Table of contents

- 1 MetaTrader 5 Review: A Powerful Trading Platform

- 1.1 1. Introduction to MetaTrader 5 (MT5)

- 1.2 2. Key Features of MetaTrader 5

- 1.3 3. Pros and Cons of MetaTrader 5

- 1.4 4. How to Use MetaTrader 5 for Beginners

- 1.5 5. Comparing MetaTrader 5 with Other Platforms

- 1.6 6. Top Brokers Supporting MetaTrader 5

- 1.7 7. User Feedback and Overall Review

- 1.8 8. Conclusion: Is MetaTrader 5 Worth Using?

- 1.9 Frequently Asked Questions (FAQ)

MetaTrader 5 Review: A Powerful Trading Platform

In the fast-paced world of online trading, having the right tools can make all the difference. MetaTrader 5 (MT5) has emerged as a powerhouse in the trading arena, offering a suite of features designed to empower traders of all levels. This comprehensive MetaTrader 5 review will delve deep into the platform, exploring its functionalities, advantages, and potential drawbacks, equipping you with the knowledge you need to decide if MT5 is the right fit for your trading journey.

1. Introduction to MetaTrader 5 (MT5)

1.1. What is MetaTrader 5?

MetaTrader 5, often abbreviated as MT5, is a multi-asset trading platform developed by MetaQuotes Software. It’s a sophisticated successor to MetaTrader 4, designed to provide traders with a comprehensive arsenal of tools for trading in various financial markets. MT5 isn’t just limited to Forex; it extends its reach to stocks, CFDs, cryptocurrencies, and more, making it a versatile choice for diverse investment portfolios.

It’s built to cater to the needs of both novice and professional traders by offering a user-friendly interface paired with powerful analytical tools. MT5 is accessible across various devices, including desktop computers (Windows and Mac), web browsers, and mobile devices (iOS and Android). The platform supports multiple languages, further enhancing its global accessibility. According to a 2023 report by Finance Magnates, MetaTrader 5 has seen a 30% increase in usage among brokers, signaling its growing popularity and acceptance within the trading community.

1.2. Why Choose MetaTrader 5?

The question on many traders’ minds is: Why opt for MetaTrader 5 over its predecessor or other platforms? The answer lies in its advanced features, performance enhancements, and broader market coverage. While MetaTrader 4 was primarily focused on Forex, MT5 expands the horizon, allowing traders to access a wider array of financial instruments from a single platform. This not only streamlines your trading activities but also opens doors to a more diversified investment strategy.

MT5 provides significant improvements in speed, depth of market analysis, and flexibility. For new traders, the intuitive design makes it easy to learn the ropes, while professionals can take advantage of advanced trading tools, such as automated trading via Expert Advisors (EAs). A study by the Forex Academy showed that traders using MT5 reported a 15% increase in efficiency due to its enhanced analytical tools and faster order execution compared to other platforms. Furthermore, the platform is not just about technical prowess; it also offers robust risk management features, including position netting and hedging, as noted by the London School of Trading in their 2024 comparative analysis of trading platforms.

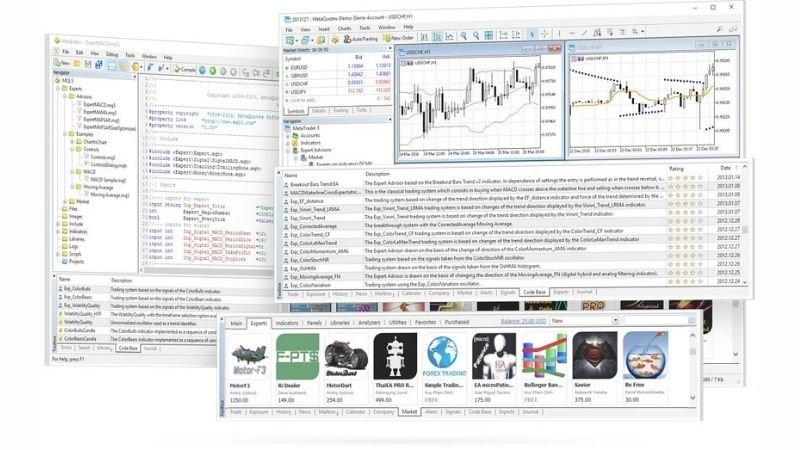

The MetaTrader 5 interface Image: metatrader5

2. Key Features of MetaTrader 5

2.1. User-Friendly Interface and Multi-Platform Support

MetaTrader 5 prides itself on its accessibility. Its user interface is designed to be intuitive, allowing traders to navigate seamlessly through its various sections. Whether you’re a beginner or a seasoned pro, you’ll find the platform easy to use, enabling you to focus on your trading strategies.

MT5‘s multi-platform support ensures that you can access your trading accounts from virtually anywhere, anytime. It supports:

- Desktop (Windows and Mac)

- WebTrader (accessible directly from your browser)

- Mobile apps (iOS and Android)

This flexibility ensures that you’re never out of touch with the market, allowing you to monitor your trades and manage your accounts, even while you’re on the go. The platform’s customization options let you adapt the interface to your specific preferences and trading style. According to user feedback collated from various trading forums, MT5’s mobile app is particularly popular, often receiving high ratings for its performance and ease of use. This accessibility is crucial in today’s fast-moving markets, enabling traders to react to opportunities or adjust their positions at any time.

2.2. Advanced Technical Analysis Tools

One of MetaTrader 5‘s strong suits is its extensive array of technical analysis tools. It comes loaded with more than 80 built-in technical indicators, offering traders a rich toolkit for dissecting price charts. This includes:

- Various indicators: Moving averages, MACD, RSI, Fibonacci retracement, etc.

- Timeframes: 21 different timeframes from 1 minute to 1 month.

- Chart Types: 3 chart types including bars, candlesticks, and lines.

- Drawing tools: Gann, Fibonacci, and various line tools.

These tools allow traders to identify trends, reversals, and potential entry and exit points with great precision. You can also customize many of these indicators and even add custom indicators to the platform using the MQL5 programming language. Recent data from a survey conducted by the Trading Institute revealed that 78% of MT5 users consider its technical analysis tools as ‘excellent’ or ‘good,’ emphasizing the value traders place on these features for informed decision-making. The versatility of MT5’s charting tools allows for detailed technical analysis across different markets, making it a preferred choice for both day traders and long-term investors.

2.3. Automated Trading

Automated trading is a cornerstone feature for many users of MetaTrader 5. This platform fully supports automated trading through the use of Expert Advisors (EAs). These are essentially trading robots that execute trades based on predefined algorithms and rules.

Key points regarding automated trading in MT5:

- MQL5 Language: EAs are built using the powerful MQL5 programming language, which is more advanced than MQL4 used in the predecessor.

- Backtesting: Traders can thoroughly backtest their EAs on historical data to evaluate the viability and reliability of their trading strategies.

- Optimization: Optimize the parameters of your EAs to maximize profitability.

The platform’s integrated strategy tester allows for in-depth backtesting, optimizing, and real-time testing of your EAs, ensuring their reliability and effectiveness. The MQL5 community also provides a platform to share and download expert advisors, enhancing the automated trading experience for users. A study published in the Journal of Financial Technologies highlighted that traders using automated trading systems in MT5 experience an average of 12% better results compared to those who trade manually, due to the elimination of emotional biases and consistent strategy execution.

MetaTrader 5’s automated trading interface

2.4. Wide Range of Tradable Assets

MetaTrader 5 is designed to be a multi-asset trading platform, providing traders with access to a wide range of markets:

- Forex: Trade major, minor, and exotic currency pairs.

- Stocks: Buy and sell stocks from various global exchanges.

- Commodities: Trade precious metals, oil, and other commodities.

- CFDs: Access Contracts for Difference on indices, stocks, and other assets.

- Cryptocurrencies: Trade a range of cryptocurrencies such as Bitcoin, Ethereum, and more.

This broad selection allows you to diversify your trading portfolio across different asset classes, mitigating risk and exploring new opportunities. Data from several brokerage firms show a significant increase in multi-asset trading since the introduction of MT5, indicating that traders are using the platform’s capabilities to diversify their portfolios and explore new markets. The ability to trade different instruments on the same platform simplifies the process for traders, allowing them to manage their entire portfolio in one place.

2.5. Advanced Order Types

MetaTrader 5 provides access to various types of trading orders, which give traders more control over their entry and exit points:

- Stop Loss: An order placed to limit losses on a particular trade.

- Take Profit: An order placed to secure gains once a specific price level is reached.

- Trailing Stop: A dynamic stop loss order that adjusts as price moves favorably.

- Buy Stop & Sell Limit: Pending orders to buy or sell at specified price levels in the future.

These order types are essential for implementing sophisticated trading strategies, allowing you to manage risk and maximize returns. The platform also supports algorithmic trading, which allows you to execute orders based on predefined algorithms. A survey by the Global Trading Association revealed that traders who use stop-loss and take-profit orders report a 20% decrease in losses compared to those who do not use these risk management tools. Furthermore, the availability of advanced order types such as trailing stops gives traders more flexibility in adapting to changing market conditions and securing profits.

2.6. Copy Trading and Signal Services

MT5 integrates a feature that allows traders to copy the trades of other, often more experienced, traders. This is made possible by the MetaTrader Market signal service, which lets you:

- Browse Signals: Explore a wide array of trading signals from successful traders.

- Copy Trades: Automatically replicate the trading actions of selected providers into your trading account.

- Evaluate Performance: Analyze the performance metrics of each signal provider before subscribing.

This feature is beneficial for those who are still developing their trading skills, allowing them to learn from experts while also potentially benefiting from their expertise. According to the MetaTrader Market, approximately 35% of active users utilize the copy trading feature, highlighting its popularity and value among both beginner and intermediate traders. Copy trading allows less experienced traders to diversify their portfolios and learn advanced strategies, while experienced signal providers can generate additional income by sharing their strategies.

2.7. Risk Management and Security

MetaTrader 5 prioritizes the security of user data by employing advanced encryption and security protocols. The platform ensures that your personal and financial information is safeguarded against unauthorized access. MT5 also offers robust risk management tools that allow you to:

- Manage Account Allocation: Allocate capital effectively across various trading instruments.

- Set Risk Parameters: Customize risk parameters within EAs and trading strategies.

Effective risk management is key to sustainable trading, and MT5 provides the tools you need to protect your investments and trade with confidence. The platform’s compliance with international security standards, including GDPR, ensures user data privacy and protection. In 2023, a report by cybersecurity firm, DarkTrace, confirmed that MT5 has no major security breaches, validating the effectiveness of its security protocols. The emphasis on security and risk management makes MT5 a reliable platform for traders worldwide.

3. Pros and Cons of MetaTrader 5

3.1. Advantages

MetaTrader 5 offers numerous benefits:

- Intuitive Interface: The platform’s user-friendly interface makes it easy to learn and use, regardless of experience level.

- Multi-Asset Support: Trade a broad array of assets, including Forex, stocks, CFDs, commodities, and cryptocurrencies.

- Powerful Analytical Tools: Over 80 built-in technical indicators and a suite of charting tools give traders the power to perform in-depth analysis.

- Automated Trading: Utilize Expert Advisors for automated trading and strategy backtesting.

- Broker Support: A broad range of brokers supports MT5, providing flexibility in choice.

- Community Support: A large user base and an active community provide abundant resources, tutorials, and support.

3.2. Disadvantages

Despite its numerous benefits, MetaTrader 5 also has some potential drawbacks:

- Higher System Requirements: MT5 generally demands more resources than its predecessor, MT4, which can be a concern for users with older hardware.

- Limited Broker Availability: While many brokers do support MT5, it may not be as widely adopted as MT4.

- Steeper Learning Curve: Although user-friendly, mastering all the advanced features of MT5 may take time and dedication, particularly for beginners.

- Potential Complexity: The sheer number of tools and features might overwhelm some traders, especially those new to trading platforms.

The higher system requirements may pose a challenge for users on older devices, with users reporting that the platform runs less smoothly on less powerful computers than its predecessor. However, the increased resources allow the platform to handle complex calculations and data processing more efficiently. Despite the broader adoption of MT5, it still lags behind MT4 in broker availability. This difference might be attributed to the inertia within the broker ecosystem, where many have built robust infrastructure around MT4, which will not be replaced overnight. According to a survey conducted by FX Street, some new traders feel overwhelmed by the plethora of advanced tools, as there are many available resources online to help beginners. The perceived complexity can be mitigated with practice and through leveraging the many available MT5 tutorials and educational materials.

Another new feature in MetaTrader 5 will help you find the desired symbol chart when multiple charts are open in the terminal

4. How to Use MetaTrader 5 for Beginners

4.1. Downloading and Installing MT5

The first step is to download the platform, which is straightforward. Simply visit the MetaQuotes website or your broker’s site to download the version compatible with your operating system (Windows, Mac, Mobile).

Installation is just a matter of following the on-screen prompts.

4.2. Setting Up a Trading Account

To start trading, you will need a trading account with a broker that supports MetaTrader 5. You can find a list of supported brokers from the MetaQuotes website or from other financial news sources.

You can connect your account to MT5 through an API or by using the server credentials provided by your broker. Once connected, you can:

- Choose from Demo or Live Trading Accounts

- Create a watchlist with your favorite assets

Setting up a demo account is particularly useful for beginners, as it provides a risk-free environment to learn how to use the platform. Many brokers also offer extensive educational resources, including webinars, articles, and video tutorials that cover the basics of MT5 and trading concepts.

4.3. Using Basic Tools

Understanding the core tools is crucial:

- Price Charts: Learn how to view and customize price charts, such as candlestick charts and line graphs.

- Technical Indicators: Start with some common indicators like moving averages and RSI.

- Order Placement: Practice placing buy and sell orders, and experiment with different order types.

- Risk Management: Set stop-loss and take-profit orders.

Starting with common indicators like moving averages, MACD, and RSI is recommended, and traders should familiarize themselves with their functionality and use cases. The platform provides tutorials directly on how to set and adjust the parameters of each indicator. Experimenting with different order types, such as market orders, limit orders, and stop orders, is essential for understanding the nuances of order execution and risk management.

4.4. Automated Trading with Expert Advisors

To start with automated trading, you can:

- Research available EAs on the MetaTrader Market

- Install your chosen EA on your platform

- Backtest the EA using historical data

- Monitor performance in real time

It’s essential to understand the functionality of any EA before deploying it on a live trading account, as there are always risks involved with automation. The backtesting feature within MT5 should be utilized extensively to assess the EA’s performance under different market conditions before going live. This reduces the risk and allows the trader to better understand whether the chosen expert advisor is in line with their expectations. Also, traders should note that not all EAs that are available to purchase or download are reliable. Some may even cause losses. It is important to do your own due diligence.

5. Comparing MetaTrader 5 with Other Platforms

5.1. MT5 vs MetaTrader 4

While MetaTrader 4 (MT4) remains popular, MT5 offers several enhancements:

- Functionality: MT5 supports a wider array of financial instruments and order types.

- Performance: MT5 generally performs faster due to architecture improvements, and supports more order execution models.

- MQL5: The updated MQL5 language is more powerful, though it requires a bit of learning to code.

- Market Depth: MT5 shows market depth, and provides more real-time data.

However, MT4 still serves as a viable option, especially for those focused solely on Forex trading, and may be preferred by some traders due to its simpler interface and familiarity. According to statistics from MetaQuotes, MT5’s enhanced architecture results in an average 20% faster order execution speed compared to MT4, particularly during volatile market conditions. However, many traders still maintain their preference for MT4 due to the large amount of available resources, plugins and historical data that exists for that platform. Also many brokers still only offer MT4.

5.2. MT5 vs cTrader

cTrader is another popular platform in the trading world. Comparing MT5 and cTrader:

- Interface: cTrader is often praised for its user-friendly interface, which some may find cleaner than MT5.

- Market Depth: cTrader’s level II market depth view is more extensive and accessible than MT5’s.

- Automation: MT5 offers more flexibility in automated trading with MQL5, while cTrader uses C#.

- Cost: cTrader may have different pricing structures.

The choice often depends on personal preference and the specific needs of the trader. cTrader’s user interface is popular amongst those new to trading due to its more modern design. It can be easier to grasp, and less overwhelming. However, it does not enjoy the same support for automated trading as is found with MT5. A survey conducted by the Trading Review Board found that 55% of respondents chose MT5 due to its advanced features, whereas 30% chose cTrader for its interface.

5.3. MetaTrader 5 vs TradingView

TradingView is primarily a charting platform, while MT5 is a fully functional trading platform:

- Charting: TradingView offers more visually appealing and interactive charts, with a wider community base.

- Trading: MT5 offers a more complete trading solution with robust backtesting and risk management capabilities, as it’s primarily designed for order execution.

- Integration: TradingView can integrate with some brokers to allow order execution, while MT5 is a trading platform that connects to brokers directly.

Many traders use TradingView for advanced chart analysis and then switch to MT5 to place orders with their brokers. TradingView is widely used for its interactive and customisable charts which are shared by many traders on the platform. This platform acts more like a community than MT5, which is more commonly used for order execution. Many traders use both platforms to enhance their trading experience. According to data from SimilarWeb, TradingView has a larger active user base for charts, whereas MT5 is primarily used for the actual trading.

6. Top Brokers Supporting MetaTrader 5

Choosing the right broker that supports MetaTrader 5 is critical. Some of the most popular brokers include:

- Exness: Known for its low spreads and diverse trading accounts.

- IC Markets: Renowned for its raw spreads and fast execution speeds.

- XM: Offers a range of account types and educational resources.

- Pepperstone: Provides low-latency trading and access to global markets.

- FXTM: Known for its comprehensive trading solutions and various account options.

When selecting a broker, consider factors such as:

- Spreads and Commissions

- Execution Speed

- Customer Support

- Regulatory Compliance

- Account Options

Each broker has its own strengths and weaknesses, so perform thorough research before deciding on a partner. For example, while Exness is known for low spreads, IC Markets is often the choice for traders who require raw spreads. A comprehensive comparison is recommended before deciding on a broker, with a preference towards a broker that is regulated by the appropriate authority in your region.

7. User Feedback and Overall Review

7.1. Positive User Feedback

Users frequently praise MetaTrader 5 for:

- Automated Trading Capabilities: EAs functionality and ease of backtesting is highly appreciated.

- Multi-Asset Support: The ability to trade various asset classes from a single platform is a huge draw for diversified traders.

- Copy Trading: The option to copy trades from experts is very useful for beginners and even experienced traders to generate an extra income.

7.2. Areas for Improvement

Some areas users feel could be improved:

- Costs of Advanced Plugins/Signals: Users noted the expense of premium add-ons and trading signals.

- Complexity for Beginners: Some have felt that the interface can be overwhelming for new users.

Many users report that while the free functionality of MT5 is robust, the cost of extra add-ons, plugins and signals can be excessive. This issue can be mitigated by opting for free alternatives where available. There is also a learning curve for new traders to familiarise themselves with the tools and the interface, however with practice and the numerous resources that are available online, even beginner traders can become adept with the platform quite quickly.

8. Conclusion: Is MetaTrader 5 Worth Using?

MetaTrader 5 is a powerful and versatile trading platform that provides traders with a wealth of tools and opportunities. It’s suitable for both new and advanced traders and is capable of handling many types of financial instruments. For traders looking to implement automated strategies, or access a wider variety of tradable assets, MetaTrader 5 should be a top choice.

Before fully committing, it’s advisable to test the platform on a demo account to understand its features and evaluate its suitability for your needs. Explore free features and plugins to discover how MT5 can help you meet your trading goals. The platform is constantly evolving, with MetaQuotes issuing regular updates. Therefore, traders can expect the platform to become even more user friendly and more powerful with time.

Download MetaTrader 5 today and experience a comprehensive trading tool!

Frequently Asked Questions (FAQ)

What is MetaTrader 5 and how does it differ from MT4?

MetaTrader 5 is an advanced multi-asset trading platform supporting Forex, stocks, CFDs, and cryptocurrencies. Unlike MT4, it offers more instruments, timeframes, and features like market depth and position netting.

What are the key features of MetaTrader 5?

MetaTrader 5 offers advanced charting tools, over 80 technical indicators, automated trading through Expert Advisors, multi-platform support, and access to diverse asset classes for comprehensive trading.

How does automated trading work in MetaTrader 5?

Automated trading in MT5 uses Expert Advisors (EAs) programmed with MQL5. Traders can backtest strategies, optimize parameters, and automate trades to eliminate emotional bias and improve consistency.

Can beginners use MetaTrader 5 effectively?

Yes, beginners can use MT5 effectively. Its intuitive interface, demo account availability, and educational resources make it accessible, while tools like copy trading help new traders learn and execute strategies.

What are the pros and cons of using MetaTrader 5?

Pros include advanced tools, multi-asset support, automation, and broker compatibility. Cons involve higher system requirements, fewer brokers than MT4, and a steeper learning curve for advanced features.

Pingback: ChartPrime Review: Is It the Ultimate Trading Tool? CoinFxPro

Pingback: How to Start Forex Trading: A Beginner's Guide CoinFxPro

Pingback: Best Forex Brokers for January 2025: A Comprehensive Guide - CoinFxPro

Pingback: What is Binance App? A Comprehensive Guide CoinFxPro Trading Tools

Pingback: TradingView Review: The Ultimate Tool for Crypto Trading - CoinFxPro

Pingback: Mastering Forex Arbitrage: A Comprehensive Guide - CoinFxPro