Table of contents

- 1 Decoding EUR/USD: A Comprehensive Guide with MarketWatch

- 1.1 I. Introduction to EUR/USD and MarketWatch

- 1.2 II. Overview of EUR/USD Market Analysis

- 1.3 III. Trading Strategies for EUR/USD

- 1.4 IV. Benefits of Using MarketWatch for EUR/USD Trading

- 1.5 V. Optimal Times for Trading EUR/USD

- 1.6 VI. Important Considerations When Trading EUR/USD

- 1.7 VII. EUR/USD Compared to Other Currency Pairs

- 1.8 VIII. Conclusion

- 1.9 Frequently Asked Questions (FAQs) – EUR/USD Trading

Decoding EUR/USD: A Comprehensive Guide with MarketWatch

The EUR/USD currency pair is often called the world’s most traded and most liquid pair, making it a focal point for many forex traders. In this comprehensive guide, we will explore the intricacies of EUR/USD, its behavior, and how to leverage tools like MarketWatch for strategic trading decisions.

I. Introduction to EUR/USD and MarketWatch

Overview of EUR/USD

The EUR/USD, representing the exchange rate between the Euro and the US Dollar, is not just a random currency pair; it is the lifeblood of the forex market. Its high liquidity means that large volumes can be traded without significantly impacting price, which is why it’s preferred by both novice and experienced traders. According to the Bank for International Settlements, the EUR/USD pair constitutes approximately 24% of all global foreign exchange turnover, making it the most heavily traded pair worldwide. This high volume contributes to its liquidity and the relatively tight spreads traders often enjoy.

Why is EUR/USD So Liquid?

- Economic Size: Both the Eurozone and the United States have massive economies, leading to a constant flow of trade and investment.

- Global Reserve Status: The US Dollar has long held the status of the world’s reserve currency, while the Euro is a strong second, creating high demand.

- Institutional Involvement: Large financial institutions, corporations, and central banks actively trade this pair, driving liquidity.

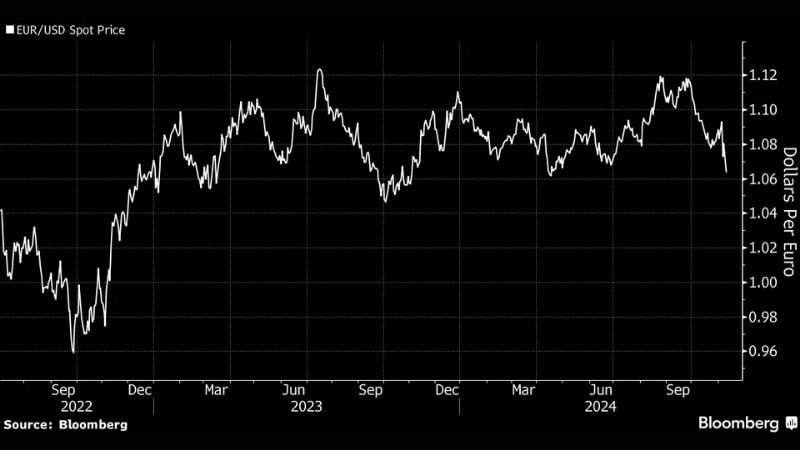

Example of an EUR/USD price chart. Source: Bloomberg

Introduction to MarketWatch

MarketWatch is a financial news and data website that provides real-time market quotes, news, and analysis. It’s an invaluable tool for traders, allowing them to monitor EUR/USD movements and stay informed about factors influencing the currency pair.

- What is MarketWatch? A platform providing financial insights and tools.

- Benefits for EUR/USD Monitoring: Real-time data, news, and expert analysis on EUR/USD.

- Role in Providing Real-Time Information: Delivering up-to-date information to assist in timely and effective trading.

II. Overview of EUR/USD Market Analysis

Technical Analysis

Technical analysis involves using price charts and technical indicators to predict future price movements. For EUR/USD, this is essential due to the pair’s high volatility and sensitivity to market sentiment. It is important to note that while technical analysis can be useful, it is not foolproof and should be used in conjunction with other types of analysis.

- Chart Patterns: Utilizing patterns like triangles, flags, and head-and-shoulders for predicting price directions.

- Indicators: Common indicators such as RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Fibonacci retracement levels assist in identifying potential entry and exit points. For example, an RSI reading above 70 could indicate that EUR/USD is overbought, potentially signaling a reversal, while readings below 30 could indicate an oversold condition. Similarly, MACD crossovers can offer valuable buy or sell signals.

- Trend and Support/Resistance Levels: Identifying trendlines helps in understanding the direction of price movement, while support and resistance levels indicate potential areas where price might reverse or pause.

A basic example of how technical analysis may be used.

Fundamental Analysis

Fundamental analysis focuses on macroeconomic factors that impact currency values. For EUR/USD, it’s crucial to track economic releases and policy decisions from both the European Central Bank (ECB) and the US Federal Reserve (FED). According to a report by the International Monetary Fund (IMF), changes in interest rates set by central banks are among the most significant drivers of currency valuations.

Key Factors Affecting EUR/USD:

- ECB and FED Monetary Policy: Interest rate decisions, quantitative easing, and forward guidance from these central banks significantly influence the pair. For instance, an interest rate hike by the Fed generally strengthens the USD, potentially weakening the EUR/USD pair, and vice-versa.

- Inflation (CPI): Consumer Price Index reports from both the US and Eurozone can cause significant volatility in the pair, as they directly influence central bank policy.

- Employment Reports (Non-Farm Payrolls): The US Non-Farm Payrolls report can move the EUR/USD pair. A strong NFP usually suggests a strong US economy, which can lead to a stronger dollar. In fact, studies have shown that the NFP release can lead to some of the highest price moves for the EUR/USD pair on a monthly basis.

- Geopolitical Events: Global events such as political instability or trade wars can impact the pair due to perceived risk.

Market Sentiment

Market sentiment refers to the overall attitude of investors towards a particular asset. Understanding market sentiment can provide an edge in trading EUR/USD.

- Assessing Market Sentiment: MarketWatch provides tools and articles that reflect the overall mood of investors.

- Fear and Greed Index: The Fear & Greed Index, often available on MarketWatch, is a gauge of market sentiment. High levels of greed might indicate a potential top, while high levels of fear might suggest a potential bottom.

III. Trading Strategies for EUR/USD

Day Trading

Day trading involves opening and closing positions within the same trading day. Due to the EUR/USD’s volatility and high liquidity, day trading can be a very common strategy.

- Using MarketWatch for Short-Term Moves: Monitoring real-time quotes and news allows for quick trading decisions.

- Suitable Timeframes: 5-minute and 15-minute charts are often used to identify potential trade opportunities for day traders.

- Trading Breakouts: Breakouts can be a common strategy in day trading, where traders look to capitalize on rapid price movements after a period of consolidation.

Trend Trading

Trend trading focuses on capitalizing on longer-term price movements, rather than short term fluctuations. This is done by identifying the direction of the price movement and then opening positions that are in line with the direction of the trend.

- Long-Term Trend Analysis: Analyzing trends through the daily and weekly charts on MarketWatch.

- Moving Averages (MA): Using moving averages to identify and validate the trend. For example, a 50-day moving average crossover above the 200-day moving average can be seen as a bullish signal and visa versa for bearish.

Reversal Trading

Reversal trading involves identifying when a trend might be ending and trading in the opposite direction. This often involves some sort of support/resistance and often involves identifying candlestick patterns.

- Identifying Reversal Patterns: Recognizing patterns like the Hammer or Shooting Star to predict potential reversals.

- Volume Analysis: Combining volume indicators with patterns to confirm reversal signals.

News Trading Strategy

News trading capitalizes on the high volatility often present immediately before and after an important news announcement. The news is usually directly related to the underlying currencies.

- Using the Economic Calendar on MarketWatch: Tracking upcoming economic announcements to anticipate market reactions.

- Trading Before and After News Releases: Being prepared for price spikes and increased liquidity following key announcements. For example, a worse than expected CPI report can lead to short term volatility.

IV. Benefits of Using MarketWatch for EUR/USD Trading

Real-Time Updates

One of the critical elements for a trader is receiving up-to-date information. MarketWatch provides real time prices and real time events that may influence prices.

- Live Price Data: MarketWatch offers live streaming price feeds for EUR/USD, and other financial instruments.

- Alerts and Chart Monitoring: Real-time alerts and chart analysis tools for quick reactions to market changes.

In-Depth Analysis

MarketWatch offers more than just real-time data, and also offers in-depth analysis from their own team and contributing analysts which may inform a traders analysis.

- Articles, Reports, and Forecasts: Access to articles, reports, and forecasts by financial analysts, helping in informed decisions.

- Comparing Performance: Ability to compare the performance of EUR/USD against other currency pairs.

Integration with Trading Tools

MarketWatch also provides a suite of tools that are beneficial to a trader, such as their charting platform, or integration with certain brokers.

- Tools and Utilities: A variety of tools available for traders such as a charting application.

- Customization Options: Personalizing your platform view for more effective trading.

V. Optimal Times for Trading EUR/USD

Major Trading Sessions

- London Session: The most liquid session, accounting for a majority of the trading volume for EUR/USD.

- New York Session: High interaction with US-based economic events, providing significant trading opportunities.

Optimal Trading Times

The overlap between the London and New York session is often when the most volatility can be found, due to the interaction between the European and American markets. Additionally, trading at time periods when economic announcements are made can also see increased volatility.

- Overlap Between London and New York: The period between 1 PM UTC to 4 PM UTC often provides good movement in the market.

- Economic News Release Times: Trading during release times can be profitable if you know what to look for, and expect large price movement.

Real-Time Impact Analysis

MarketWatch’s live data feed allows traders to monitor real-time price changes, and react to them in real time. This means that traders can potentially capitalize on short term movements by using the live data to inform their decisions.

- Using MarketWatch to Spot Potential Trade Opportunities: MarketWatch data can help spot potential trade opportunities due to the high volatility of the currency pair.

VI. Important Considerations When Trading EUR/USD

Risk Management

Risk Management is often seen as one of the most important elements to a successful trading strategy. Without risk management, losing trades may be able to take out more of your capital than you are willing to lose.

- Stop-Loss and Take-Profit Orders: Using stop losses and take profit orders are a key element to effective risk management.

- Impact of Transaction Costs: Being aware of spreads, and commission costs of trades are key to having a profitable trading strategy.

Common Mistakes to Avoid

Many traders often fall into common mistakes that lead to losing trades, and over time, loss of their account. Some of the most common mistakes are listed below.

- Emotional Trading: Not letting emotions control your trades will likely lead to less impulsive, and better trades.

- Over-Trading Based on Unverified News: Over-trading based on unverified news can often lead to losses.

Performance Evaluation

Evaluating your trading performance is a key to improving as a trader, as you are able to see what you are doing right and wrong. This can help reduce losses, and improve profits overall.

- Using Historical Data on MarketWatch: Leveraging historical data to analyze trading performance.

- Keeping a Trading Journal: Tracking your trades and the reasoning behind them helps you learn and improve over time.

VII. EUR/USD Compared to Other Currency Pairs

EUR/USD vs. GBP/USD

- Volatility and Liquidity: EUR/USD and GBP/USD both are very liquid pairs, but the GBP/USD pair often has a higher volatility.

- Influence of UK and US Economic News: Both pairs are impacted by US news, but the GBP/USD will be impacted by UK news and events, which may be more beneficial for some traders depending on their strategy.

EUR/USD vs. USD/JPY

- Response to Global Economic Shifts: Both pairs have a tendency to react differently to different types of economic events.

- Price Behavior During Different Trading Sessions: The trading volume for the USD/JPY will be highest during Asian trading hours, while EUR/USD will be highest during the London and New York trading sessions.

EUR/USD vs. Minor Currency Pairs

- Trading Cost Advantages: EUR/USD often offers lower spread costs compared to minor pairs.

- Predictability of Trends: The highly liquid nature of the EUR/USD often makes it more predictable, and has less slippage than lesser traded pairs.

VIII. Conclusion

The EUR/USD pair is a cornerstone of the forex market, offering numerous trading opportunities. Combining a solid understanding of the pair with the tools offered by MarketWatch can give traders a competitive edge. For additional information on the forex market, you can visit the website of the Bank for International Settlements which provides extensive data and analysis on global currency trading.

Summary of EUR/USD’s Role in Forex

- Why EUR/USD is Essential in a Trading Portfolio: Its high liquidity, low transaction costs, and availability of resources make it an ideal pair to trade for both new and veteran traders.

Advice for Traders

- Using MarketWatch as a Strategic Tool: Leveraging MarketWatch’s news, data, and analysis can be an advantage for a trader.

- Continuous Learning and Practice: Always keep learning, and practicing with a demo account, before trading with real money. You can learn more about how to start forex trading on our website.

Frequently Asked Questions (FAQs) – EUR/USD Trading

What is EUR/USD and why is it important in forex trading?

EUR/USD represents the Euro/US Dollar exchange rate. It’s the most traded currency pair globally, offering high liquidity and tight spreads. This makes it popular for both beginner and experienced forex traders seeking frequent opportunities.

How can MarketWatch help in EUR/USD trading?

MarketWatch provides real-time EUR/USD quotes, charts, and news. It offers in-depth analysis, expert opinions, and economic calendars, crucial for making informed trading decisions and staying updated on market-moving events impacting the pair.

What are the best trading strategies for EUR/USD?

Popular EUR/USD strategies include trend following (using moving averages), breakout trading, and news-based trading. Consider factors like economic releases from the Eurozone and the US, and employ appropriate risk management.

When is the best time to trade EUR/USD?

The optimal time is during the London/New York session overlap (around 1 PM to 4 PM UTC). This period typically experiences the highest trading volume and volatility, presenting more trading opportunities and potentially tighter spreads.

How can I use MarketWatch’s economic calendar for EUR/USD trading?

Leverage MarketWatch’s economic calendar to track key releases like ECB interest rate decisions, US Non-Farm Payrolls, and inflation data. These events can significantly influence EUR/USD, allowing for proactive trading strategies.

Pingback: Mastering Forex Sentiment Analysis with Myfxbook: A Guide

Pingback: Mastering Forex Arbitrage: A Comprehensive Guide - CoinFxPro

Pingback: What Is a Trading Strategy? A Deep Dive into Forex Trading - CoinFxPro

Pingback: The Professional Trader's Guide to Forex Risk Management - CoinFxPro

Pingback: MetaTrader 4 Review: The Ultimate Guide for Forex Traders - CoinFxPro

Pingback: Uncle Ted Forex: Exploring Proven Trading Strategies CoinFxPro Learn Forex

Pingback: Mastering the Forex Market: A Deep Dive into Major Pairs - CoinFxPro

Pingback: Quasimodo Forex Trading: A Reliable and Versatile Pattern

Pingback: Decoding the Forex Market: A Comprehensive Guide - CoinFxPro