Table of contents

- 1 The Professional Trader’s Guide to Forex Risk Management

- 1.1 Why Risk Management is Non-Negotiable in Forex Trading

- 1.2 Key Concepts in Advanced Forex Risk Management

- 1.3 Advanced Forex Risk Management Strategies

- 1.4 Professional Forex Risk Management Tools

- 1.5 Practical Tips for Enhanced Forex Risk Management

- 1.6 Common Pitfalls in Forex Risk Management

- 1.7 Strategies to Protect Your Forex Account

- 1.8 Conclusion

- 1.9 Frequently Asked Questions (FAQ)

The Professional Trader’s Guide to Forex Risk Management

Mastering Risk for Sustainable Forex Trading Success

In the high-stakes world of Forex trading, risk management transcends basic guidelines; it’s the strategic imperative for long-term profitability. This guide provides a deep dive into advanced risk management techniques, moving beyond generic advice to offer a comprehensive framework for professional traders. We’ll explore specific strategies, real-world examples, and tools to fortify your trading approach and mitigate losses effectively.

Why Risk Management is Non-Negotiable in Forex Trading

The Forex market’s inherent volatility, driven by global economic events, political shifts, and unexpected news, demands a robust risk management strategy. Without it, traders face not just financial setbacks, but also the erosion of trading discipline and emotional control. Consider the impact:

- Potential for Catastrophic Losses: Unmanaged risk can lead to substantial losses. For instance, the 2015 Swiss Franc crisis saw some traders lose their entire account balance in minutes.

- Emotional Instability: Significant losses trigger emotional reactions that lead to irrational trading decisions. A trader might attempt revenge trading after a loss, potentially increasing risk beyond their comfort zone.

- Inconsistency: Risk mismanagement leads to unpredictable results. A trader might win a few trades but then experience a catastrophic loss, erasing all gains, because of lack of risk controls.

- Missed Opportunities: Lack of capital, as a result of improper risk management, prevents traders from taking advantage of future opportunities. Without effective risk controls, they can be stuck on the sidelines, unable to participate in the markets.

Effective risk management in Forex is about more than just preventing loss; it’s about creating a stable, predictable trading environment that promotes long-term success. It allows for sustained engagement in the market and enables traders to grow their capital steadily over time.

Key Concepts in Advanced Forex Risk Management

Here are some essential risk management concepts.

Advanced Position Sizing

Position sizing is a nuanced art, not just a simple calculation. It involves a deep understanding of your risk profile, market volatility, and trade-specific risks. Instead of just using a fixed percentage, adjust your position size based on the volatility of the currency pair. For instance, if trading a highly volatile pair like GBP/JPY, you would use a smaller position size compared to a less volatile pair like EUR/USD. Consider the Kelly Criterion for a more sophisticated approach to position sizing which can help to optimize the trade position size.

Optimizing Stop Loss Orders

A stop loss in Forex is not just a price level; it’s an integral part of your trade setup. Rather than using a fixed pip amount, set your stop loss based on technical analysis, for instance, placing it just beyond a critical support or resistance level. Dynamic stop losses, like trailing stops, adjust with profitable movement, further protecting your gains. For example, if you are entering a long position on the EUR/USD and your analysis shows that a support is at 1.0850, you would place your stop loss order slightly below that level at around 1.0840.

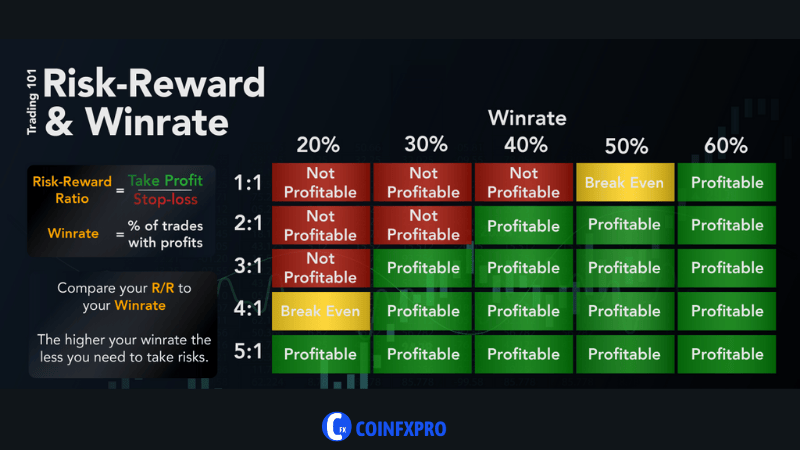

Risk to Reward Ratio Analysis

The risk to reward ratio should be part of every trading setup. Look for trades that have a risk to reward ratio of at least 1:2, or 1:3 if possible. More sophisticated traders incorporate probability into this ratio. This goes beyond calculating potential gains, and takes into account the probability of the trade reaching its target. Using this analysis you can avoid trades that have high risk despite having an acceptable risk to reward ratio. For instance, if your trade has a 1:2 risk to reward ratio but technical analysis shows that the trade only has 30% chance of hitting its target, then it is probably not a good trade.

Risk to reward in Forex trading.

Advanced Forex Risk Management Strategies

Here are some effective strategies for managing risk.

Developing a Custom Risk Management Plan

A personalized risk management plan is crucial for long term success. Instead of following generic rules, you should create a plan that fits your unique goals, tolerance for risk, and trading style. Your plan should include:

- Detailed guidelines for stop loss placements

- Specific rules for position sizing

- Maximum capital at risk in any given time

- Clear guidelines on when to exit a trade

This strategy is about creating a personalized guide that is aligned with your personality and your understanding of the market. It is not something that should be copied from others.

Systematic Risk Approach

Effective risk management is achieved through a systematic approach. Develop a checklist for each trade that incorporates all risk parameters. Ensure that the same process is followed for every trade. This will remove the emotions from the decision process. You must follow your plan, regardless of market conditions. For example, before each trade, you will go through the checklist and verify that you are meeting all the criteria, before entering the trade. This includes confirming stop loss placements, position size, risk to reward ratio, and your exit plan.

Leverage Control

While leverage can increase profits, it can equally increase losses. Using smaller amounts of leverage will help you avoid potential large losses. For example, if you have a $10,000 account, you can choose to use 1:10 leverage which will give you $100,000 of trading capital. However, if the trade goes badly, your potential loss will be much greater than if you had less leverage. Always be mindful of how much leverage you are using.

Advanced Diversification

In Forex, diversification is more than trading multiple currency pairs. It involves trading currency pairs that are not strongly correlated, and trading on different time frames and different trading strategies. Trading pairs that are correlated means your diversification is not really effective. You should also avoid focusing all trades on one type of strategy. Your trades should be spread across a number of different strategies. For instance, you can trade a long term position trade on the EUR/USD, a day trade on GBP/JPY, and scalp trade on the AUD/USD.

Capital Preservation Techniques

Prioritize the preservation of capital above all else. This means being selective on the trades you take. Do not feel pressured to trade if the opportunities are not clear, and do not over-trade. Avoid emotional trades that may cause potential losses. For instance, if you have a $10,000 trading account, your goal should be to protect that capital from the volatility of the market, so that it can be used in future trades. Your goal should not be to try and double your account in one trade. Always trade with a mindset of protecting capital.

Volatility Management

High market volatility is often linked to major news events. Be prepared for these events. You can use the economic calendar to find out when the upcoming news events are scheduled, and decide if you want to avoid trading in those times or to decrease your position size and tighten your stop losses. Use pending orders to better manage your entry point after the news, so you do not get caught in a volatile trade. For example, prior to a major announcement, such as the FOMC meeting, reduce your position size and make your stop losses tighter than usual.

Professional Forex Risk Management Tools

Here are some tools that help with risk management.

Advanced Stop Loss Orders

Use advanced stop loss orders, like trailing stops, to dynamically adjust the stop loss with the price movement. This helps to protect your profits once a trade becomes profitable. Use partial closes to take profit and reduce your position size without completely closing the trade. This will help to reduce risk as the trade progresses. For example, if you have a long trade, and the price moves up by 50 pips, you might partially close the trade by taking profit on half of the position, and then using a trailing stop on the other half of the position.

Sophisticated Position Size Calculators

Use online position size calculators to calculate the correct position size based on the risk to reward parameters. Make sure these calculators use the latest prices to calculate the positions. You can also program your own position size calculator that is tied directly to your trading platform, to avoid calculation mistakes. These are more accurate and do not have human error.

Economic Calendar Integration

Integrate economic calendars directly into your trading platform, so that you can see upcoming news events. This will help you avoid trading in the periods of high volatility. Most brokers offer these as part of the trading platform. This ensures you can properly manage your risk based on the information presented.

Practical Tips for Enhanced Forex Risk Management

Here are some actionable tips to improve your risk management.

Paper Trading

Before engaging in live trading, test your risk management techniques using a paper account. This will let you familiarize yourself with all the tools and techniques without putting your capital at risk. You will also be able to evaluate the effectiveness of your plan and make corrections as needed. It is important to do this regularly to stay in practice.

Continuous Learning

The Forex market constantly changes so it is important to always stay up to date with the latest risk management strategies. Read books, attend webinars, and always look for ways to improve your knowledge of the market. This will help you make better decisions and manage risk more effectively.

Trading Discipline

Discipline is key to risk management. You must follow your risk plan, regardless of the emotion of the moment. Avoid the temptation to over trade or increase the risk to make quick profits. You must stick to your plan and avoid deviating from it for any reason.

Performance Tracking

Regularly analyze your trades and look for mistakes in your risk management plan. Track your progress and make changes as needed. You can use a journal to keep track of your trades. This will give you insight into your trading behavior and ways to improve.

Emotional Stability

Trading psychology plays a crucial role in risk management. Always manage your emotions and avoid impulsive trades, especially after losses. When you are feeling emotional take a break from the market to regain your composure before entering your next trade.

Calculating Risk Effectively

Risk calculation includes the following:

- Determine capital at risk: Find your total amount of trading capital.

- Calculate risk per trade: Determine the percentage of capital you are comfortable risking.

- Set the maximum loss amount: Multiply the risk percentage by the total capital.

- Determine the stop loss level: Based on technical analysis, and position size, determine the appropriate stop loss level.

- Calculate position size: Use position size calculators to determine the proper trade size.

Common Pitfalls in Forex Risk Management

Avoid these common mistakes in risk management.

Stop Loss Neglect

Ignoring stop losses is a very dangerous practice, and many traders have lost their capital due to this. Your stop loss will protect your capital in the event a trade moves against you. Always make stop loss placements a requirement for every trade you make.

Excessive Leverage

Using too much leverage will quickly increase your losses. Start with smaller amounts of leverage, and increase as your understanding of the market and your experience increases.

High Risk on Single Trades

Risking large percentages of your capital on a single trade will put you in a dangerous position. Stick to the rule of 1-2% and avoid over risking on any trade. Always be mindful of how much capital you risk in any given time.

Revenge Trading

Trying to recover losses by taking riskier trades can result in larger losses. When you have a losing streak, cut your losses and reevaluate your strategy. You should always stick to your strategy even after losses.

Lack of Planning

Trading without a plan is like driving a car without directions. Be aware of all risks involved in each trade, and be sure to stick to your trading plan. This way your trades will be in line with your overall goals.

Strategies to Protect Your Forex Account

Use these tips to protect your Forex account.

Starting Small

Start with a small trading account, and grow it as you increase your skill level and trading knowledge. This will allow you to learn without putting your capital at high risk. This will help you avoid large losses as you are learning.

Profit Withdrawal

Regularly withdraw profits from your account. This will help you secure profits, and protect your capital. Move profits to a savings account, once your account has reached the desired goal.

Reputable Brokers

Always choose reputable brokers who are regulated and have high safety standards. Do research on your broker before entrusting your capital to them. This is crucial in securing your capital.

Regular Reviews

Your risk management strategy should not be static. Always review your plan, and adapt it as your skills evolve. This way you are always up to date with the best risk management strategies.

Conclusion

Mastering Forex risk management is an ongoing process that requires dedication and discipline. By using the concepts and strategies mentioned here you will be well on your way to achieving your goals in the Forex market. Remember, success in Forex trading is not just about earning profits; it is about managing your risk and protecting your capital.

Pingback: 3Commas Review: The Ultimate Crypto Trading Bot for Automation - CoinFxPro

Pingback: Decoding EUR/USD: A Comprehensive Guide with MarketWatch

Pingback: Mastering the Crypto Market: Understanding Your Break Even Point - CoinFxPro

Pingback: Mastering Forex: A Guide to Currency Pairs CoinFxPro

Pingback: What is Kraken Crypto: A Comprehensive Guide CoinFxPro Crypto Tools

Pingback: What is Ripple Cryptocurrency? Discover XRP’s Role in Finance

Pingback: Uncle Ted Forex: Exploring Proven Trading Strategies CoinFxPro Learn Forex

Pingback: Decoding the Forex Market: A Comprehensive Guide - CoinFxPro

Pingback: What is Binance App? A Comprehensive Guide CoinFxPro Trading Tools

Pingback: ZuluTrade Review: Is It the Right Copy Trading Platform for You? - CoinFxPro

Pingback: MetaTrader 4 Review: The Ultimate Guide for Forex Traders - CoinFxPro

Pingback: Quasimodo Forex Trading: A Reliable and Versatile Pattern

Pingback: A Comprehensive Guide to Cryptocurrency Trading CoinFxPro

Pingback: Cryptocurrency Trading Strategies: A Comprehensive Guide CoinFxPro

Pingback: Best Forex Brokers for January 2025: A Comprehensive Guide - CoinFxPro

Pingback: MetaTrader 5 Review: A Powerful Trading Platform CoinFxPro Forex Tools

Pingback: Understanding Pips in Forex: A Trader's Essential Guide - CoinFxPro

Pingback: Mastering the Forex Market: A Deep Dive into Major Pairs - CoinFxPro