100 ETH, or even higher depending on market conditions, making it one of the most expensive NFT collections in the world.

2. CryptoPunks

CryptoPunks are pioneers in the NFT space, with significant historical and cultural value. These 8-bit style characters often have high prices, with the floor price acting as a barometer for the high-end NFT market. These characters were one of the first major NFT projects on the blockchain, viewed as historical pieces in the crypto space. As of today’s date, the floor price of CryptoPunks can range from 40-70 ETH, with some individual punks reaching much higher prices.

3. Azuki

Azuki is a popular anime-inspired NFT collection known for its detailed artwork and strong community. The floor price of Azuki NFTs tends to be high because of its visual appeal and metaverse experience. The detailed artwork and interactive metaverse experience have helped Azuki maintain popularity, which is reflected in its high floor price. As of today’s date, the floor price for Azuki can range from 10-20 ETH.

4. Doodles

Doodles feature colorful and creative characters and are popular because of their artistic value and community focus. Their floor price is elevated due to the unique brand and high demand. The Doodles collection has strong community engagement, which leads to the high demand for the project. As of today, the floor price for Doodles can range from 5-15 ETH.

5. Other Emerging Collections

The NFT market is always evolving, with new collections regularly emerging. Some collections to watch include CloneX, Mutant Ape Yacht Club, and Moonbirds. These projects often have fluctuating floor prices based on innovation, utility, and community engagement. These projects should be monitored closely if you are interested in the NFT space, as they can provide insight into the latest trends, technologies, and overall market dynamics. Always perform thorough due diligence before investing because there can be a high level of volatility and risk.

VII. Comparing NFT Floor Price with Other Metrics

1. Floor Price vs. Market Price

The floor price is the lowest available listing, while the market price is the price at which an NFT is sold. The floor price gives you the starting point, and the market price often sits above that, depending on an NFT’s traits or strong demand. The market price is used to gauge the value of specific NFTs, while the floor price can help to see the minimum price, and the overall health of the project.

2. Floor Price vs. Rarity Score

The rarity score measures how unique an NFT is compared to others in the collection. The floor price is a basic metric for the cheapest option, while rarity scores can explain why some NFTs within a collection are priced at multiples of the floor. Rarer NFTs can fetch a far higher price. The rarity score can often be an essential piece of information to see if any NFT is undervalued, or overpriced, and it is often used together with the floor price to make more informed decisions.

3. Floor Price vs. Volume Traded

The trading volume of an NFT collection is the total value of transactions over a certain period. High trading volume generally indicates more interest and engagement, which can influence and stabilize or increase the floor price. Low volume might signal a decrease in interest and possible floor drops. This metric should be considered alongside the floor price, as trading volume is essential for understanding a project’s liquidity, and can help in seeing if the floor price is likely to trend higher or lower.

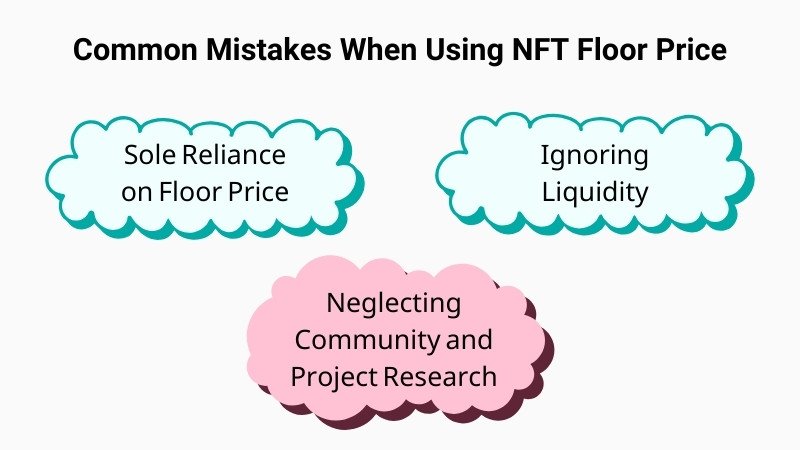

VIII. Common Mistakes When Using NFT Floor Price

1. Sole Reliance on Floor Price

Relying solely on the floor price for investment decisions is one of the biggest mistakes investors make. The floor price is just a starting point, and doesn’t give a complete picture. You must always investigate the actual NFT, and other metrics related to the collection. You should always look at rarity, trading volume, market trends, community sentiment, and the team behind the project. Using the floor price alone may lead to very poor investment decisions.

2. Ignoring Liquidity

Buying into an illiquid collection based solely on a low floor price is a very common mistake. If there are few buyers, it can be difficult to sell, or you may have to sell at a loss to exit a position. It’s critical to check the trading volume to see if there is consistent activity and potential buyers if you need to exit quickly. Low liquidity can lead to poor trading opportunities, or getting “stuck” holding an asset that no one wants to buy.

3. Neglecting Community and Project Research

Failing to research a project’s community, and the team behind it, can be risky. A strong and active community, along with a transparent team, are essential factors for a long-term investment. Ignoring them increases the risk of buying into a failing project, or one that may disappear from the market. It’s essential to spend the time to review all the aspects of a project before investing any money into it, or else you risk losing your investment.

IX. Future Trends in NFT Floor Price

1. AI and Data Integration

Artificial intelligence and advanced data analytics are expected to play a larger role in analyzing NFT floor prices. These tools can provide more accurate predictions and insights into market movements. AI could help to identify undervalued or overvalued assets in real time, and generate real-time price predictions. This can change how investors make their decisions.

2. Metaverse and Gaming NFTs

As metaverse and gaming NFTs gain traction, their floor prices are expected to be influenced by the utility and functionality they offer within those virtual worlds. NFTs that provide access or offer special in-game features will likely command higher floor prices. There will be more focus on practical use cases rather than just collection value. The floor prices of these NFTs will be directly correlated with their usefulness and demand in the metaverse.

3. NFT and Crypto Market Volatility

The floor price of NFTs will continue to be influenced by the overall volatility of the crypto market. Major market trends, economic news, and technological advancements will continue to drive fluctuations in both the crypto and NFT market prices, which will add to the importance of accurate NFT floor price analysis. Staying on top of market conditions and using real-time data will be important to understand the market and make informed decisions.

X. Conclusion

1. Summarizing the Importance of NFT Floor Price

NFT floor price is a critical metric for assessing value and risk in the NFT market. It helps traders and investors assess the lowest value of a collection, gauge market sentiment, and develop smart investment strategies. When used correctly, it is one of the most important indicators to follow when making NFT decisions. It is essential that you understand how the floor price works, and how to combine it with other metrics and tools to come to well-informed investment decisions.

2. Final Advice

While the floor price is valuable, it should not be the only factor in your decision-making. Always do thorough research, look at the project team, review the community, and consider both the rarity and volume traded before investing. Making informed decisions and diversifying your portfolio are crucial for success. Never rush into an investment without taking all the necessary steps to minimize risk. Taking a long-term view is often more beneficial and can lead to better results over time.

Ready to make informed NFT investments? Start tracking NFT Floor Prices today and maximize your potential returns! Stay updated on the projects you’re interested in, analyze the floor prices, and always make sound investment decisions. Join the discussion with other like-minded NFT enthusiasts and start your journey today! Remember, the more you educate yourself, the better your results will be in the long run.

Pingback: AI Wallets Explained: Features, Benefits, and Investment Strategies

Pingback: Koinly Reviews: The Complete Crypto Tax and Portfolio Guide CoinFxPro

Pingback: What are xNFTs and How Mad Lads Paved the Way CoinFxPro

Pingback: What is Kraken Crypto: A Comprehensive Guide CoinFxPro Crypto Tools

Pingback: Autonomous NFTs: Redefining Digital Ownership CoinFxPro Learn Crypto