Table of contents

- 1 Cryptocurrency Trading Strategies: Master the Art of Profitable Crypto Trading

- 1.1 Introduction

- 1.2 Day Trading vs. Swing Trading Crypto

- 1.3 Trading in crypto: Long-term vs. short-term

- 1.4 Scalping Crypto Strategy

- 1.5 Crypto Arbitrage Trading Strategy

- 1.6 Key Takeaways

- 1.7 References

- 1.8 Frequently Asked Questions (FAQs)

- 1.8.1 What are Cryptocurrency Trading Strategies?

- 1.8.2 Why are Trading Strategies Important in Crypto?

- 1.8.3 What is Day Trading?

- 1.8.4 What are the Pros and Cons of Day Trading?

- 1.8.5 What is Swing Trading?

- 1.8.6 What are the Pros and Cons of Swing Trading?

- 1.8.7 What is Long-term Trading (HODLing)?

- 1.8.8 What are the Pros and Cons of Long-term Trading?

- 1.8.9 What is Short-term Trading?

- 1.8.10 What are the Pros and Cons of Short-term Trading?

- 1.8.11 What is Scalping in Crypto?

- 1.8.12 What are the Pros and Cons of Scalping?

- 1.8.13 What is Crypto Arbitrage?

- 1.8.14 What are the Pros and Cons of Crypto Arbitrage?

- 1.8.15 How to choose the best methods for trading cryptocurrencies?

Cryptocurrency Trading Strategies: Master the Art of Profitable Crypto Trading

Introduction

The dynamic and often volatile nature of the cryptocurrency market provides traders with unparalleled opportunities. But steering through these virtual waters is not merely by gut; it is by design. In this thorough guide, we’ll be exploring the best cryptocurrency trading strategies to help you navigate this thrilling terrain with confidence and success.

We will not only cover the fundamentals but also explore advanced concepts and offer actionable insights for both novices and experienced traders alike. We will cover metrics like Sharpe Ratio, Maximum Drawdown, and Sortino Ratio; technical indicators like RSI and Fibonacci retracement; and even talk about market sentiment analysis.

Why Trading Strategies Are Important in Crypto

The volatile nature of the cryptocurrency market is a double-edged sword. It is to risk management that, whilst it offers the potential for big profits, it also carries big risks. For example, in 2023, Bitcoin prices ranged up to about 25,000 to a record 68,000, demonstrating the volatility such markets are famous for. This volatility highlights the need for a clear trading strategy to mitigate risks and take advantage of opportunities.

A strong trading strategy allows you to:

Identify Entry and Exit Points: Understanding when to enter and exit is vital. Strategies give clear signals using technical or fundamental analysis.

Manage Risk: Many strategies build in rules around stop-loss orders and position sizing as part of their risk management practices.

Stay Disciplined: Trading from emotions can result in losses. Using strategies gives an objective framework for making decisions and eliminates impulsive decisions.

Maximize Earning Potential: Strategies based on trends and patterns help you achieve an optimal profit over time by letting you know how to maximize gains—and minimize losses.

Depending on the exposure of traders as per their experience, appetite towards risk, and available time, they will come up with different approaches. Successful traders customize their strategy for various factors, including the market, the cryptocurrency, and their trading psychology. You also need to think about metrics such as:

- Sharpe Ratio: It is used to measure risk-adjusted returns and help to understand how much return you are receiving per unit of risk you are taking.

- Maximum Drawdown: That shows how much your portfolio fell from the highest peak to the lowest trough, thus reflecting its downside risk.

- Sortino Ratio: This is like the Sharpe Ratio but only considers downside risk, giving a more nuanced perspective for assets that tend to be more volatile, like cryptocurrencies.

What You Will Discover in This Guide

- Day Trading vs. Swing Trading Comparison

Long-term vs. Short-term Strategies Explained

Scalping & Arbitrage Trading

Curating trading strategies for one and all

Illustrative use cases, advantages, and disadvantages of every approach

In this guide, you will learn about several different strategies, which will empower you to identify what truly works for you and the type of market trading you engage in. Let’s embark on this journey to mastering cryptocurrency trading strategies.

Day Trading vs. Swing Trading Crypto

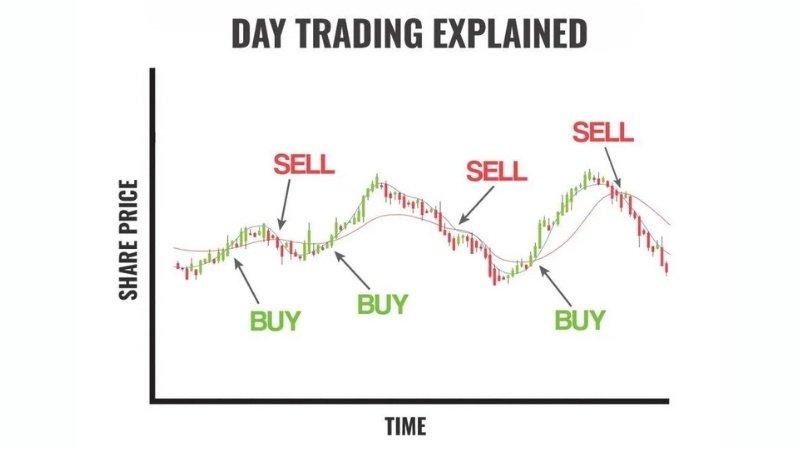

What is Day Trading?

Day trading is to buy and sell cryptocurrency during a trading day on the same day. The objective is to profit from short-term price movements. Day trading—day traders will buy and sell many times during the day in hopes of gaining small profits from price changes. And with the average daily trading volume of Bitcoin futures being $36.88 billion in 2023 (month-to-date according to Bybt, currently known as Coinalyze), the opportunity for day traders is too great to be missed.

Day traders rarely carry open positions overnight to avoid the risk of price change after hours. Much of this strategy usually involves technical analysis, a thorough knowledge of the crypto markets, and the establishment of exit strategies. Good day traders keep an eye on indicators such as:

Volume Weighted Average Price (VWAP): It is an indicator of the price at which a security has traded throughout the day, based on both volume and price.

Moving Averages (MA): Smooth Jones the price dates for above to observe trends and potential reversion.

Relative Strength Index (RSI): A momentum indicator that measures the speed and change of price movements and is used to identify overbought or oversold conditions;

Support and Resistance Lines: Find and analyze possible price turning points.

A typical day trading setup with multiple monitors displaying charts and market data.

Essentials of Day Trading

- Requires constant monitoring of charts and market trends.

- Relies heavily on technical analysis for quick decision-making.

- Typically requires trading on assets with a large number of buyers and sellers, such as Bitcoin (BTC) or Ethereum (ETH).

- Investors often use leverage to amplify their gains, but that also increases the possibility of multiplying their losses.

- These fast-moving price changes can lead traders to panic. They must be skilled at making decisions under uncertainty, as well as regulating their emotions.

- High-Frequency Trading (HFT): Some day traders utilize HFT, a technique that executes numerous orders in and out in very short periods of time using algorithms.

Pros & Cons

| Pros ✅ | Cons ❌ |

|---|---|

| ✅High potential for quick profits. | ❌High risk due to market volatility. |

| ✅Capitalizes on daily price swings. | ❌Requires full-time commitment and attention. |

| ✅No overnight risk exposure. | ❌Can be emotionally taxing due to its fast-paced nature. |

| ✅Traders can develop a deep understanding of market movements through constant engagement. | ❌Transaction fees can eat into profits, especially with frequent trading. |

| ✅Potential to benefit from both rising and falling markets by short-selling. | ❌Steep learning curve, requiring extensive knowledge of technical analysis and market dynamics. |

What is Swing Trading?

With swing trading, the traders hold on to their positions for days or even weeks to capitalize on price changes that are expected to last for the medium term. Swing trades, on the other hand, seek to profit from larger price movements occurring over a longer time frame. Swing traders frequently employ technical and fundamental analysis together to identify solid entry and exit times for a trade.

Swing traders (those who use swings) generally do:

- Trend following is a method to discover market trends and capitalize by employing moving averages or trend lines.

- Fibonacci numbers They are estimates of areas of support and resistance, which can help you predict a price change.

- There are certain key price points known as support and resistance levels indicating where buying (support) or selling (resistance) pressure has been relatively strong.

Key Features of Swing Trading

- Utilizes a combination of technical and fundamental analysis.

- Allows traders to take advantage of trending markets.

- Works best on assets with relatively predictable price movements.

- Swing traders may hold positions overnight or for several weeks, and they are less affected by intraday price fluctuations.

- This strategy often involves identifying trends and patterns that develop over multiple trading sessions.

- Lower Time Commitment: Compared to day trading, swing trading requires less constant monitoring, making it suitable for those with other commitments.

Pros & Cons

| Pros ✅ | Cons ❌ |

|---|---|

| ✅Less stressful than day trading. | ❌Requires patience and discipline. |

| ✅Can generate larger profits per trade. | ❌Susceptible to sudden market downturns. |

| ✅Swing trading requires less time commitment compared to day trading, making it more suitable for those with other obligations. | ❌Holding positions overnight exposes traders to risk from after-hours market movements. |

| ✅Allows for more comprehensive analysis of market trends. | ❌May miss out on short-term opportunities that day traders can capture. |

| ✅Well-suited for identifying and capitalizing on medium-term trends. | ❌Requires a good understanding of both technical and fundamental analysis. |

Key Differences: Day Trading vs. Swing Trading

| Feature | Day Trading | Swing Trading |

|---|---|---|

| Trade Frequency | Multiple trades per day | Few trades per week/month |

| Time Commitment | Full-time | Part-time |

| Risk Level | High | Moderate |

| Profit Potential | Short-term gains | Medium-term gains |

| Analysis Type | Primarily Technical | Technical & Fundamental |

| Key Indicators | VWAP, RSI, Bollinger Bands, Moving Averages | Moving Averages, Fibonacci Retracement, Support and Resistance |

Which Strategy Should You Choose?

Day trading or swing trading? This relies on your trade aim, personality, and the level of risk you are willing to assume.

Day trading might be your game if you want things to happen fast, want to be involved in the market all the time, and are able to devote lots of time to dealing.

If you’d prefer to take things easier, are comfortable with holding positions longer, and don’t have much time to spend on the act of trading, then swing trading may suit you better.

Many expert traders will execute both day trades and swing trades to ensure their portfolios are diverse and poised for movement in the market. That way they can observe both short-term changes and long-term trends. They might allocate a portion of their portfolio to each strategy, adjusting the size of the allocation relative to performance in the market and perceived effectiveness.

Trading in crypto: Long-term vs. short-term

What is the long-term way of trading?

Long-term trading, or “HODLing” as it is known in the crypto community, means buying a digital asset and holding on to it for a long time—months or years. This philosophy rests on the notion that the value of the asset will increase greatly in the long run, regardless of near-term market fluctuations. Bitcoin is worth more than $800 billion as of early 2024, illustrating the incredible growth potential that long-term investors hope for. If you take the long 10-year view, you can see that Bitcoin has returned over 100% per annum on average. Nonetheless, past performance does not equate to future performance having the same trajectory as either.

These long-term investors buy and often hold onto cryptocurrencies with solid fundamentals, such as:

- When people think about Bitcoin (BTC), the first and largest cryptocurrency, they think of it as digital cash and a store of value.

- Ethereum (ETH), a smart contracts and decentralized apps (dApps) platform Its community is growing.

- Solana (SOL) is popular for quick transaction times and low costs.

Key elements of long-term trading

- Requires an in-depth investigation of the underlying tech, adoption curve, and future potential of the cryptocurrency (e.g., BTC, ETH, SOL).

- Less reactive to daily market fluctuations and temporary volatility.

- Concentrates on the long-term profitability of the asset.

- Long-term traders usually research a project team behind the crypto, its technology, partnerships, and its position in the market before they invest.

- Dollar-Cost Averaging (DCA) is a common method that investors use to mitigate the impact of price shifts by purchasing a fixed size of an asset periodically, regardless of the price.

- On-Chain Analysis: Using blockchain data such as transaction count, live addresses, and network hashrate to determine how healthy and expanding a cryptocurrency is.

Pros & Cons

| Pros ✅ | Cons ❌ |

|---|---|

| ✅Less stressful than short-term trading. | ❌Cannot capitalize on short-term price swings. |

| ✅Requires minimal time commitment once the initial research is completed. | ❌Exposes investors to long-term market risk and potential regulatory changes. |

| ✅Benefits from the long-term growth trends of the cryptocurrency market. | ❌Requires patience and resilience during market downturns. |

| ✅Potentially lower tax implications compared to frequent short-term trading. | ❌”Opportunity cost,” where capital is tied up in long-term investments and cannot be used for other potentially profitable trades. |

| ✅Well-suited for building wealth over time. | ❌Requires thorough due diligence and a strong belief in the long-term value of the chosen assets. |

What is Short-term Trading?

Short-term trading means that you shorten your position in holding bitcoin assets in a few hours to a few weeks. The purpose of this method is to profit from rapid price fluctuations in the market. For short-term traders, technical indicators and chart trends are often used to identify optimal times to enter and exit the market.

The main components of short-term trading

Technical tools such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands are among the tools used.

Using stop-loss orders and other strong risk management methods is a must to protect oneself from price drops.

More influenced by sentiment around the market, news events, and short-term trading trends.

In the case of short-term trading, a high level of liquidity is an important factor in choosing an instrument, as it allows traders to quickly enter and exit positions.

Traders also use leverage to amplify their earnings, which in turn also amplifies their losses.

News trading is quick action on news stories that can lead to price movements in cryptocurrencies, such as regulator comments or large partnerships.

Market mood analysis means monitoring news articles, social media, and other sources to see how a cryptocurrency, or the market as a whole, is perceived by the people. For example, an increase in the number of positive tweets regarding Ethereum might indicate that in the short term, the price will increase.

Pros & Cons

| Pros ✅ | Cons ❌ |

|---|---|

| ✅Higher frequency of profit opportunities due to frequent market movements. | ❌Can be highly stressful due to the need for constant monitoring and quick decision-making. |

| ✅Allows for greater flexibility in adapting to changing market conditions. | ❌Susceptible to flash crashes, market manipulation, and sudden news events. |

| ✅Can lead to faster capital growth compared to long-term holding. | ❌Transaction fees can significantly impact profits, especially with high-frequency trading. |

| ✅Potential to profit from both bullish and bearish markets through short selling. | ❌Requires a high level of skill, experience, and discipline. |

Scalping Crypto Strategy

What is Scalping in Crypto?

Scalping is an advanced trading strategy that involves making numerous trades throughout the day, each aiming to capture very small profits from minor price fluctuations. Scalpers typically hold positions for seconds to minutes, and their cumulative gains from these small trades can add up to significant amounts over time. In highly liquid markets like Bitcoin and Ethereum, scalping can be particularly effective due to the tight spreads and high trading volume.

How Scalping Works

- Traders buy and sell assets within seconds or minutes, exploiting small price discrepancies.

- Relies heavily on high liquidity and tight spreads to minimize transaction costs.

- Commonly used in Bitcoin and Ethereum trading pairs due to their high trading volumes.

- Scalpers use advanced charting tools and often rely on Level 2 market data to identify small price movements.

- Automated trading bots are frequently employed to execute trades quickly and efficiently.

- Order Book Analysis: Scalpers often analyze the order book to identify imbalances between buy and sell orders, which can signal short-term price movements.

Pros & Cons

| Pros ✅ | Cons ❌ |

|---|---|

| ✅Potential for fast, consistent profits. | ❌High transaction fees can significantly reduce profits. |

| ✅Works well in high-volatility markets. | ❌Requires a deep understanding of market dynamics, order book behavior, and technical analysis. |

| ✅Limited exposure to large market swings due to the short duration of each trade. | ❌Can be extremely stressful and demanding due to the need for constant focus and rapid decision-making. |

| ✅Can be highly profitable if executed correctly and consistently. | ❌Requires specialized tools and a high-speed trading setup. |

Best Tools for Scalping

- Trading Bots: If you want to be able to act according to the opportunities that arise, simplifying your scalping approach is very important. There are specialized grid set bots like the ones built directly into large exchanges such as Binance, Pionex, and 3Commas. They can assist in scalping strategies.

- High-Speed Trading Platforms: Binance, Kraken, and KuCoin are popular for their wide variety of coins in circulation and fast trading features, both of which are imperative in scalping.

- Scalpers make use of technical indicators, most commonly moving averages, volume-weighted average price (VWAP), and MACD, to identify short-term tendencies and potential entry/exit points.

- Level 2 Market Data: This provides scalpers with live, destructive info about the order guide and lets them discover gaps between supply and demand.

- Adjustable charting platforms: Apps such as TradingView allow you to create intricate, variable charts with plenty of markers, which is key for rapid analysis.

Crypto Arbitrage Trading Strategy

What is Crypto Arbitrage?

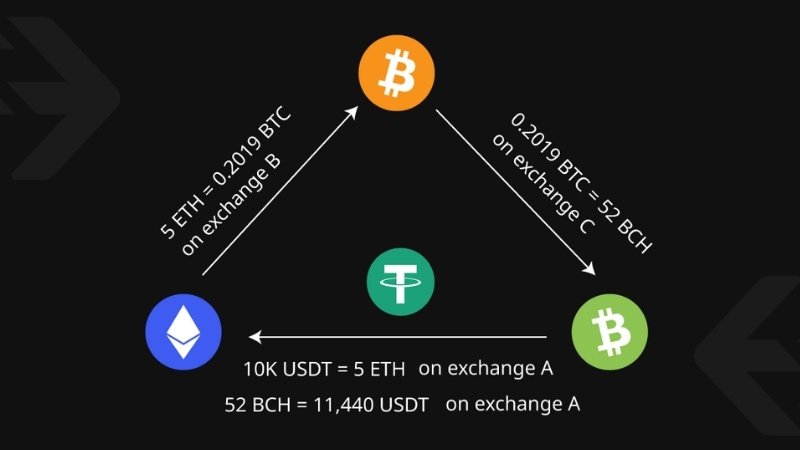

Crypto arbitrage trading is when the same crypto is sold at multiple exchange platforms at different prices. When traders purchase an asset at a cheaper price on one exchange and then sell it at a higher price on a different one, they are able to secure a risk-free profit. According to a 2022 study by the National Bureau of Economic Research, arbitrage opportunities have always existed in historical cryptocurrency markets but become less common as markets mature.

Types of Arbitrage

- For example, tropical arbitrage is just when you buy the coin on one exchange where the price is lower and sell it (immediately) on the other exchange where the price is higher.

- It is called triangular arbitrage when you make a profit by taking advantage of price differences between three different cryptocurrencies on the same market. If the prices of the BTC/USD, ETH/USD, and ETH/BTC pairs are not equal, for instance, one can convert USD to BTC, BTC to ETH, and ETH back to USD and end up with a larger amount of USD than they started with.

- Statistical arbitrage refers to the use of low-latency market data for statistical analysis, with the goal of exploiting discrepancies in the price signals from various markets through sophisticated mathematical models. This is normally done very fast and requires a high level of technical expertise.

- Convergence arbitrage is using the spread between the spot price and the futures contract price of a coin to your advantage.

- Centralized exchanges (DEXs) price gaps and price differences between centralized exchanges and decentralized exchanges, such as Uniswap or PancakeSwap.

Example of Crypto Arbitrage

| Exchange | BTC Price | Arbitrage Opportunity |

|---|---|---|

| Binance | $40,000 | Buy BTC |

| Coinbase | $40,200 | Sell BTC |

In this simplified example, a trader could buy BTC on Binance for $40,000 and simultaneously sell it on Coinbase for $40,200, making a profit of $200 per BTC (minus transaction fees). It is important to note with arbitrage that you need to act very quickly to take advantage of opportunities when you see them.

Pros & Cons of Crypto Arbitrage

| Pros ✅ | Cons ❌ |

|---|---|

| ✅Low-risk if executed correctly, as the price difference is locked in at the time of the trade. | ❌Requires significant capital to generate substantial profits, as individual arbitrage opportunities often yield small margins. |

| ✅Can generate profits regardless of the overall market direction (works in both bull and bear markets). | ❌Speed of execution is critical, and delays can eliminate the opportunity or even result in losses. |

| ✅Helps to improve market efficiency by reducing price discrepancies across exchanges. | ❌Transaction fees can significantly impact profits, especially with smaller trades. |

| ❌Requires constant monitoring of multiple exchanges and a good understanding of different trading platforms’ fee structures. | |

| ✅Can be automated using bots to increase efficiency and speed. | ❌Arbitrage opportunities are often short-lived and may disappear quickly as the market adjusts. |

Key Takeaways

- Day trading is a high-risk, high-reward method that requires around-the-clock monitoring, quick decisions, and excellent knowledge of how technical analysis works.

- Swing trading is a less-stressful approach to trading that targets short- to medium-term price movements occurring over days or weeks. Both technical and fundamental analysis have been applied by it.Scalping: Making loads of trades on the reg to gain small amounts off minor price fluctuations. To assist, traders commonly utilize automated bots and other niche tools.

- Arbitrage trading exploits price discrepancies between markets, profiting from relatively low risk. It has to be done quickly, effectively, and, well, with money.

- The best way to trade cryptocurrencies depends on your own risk tolerance, your availability, the amount of money you have to invest, and your goals for trading.

- Using different trading methods together can help you mitigate your risks and be more agile to market changes.

- To be successful, one must understand key metrics such as the Sharpe Ratio, Maximum Drawdown, and Sortino Ratio, as well as technical indicators such as the RSI, Fibonacci, and market sentiment analysis

- That means continuing to learn and refining your strategy based on market cycles and your results until you become an increasingly profitable trader.

References

- Bybt (Coinalyze) – Provides data on Bitcoin futures trading volume.

- Binance – Information on cryptocurrency trading bots.

- Kraken – Details on cryptocurrency exchange services.

- KuCoin – Information on cryptocurrency exchange services.

- National Bureau of Economic Research – Study on cryptocurrency arbitrage.

Frequently Asked Questions (FAQs)

What are Cryptocurrency Trading Strategies?

Cryptocurrency trading strategies are simply methods to buy and sell cryptocurrencies to generate a profit. Some of the most popular trading strategies include day trading, swing trading, scalping, and arbitrage. Each offers its own risk-and-reward profile. Which approach to use depends on factors such as how much risk you are willing to take, how much time you have,, and how well the market is performing.

Why are Trading Strategies Important in Crypto?

Trading techniques can help by letting you determine where to enter and exit trades, what your risk is via stop-loss orders (see forex risk management principles for related ideas), preventing you from trading out of emotion or gut, determining your trends and patterns, and being in the right frame of mind… so as to make as much money as humanly possible.

What is Day Trading?

Day trading means you buy and sell crypto on the same trade day. The objective is to profit from short-term price movements. Day traders buy and sell many times during the day, hoping to profit from small price movements. If you want to view the charts, you can use tools like TradingView.

What are the Pros and Cons of Day Trading?

Pros: High probability to yield decently well in a short amount of time, used by daily price fluctuations, does not expose to overnight risk,, and the trader understands the market very well.

Cons: The market is ever-changing, time-consuming, emotionally taxing, transaction fees may eat up profits, and it is it is hard to master.

What is Swing Trading?

Swing trading is a strategy where traders hold positions for several days or even weeks to capture medium-term price movements. Unlike day traders, swing traders aim to profit from larger price swings that occur over a longer timeframe.

What are the Pros and Cons of Swing Trading?

Pros: High probability to yield decently well in a short amount of time, used by daily price fluctuations, does not expose to overnight risk,, and the trader understands the market very well.

Cons: The market is ever-changing, time-consuming, emotionally taxing, transaction fees may eat up profits, and it is it is hard to master.

What is Long-term Trading (HODLing)?

Long-term trading, often referred to as “HODLing”, involves buying and holding cryptocurrency assets for an extended period, typically months or even years. This strategy is based on the belief that the value of the asset will appreciate significantly over time.

What are the Pros and Cons of Long-term Trading?

Pros: Less stressful than short-term trading, minimal time commitment, benefits from long-term growth, lower tax implications.

Cons: Cannot capitalize on short-term price swings, exposes to long-term market risk, requires patience, “opportunity cost”.

What is Short-term Trading?

In a short-term trade, you hold bitcoin assets only for a short time, usually a few hours to a few weeks. This strategy aims to profit from short-term market movements and rapidly changing prices.

What are the Pros and Cons of Short-term Trading?

Pros: More opportunity to bet, making more money; more freedom; your money can grow faster; you can profit in both bull and bear markets.

Pros: A lot of people could use your services, especially if you have a specialized skill. Cons: It can be hell, the website may crash at times, and transaction fees take a bite out of your profits, and you really have to be good at what you do.

What is Scalping in Crypto?

Scalping is an advanced trading strategy in which a trader attempts to profit from small price changes over many trades throughout the day. Scalpers tend to remain in a position for a few seconds to a couple of minutes.

What are the Pros and Cons of Scalping?

Pros: If you do it right and often, it can be super lucrative; it means that in highly volatile markets it works, and you only have to not worry a lot about large swings in the market.

Cons: Very hard to profit because of high transaction fees, you need significant market knowledge, you need to be always focused and make quick decisions, and you need special tools and a high-frequency trading setup.

What is Crypto Arbitrage?

Crypto arbitrage is a trading technique that capitalizes on the idea that the same cryptocurrencies can be bought and sold at different values on different exchanges or platforms. Traders who buy an asset at a lower price from one exchange and sell it at a higher price on another can lock in a risk-free return.

What are the Pros and Cons of Crypto Arbitrage?

Pros: Low-risk when done correctly, can be profitable regardless of post-market movement, contributes to a more efficient market, and bots can be used.

Cons: Great amount of funds required, urgent action must be taken, fees from transactions can be deducted from advantages, must be supervised at all times, hoarding situations are short-lived.

How to choose the best methods for trading cryptocurrencies?

Based on your trading goals, personality, and risk appetite, you could choose to follow any one of the trading strategies. Day trading may suit you if you prefer things to move pretty quickly, enjoy being involved in the market constantly, and can devote a great deal of time to trading. If you would prefer to take it easy, have time to hold positions longer, and do not have much time for active trading, swing trading may be more suitable for you.

Pingback: Understanding Cryptocurrency Regulations and Their Importance

Pingback: What is a Crypto Stock and How Does it Work? CoinFxPro