Table of contents

Koinly Reviews: The Ultimate Guide to Crypto Tax and Portfolio Management

Introduction

According to a report by Chainalysis, in 2024, global crypto transaction volume reached approximately $5 trillion, underscoring the significant financial activity in the cryptocurrency market. This highlights the increasing need for robust tax and portfolio management tools. As more individuals and institutions participate in the crypto space, the complexity of managing taxes and tracking assets will only increase. Platforms like Koinly are instrumental in addressing these challenges. Understanding what cryptocurrency is, is the first step to comprehending the need for these tools.

![]()

Koinly: Free Crypto Portfolio Tracker

What is Koinly?

Koinly is a cryptocurrency tax and portfolio management software designed to simplify the complexities of crypto tax reporting and investment tracking. It’s built to cater to users worldwide by automating the process of calculating crypto taxes, making compliance with local regulations less of a headache. For investors dealing with multiple crypto exchanges, wallets, and different types of transactions, Koinly offers a unified platform to manage all their financial data.

The software’s primary purpose is to help users accurately generate tax reports based on their specific country’s regulations and provide insights into the performance of their crypto portfolio. This includes tracking profits, losses, and overall investment strategy. As you continue through this article on Koinly reviews, you’ll see how this tool stands out in the crowded market.

The landscape of crypto taxation is constantly evolving. For instance, the IRS in the United States has issued several clarifications and updates regarding cryptocurrency taxation over the past few years. Similarly, many European countries have adopted various regulatory frameworks to address the challenges of taxing digital assets. According to a study by the European Central Bank, the complexity of crypto taxation poses significant challenges for both individuals and tax authorities, thus emphasizing the importance of tools like Koinly. Understanding cryptocurrency trading can also give users an insight into the importance of using tax software.

Key Features of Koinly

Koinly offers a broad range of features that make it a preferred choice for many crypto investors. Here’s a deeper look:

Automated Tax Reporting

One of the most critical aspects of Koinly is its automated tax reporting system. It supports various tax calculation methods, including First-In-First-Out (FIFO) and Last-In-First-Out (LIFO), and generates tax reports compliant with local regulations. For example, in the US, it generates Form 8949, making tax filing straightforward. In other countries, it also tailors its reports to meet the specific requirements of their tax authorities. The automation provided by Koinly saves users significant time and reduces the risk of errors in tax calculations.

Portfolio Management

Beyond tax compliance, Koinly also shines in portfolio tracking. It provides real-time insights into your profits, losses, and overall portfolio performance. This allows you to see how your assets are allocated and provides the data needed to optimize your investment strategy. With Koinly, tracking the daily or monthly changes in your crypto portfolio becomes incredibly easy, helping you make well-informed decisions about when to buy or sell assets. Learning how to buy cryptocurrency is the first step but tracking it is also crucial.

Integrations with Major Platforms

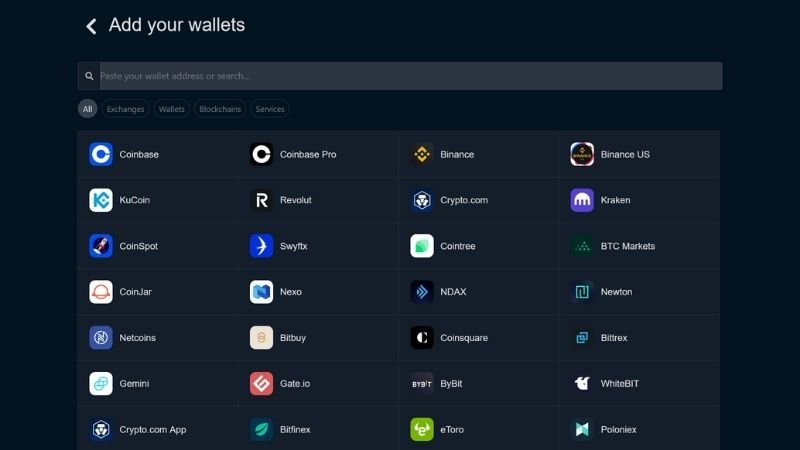

Koinly’s seamless integration with major crypto exchanges and wallets is a game-changer. Through API connections, it can automatically sync your transactions from platforms like Binance, Coinbase, Kraken, and wallets like Ledger and MetaMask. This means you don’t have to spend time manually entering your transactions. The extensive list of supported platforms makes Koinly incredibly versatile, supporting the majority of crypto users.

Support for DeFi and NFTs

The complexity of DeFi (Decentralized Finance) transactions and NFTs (Non-Fungible Tokens) can be challenging to manage for tax purposes. Koinly supports staking, lending, and NFT trading, ensuring that your tax reports are complete, even if you’re active in these emerging fields. The platform’s ability to handle these complex transactions makes it stand out in the realm of Koinly reviews. You can learn about NFT Staking to get a better picture of this.

Recent data from a report by Messari indicates that DeFi protocols saw over $100 billion in total value locked (TVL) during 2024, highlighting the growing importance of managing taxes for DeFi transactions. Similarly, the NFT market has grown exponentially, with trading volume in the billions, making it necessary for crypto tax software to accommodate these unique asset types. You might also find what are xNFTs useful here.

Multi-Currency Support

Koinly is built for the global crypto community, offering support for multiple fiat currencies and crypto-assets. Whether you’re based in the US, Europe, or Asia, Koinly is adaptable to meet your specific tax and reporting needs. This international versatility is one of the key reasons why so many people choose to use this tool.

Koinly’s integration with various cryptocurrency platforms

Pros and Cons of Koinly

Pros

- User-Friendly Interface: Koinly is known for its intuitive and easy-to-navigate interface, making it suitable for both beginners and experienced crypto users.

- Comprehensive Tax Reporting: The platform’s tax reporting features cover a wide range of crypto transactions and are compliant with regulations in multiple countries.

- Extensive Exchange and Wallet Integrations: With support for numerous platforms, Koinly ensures that you can easily sync your transaction history and keep everything organized.

- Global Tax Regulations and Multi-Currency Support: Koinly’s ability to handle regulations in various countries and support multiple currencies makes it ideal for international investors.

Cons

- Paid Subscription for Advanced Features: While Koinly offers a free plan, it is limited in features. To get the full suite of tools, you will need to pay for a subscription.

- Limited Support for Niche Exchanges and Transaction Types: Despite its extensive integrations, there might be some smaller or less common exchanges or unique transaction types that are not fully supported, which could require manual inputs.

- NFT Tracking Capabilities: While NFT tracking is available, some users suggest that this feature could be improved to more accurately manage the intricacies of NFT transactions.

How to Use Koinly

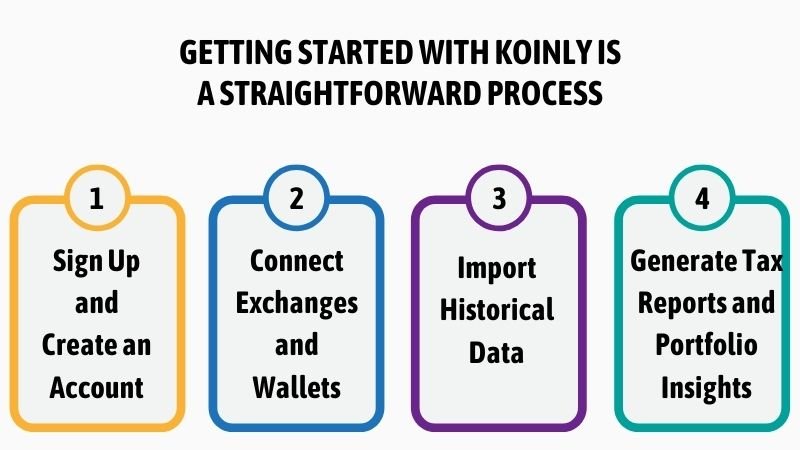

Getting started with Koinly is a straightforward process. Here’s a quick guide for beginners:

Step-by-Step Guide

- Sign Up and Create an Account: Begin by signing up on Koinly’s website. You’ll need to provide an email and set up a password.

- Connect Exchanges and Wallets: After logging in, you’ll be prompted to connect your crypto exchanges and wallets. You can do this via API or by uploading CSV files.

- Import Historical Data: Ensure all your historical transaction data is accurately imported to ensure that your tax reports are comprehensive.

- Generate Tax Reports and Portfolio Insights: Once all the information is in place, Koinly will generate your tax reports and provide a detailed view of your portfolio performance.

Tips for Maximizing Koinly’s Features

- Regularly Update Synced Accounts: Make sure to sync your accounts regularly so that all your latest transactions are included in your reports.

- Verify Imported Data for Accuracy: Always double-check the data that’s imported from CSV files or via APIs to make sure everything is accurate.

The basic steps of how to setup Koinly for your account.

Comparison with Competitors

The market for crypto tax tools is competitive, so let’s look at how Koinly stacks up against some of its main rivals, including CoinTracker, ZenLedger, and CryptoTrader:

| Feature | Koinly | CoinTracker | ZenLedger | CryptoTrader |

|---|---|---|---|---|

| DeFi Tracking | Excellent | Good | Good | Fair |

| Multi-Currency Support | Excellent | Good | Fair | Fair |

| Pricing | Competitive | Competitive | Premium | Variable |

| Ease of Use | Very Good | Good | Good | Fair |

| Customer Support | Good | Good | Good | Fair |

Koinly is generally praised for its robust support for DeFi transactions and multi-currency adaptability. However, the ideal choice for you depends on your specific needs, transaction volume, and comfort level with each platform’s interface. When analyzing Koinly reviews, it’s important to consider the specific aspects that matter most to you.

User Feedback and Reviews

The general consensus from Koinly reviews is largely positive, but here’s a more detailed summary:

Positive Feedback

- Ease of Use: Users consistently praise Koinly for its user-friendly interface and ease of navigation, which is particularly important for newcomers to crypto.

- Comprehensive Tax Reporting: Many users find Koinly’s tax reporting capabilities to be thorough, compliant, and capable of handling complex transactions.

- Support for Multiple Exchanges: The ability to integrate with various exchanges and wallets is another frequently mentioned advantage.

Criticisms

- Pricing: Some users have noted that the subscription costs can be high, especially for users with a large transaction history, although most agree it’s a worthwhile investment to save time and avoid compliance issues.

- Niche Platform Support: While most major platforms are supported, users have noted limited support for niche exchanges or very specific types of transactions.

- NFT Tracking: NFT tracking has been identified as an area for improvement.

Improvements Based on User Feedback

Koinly is continually working on updates and improvements based on feedback from the community. This is why you’ll see that many Koinly reviews, especially the more recent ones, highlight changes based on user suggestions.

For a broader understanding of user experiences, you can refer to reviews on platforms like Trustpilot, where Koinly maintains a strong rating, or Reddit forums dedicated to cryptocurrency taxation. These platforms offer a diverse range of opinions and experiences that can further assist you in making an informed decision. You might find the information on CoinStats review useful as well.

Conclusion

In conclusion, Koinly is a powerful and versatile tool for crypto investors worldwide. Its strong features, including automated tax reporting, extensive platform integrations, and support for DeFi and NFTs, make it a standout choice in the crowded crypto tax software market. While it’s not perfect, the advantages of using Koinly to streamline your tax obligations and track your investment performance are hard to ignore. We encourage you to explore their offerings and consider whether they meet your crypto tax and portfolio management requirements.

Ready to simplify your crypto taxes and portfolio management? Discover how Koinly can help you today.

Pingback: What is Binance App? A Comprehensive Guide CoinFxPro Trading Tools

Pingback: How Bubblemaps Crypto Tools Revolutionize Blockchain Analytics

Pingback: The Fee Switch in Crypto: A Deep Dive into Revenue Sharing - CoinFxPro