Table of contents

- 1 How to Start Forex Trading: A Beginner’s Guide

- 1.1 What is Currency Trading?

- 1.2 Getting Started: Forex Trading for Beginners

- 1.3 Dive Deep: Forex Trading Strategies

- 1.4 Technical Analysis for Forex and Fundamental Analysis in Forex

- 1.5 Mastering the Market: How to Trade Forex Successfully

- 1.6 Risk Management and Leverage in Forex Trading

- 1.7 Forex vs. Stock Market: Key Differences

- 1.8 Making Money and Trading Tips

- 1.9 Conclusion: Your Journey to Forex Trading Success

- 1.10 FAQ: Forex Trading

How to Start Forex Trading: A Beginner’s Guide

Are you captivated by the potential of Forex trading but feel lost about where to begin? Or perhaps you’re a seasoned trader seeking to sharpen your strategies and gain a deeper understanding of the currency market? This extensive guide is tailored for you. We’ll navigate through everything from the foundational principles to advanced techniques, ensuring you have the necessary knowledge and confidence to thrive in the dynamic Forex world.

What is Currency Trading?

Forex trading, short for foreign exchange trading, is the process of buying and selling currencies in the global market with the goal of profiting from the changes in their values. It is the world’s largest and most liquid financial market, operating 24 hours a day, five days a week.

At its essence, Forex trading, also referred to as currency trading, involves the exchange of currencies on the foreign exchange market. Unlike the stock market, where you trade shares of a company, Forex entails speculating on the relative values of different currencies. For instance, if you predict that the Euro will appreciate against the US Dollar, you would buy EUR/USD. The ultimate objective is to capitalize on these fluctuations in exchange rates.

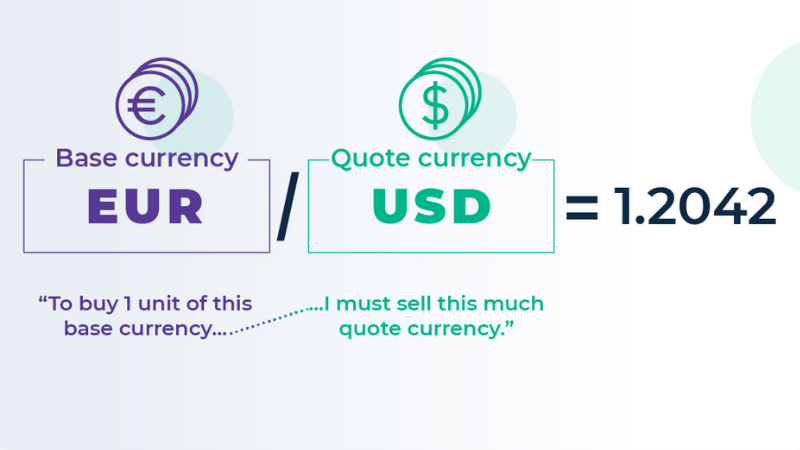

Understanding Forex Pairs

In Forex, currencies are always traded in pairs. The first currency in the pair is termed the base currency, while the second is the quote currency. For example, in the EUR/USD pair, the Euro (EUR) is the base currency, and the US Dollar (USD) is the quote currency. The price of the pair indicates how much of the quote currency you need to purchase one unit of the base currency. Understanding Forex pairs is fundamental to grasping the dynamics of market movements. Let’s say the EUR/USD is trading at 1.10; this means that 1 Euro can be exchanged for 1.10 US dollars.

Example of a Forex Pair: EUR/USD.

Getting Started: Forex Trading for Beginners

If you’re new to Forex, the sheer amount of information can feel overwhelming. However, with a structured approach, you can quickly become proficient. Here’s how to begin your Forex journey:

Essential Steps for Beginners

- Education is Key: Before putting any capital at risk, it’s crucial to understand the fundamentals. Begin by studying currency pairs, pips, lots, and order types. Numerous online platforms offer free educational resources to help you grasp these concepts. A pip, for example, is a unit of measurement used in currency trading to express the change in value between two currencies, while a lot is a standardized unit that represents the amount of currency you buy or sell.

- Choosing the Right Forex Broker: Selecting one of the best Forex brokers is paramount. Seek out regulated brokers with positive reviews, competitive spreads, and a user-friendly platform. Consider factors such as the variety of currency pairs they offer, leverage options, and the quality of their customer support. Some well known brokers that you may consider include IG, Interactive Brokers and Saxo Bank.

- Opening a Demo Account: Before trading with real funds, practice with a demo account. This enables you to simulate trades and learn to navigate Forex trading platforms without any monetary risk. This can be a great way to get a feel for the platform and develop your trading strategy.

- Understanding Risk Management: One of the most critical aspects for those beginning Forex trading for beginners is learning and implementing a proper Forex trading risk management plan. This should include how to set stop-losses and what percentage of your capital you should risk on any trade.

Forex Trading Platforms

The platform you select can greatly influence your trading experience. Opt for platforms that are stable, easy to navigate, and offer a range of technical analysis tools, including real-time charts. Some of the most popular platforms include MetaTrader 4, MetaTrader 5, and cTrader. These platforms can be used on a desktop computer, or a mobile phone.

Example of a typical Forex trading platform interface.

Dive Deep: Forex Trading Strategies

Once you have a grasp of the basics, it’s time to explore various Forex trading strategies. Here are a few popular approaches:

Common Forex Trading Strategies

- Day Trading: This strategy involves opening and closing positions within the same day. Day traders aim for quick profits from minor price fluctuations.

- Scalping: A very short-term strategy that seeks to profit from extremely small price changes over very short periods, often within minutes. Scalpers typically use high leverage.

- Swing Trading: Swing traders hold positions for several days or weeks, aiming to capture larger price swings, often over several days, or even weeks. This is one of the more popular styles of trading.

- Position Trading: This strategy involves holding positions for extended periods, sometimes months or even years, based on a long-term trend analysis. This style focuses more on fundamental analysis rather than technical analysis.

- Trend Following: This strategy seeks to capitalize on long-term trends. Trend followers often use technical indicators to identify these trends.

- Range Trading: This strategy utilizes identified ranges between high and low prices, looking to buy at the bottom of the range and sell at the top, with the expectation that the price will stay within that range.

Forex Trading Indicators

To refine your strategies, it’s crucial to understand and utilize Forex trading indicators. These tools analyze price patterns and offer insights into potential future price movements. Common indicators include:

- Moving Averages: Smooth price data to highlight trends. There are multiple types of moving averages including simple moving averages, and exponential moving averages.

- Relative Strength Index (RSI): Measures the speed and change of price movements to identify overbought or oversold conditions. RSI values range from 0 to 100. An RSI above 70 is typically considered overbought, while an RSI below 30 is considered oversold.

- Moving Average Convergence Divergence (MACD): Tracks the relationship between two moving averages of a security’s price. The MACD line crossing above the signal line can be interpreted as a buy signal, while the MACD line crossing below the signal line can be interpreted as a sell signal.

- Bollinger Bands: Show volatility by highlighting the price action in a given range, using a moving average and two standard deviations. Prices tend to stay within the bands, with breakouts potentially signaling a significant move.

- Fibonacci Retracements: Identifies potential support and resistance levels based on Fibonacci numbers. The most commonly used Fibonacci retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 100%.

Technical Analysis for Forex and Fundamental Analysis in Forex

Successful Forex traders often integrate both technical and fundamental analysis. Technical analysis for Forex involves studying price charts, patterns, and utilizing indicators to forecast price movements. Fundamental analysis in Forex focuses on economic and political factors that can influence currency values. By mastering both, you can gain a more balanced perspective on the market.

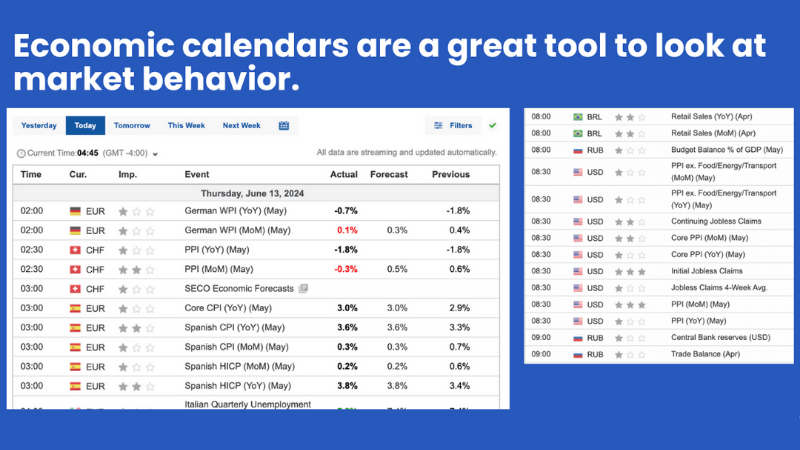

The Importance of Fundamental Analysis

Understanding factors such as economic growth, interest rates, inflation, and political stability can assist traders in predicting long-term trends. Stay informed by monitoring economic calendars and central bank announcements to remain abreast of market-moving events. For example, a rise in interest rates by a central bank will usually result in the strengthening of that particular currency. The US Federal Reserve is one such central bank that can cause significant moves in currency values.

Example of an Economic Calendar. Image: binaryoptions

The Importance of Technical Analysis

Technical analysis equips traders with the ability to recognize patterns in price action, which can facilitate making well-timed entries and exits. While no strategy guarantees success, understanding various technical analysis concepts can be incredibly beneficial. These concepts include support and resistance, trendlines, and various chart patterns such as triangles, wedges, flags, and head and shoulders.

Mastering the Market: How to Trade Forex Successfully

How to trade Forex successfully involves not only having a solid strategy but also comprehending market dynamics and managing risks effectively.

What Moves Forex Market?

Several factors can influence the Forex market, causing substantial price swings. Key drivers include:

- Economic Data: Releases such as GDP, employment figures, and inflation rates can significantly impact currency values. For example, a stronger than expected jobs number in the US, will usually cause the US Dollar to rise in value.

- Interest Rates: Changes in interest rates by central banks can result in significant currency movements. For example, if a country’s central bank raises interest rates, this will often cause the country’s currency to appreciate.

- Geopolitical Events: Political instability or global events can cause currency values to fluctuate. For instance, political turmoil, wars or elections in any country can cause a significant move in the currency of that country.

Forex Market Hours

The Forex market operates 24 hours a day, five days a week, across different time zones. Understanding Forex market hours is crucial for planning your trading activity. The market is most active during the overlaps of major market sessions (e.g., London and New York). These market overlaps tend to be the most volatile, and this is when most traders prefer to be active in the market.

Visual representation of Forex Market Hours.

Risk Management and Leverage in Forex Trading

What is Forex Leverage?

What is Forex leverage? It enables you to control a substantial position with a relatively small amount of capital. While this can amplify your profits, it can also magnify your losses. Using leverage prudently is essential. This can be achieved by risking only a small percentage of your capital on any given trade. Brokers often offer leverage ratios such as 1:100, 1:200 or even higher in some cases. If you use leverage of 1:100 for example, it means you can control a $100,000 position with only $1,000 in your trading account.

Forex Trading Risk Management

Proper Forex trading risk management is vital for protecting your capital. Always use stop-loss orders to limit potential losses, and avoid risking more than you can afford to lose. A good rule of thumb is to never risk more than 1-2% of your capital on any single trade. It is important to understand that losses are possible, and this is a very real risk when trading Forex.

Forex vs. Stock Market: Key Differences

While both the Forex and stock markets involve trading assets, they have significant differences:

Forex vs Stock Market

- Trading Volume: Forex boasts significantly larger daily trading volume compared to the stock market. The Forex market trades trillions of dollars per day.

- Market Hours: Forex is open 24 hours, whereas stock markets have specific trading hours. The NYSE for example is only open during business hours.

- Leverage: Forex generally offers higher leverage than stock trading. Forex brokers often provide higher leverage compared to stock brokers.

- Instruments: Forex is solely about trading currencies, while the stock market deals with shares of companies. The Forex market has a more limited number of tradable instruments, mainly focusing on major and minor currency pairs.

Making Money and Trading Tips

How to Make Money from Forex

Making money from Forex requires discipline, patience, and a commitment to continuous learning. While there are no guarantees of profit, consistently implementing a well-thought-out strategy, coupled with proper risk management, can significantly enhance your chances of success. Many traders fail due to lack of discipline and not following their trading plan.

Forex Trading Tips

- Start Small: Begin with a demo account and then start with small trades to get a feel of the market. Starting small will protect you from losing significant amounts of money while you are still learning.

- Have a Trading Plan: Develop a clear trading strategy and adhere to it. A good trading plan should include your entry and exit rules, risk tolerance, and what your strategy is.

- Use a Trading Journal: Keep a record of all your trades, including entry and exit points, the strategy you used, as well as your emotions. Also note what went well and what you could improve on.

- Stay Informed: Keep up to date with economic news and market developments. It’s crucial to be aware of the factors that can impact currency values. You can also find out the latest news on EURUSD here.

- Be Patient: Don’t rush into trades and always wait for the right opportunity. Many beginning traders jump into trades without a valid reason, which often results in losses.

- Stay Emotionally Disciplined: Avoid letting emotions influence your trading decisions. The most common mistake is allowing fear and greed to influence trading.

Conclusion: Your Journey to Forex Trading Success

How to invest in Forex is more than just buying and selling currencies. It’s about understanding the global economic landscape, developing strong analytical skills, and mastering risk management techniques. It is a challenging field to master, however with dedication, hard work and patience, it is possible to be successful.

This guide has provided you with a comprehensive foundation, but your journey to becoming a successful Forex trader is ongoing. Stay committed to learning, practicing, and adapting to market changes, and you’ll be well on your way to achieving your trading goals. By continually honing your skills in various aspects of Forex, you can significantly improve your chances of success. Never stop learning, and always be open to trying out new strategies.

Pingback: ZuluTrade Review: Is It the Right Copy Trading Platform for You? - CoinFxPro

Pingback: Decoding EUR/USD: A Comprehensive Guide with MarketWatch

Pingback: Mastering the Forex Market: A Deep Dive into Major Pairs - CoinFxPro

Pingback: Mastering Forex Arbitrage: A Comprehensive Guide - CoinFxPro

Pingback: All Forex No Deposit Bonus: Guide to Risk-Free Trading CoinFxPro

Pingback: ChartPrime Review: Is It the Ultimate Trading Tool? CoinFxPro

Pingback: Understanding Pips in Forex: A Trader's Essential Guide - CoinFxPro

Pingback: Mastering Forex: A Guide to Currency Pairs CoinFxPro

Pingback: What Is a Trading Strategy? A Deep Dive into Forex Trading - CoinFxPro

Pingback: Decoding the Forex Market: A Comprehensive Guide - CoinFxPro

Pingback: What is Netdania Charts? A Complete Guide for Forex Traders - CoinFxPro

Pingback: Navigating the World of Forex Brokers: A Comprehensive Guide - CoinFxPro