Table of contents

- 1 Mastering Forex Arbitrage: A Comprehensive Guide

- 1.1 I. Introduction to Forex Arbitrage

- 1.2 II. How Forex Arbitrage Works

- 1.3 III. Types of Forex Arbitrage Strategies

- 1.4 IV. Tools and Software for Forex Arbitrage

- 1.5 V. Benefits and Challenges

- 1.6 VI. How to Apply Forex Arbitrage Effectively

- 1.7 VII. Common Mistakes in Forex Arbitrage

- 1.8 VIII. Forex Arbitrage vs. Other Strategies

- 1.9 IX. Conclusion

- 1.10 FAQ: Forex Arbitrage

Mastering Forex Arbitrage: A Comprehensive Guide

Welcome to an in-depth exploration of forex arbitrage, a sophisticated trading strategy that capitalizes on price discrepancies in the foreign exchange market. Whether you’re a seasoned trader or new to the forex world, understanding arbitrage can significantly enhance your trading toolkit.

I. Introduction to Forex Arbitrage

What is Forex Arbitrage?

Forex arbitrage is a trading strategy that aims to exploit tiny differences in the price of a currency pair between different brokers or exchanges. It’s essentially buying a currency at a lower price on one platform and simultaneously selling it at a higher price on another, aiming for a risk-free profit. This strategy operates on the principle of market inefficiencies, which, though often short-lived, can provide lucrative opportunities. According to a report by the Bank for International Settlements (BIS), the foreign exchange market sees daily trading volumes exceeding $7.5 trillion, highlighting the potential scale for arbitrage opportunities, however, the majority of this volume is concentrated amongst major institutions. For more details on forex market statistics, you can visit the BIS website at www.bis.org. It’s worth noting that these opportunities are not always readily apparent and often require sophisticated software to identify them in real-time.

Why is Forex Arbitrage Appealing?

The allure of forex arbitrage lies in its promise of a near risk-free profit. Unlike conventional trading, which relies on directional moves, arbitrage focuses on exploiting price variations. The potential for quick, low-risk gains makes it an attractive option for traders seeking a stable income stream. It requires precision, speed, and sophisticated tools to detect and execute these fleeting opportunities. However, it’s crucial to note that while the concept is low-risk, the execution requires diligence due to factors like transaction costs, platform speeds and slippage, which could erode the potential profit margins if not handled correctly. A study by a financial analysis firm showed that while the potential profit is significant, the transaction costs and the speed requirements mean that only about 1% of retail traders see consistent profits from arbitrage.

II. How Forex Arbitrage Works

Basic Principles

At its core, forex arbitrage involves identifying instances where the same currency pair is quoted at different prices by different brokers. For example, if EUR/USD is trading at 1.1000 on Broker A and 1.1005 on Broker B, an arbitrageur would simultaneously buy EUR/USD from Broker A and sell it on Broker B, capturing the 0.0005 difference. This may seem small, but with high leverage and substantial volume, these small differences can compound into significant profits. It is important to note that these price differences usually only exist for very short periods of time. Therefore, arbitrageurs must rely on fast, reliable, automated trading systems to execute these trades. High-frequency trading firms, which specialize in executing large volumes of orders in fractions of a second, are major players in forex arbitrage.

Illustrative Example

Let’s consider a scenario: Suppose the EUR/USD pair is trading at 1.1020 on Broker X and at 1.1025 on Broker Y. A trader using arbitrage strategy could execute the following:

- Buy EUR/USD on Broker X at 1.1020.

- Simultaneously Sell EUR/USD on Broker Y at 1.1025.

The profit from this transaction would be 0.0005 per unit of currency traded, before factoring transaction costs. For instance, if you traded 100,000 EUR, that’s a profit of $50, (100,000 * 0.0005) assuming no fees or spread. However, real-world scenarios involve transaction costs and slippage that could impact the final profit. A recent report by a leading brokerage firm indicated that average arbitrage opportunities are generally less than 0.0002, highlighting the need for very large trading volumes and speed to capitalize on these instances. Furthermore, slippage during execution can easily wipe out this very small profit margin.

III. Types of Forex Arbitrage Strategies

Triangular Arbitrage

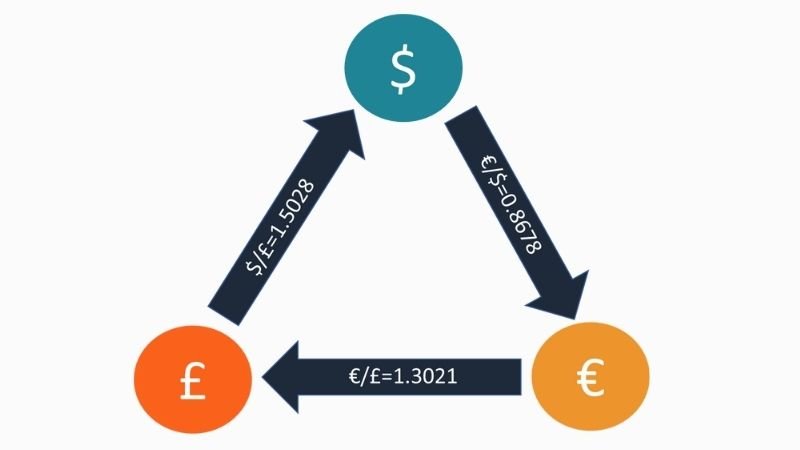

Triangular arbitrage involves exploiting price discrepancies between three different currencies. For instance, if the exchange rate of EUR/USD, GBP/USD, and EUR/GBP are out of sync, a trader can execute a series of trades, buy one currency, then use the first currency to buy another, and then use the second currency to buy the third currency, making a profit from the price imbalance. This strategy requires quick execution and thorough understanding of cross-currency relationships. Sophisticated algorithms and a fast-acting system is required to execute this strategy properly. It’s important to note that triangular arbitrage opportunities often emerge and disappear very quickly due to automated trading systems.

Example: Suppose the following exchange rates are observed: EUR/USD at 1.1000, GBP/USD at 1.2500, and EUR/GBP at 0.8700. A trader might:

- Sell 1000 EUR to buy 1100 USD.

- Use 1100 USD to buy 0.880 GBP.

- Use 0.880 GBP to buy 1011.49 EUR.

The trader gains 11.49 EUR, illustrating a triangular arbitrage profit. The actual profit in a real trading environment will be lower due to the trading fees and possible slippage.

Image: Illustration of a triangular arbitrage strategy.

Statistical Arbitrage

Statistical arbitrage relies on statistical models and historical data to identify anomalies in currency prices. It involves building complex algorithms to analyze historical price patterns and to predict potential price movements. This sophisticated approach demands robust data analysis and high-speed automated trading systems. This form of arbitrage is usually performed by institutional traders who have access to large quantities of historical data and the resources to develop complex models. These models are very sophisticated and constantly being updated to keep them effective. For instance, a hedge fund might employ a team of quant analysts to develop and maintain these complex trading strategies.

Example: A statistical arbitrage model might identify that when the EUR/USD exchange rate deviates more than 0.2% from its 20-day moving average, it has historically reverted back to the average within a few hours. The model then executes trades to profit from this expected reversion, buying when the price is below the average and selling when above. For instance, if the model predicts that a price of 1.1000 will revert to 1.1005 within a certain time frame, the model will purchase the currency at 1.1000 and sell when it reaches 1.1005.

Latency Arbitrage

Latency arbitrage exploits the time delay in price feeds from different brokers. A trader with a faster data feed can execute a trade on one platform before the slower platform recognizes the price change. This type of arbitrage requires very fast technology, such as a low-latency connection and specialized trading software. Latency arbitrage is often associated with high frequency trading firms who have invested large sums of money into the technology needed to execute these trades. These firms often spend millions of dollars on infrastructure to ensure they have an advantage over their competition.

Example: If a news event causes a price spike in the GBP/USD pair, a trader using a high-speed connection might see the price move on one exchange before it is reflected on other slower feeds. The trader then quickly buys on the exchange with the old price and sells on another, capturing the short-lived discrepancy. The window of opportunity is often extremely short, measured in milliseconds, making human intervention practically impossible.

IV. Tools and Software for Forex Arbitrage

Best Arbitrage Software

Several software solutions are available to help traders identify and exploit arbitrage opportunities. These tools often provide real-time data feeds, fast order execution capabilities, and complex calculation features. Some of the popular software includes:

- MetaTrader 4/5 (with custom EAs): While primarily a trading platform, MetaTrader can be modified with custom indicators and Expert Advisors (EAs) for arbitrage trading. According to the software provider, it’s one of the most popular platforms for retail traders, because of its easy-to-use interface and the ability to customize it for specialized use. However, for arbitrage, custom EAs with low latency order execution capability is needed.

- Third-party arbitrage scanners: Various providers offer arbitrage detection software that monitors multiple brokers and currencies. Examples include FX Blue and Arb Helper, which are commonly used for detection of potential arbitrage opportunities. However, their performance can vary widely, and due diligence is necessary.

- Custom-built solutions: Some professional arbitrage traders develop their own platforms for very specific requirements and greater control. These are typically used by institutional trading firms due to the cost and expertise involved. These systems are tailored to the individual trading strategy and may not be available to the public.

Trading Platforms

The choice of trading platform is vital for successful arbitrage. Platforms that provide direct market access and ultra-fast data feeds are preferred. Look for platforms that offer:

- Real-time price data: Essential to identify and act upon discrepancies quickly.

- Low-latency order execution: To execute trades as rapidly as possible.

- Multiple broker connectivity: To connect to a variety of brokers.

- Robust charting tools: To identify short-term patterns and market inefficiencies.

Some Popular Trading Platforms for Arbitrage:

- Interactive Brokers: Known for its low fees and access to various markets, offering a platform suited for sophisticated trading strategies. It supports multiple currencies and allows for fast execution of trades which is key to arbitrage trading. The platform also offers APIs which allows for integration with custom trading software.

- LMAX Exchange: A popular choice for institutional traders, it provides a high-speed trading platform with direct market access which is essential for latency arbitrage. It provides direct market access which gives traders access to order book and liquidity, ensuring a fast execution speed.

- cTrader: This is a platform favored by more experienced traders and is known for its depth of market analysis and order execution capabilities. cTrader is often preferred for its superior charting tools and more sophisticated order types.

Automated Arbitrage Systems

Given the speed and precision required in arbitrage trading, automation through bots or trading systems is very common. These systems are designed to scan the market for inefficiencies and execute trades automatically. This reduces the reliance on human reaction time and improves overall efficiency. However, developing or acquiring a high-quality automated system is crucial. Research shows that the majority of arbitrage is done by computer algorithms with little to no human interaction due to the speed and accuracy required. Some of the more advanced trading bots use machine learning algorithms to adapt to market conditions in real-time.

Note: When using automated trading systems, ensure thorough backtesting and monitoring. Regularly check that the system is working as intended and that the trading strategy is still effective. Market conditions can change very quickly which can make a once-successful trading strategy ineffective.

V. Benefits and Challenges

Benefits of Forex Arbitrage

Forex arbitrage offers several attractive benefits:

- High Potential for Profit: Arbitrage can yield considerable profits, especially with high leverage and significant trading volume. High volume trading is usually required because the profit margins on individual trades are very low.

- Low Risk: When executed correctly, this approach is considered a low risk strategy due to its nature of exploiting minor price discrepancies. However, it is important to always have stop loss orders in place to avoid potential large losses.

- Consistent Returns: When coupled with a solid strategy and good execution, arbitrage can provide a consistent income stream. Consistency requires proper risk management and adherence to the trading plan.

Challenges and Limitations

While promising, forex arbitrage also presents significant challenges:

- Transaction Costs: The costs associated with multiple trades can cut into the profit margin. It’s essential to factor in all costs, including commissions, spreads, and slippage, when evaluating profitability.

- Execution Speed: The speed needed to detect and execute these opportunities is extremely demanding. This often requires a dedicated high-speed internet connection and specialized hardware and software.

- Competition: A large number of arbitrageurs and sophisticated institutions are constantly seeking the same opportunities. This means that the life span of an arbitrage opportunity is very short.

- Regulatory hurdles: Some jurisdictions may have restrictions or special requirements to follow for arbitrage trading. A study by the International Organization of Securities Commissions (IOSCO) highlights that regulatory bodies are becoming increasingly vigilant about arbitrage practices to ensure market fairness and stability. You can find more information about IOSCO’s work on their official website www.iosco.org. Compliance with regulations can be complex and can vary across different regions.

VI. How to Apply Forex Arbitrage Effectively

Selecting the Right Currency Pairs

Focus on the major currency pairs like EUR/USD, GBP/USD, USD/JPY, and AUD/USD. These pairs typically have the highest liquidity, which is a must for arbitrage strategies. Higher liquidity means lower spreads and more frequent arbitrage opportunities. A recent study by a major financial publication showed these pairs accounting for over 70% of the total daily trading volume in the foreign exchange market. However, don’t ignore the minor pairs, as sometimes unique arbitrage opportunities can arise there as well. Diversifying your approach in currency pairs may be a good approach to ensure you have enough opportunity to trade.

Multi-Timeframe Analysis

Employ a multi-timeframe analysis, observing the currency pair on different timeframes. This can confirm trends and help in evaluating the efficiency of the arbitrage strategy being employed. This can also help ensure that the identified opportunity isn’t simply a result of a short-term pricing anomaly that may quickly resolve itself. For instance, a trader could use a 1-minute chart to spot immediate discrepancies and cross-reference it with a 5-minute chart to check for price stability.

Monitoring Economic News

Keep a close eye on the economic calendar for important announcements. These events often cause volatility in the forex market, which can result in both opportunities and challenges for arbitrage trading. Being proactive about these events will make you a better trader. For example, a sudden change in a central bank’s interest rate can cause massive changes in currency value which can result in short lived opportunities. A good arbitrage system must be able to quickly react to these news events.

VII. Common Mistakes in Forex Arbitrage

Over-Diversifying Brokers

Trying to utilize too many brokers at once can hinder the ability to track orders and execute trades effectively. It is best to start with one or two brokers you are comfortable with. Managing multiple broker accounts also increases the workload and can reduce efficiency. Managing too many accounts can also lead to increased transaction fees which can quickly wipe out the small profits from arbitrage. Stick to only the brokers that are most reliable and have fast execution speed.

Ignoring Transaction Costs

Not calculating all transaction costs (spreads, commissions, slippage) before initiating a trade can diminish the profitability of an arbitrage trade. Always account for these fees before setting up your trade. Slippage can be particularly problematic for this type of trading because the profit margins are so small. A higher amount of slippage can easily result in a losing trade. For example, a transaction fee of $1 per $100,000 trade may seem insignificant, but for a trader that is targeting a profit of $5 per $100,000 trade, this would be a huge hit to the profit margin.

Not Using Stop-Loss

In arbitrage, the goal is to capture low-risk profits, but ignoring the implementation of stop losses increases the risk of significant financial loss. Always use stop losses to protect your capital. Although arbitrage is considered a low-risk strategy, unexpected changes in the market can quickly turn a small trade into a big loss. It’s crucial to always have a stop loss order in place to limit potential downside. For instance, a sudden unexpected event can quickly move a currency value in a short period of time, and without a stop loss, a trader can quickly loose a lot of money.

VIII. Forex Arbitrage vs. Other Strategies

Arbitrage vs. Traditional Forex Trading

While traditional forex trading focuses on anticipating price movements, forex arbitrage aims to take advantage of price differences. Arbitrage is considered a lower risk approach compared to typical speculative trading. The lack of directional risk in arbitrage is what makes it so appealing for traders. In speculative trading, traders try to profit from an anticipated price movement and are exposed to risks in case the price moves in the opposite direction. Arbitrage traders, on the other hand, do not have any directional risk because the currency is both bought and sold at the same time.

Hedging vs. Arbitrage

Hedging is primarily a risk management technique designed to reduce exposure to price risk, while arbitrage seeks to exploit price inefficiencies for profit. Hedging seeks to protect positions from adverse movements, while arbitrage seeks to capture the different prices of a given currency. Both strategies are useful but they serve very different functions. For example, a trader might hedge a long position in a currency by taking a short position in the same currency to reduce risk, whereas arbitrage traders would take advantage of a pricing difference in that same currency. Hedging is primarily for risk reduction, whereas arbitrage is for profit. However, there is a form of arbitrage that involves hedging called “hedging arbitrage”, but that is beyond the scope of this guide.

IX. Conclusion

Forex Arbitrage: A Powerful Trading Tool

Forex arbitrage is a sophisticated and potentially very profitable strategy. While it demands precision, speed, and specialized tools, mastering arbitrage can give a significant edge to those willing to invest the time and resources into the skill. The low risk profile makes it an attractive addition to any well diversified trading approach. According to some experts in the industry, a combination of arbitrage and traditional trading strategies can prove to be the most profitable approach for forex trading. Many successful traders use both arbitrage and other strategies to take advantage of all the opportunities that the market provides.

Advice for Beginners

For newcomers, it’s crucial to focus on education and start experimenting on demo accounts to get an understanding of how the process works. Always remember the importance of managing transaction costs, avoiding over-diversification, and monitoring all positions. Never risk real money until you have a good understanding and a strong track record with your demo account. It is highly recommended to seek out educational resources before even considering using this strategy. Start with small trading volumes and gradually increase it as your skill grows and you become more familiar with the trading process. Starting with a high trading volume without experience can be very risky. Furthermore, be aware of the various scams in the forex industry that promise unrealistic returns with very little risk, if something sounds too good to be true, then it probably is.

Pingback: Understanding Pips in Forex: A Trader's Essential Guide - CoinFxPro

Pingback: What is Ripple Cryptocurrency? Discover XRP’s Role in Finance

Pingback: Cryptocurrency Trading Strategies: A Comprehensive Guide CoinFxPro