Table of contents

- 1 History of Cryptocurrency: A Comprehensive Journey from Concept to Global Phenomenon

- 1.1 What is the History of Cryptocurrency?

- 1.2 Sources of Decentralized Digital Currency: The Theoretical Foundations

- 1.3 The Birth of Bitcoin: A Revolutionary Breakthrough

- 1.4 The Emergence of Altcoins and the Growing Ecosystem

- 1.5 Mainstream Awareness and Institutional Adoption

- 1.6 The Present and Future of Cryptocurrency

- 1.6.1 Decentralized Finance (DeFi) Continues to Grow

- 1.6.2 NFTs are revolutionizing the means of digital ownership.

- 1.6.3 Layer-2 Scaling Solutions Address Scalability

- 1.6.4 Central Bank Digital Currencies (CBDCs) Emerge

- 1.6.5 The Metaverse and Web3 Integration

- 1.6.6 Regulatory Scrutiny and Clarification

- 1.7 Key Takeaways

- 1.8 Conclusion

- 1.9 Frequently Asked Questions

History of Cryptocurrency: A Comprehensive Journey from Concept to Global Phenomenon

One of these developments that has shaken up the finance industry is an innovative technology that has emerged with unprecedented force: the technology in question is cryptocurrency. Bitcoin has evolved into a global phenomenon, with a compelling narrative of invention, disruption, and changing viewpoints—rising from theoretical conceptions to mainstream finance. Covering everything from a deep dive into the key events, people, and technological advancements that have shaped the cryptocurrency scene, this weighty tome is an in-depth read for the history buff.

What is the History of Cryptocurrency?

The history of cryptocurrency began in the late 20th century with concepts like DigiCash and B-money.

The official emergence occurred in 2008 with Satoshi Nakamoto’s Bitcoin whitepaper.

Since then, the industry has evolved with thousands of cryptocurrencies, including Ethereum,

fueling innovations in decentralized finance (DeFi) and non-fungible tokens (NFTs).

Sources of Decentralized Digital Currency: The Theoretical Foundations

The notion of a digital currency independent of central authorities has been years in the making. A lot of important things happened before Bitcoin came out that laid the groundwork for the crypto revolution.

Early Forms of Digital Currency and Cryptography

The Work of David Chaum and DigiCash (1989):

In 1982 (Chaum, 1982), the innovative cryptographer David Chaum proposed the concept of “blind signatures” in his article “Blind Signatures for Untraceable Payments.” This line of inquiry paved the way for DigiCash, an early electronic currency he co-founded in 1989. DigiCash was facing many commercial and adoption hurdles but ultimately failed to provide anonymous internet transactions.

B-Money and Hashcash (1997-1998):

The independent ideas behind decentralized digital currency first emerged in the late 1990s. Wei Dai introduced his “b-money,” which was a description of a sort of distributed, anonymous electronic currency system, even implying a proof-of-work-like mechanism. Around the same time, Adam Back developed a proof-of-work system called “Hashcash” to discourage e-mail spam (Back, 2002). Such ideas would come to shape the design of Bitcoin in later years.

Cypherpunk Movement and Search for Privacy

To protect individual freedoms in the Information Age, a cadre of activists and crypto-anarchists emerged in the late 1980s and advocated for the widespread use of strong cryptography and privacy-enhancing technology, building the foundations for the Cypherpunk movement. They studied digital currencies as a means of attaining financial freedom and countering government spying because they believed privacy was the foundation of an open society. Notable contributors/figures Eric Hughes / John Gilmore / Timothy C. May”

Illustration of the Cypherpunk Movement featuring digital privacy advocates and cryptographic themes Image: Cointelegraph

The Birth of Bitcoin: A Revolutionary Breakthrough

The global financial crisis of 2008 was a seminal event in the history of technology and finance. The trust in established financial institutions took a significant dip, making way for the emergence of alternative solutions. With all of this in mind, the Bitcoin white paper was written under the pseudonym Satoshi Nakamoto.

The Bitcoin Whitepaper (2008)

Bitcoin was introduced as a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” on October 31, 2008, and published to a cryptography mailing list (Nakamoto, 2008). In October 2008, Satoshi Nakamoto published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This seminal paper proposed a decentralized digital currency called Bitcoin that would enable participants to make online payments without a financial processing company. It covered basic topics, such as:

Blockchain:

It refers to a distributed, immutable, public ledger that keeps track of all Bitcoin transactions. Which eradicates the need for a central authority to verify and process transactions.

Proof-of-Work (PoW):

A consensus mechanism that requires miners to work through complex cryptographic challenges to confirm transactions and create additional blocks in the blockchain. This makes the network secure and makes sure double spending does not occur.

Decentralization:

The system relies on a peer-to-peer computer network (nodes) that makes it unnecessary to have a single point of control or failure.

Limited Supply:

The total supply of Bitcoin is capped at 21 million BTC, giving it a scarce property, which will be limited by its supply.

The Genesis Block and Early Adoption (2009)

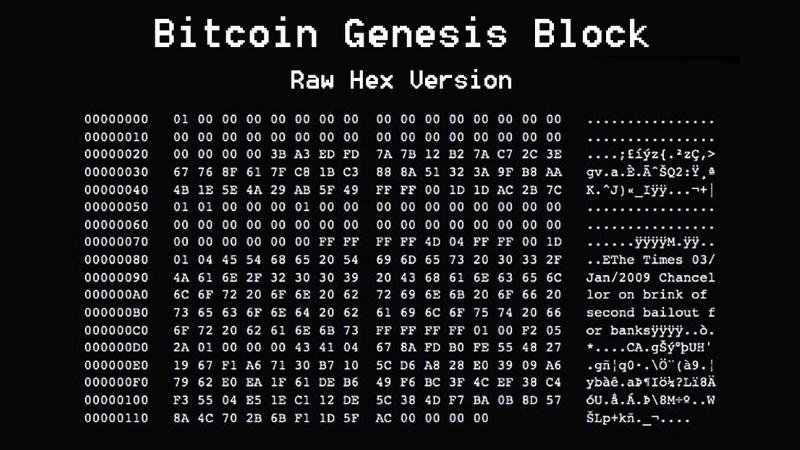

The genesis block, or first block, of the Bitcoin network was mined on January 3, 2009. It contained the now-famous statement “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” an oblique insult to the financial turbulence that spurred the creation of Bitcoin.

Initially, Bitcoin was adopted by a niche of cryptographers, programmers, and enthusiasts who saw an opportunity for innovation even among themselves. A few key upcoming events:

First Bitcoin Transaction:

A few minutes later, Satoshi Nakamoto did send 10 Bitcoins over to Hal Finney, a well-known cypherpunk and a pivotal player in the creation & development of Bitcoin.

The Bitcoin Pizza Day:

The first known real-life purchase of items with Bitcoin happened in May 2010, when Laszlo Hanyecz bought two pizzas for 10,000 BTC. A deal that is now worth hundreds of millions of dollars, a fact that underscores the meteoric rise in value of Bitcoin.

Bitcoin Genesis Block – A visual representation of the first block of the Bitcoin blockchain.

The Emergence of Altcoins and the Growing Ecosystem

The success of Bitcoin led to the development of various alternative cryptocurrencies, which are popularly referred to as “altcoins.” These new projects were built to accomplish things Bitcoin was unable to do or to provide alternative functionalities. As such, this spurred a multitude of crypto ecosystems to be developed, ever-evolving.

2011-2013: Namecoin, Litecoin & Other Early Altcoins

The very first altcoins launched in 2011. Among these were Namecoin, which sought to create a decentralized domain name system, and Litecoin, which was meant to be a faster and lighter alternative to Bitcoin. Litecoin: Also referred to as the “silver to Bitcoin’s gold,” Litecoin adopted the Scrypt algorithm for mining that made it more accessible to normal computers (Litecoin Foundation). Some other notable cryptocurrencies from this period are Peercoin, which employed a Proof-of-Stake (PoS) consensus mechanism, and Ripple (XRP), which aims to provide financial institutions (Ripple (XRP) with cheap and swift international payments.

Ethereum and the ICO Boom (2014-2017)

A notable transformation in the crypto marketplace was the emergence of Initial Coin Offerings (ICOs). Fundraising has turned into such an integral part of crypto development that it is now divided into ICOs (Initial Coin Offerings), which allowed crypto projects to raise cash by making their tokens available to the public. During this time, many of these innovations emerged in the new crypto market with new altcoins that had little to no value proposition, creating giant market swings in volatility.

Out of dozens of others, however, one project caught the most attention: Ethereum. Ethereum, the brainchild of Vitalik Buterin, burst onto the scene in 2015 with the game-changing concept of a programmable blockchain. Powered by its own cryptocurrency, Ether (ETH), the network enabled the issuance of smart contracts: code-written agreements to execute actions virtually (Ethereum Foundation).

These smart contracts introduced a realm of possibilities, which laid the foundation for:

Decentralized Applications (DApps):

These applications run on the Ethereum blockchain and can range from lending money to playing games and selling art without any intermediaries.

Decentralized Finance (DeFi):

This has helped a parallel financial system operate via blockchain using DeFi protocol building blocks such as Aave, Compound, and Uniswap.

Non-Fungible Tokens (NFTs):

These tokens signify ownership of digital or physical items, and they are shaking up the art and collectibles market in a big way.

Mainstream Awareness and Institutional Adoption

Cryptocurrencies have garnered a significant amount of public interest since 2017. Bitcoin was entering the orbit above $20K, first reported around the world. As time went on, more institutions expressed interest, and better infrastructure was created.

The 2017 Bull Run and Subsequent Market Correction

The 2017 bull run was fueled by a combination of factors, including increased media coverage, growing retail investor interest, and the ICO craze. However, the market experienced a significant correction in 2018, highlighting the volatility inherent in the nascent crypto industry at that time.

Institutional Interest and Infrastructure Development

The 2017 Bull Run was driven by a confluence of factors, notably increased media coverage, heightened retail investor demand, and the ICO mania. But the market had a major correction in 2018, exposing the volatility that was rampant in the then-nascent crypto industry. Institutional Interest and Infrastructure Development The underlying technology also matured over the course of the market correction. Then, institutional investors, which included hedge funds and investment banks, began to seek access to the crypto market. The result was professional-grade trading platforms, custody solutions, and investment products. Fidelity Digital Assets (2021): As of 2021, 58% of institutional investors surveyed in the United States, Europe, and Asia were investing in digital assets.

Traditional financial firms have also been increasingly warming to the idea of digital assets, with the likes of Fidelity, JP Morgan, and Goldman Sachs all getting in on the act.

The Present and Future of Cryptocurrency

The history of cryptocurrency is still being written. As of 2023, the crypto market has evolved significantly, with new trends and technologies emerging:

Decentralized Finance (DeFi) Continues to Grow

DeFi protocols are giving the world of lending, borrowing, and trading a big makeover by providing an open, permissionless financial system to the masses. TVL in DeFi protocols has climbed to billions, with more individuals trying out decentralized financial services.

The market experienced amazing growth, and as of November 2021, the total value locked (TVL) in DeFi protocols reached over $250 billion (DeFi Llama, 2023)..

NFTs are revolutionizing the means of digital ownership.

NFTs have come to be the rage, enabling artists, musicians, and creators to monetize their work in new ways. There has been incredible growth in the NFT market, with some digital artworks going for millions of dollars at auction.

According to DappRadar, the NFT market generated over $23 billion in trading volume in 2021 alone, marking a massive increase in interest.

Layer-2 Scaling Solutions Address Scalability

To address the scalability limitations of some blockchains, layer-2 solutions like Polygon and Optimism are being implemented. These solutions enable faster and cheaper transactions, making cryptocurrencies more practical for everyday use.

Central Bank Digital Currencies (CBDCs) Emerge

Central banks around the world are exploring the possibility of issuing their own digital currencies, known as CBDCs. These digital currencies could potentially transform the financial system, offering new possibilities for payments and monetary policy, while also raising concerns about privacy and control.

According to the Atlantic Council’s CBDC tracker, over 100 countries are currently exploring or piloting CBDCs (Atlantic Council, 2023).

The Metaverse and Web3 Integration

One more thrill is that of the metaverse, a computer-generated (VR) environment where users can experience life-like experiences. And those technologies are going to become more integrated into the way we live in the years to come, and across the metaverse, cryptocurrencies will probably play a significant role in that.

Web3—the next generation of the World Wide Web—is based on a decentralized online ecosystem that relies on blockchain technology. Web3 is all about providing users more ownership of their data and their digital experience. The vision for Web3’s decentralized web was advanced by Ethereum co-founder Gavin Wood in 2014.

Regulatory Scrutiny and Clarification

As the crypto market matures, regulators across the globe are turning their gaze inward, subjecting it to more scrutiny. We’re all in this together, and we are committed to developing clear, fair, and modern rules that protect you while also allowing new ideas to thrive.” It is critical for the future of cryptocurrency and blockchain technology.

Key Takeaways

- Early Concepts: The idea of digital cash predates Bitcoin, with important contributions from DigiCash and the Cypherpunk movement.

- Bitcoin’s Genesis: Bitcoin introduced the world to decentralized digital currencies through blockchain and Proof-of-Work.

- Altcoin Expansion: The crypto market has diversified with the rise of altcoins, including Ethereum and its smart contracts.

- Institutional Adoption: Mainstream interest and institutional investment are driving the maturity of the crypto market.

- Future Trends: The future includes increased DeFi adoption, NFTs, Layer-2 solutions, CBDCs, and Web3 integration.

Conclusion

The history of cryptocurrency is a testament to the power of innovation and the human desire for a more open, transparent, and decentralized financial system. From its early conceptual roots to the rise of Bitcoin and the blossoming of a diverse ecosystem, the journey has been nothing short of remarkable. While challenges remain, including scalability issues, regulatory uncertainties, and market volatility, the potential of cryptocurrencies and blockchain technology to reshape the global financial landscape is undeniable. As we move forward, continued technological advancements, increasing adoption, and evolving regulatory frameworks will undoubtedly shape the next chapter in this ongoing story of innovation, and you can count on us to keep you updated with the latest news and developments.

Pingback: What is a Crypto Stock and How Does it Work? CoinFxPro