Table of contents

- 1 The Ultimate Guide to Governance Tokens in 2025

- 1.1 I. Introduction

- 1.2 II. What is a Governance Token?

- 1.3 III. Use Cases of Governance Tokens

- 1.4 IV. Top Governance Tokens in 2025

- 1.5 V. Benefits and Risks of Governance Tokens

- 1.6 VI. Governance Tokens in Decentralized Finance (DeFi)

- 1.7 VII. Investment Strategies for Governance Tokens

- 1.8 VIII. Future of Governance Tokens

- 1.9 IX. Conclusion

- 1.10 Frequently Asked Questions (FAQ)

The Ultimate Guide to Governance Tokens in 2025

In the constantly changing world of cryptocurrency and blockchain, governance tokens have become very important. They are changing the way decentralized projects work. This guide will provide a detailed look at governance tokens, explaining why they are important, how they are used, and their investment potential in 2025. We will cover the basic ideas and also explore the more complex parts of these digital assets. This information is based on recent data and analysis to give you a complete understanding.

I. Introduction

Overview of Governance Tokens

A governance token is a type of cryptocurrency that allows its holders to participate in making decisions for a blockchain project or a decentralized autonomous organization (DAO). Unlike other tokens, governance tokens give holders a say in how the project will be run in the future. They help make sure that decentralized projects are controlled by the community, not just by a central group. In 2024, the market value of governance tokens increased significantly, showing that more people are using and interested in decentralized governance. According to a report by Messari, the total value of assets in DeFi projects that are governed by these tokens reached over $100 billion by the end of 2024. This shows how important community-driven projects are becoming.

What is a governance token?

A governance token is a type of cryptocurrency that grants its holders the right to participate in the decision-making processes of a blockchain project or decentralized autonomous organization (DAO). Holders can vote on proposals related to protocol upgrades, treasury management, and other critical aspects of the project, ensuring a decentralized and community-driven approach to development and management.The Rise of Decentralized Governance

Decentralized governance started with blockchain technology, with projects like Bitcoin creating peer-to-peer networks. The introduction of governance tokens was a big step in the development of blockchain. These tokens gave power to the community instead of just a few people, leading to more transparent and democratic systems. As the industry has grown, governance tokens have become more important. Many projects are now using them to decentralize decision-making. In 2022, only a few projects used governance tokens. By 2024, over 200 projects had started using them. This shows how quickly this type of governance model is being adopted. This trend is expected to continue in 2025, with more projects using governance tokens for community-led decisions.

II. What is a Governance Token?

Definition of Governance Tokens

Governance tokens are digital assets that give their holders voting rights on project-related proposals. They are different from utility tokens, which are mainly used to access a platform’s services, and security tokens, which represent ownership of an asset. Governance tokens give the community the power to decide on important aspects of a project, such as protocol upgrades, treasury management, and platform adjustments. According to data from CoinGecko, as of January 2025, governance tokens make up about 15% of the total cryptocurrency market value. This shows how much influence they have in the crypto world. This percentage has been growing steadily over the past three years, which indicates how important they are for decentralized governance.

Basically, governance tokens are like shares in a company. However, instead of giving rights to financial profit, they give power over how the platform works.

How Governance Tokens Work

Governance tokens work through a system of proposals and voting. Token holders can suggest changes to the protocol or platform. These proposals are then voted on, and holders use their tokens to cast their votes. The more tokens you have, the more your vote is worth. This system allows the community to decide together on the project’s future. For example, token holders might vote on how to use funds from a project’s treasury or decide on adding new features or upgrades to the platform. Some common mechanisms include:

- Voting Rights: Holders vote on proposals submitted by the community.

- Treasury Management: Token holders can decide how to allocate funds from the project’s treasury.

- Protocol Upgrades: Voting to approve or reject changes to the protocol or platform.

For example, Uniswap (UNI), a decentralized exchange (DEX), allows UNI token holders to vote on changes to the protocol. Aave (AAVE), a decentralized lending platform, uses its token to manage upgrades and parameters. MakerDAO (MKR), which manages the DAI stablecoin, allows its holders to influence the risk levels and stability fees. In a recent vote, AAVE token holders voted to add new collateral options to the Aave platform. This shows how actively the community is involved in managing the protocol. Statistics show that about 35% of governance token holders participate in votes, but this number can vary from project to project.

Governance Token vs Utility Token

It’s important to know the difference between governance and utility tokens to understand their roles in a blockchain system. Utility tokens give you access to a product or service, while governance tokens give you decision-making power. Utility tokens are used for things like paying transaction fees or getting premium features. Governance tokens allow you to influence the development and operation of a protocol. For example, Binance Coin (BNB) is a utility token used to pay for transactions on the Binance exchange and get discounts. On the other hand, UNI is a governance token that gives voting rights in the Uniswap protocol. While both types of tokens can be valuable, they have different purposes. A report from TokenAnalyst shows that projects that have well-integrated utility and governance tokens tend to have more users and higher value. This is because the utility provides a practical use, and the governance provides control and influence.

A simple way to think about it is that a utility token provides access, while a governance token provides influence. The success of a project often depends on both types of tokens working well together.

III. Use Cases of Governance Tokens

Voting and Decision-Making

One of the main ways governance tokens are used is to help with voting and decision-making in DAOs. In a DAO, decisions are not made by a central authority but by the collective of token holders. This democratic system makes sure that the project is directed by the community, not just a few leaders. An example of this is the ConstitutionDAO, where token holders tried to buy a copy of the U.S. Constitution using funds pooled through governance tokens. This shows the power of a community working together towards a common goal through decentralized decisions.

For example, in a project that manages a development fund, governance token holders can vote on which projects should get funding. This makes sure that the community’s needs are met instead of the preferences of a small group of managers.

Illustration of community voting using governance tokens

Protocol Upgrades

Governance tokens are also very important for protocol upgrades. When a project needs to change or add new features, token holders make proposals and vote on them. This makes sure that the changes are in line with the community’s vision and avoids any unwanted updates. The Ethereum Improvement Proposals (EIPs) show how community-driven protocol changes work, even though they are not directly governed by a governance token. This process has inspired many other projects to adopt similar governance systems. For example, the successful upgrade of Uniswap V3 to V4 was partly decided by governance token holders voting on important parameters and changes.

Incentives for Holders

Holding governance tokens often comes with benefits. Many projects offer staking rewards, where holders can lock their tokens to support the network and earn more tokens or a share of transaction fees. These financial benefits encourage long-term holding and participation in governance, which helps the project succeed in the long run. For example, Curve (CRV) token holders who lock their tokens for long periods earn a large share of transaction fees. This encourages them to participate in governance and reduces selling pressure, creating a stable environment for the protocol.

IV. Top Governance Tokens in 2025

Ethereum-Based Governance Tokens

The Ethereum blockchain has many successful and widely used governance tokens. These tokens power some of the most innovative decentralized applications and protocols in the crypto world.

- Uniswap (UNI): UNI is the governance token for the popular decentralized exchange, Uniswap. Token holders can vote on proposals related to the exchange’s protocol, fee structure, and treasury management. In early 2025, Uniswap has been increasingly focused on decentralized community-led initiatives. Data indicates that the average voter turnout for Uniswap governance proposals is around 40%, which is considered high within the DeFi space, indicating strong engagement from token holders.

- MakerDAO (MKR): MKR is the governance token for the MakerDAO platform, responsible for the DAI stablecoin. MKR holders have the power to manage the system’s risk parameters and stability fees, playing a key role in maintaining DAI’s price stability. MakerDAO has over 1000 active MKR token holders regularly participating in voting, a number that has been growing steadily since the platform’s inception.

- Compound (COMP): COMP is the governance token for Compound, a decentralized lending platform. COMP holders can vote on platform upgrades and adjust interest rate parameters. Compound has been at the forefront of decentralized finance, with a robust ecosystem and active community, which is reflected in the high rates of participation in governance proposals.

DeFi Governance Tokens

The DeFi (Decentralized Finance) space has seen a big increase in the use of governance tokens, which are essential for the functioning of decentralized lending and trading platforms.

- Aave (AAVE): AAVE governs the Aave lending protocol. Holders can vote on platform upgrades and risk management parameters, making it a vital component of Aave’s decentralized infrastructure. Aave has seen an active growth in its community, with average proposals seeing over 45% turnout in votes, showcasing the platform’s commitment to democratic governance.

- Curve DAO Token (CRV): CRV holders govern the Curve Finance platform, a decentralized exchange designed for stablecoin trading. The token plays a crucial role in managing liquidity pools and protocol parameters. Curve is known for its high total value locked, and its governance mechanism ensures the platform’s stability and efficiency.

- SushiSwap (SUSHI): SUSHI governs the SushiSwap exchange, allowing holders to vote on protocol changes and new features for the DEX. SushiSwap has also explored cross-chain governance and has plans for more robust community involvement going into 2025, with a goal to increase voter participation rates in the coming year.

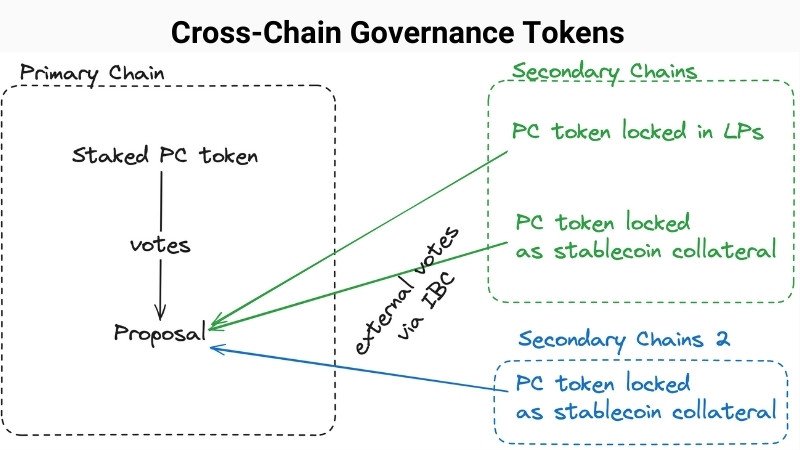

Cross-Chain Governance Tokens

With the rise of multi-chain systems, cross-chain governance tokens are becoming more popular by enabling governance across different blockchain platforms.

- Polkadot (DOT): DOT is used to govern the Polkadot network, enabling holders to participate in decisions related to its parachain system and network upgrades. Polkadot’s governance mechanism allows for on-chain upgrades without the need for hard forks, which is a key reason for its adoption by various projects.

- Cosmos (ATOM): ATOM governs the Cosmos network, granting holders the right to vote on proposals for changes to the ecosystem and its interoperability features. Cosmos is focused on creating an internet of blockchains, and ATOM holders have a crucial role to play in its evolution.

- Avalanche (AVAX): AVAX holders vote on proposals for the Avalanche blockchain, impacting its network parameters and ecosystem development. Avalanche has seen massive growth over the past few years, driven by its high throughput and scalability, and its governance model is a key aspect of its success.

Illustration of cross-chain governance using governance tokens.

V. Benefits and Risks of Governance Tokens

Benefits

Governance tokens offer several important benefits to their ecosystems and the broader blockchain space:

- Decentralization: By distributing governance among token holders, projects become more decentralized and democratic. This prevents a single entity from controlling the project. Studies show that projects with strong decentralized governance models tend to attract more users, which helps them grow and be sustainable in the long term.

- Transparency: The governance process, including proposals and voting, is often done on-chain. This ensures that it is transparent and allows anyone to review the decision-making process. On-chain data provides valuable information about the governance structure, allowing the community to hold the project accountable.

- Financial Incentives: Staking rewards and other incentives encourage people to participate and commit to the project for the long term. These incentives help to make the governance model more effective.

Risks

Despite their advantages, governance tokens also have some risks:

- Centralized Voting Power: A small number of large token holders (“whales”) can control the voting process, which leads to a form of centralized control, even if the system is supposed to be decentralized. This is a major challenge for decentralized governance, and projects are looking for new solutions like quadratic voting to fix this.

- Low Participation: Lack of interest or understanding may lead to low voter turnout. This undermines the goal of decentralized governance. To solve this, some projects are creating user-friendly voting interfaces and introducing ways to encourage voter participation.

- Volatility: The value of governance tokens can change a lot due to market trends and sentiment. This can cause uncertainty for holders. Investors need to be aware of this volatility, which can affect the long-term price stability of these tokens. You can stay up to date with the latest market trends.

VI. Governance Tokens in Decentralized Finance (DeFi)

Role in DeFi Ecosystems

In DeFi, governance tokens are essential for the transparent and community-driven operation of protocols. They allow users to manage various aspects of DeFi platforms together, such as setting interest rates for lending protocols, controlling liquidity pool parameters on decentralized exchanges, and deciding when to upgrade the protocol. Data shows that the level of decentralization is directly related to growth and user adoption, and governance tokens are key to achieving this.

For example, governance token holders in DeFi protocols can decide on the fees charged on the platform, the interest rates for borrowing and lending, and the types of assets accepted as collateral. This ensures that the platforms meet the community’s needs and operate sustainably. For example, Aave token holders decided to add new collateral options based on market demand. This shows the direct impact of the governance model.

Governance Tokens as Collateral

In some cases, governance tokens can also be used as collateral for borrowing assets on DeFi platforms. For example, MakerDAO allows users to lock up their MKR tokens as collateral to generate the DAI stablecoin. This highlights the value of governance tokens beyond just voting rights. This use case has increased the demand and utility of governance tokens, making them even more valuable in the DeFi system.

VII. Investment Strategies for Governance Tokens

How to Choose Governance Tokens

Selecting the right governance tokens for investment requires careful evaluation of several factors:

- Project Analysis: Assess the project’s fundamentals, such as the technology, use case, team, and partnerships. It’s important to do thorough research and understand the project’s long-term goals and how it plans to solve real-world problems.

- Community Engagement: Look for projects with strong and active communities, as this indicates long-term sustainability. A vibrant community often helps the platform grow, which increases its value over time.

- Potential for Growth: Consider the project’s potential for future development and adoption in the industry. Determine if the project has a clear roadmap for the future, and see if it has potential in the rapidly expanding DeFi space.

- Whitepaper and Roadmap: Review the project’s whitepaper and roadmap to understand its goals and plans. These documents provide information about the project’s token system, planned updates, and overall approach to governance.

Long-Term Holding

Long-term investing involves choosing governance tokens from projects with strong fundamentals and growth potential. Investors who believe in a project’s long-term vision and community involvement may benefit from holding governance tokens for a long time. Data shows that projects with a solid governance model tend to perform better over time, benefiting long-term holders.

Yield Farming and Staking

Yield farming and staking offer ways to earn passive income by locking governance tokens in a protocol. Investors can earn more governance tokens or a share of transaction fees as rewards. This increases their holdings while contributing to the network’s security and efficiency. These staking rewards provide a financial incentive to participate in governance, which encourages the community to stay invested in the project’s success.

Market Trends

Keeping track of market trends and developments in the crypto space is crucial for making informed investment decisions. Monitoring the performance of various governance tokens can help investors identify opportunities and risks. By staying informed, investors can reduce risks and make better investment decisions. You can check out reviews on platforms like CoinStats to stay up-to-date with market trends.

Illustration of crypto market trends and analytics for investment decisions

VIII. Future of Governance Tokens

Predictions for Governance Tokens

The future of governance tokens looks promising. The industry is likely to see several key improvements:

- Decentralized Governance: Decentralized governance is expected to become even more important for the success of blockchain projects. As the industry matures, we should see more efficient and inclusive governance systems. The trend is towards more advanced governance mechanisms that improve voter turnout and reduce centralized control by larger token holders.

- Impact on Finance and Blockchain: Governance tokens will continue to change the traditional financial system by increasing transparency and community control. They will continue to be very important in the development of decentralized finance. As we move towards more decentralized systems, the role of governance tokens in providing transparency will only increase.

Integration with AI and Data Analytics

The use of AI and data analysis in the governance process will allow for data-driven decision-making. AI algorithms can analyze large amounts of on-chain data to improve voting efficiency and identify potential problems. This could make governance more efficient and proactive. AI can also be used to create more personalized governance models that meet the diverse needs of communities. You can explore more about the use of AI in crypto.

Evolving Tokenomics Models

We will continue to see new token models appear that are designed to improve the incentive structure and ensure the long-term sustainability of governance systems. These models will focus on making sure that the interests of token holders, platform users, and project developers are aligned. Experiments with new models, such as veTokenomics, which emphasizes long-term lockups, may lead to more sustainable governance and price stability.

IX. Conclusion

Recap of Governance Tokens’ Importance

Governance tokens are essential for the success of decentralized projects. They provide a way for transparent, community-driven decision-making. They empower token holders to influence the future direction of a project. This ensures that development is in line with the community’s needs and priorities. Their presence creates a more democratic, transparent, and community-focused environment.

Frequently Asked Questions (FAQ)

What is a governance token?

A governance token empowers holders with the right to vote on critical project decisions, including protocol upgrades and treasury management. This ensures decentralized control and community-driven development.

How do governance tokens work?

Governance tokens function by granting holders voting power within decentralized projects. The number of tokens held directly correlates to the voting influence on essential decisions, shaping the project’s future.

Are governance tokens a good investment?

Governance tokens offer the potential for voting rights and staking rewards, however, their investment viability hinges on the project’s overall success and prevailing market conditions. Thorough research is crucial.

What are the risks of holding governance tokens?

Holding governance tokens carries risks such as price volatility, low voter participation potentially leading to skewed outcomes, and the centralization of decision-making power among a few large holders, undermining decentralization.

How can I earn governance tokens?

You can earn governance tokens through various methods, including staking your existing crypto assets, participating in liquidity mining programs, receiving airdrops from projects, or actively engaging in decentralized finance (DeFi) governance-related activities.

Pingback: Unlocking the Potential: A Deep Dive into Node Sales - CoinFxPro

Pingback: The Fee Switch: Should Projects Share Revenue? - CoinFxPro

Pingback: How Bubblemaps Crypto Tools Revolutionize Blockchain Analytics

Pingback: What are xNFTs and How Mad Lads Paved the Way CoinFxPro

Pingback: CoinStats Review: The Ultimate Tool for Crypto Portfolio Tracking

Pingback: What is Cryptocurrency? A Comprehensive Guide to Digital Assets

Pingback: What is Binance App? A Comprehensive Guide CoinFxPro Trading Tools

Pingback: What are Altcoins? A Deep Dive into the World Beyond Bitcoin