Table of contents

- 1 Mastering Forex Sentiment Analysis with Myfxbook: A Guide

- 1.1 I. Introduction to Forex Sentiment and Myfxbook

- 1.2 II. The Importance of Forex Sentiment in Trading

- 1.3 III. How to Use Forex Sentiment on Myfxbook

- 1.4 IV. Combining Forex Sentiment with Other Tools

- 1.5 V. Pros and Cons of Forex Sentiment on Myfxbook

- 1.6 VI. Comparison of Myfxbook Sentiment with Other Platforms

- 1.7 VII. Creating a Trading Strategy with Forex Sentiment

- 1.8 VIII. Myfxbook Sentiment: Community and User Feedback

- 1.9 IX. Conclusion: Is Myfxbook Sentiment Right for You?

- 1.10 FAQs about Forex Sentiment

Mastering Forex Sentiment Analysis with Myfxbook: A Guide

In the dynamic world of forex trading, understanding market sentiment can be a game-changer. It’s not just about technical charts and economic calendars; it’s about grasping the collective psychology of traders. This blog post delves into the fascinating realm of forex sentiment and how you can harness its power using the analytical tools provided by Myfxbook. Let’s explore how this can elevate your trading strategy.

I. Introduction to Forex Sentiment and Myfxbook

What is Forex Sentiment?

Forex sentiment, in essence, is the overall feeling or attitude of traders towards a particular currency pair or the market as a whole. It’s a measure of whether the market is generally optimistic (bullish) or pessimistic (bearish) about a currency’s future price movements. This feeling drives buying and selling decisions, impacting price trends. Understanding sentiment helps traders anticipate potential market shifts.

Sentiment is not about individual opinions but the collective view of the majority of participants in the market. It’s a psychological factor that often dictates how prices behave and acts as a vital component of understanding market dynamics. Think of it as the prevailing mood of the trading crowd, influencing market direction.

The Role of Sentiment in Understanding Market Psychology

Market sentiment can often be a leading indicator of potential price movements. By grasping sentiment, traders can gain insights into whether a market trend is likely to continue or reverse. For instance, if there is overwhelmingly positive sentiment towards a currency pair, a trader might expect the price to rise, but they should also be wary of a potential overbought condition and the possibility of a reversal.

What is Myfxbook?

Myfxbook is a popular online platform that offers various tools and services for forex traders. It’s renowned for its robust tracking, analysis, and community features, allowing traders to monitor their performance, share strategies, and engage with other traders.

Myfxbook has grown into a comprehensive hub for traders, providing tools that go far beyond basic tracking. It is a key part of the online forex trading community for both new and experienced traders alike. This platform enables users to view detailed performance analytics, social trading features, and, crucially for our discussion, sentiment analysis.

Key Functions of Myfxbook in Forex Trading

Myfxbook primarily serves as a platform to:

- Track trading accounts and performance in real-time

- Analyze trading history and statistics.

- Share and compare trading results with others.

- Access social trading features

- Utilize sentiment analysis tools.

Forex Sentiment on Myfxbook

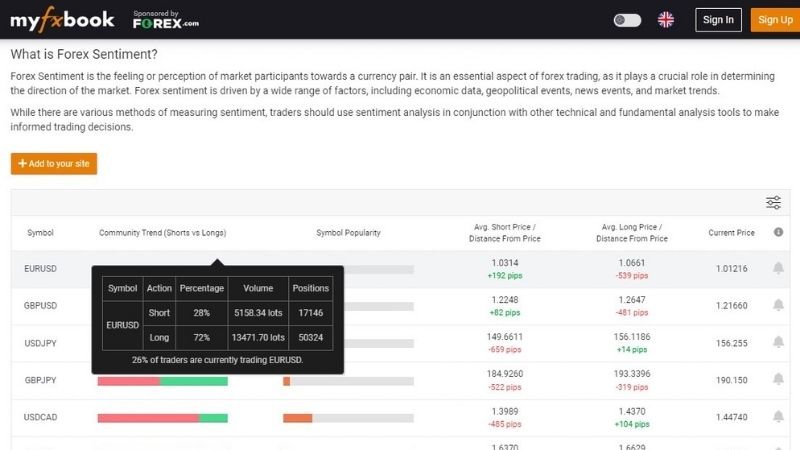

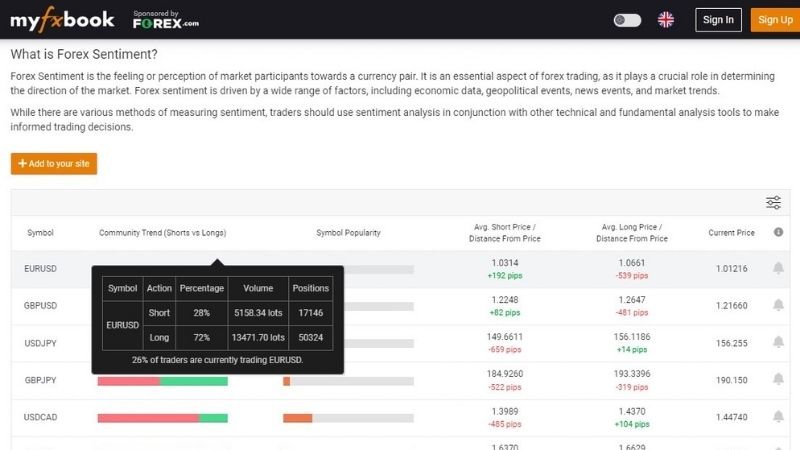

Myfxbook’s sentiment analysis feature is a valuable tool that provides a snapshot of market sentiment. By aggregating data from various sources, Myfxbook gives traders a general idea of whether the market is predominantly bullish or bearish on a particular currency pair.

Myfxbook’s Sentiment Analysis

Myfxbook offers a visual representation of market sentiment through charts and percentages, showing the proportion of traders who are currently long (buying) or short (selling) a particular asset. This provides a clear and easy way to gauge market sentiment.

Benefits of Using Myfxbook for Sentiment Analysis

Leveraging Myfxbook for sentiment analysis offers multiple benefits:

- Real-time Data: Access up-to-the-minute sentiment data for various currency pairs.

- Comprehensive Overview: Gain a holistic view of market sentiment, which helps in making informed trading decisions.

- Historical Data: Analyze past sentiment to understand how it affects price movement.

- Community Feedback: Use the general market view to support or challenge your personal strategy.

II. The Importance of Forex Sentiment in Trading

How Sentiment Helps Traders

Understanding market sentiment is crucial for traders as it helps in making informed decisions. Sentiment provides clues about potential market trends and shifts, which technical or fundamental analysis might not capture on their own.

Analyzing Crowd Psychology and Its Impact on the Market

Markets are largely driven by the collective behavior of traders. When a large majority of traders are bullish, the demand for a currency increases, driving its price up. Conversely, strong bearish sentiment can lead to a price decline. By understanding this dynamic, traders can better position themselves to capitalize on market shifts. For example, if sentiment shows that 80% of traders are long on EUR/USD, a contrarian trader might start looking for opportunities to sell, betting on a potential reversal.

Predicting Market Trends Based on Sentiment

Sentiment analysis is a tool for predicting potential market trends. When sentiment is strongly skewed in one direction, it often indicates that the market is either overbought or oversold, which can signal a coming trend reversal or consolidation. Traders look for extreme levels of bullish or bearish sentiment to identify these opportunities.

Sentiment vs. Technical/Fundamental Analysis

While technical and fundamental analysis are the foundations of trading, sentiment analysis adds another dimension. Each method provides unique insights into the market. It’s crucial to understand the differences and use them together.

Comparison of Methods

Technical analysis focuses on price charts and indicators, helping traders identify patterns and potential entry/exit points. Fundamental analysis examines economic data and news events to assess a currency’s intrinsic value. Sentiment analysis, on the other hand, provides insight into the psychological factors that move prices.

Here’s a table to summarize:

| Analysis Type | Focus | Tools | Insight Provided |

|---|---|---|---|

| Technical Analysis | Price Charts and Patterns | Indicators, Chart Patterns | Potential price movements, entry/exit points |

| Fundamental Analysis | Economic Data and News | Economic reports, news releases | Intrinsic currency value |

| Sentiment Analysis | Market Psychology | Surveys, long/short ratios | Market optimism/pessimism |

Each method can be useful on it’s own but combining them together can offer the most comprehensive analysis

When to Use Sentiment Analysis

Sentiment analysis is particularly useful when the market appears to be driven by emotional factors or during periods of high volatility. It’s also valuable for identifying potential overbought or oversold conditions that might not be obvious from technical charts alone. Sentiment is best used as a confirmatory tool rather than a primary trading signal.

Advantages and Limitations of Sentiment Analysis

Like any tool, sentiment analysis has both its merits and demerits.

Advantages: Enhancing Market Prediction

Sentiment analysis can improve market prediction by providing insight into market psychology, helping traders understand whether a trend is likely to continue or reverse. It allows traders to spot potential trading opportunities that might be missed by solely relying on technical or fundamental factors.

Limitations: Reliance on Data

Sentiment analysis is limited by its reliance on data, which can be affected by biases. Additionally, sentiment isn’t always a reliable indicator, especially in low liquidity markets. It is not a perfect predictor of market movement, and it’s essential to use it in combination with other analysis methods. It’s important to note that market sentiment can change rapidly, and traders should not rely on it as a standalone trading signal.

III. How to Use Forex Sentiment on Myfxbook

Guidance on Accessing and Using

Navigating Myfxbook for sentiment analysis is straightforward. The platform is designed to be user-friendly, and the steps below will help you get started.

Registering and Connecting Your Myfxbook Account

To fully utilize Myfxbook, you’ll need to create an account and connect it to your trading platform. Myfxbook supports various brokers, and connecting your account is usually a straightforward process through the broker’s site.

Accessing Forex Sentiment Tools on Myfxbook

Once logged in, navigate to the ‘Community’ section, where you can locate the Sentiment tool. This tool will provide you with access to real-time sentiment data. You can select the currency pair of your choice and view its current sentiment in either chart form or as a percentage of long and short positions.

Key Features of Myfxbook Sentiment

Myfxbook’s sentiment tool is equipped with key features that allow for comprehensive market analysis.

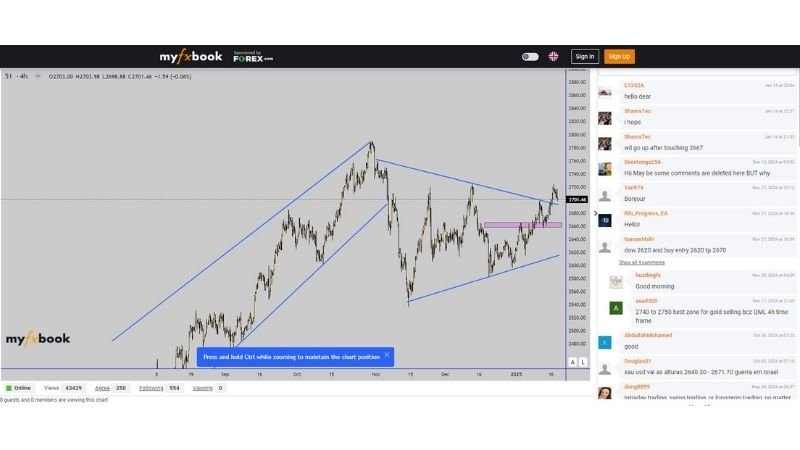

Market Sentiment Charts

Myfxbook offers visually appealing charts that show market sentiment over time. This helps traders understand how market sentiment has shifted and how it correlates with price action. These charts allow you to track sentiment trends and identify potential turning points.

Long/Short Ratio Analysis

The long/short ratio provides a clear view of the proportion of traders who are buying or selling a currency pair. This ratio is a key sentiment indicator, where extreme values can suggest overbought or oversold market conditions. Myfxbook also breaks this information down by percentage making it very easy to consume.

Real-time and Historical Data

Myfxbook’s sentiment tool provides both real-time and historical data, allowing traders to conduct both short-term analysis and long-term trend analysis. The ability to look at past sentiment can reveal how it has influenced price movements in the past, providing valuable insight for future trades.

Practical Examples of Using Myfxbook Sentiment

To truly understand how to use Myfxbook sentiment it’s best to look at real world applications.

How to Analyze the Long/Short Ratio for Trading Decisions

Let’s say that you are tracking EUR/USD, and the long/short ratio on Myfxbook indicates that 75% of traders are long. This suggests that the market is heavily bullish on EUR/USD, but it might also indicate an overbought condition. A contrarian trader might interpret this as a signal to start looking for opportunities to sell, anticipating a potential price correction. Conversely, a trader might take the heavy long position as an indication to buy.

Example: If the long/short ratio shows that 80% of traders are long on GBP/USD, this could be a sign of an overbought market. The sentiment is overwhelmingly bullish, but the market might soon become exhausted, leading to a potential price pullback. Savvy traders might look to take profits or even initiate short positions to capitalize on the reversal.

Applying Sentiment in Popular Currency Pairs (EUR/USD, GBP/USD)

Consider EUR/USD. If the sentiment tool indicates that the majority of traders are bearish (short), this could mean that the pair is in oversold territory. Experienced traders might see this as an opportunity to buy, anticipating a potential upswing. Similarly, with GBP/USD, consistently high bullish sentiment might suggest a risk of an impending correction.

IV. Combining Forex Sentiment with Other Tools

Integrating with Technical Analysis

Sentiment analysis works well with other market analysis tools, such as technical and fundamental.

Using Sentiment to Confirm Trends from Technical Analysis

Technical analysis might indicate a potential upward trend with an RSI (Relative Strength Index) showing overbought conditions. If, at the same time, Myfxbook shows a large number of traders are long, this could be a signal that the market is ripe for a reversal or correction. By cross-referencing sentiment with technical indicators, traders can make more informed decisions.

Example: If a currency pair’s chart shows a bearish flag pattern, combined with the majority of traders being long (bullish) on Myfxbook, it would strongly signal a high probability that the currency will breakout bearishly.

Integrating with Fundamental Analysis

Combining sentiment and fundamental analysis can allow for even greater clarity in understanding market movement.

Analyzing News and Sentiment for Better Predictions

Major economic news releases can significantly impact currency values. If, for instance, positive economic news is released for the USD, but sentiment data shows traders are overwhelmingly short on USD pairs, this divergence can highlight a potential trading opportunity. Traders might then wait for a sentiment shift to confirm their fundamental analysis.

Example: If fundamental analysis suggests that the British Pound should be strengthening but the market sentiment indicates the majority of traders are short on GBP pairs, this might imply that the market is lagging behind the fundamental analysis and an upcoming short squeeze may be on the cards.

Integrating with Other Indicators on Myfxbook

Myfxbook has a wide range of tools that can further strengthen your analysis.

Using Additional Indicators such as Account Performance, Trading History

By combining sentiment data with other metrics available on Myfxbook, such as account performance and trading history, traders can get a comprehensive view of the market landscape. This can help in fine-tuning the timing and strategy for trading decisions. If you notice the highest performing accounts are aligned with a particular sentiment, it may be worth noting.

V. Pros and Cons of Forex Sentiment on Myfxbook

Like any tool, Myfxbook sentiment has its advantages and disadvantages.

Advantages

Myfxbook is a well established platform and this is reflected in the quality and user experience it delivers.

Easy to Use, Intuitive Interface

Myfxbook’s interface is designed to be user-friendly, making it easy for traders of all levels to access and use sentiment data. The intuitive charts and straightforward analysis tools make navigation simple.

Continuous and Accurate Data Updates

The platform offers continuous, real-time updates of sentiment data, ensuring that traders have access to the most current information. This accurate data is essential for making timely and informed decisions.

Community Features

Myfxbook’s strong community features enable traders to engage with others, share insights, and learn from experienced traders. This interactive community approach can provide additional perspectives on sentiment data.

Disadvantages

There are some drawbacks to using Myfxbook sentiment that need to be considered.

Potential Influence of Crowd Emotions

Sentiment data can be influenced by the emotional biases of the crowd. The emotional trading habits of the majority of market participants can cause erratic or irrational price movements. Over reliance on Myfxbook sentiment may cause trades to be based on herd mentality rather than well thought out logic.

Not Always Suitable for Low Liquidity Pairs

Sentiment analysis may not be as reliable for currency pairs with low liquidity. In less liquid markets, sentiment can be easily skewed by large trades, making it difficult to use as an accurate indicator. For example, a very large trade on a low liquidity pair would significantly skew the sentiment, even if overall sentiment on the pair was different.

VI. Comparison of Myfxbook Sentiment with Other Platforms

It’s important to compare Myfxbook with alternative platforms offering similar services.

Myfxbook vs. TradingView

TradingView is another popular platform offering both charting and sentiment tools.

Integration and Sentiment Features

While TradingView excels in technical analysis with its advanced charting capabilities, Myfxbook focuses specifically on performance tracking and sentiment. Myfxbook often integrates trading activity and sentiment analysis much better. Each platform has its own strength making it a case of horses for courses.

Myfxbook vs. eToro

eToro is well known for its social trading platform.

Comparison of Trading Community and Sentiment Tools

eToro is well known for its social trading features and copy trading tools. However, when it comes to in-depth sentiment analysis, Myfxbook typically has more robust tools and data. eToro is generally preferred for social traders who want to follow other users, whereas Myfxbook is favored by those seeking detailed analytical information.

Myfxbook vs. Myfxbook AutoTrade

AutoTrade allows users to copy other traders

Distinction Between Sentiment Tools and Copy Trading

Myfxbook’s sentiment tool is for understanding market psychology and planning your own trades. Myfxbook AutoTrade, on the other hand, is designed for copying trades from other successful traders. Therefore, the two are not related and serve very different purposes.

VII. Creating a Trading Strategy with Forex Sentiment

Here’s how you can use sentiment data to create effective trading strategies.

Choosing Currency Pairs and Trading Signals

To be successful in trading it’s crucial to pick the right currency pairs and identify the most suitable signals.

Selecting the Appropriate Pairs

You should start by identifying currency pairs that are suitable for your trading strategy. High volatility pairs with good liquidity will provide more opportunities to take advantage of market sentiment. You should focus on pairs you’re already familiar with and ensure that you have a comprehensive understanding of the pairs you trade. If you trade using EUR/USD you will likely have a good understanding of the sentiment associated with that pair, meaning you’ll be able to anticipate price movements based on sentiment more accurately.

Selecting Signals

With the correct currency pair you can begin to look for trading signals. When combining sentiment with technical analysis, you could look for divergence. For example, if a technical indicator such as RSI shows overbought, while sentiment is extremely long, then a signal could be given to short the pair. If you are trading using fundamental analysis and you see that strong positive economic news has been released for a specific currency but the sentiment is still overwhelmingly bearish, this could be a signal that the market is currently under-valuing the currency, and a signal to consider buying the currency.

Risk Management with Sentiment

Risk management is an essential aspect of trading and sentiment can play a key role.

Setting Stop Loss/Take Profit based on Market Psychology

When planning trades, the emotional state of the market can be taken into account when setting stop losses and take profits. Extreme levels of bullish or bearish sentiment could cause you to set your take profit and stop loss positions tighter than you otherwise would. Conversely, if sentiment is neutral, you may want to have wider margins for your take profit and stop loss as it could be more volatile.

Optimizing Strategy with Myfxbook Sentiment

The market is dynamic and ever-changing, therefore your strategy should also adapt with it.

Monitoring Performance and Adjusting According to Sentiment

Constantly monitoring performance and adapting your strategy to take changes in sentiment into account is crucial for long term trading success. If you notice your strategy isn’t performing well when sentiment is in a certain state, you should adjust your approach accordingly. Conversely, if your strategy is performing extremely well under certain sentiment conditions, it might be wise to focus on those conditions.

VIII. Myfxbook Sentiment: Community and User Feedback

Positive Feedback

Myfxbook sentiment is a well liked tool within the community and there are some recurring compliments.

Strengths: Detailed Data, Ease of Use

Users frequently praise the platform for its detailed and accurate data, alongside its simple and easy to navigate interface. The charts and percentages are commonly praised as being useful tools for understanding market sentiment.

Areas for Improvement

Despite being popular, there are some areas for improvement that users have commonly mentioned.

User Suggestions for Sentiment Features and Data

Some users would like to see even more detailed sentiment data, including specific trader classifications and more in depth historical analysis. Some have also suggested better integration with other charting tools to allow a more seamless transition between tools.

Success Stories

Myfxbook sentiment has been mentioned as a key component in various traders success stories.

User Success Stories

Many traders have shared that using Myfxbook sentiment as a key component of their trading strategy has led to improved trading results. By incorporating the data into their broader strategies and understanding the sentiment behind market movements, some traders have experienced a positive impact on their trading performance.

IX. Conclusion: Is Myfxbook Sentiment Right for You?

Summary of Myfxbook Sentiment’s Benefits

Let’s briefly recap the benefits of Myfxbook sentiment.

Support in Market Analysis and Trading Optimization

Myfxbook sentiment is a powerful tool for improving market analysis. When combined with other strategies, traders can use this data to make much more informed decisions, potentially leading to more profitable trading outcomes.

Recommendations for Various Users

Based on your experience level, Myfxbook sentiment may be more or less valuable to you.

Beginners and Professional Traders

While beginners may find the simplicity and overview to be useful to develop a basic understanding of sentiment, professional traders can find it even more useful by integrating the data into their trading strategies. Both can significantly benefit from Myfxbook sentiment but with different usage cases.

Final Advice

As a final word of advice, we would highly recommend the following.

Always Combine Sentiment with Other Methods

We always recommend that you use sentiment data in conjunction with other tools such as technical and fundamental analysis. By combing these three different analysis techniques, you can have a much greater understanding of market movements and potential future direction.

FAQs about Forex Sentiment

What is Forex Sentiment and why is it important?

Forex sentiment reflects the collective attitude of traders towards a currency pair, showing bullish or bearish positions. Understanding it helps predict potential market trends and shifts, enhancing decision-making in trading.

How does Myfxbook help with Forex Sentiment analysis?

Myfxbook provides real-time and historical sentiment data, showing long/short ratios and visual charts. These tools help traders gauge market psychology and make informed trading decisions.

Is Myfxbook sentiment analysis free?

Yes, Myfxbook offers sentiment analysis as a free feature. Advanced tools and integrations may have associated costs, but the core sentiment tools are free for all users.

How can traders combine sentiment analysis with other strategies?

Traders can use sentiment analysis alongside technical indicators like RSI or moving averages and fundamental insights like economic news. This combination enhances market predictions and confirms trade setups.

What are the limitations of using Forex sentiment analysis?

Sentiment analysis relies on crowd behavior, which can be influenced by emotional biases. It is less reliable for low-liquidity pairs and should always be combined with other analysis methods for accuracy.

Pingback: ZuluTrade Review: Is It the Right Copy Trading Platform for You? - CoinFxPro

Pingback: Understanding Pips in Forex: A Trader's Essential Guide - CoinFxPro

Pingback: Decoding EUR/USD: A Comprehensive Guide with MarketWatch

Pingback: Cryptocurrency Trading Strategies: A Comprehensive Guide CoinFxPro