Table of contents

- 1 Cryptocurrency Market Crash: Insights and Tips for Investors

- 1.1 What is cryptocurrency market crash?

- 1.2 I. Introduction

- 1.2.1 Defining a CryptoCurrency Market Crash

- 1.2.2 Cryptocurrency Market Crash: What Is It?

- 1.2.3 Correction vs. Crash: The Key Differences

- 1.2.4 The Importance of Understanding Market Crashes

- 1.2.5 Impact on Investors and the Blockchain Ecosystem

- 1.2.6 Why This Article Is Important

- 1.2.7 Historical Crypto Market Crashes

- 1.3 II. Causes of Cryptocurrency Market Crashes

- 1.4 III. Consequences of a Cryptocurrency Market Crash

- 1.5 IV. Strategies for Overcoming a Cryptocurrency Market Crash

- 1.6 V. Predictions and Lessons from Cryptocurrency Market Crashes

- 1.7 VI. Conclusion

- 1.8 Frequently Asked Questions (FAQ)

Cryptocurrency Market Crash: Insights and Tips for Investors

The cryptocurrency market, known for its explosive gains, is equally notorious for its dramatic crashes. These periods of sharp decline can be both frightening and confusing, especially for new investors. Understanding the dynamics of a crypto market crash, including the impact on node sales and overall blockchain health, is crucial for anyone involved in this volatile space. This article will delve into the causes, consequences, and strategies for navigating these challenging times.

What is cryptocurrency market crash?

A cryptocurrency market crash is a sudden and significant drop in the value of cryptocurrencies across the board, characterized by rapid sell-offs leading to substantial reductions in market capitalization. These crashes can be triggered by a combination of macroeconomic factors, market sentiment, regulatory changes, and technical issues within the crypto ecosystem.

I. Introduction

Defining a CryptoCurrency Market Crash

A cryptocurrency market crash refers to a sudden and significant decline in the value of cryptocurrencies across the board. This is characterized by a rapid sell-off, leading to a drastic reduction in market capitalization.

Cryptocurrency Market Crash: What Is It?

Unlike minor corrections, a market crash signifies a more severe and prolonged downturn. It’s not just a slight dip; it’s a substantial loss of value that can take weeks, months, or even years to recover from.

Correction vs. Crash: The Key Differences

A correction is a short-term price dip, typically around 10-20%, often followed by a quick recovery. A crash, however, involves a much larger drop, often exceeding 30-50%, and can trigger a prolonged bear market. The difference is crucial: corrections are normal, while crashes are often indicative of deeper issues within the market.

To illustrate the difference, consider the S&P 500, a traditional stock market index. Historically, corrections of 10-20% have occurred relatively frequently, while crashes, like the one in 2008, are much rarer but have far more devastating consequences. This same principle applies to cryptocurrencies, where corrections can be seen as a healthy part of the market cycle, but crashes often signal significant instability.

The Importance of Understanding Market Crashes

Understanding market crashes is not just academic; it’s vital for protecting your investments. A market crash can have devastating effects on investors’ portfolios, and understanding the signs, causes and mitigation strategies are critical.

Impact on Investors and the Blockchain Ecosystem

Market crashes impact not just investors but the entire blockchain ecosystem. They can lead to the devaluation of assets, projects failing, and a loss of confidence in the technology. This can particularly affect things like node sales, which are used to support and secure the network, potentially resulting in network instability. The reduction in funding for projects which occurs due to market crashes can also slow innovation as development teams become risk-averse.

Why This Article Is Important

Whether you’re a novice dipping your toes into the crypto world or a seasoned veteran, understanding how to navigate a crypto market crash is crucial. This article will provide practical strategies for both new and experienced investors to mitigate risks and capitalize on opportunities during these times. We’ll discuss how even seemingly safe investments like nodes can be affected and strategies to protect your holdings.

Historical Crypto Market Crashes

Looking at historical examples can provide a clearer understanding of the potential scale of a crash:

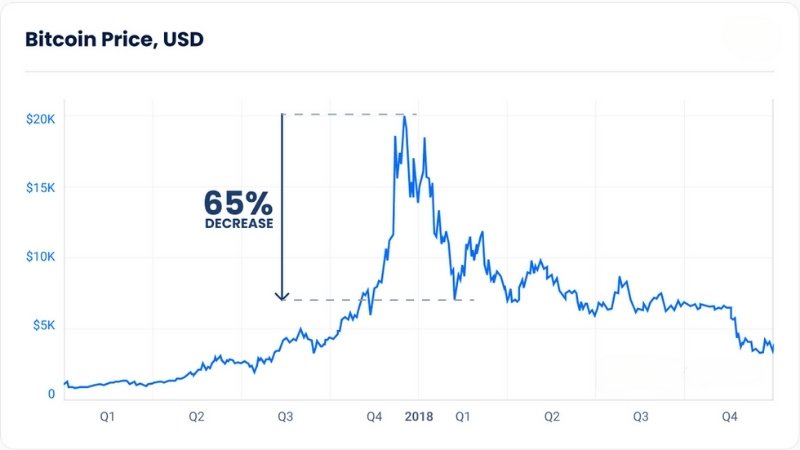

- 2018 Crash: The market saw a massive correction, with Bitcoin losing over 70% of its value after its peak in late 2017. CoinMarketCap data shows Bitcoin plummeted from nearly $20,000 to around $6,000 in a matter of months. This event highlighted the volatility and the risks associated with the crypto market.

Image showing the Bitcoin price drop during the 2018 market crash.

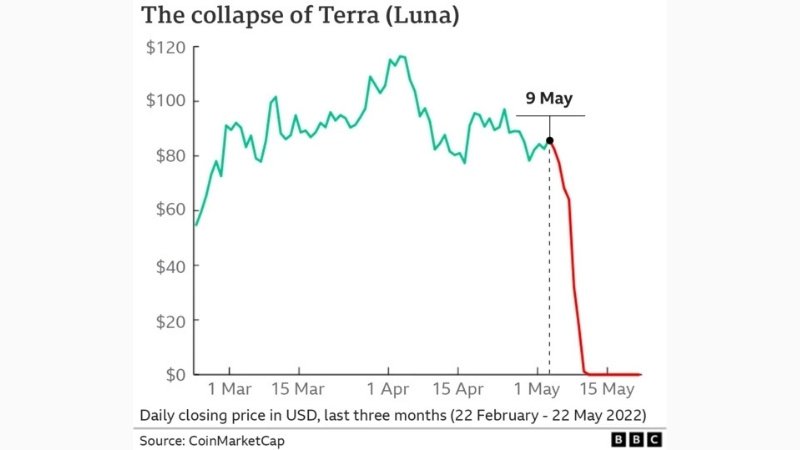

- Terra Luna Collapse 2022: The spectacular collapse of Terra Luna and its algorithmic stablecoin, UST, erased billions from the market, revealing the risks associated with unstable financial engineering. This also impacted many node sale participants who held UST and LUNA as part of their investment. The CoinDesk article from May 11, 2022, details the devastating impact of this event, with billions of dollars wiped out in a few days, and the stablecoin losing its peg to the dollar.

Image showing the rapid price drop of Terra LUNA during the collapse.

- FTX Collapse 2022: The collapse of the cryptocurrency exchange FTX, led by Sam Bankman-Fried, triggered significant sell-offs and further eroded confidence in the market. This event led to many users losing access to their funds, which in turn impacted node participants whose assets were held on the platform. The loss of trust in centralized exchanges following the FTX collapse led to a greater push for decentralization in the crypto space, with many projects trying to build self-custody solutions.

These crashes underscore the importance of understanding the market’s volatility and the need to approach cryptocurrency investments with caution and a robust risk management strategy. It’s also vital to remember that past performance is not indicative of future results.

Key Takeaways:

- Cryptocurrency market crashes are severe, rapid declines in value, unlike minor corrections.

- Macroeconomic factors such as interest rate hikes and inflation can trigger crashes.

- Internal crypto factors include high volatility, FUD, and market manipulation.

- Regulatory actions, such as trading bans and SEC enforcement can also cause crashes.

- Investor behavior like FOMO and panic selling exacerbates the decline.

- Crashes can cause financial stress, project failures, and reduced trust.

- Strategies for survival include diversification, DCA, and long-term focus.

II. Causes of Cryptocurrency Market Crashes

Macroeconomic Factors

Central Bank Interest Rate Hikes

When central banks increase interest rates, it tends to reduce liquidity in the market. Investors may shift their funds away from riskier assets like cryptocurrencies and into less volatile options such as government bonds or traditional savings accounts. This can lead to downward pressure on crypto prices and a slowdown on node sales. For instance, the US Federal Reserve’s aggressive interest rate hikes in 2022 led to a significant pullback in the crypto markets, as reported by the Federal Reserve website, demonstrating the sensitivity of crypto markets to monetary policy.

The Federal Reserve building, representing monetary policy.

Inflation and Economic Recession

High inflation and looming economic recessions can lead to a fear-driven market sell-off. People tend to liquidate their riskier assets, including cryptocurrencies, in favor of more stable stores of value like gold or the US Dollar. This impacts all aspects of the crypto space, including node sales, as investors become more risk-averse and cut back on discretionary investments. During periods of high inflation, the purchasing power of fiat currencies decreases, which encourages people to look for alternative stores of value. However, cryptocurrencies have so far proven to have a mixed record during periods of inflation, and are often seen as a risky asset class during a recession.

graph representing increasing inflation.

Internal Crypto Market Factors

High Volatility of Cryptocurrencies

Cryptocurrencies are inherently volatile assets, with prices capable of significant swings within short periods. This volatility makes them more susceptible to market crashes during economic and technological upheavals. The lack of traditional valuation methods also means that they can be easily impacted by changes in sentiment. Unlike stocks, for example, crypto valuations are not pegged to factors like profitability or assets under management.

The Role of FUD (Fear, Uncertainty, Doubt)

FUD, often amplified by social media and news outlets, can cause mass panic selling. This is particularly potent in the crypto market due to its novelty and the speculative nature of many of its assets. For projects reliant on node sales, FUD can severely impact their capital raising efforts, as prospective node operators become worried about the stability of the network. Social media platforms like Twitter and Reddit often act as echo chambers during downturns, and can accelerate the speed and scale of any price collapses. The spread of misinformation and rumors can cause significant drops in price even when there are no underlying issues with a network.

Impact of Policies and Regulations

Crypto Trading Bans in Certain Countries

Government bans on crypto trading, like those previously enforced in China, can severely impact the market by reducing demand and adding uncertainty. This may particularly scare investors who are looking at participating in node sales. When major markets like China ban crypto activity, it significantly impacts the overall sentiment of the market as it greatly reduces demand. This creates a negative cycle, where the price goes down, further undermining investor confidence and lowering demand. In addition, such crackdowns can slow innovation as development teams struggle to operate in restrictive environments.

China’s Crypto ban.

Regulations from SEC and Major Financial Institutions

Tougher regulatory actions from the SEC or other major financial institutions can send ripples through the crypto market, leading to price drops and impacting future developments of blockchain networks which rely on capital raised through node sales. Regulatory uncertainty can create uncertainty in the markets, and this is amplified by the lack of any global framework for crypto regulations. Changes in regulatory interpretation can also make it difficult for projects to plan their long term strategies. For example, an SEC investigation into a company’s operations can cause the price of their crypto to crash due to reduced trust and uncertainty.

Investor Behavior

FOMO (Fear of Missing Out) and Panic Selling

FOMO leads to irrational buying behavior during price rallies, creating unsustainable price peaks. Similarly, panic selling during price drops can exacerbate the crash. This human behavior affects all aspects of the market, including the willingness to invest in a project through its node sales. The fear of missing out can cause people to make impulsive investment decisions when prices are high, which contributes to price bubbles. When prices correct, this same emotion turns into panic and drives further selloffs.

Herd Mentality

Investors tend to follow the crowd, leading to a snowball effect. When prices go up, everyone wants in; when prices fall, everyone rushes to sell. This can be devastating in a market crash, impacting even stable assets and the ongoing operation of a blockchain via its nodes. This is especially prevalent in the crypto markets because many investors are relatively new to the field and lack the knowledge or resources to perform their own in-depth due diligence. In addition, social media can accelerate this, with groups of investors encouraging each other to buy or sell assets, regardless of whether it is a wise decision or not.

Technical Issues and Ecosystem Risks

Hacks and Exchange Technical Failures

Hacks of major exchanges and technical failures can lead to loss of investor funds and confidence. These incidents often trigger mass sell-offs. This can also shake investor confidence in projects that use node sales as part of their distribution strategy. The Mt Gox hack in 2014, which resulted in the theft of 850,000 bitcoins, is a prime example of how a major security breach can cause a massive loss of confidence in the crypto market. The collapse of exchanges can lead to a lack of trust and also create systemic risk, as many users may find themselves unable to access their assets.

Infamous Mt. Gox logo hack draws

Infamous Mt. Gox logo hack draws

Scams and Rug Pulls in DeFi Projects

The DeFi space is fraught with scams, including rug pulls where developers abandon projects after raising funds. Such incidents can devastate the market, reduce the overall confidence, and impact future node sales for new projects. The anonymity of many teams behind DeFi projects makes it easy for bad actors to launch a token or a protocol and then vanish. This lack of accountability also creates an environment where investors are very vulnerable. Due to this, it is very important to thoroughly check who is behind a node project.

III. Consequences of a Cryptocurrency Market Crash

Impact on Investors

Financial and Psychological Damage

Investors often face huge financial losses, leading to mental stress and a loss of confidence in crypto as an investment vehicle. The volatility and rapid losses associated with a crypto crash can be mentally taxing for even the most seasoned investors. Some studies have shown that those who invest in crypto can be more prone to financial anxiety, and the rapid and sudden loss of large amounts of money can trigger depressive states in some. It’s vital for investors to seek help and support during market crashes, and to try and avoid making emotional or impulsive decisions.

The mental stress that crypto crashes can cause. Image: Cointelegraph

The mental stress that crypto crashes can cause. Image: Cointelegraph

Changes in Investment Approach

A cryptocurrency market crash can force investors to reconsider their strategies, leading to a more risk-averse investment approach. This could mean less speculation, a greater focus on fundamentals, and careful selection of node networks. The market crash can cause some investors to retreat to more traditional assets, whilst others may look at focusing on long-term, low-risk crypto investment strategies. Investors may be more likely to research projects more thoroughly and focus on proven networks.

Impact on Blockchain Projects

Small Project Elimination

Many smaller projects often fail in a market crash, as their funding dries up and development slows. This is particularly true of projects that rely heavily on node sales. These projects simply can’t survive in a market where no one is buying nodes. In addition to lack of funding, the value of the project’s own token will often plummet, making it hard to fund further development, even if people do not sell the tokens. Only the most innovative and robust projects will typically survive long downturns.

Reduced Trust in DeFi and NFTs

Market crashes can significantly reduce investor faith in the long term sustainability of technologies like DeFi and NFTs. This can lead to a prolonged bear market and decreased interest in the overall digital assets space. Several projects in the NFT space saw their value go to near zero during the 2022 downturn, with many projects folding. While NFTs and DeFi still have potential, this downturn illustrated the need for greater transparency and real world utility.

Effects on the Crypto Ecosystem

Changes in Crypto Adoption Rates

Market crashes can slow down the adoption of cryptocurrencies as the public may view it as too risky. This impacts the overall growth of the crypto space and affects adoption in sectors like blockchain gaming or metaverse development. The media often focuses on the crashes and the large financial losses that people can incur, meaning that the general public may become very skeptical of crypto. It may take time to rebuild trust and recover from such events.

Slower Growth in Related Industries

Industries related to the crypto space, such as the metaverse and blockchain gaming, may experience a slower rate of growth due to market downturns. Projects that are funded through node sales might find it harder to attract investors in this climate. Investment into such sectors tends to fall, as does the amount of innovation. The impact is far reaching, as it can slow down the potential for new products or ideas to gain funding.

Impact on Traditional Financial Markets

Relationship between Crypto and Stock Markets

The increasing correlation between the crypto market and the traditional stock market means that crashes in one market can lead to volatility in the other. This is something to be aware of and it is still a relatively new and developing area of analysis. As institutional investors allocate funds to both crypto and traditional stocks, this interconnectedness is likely to grow, making it important to keep an eye on macroeconomic trends. The link between both markets means that a recession in the stock market may accelerate a downturn in crypto.

IV. Strategies for Overcoming a Cryptocurrency Market Crash

Surviving and potentially thriving during a market crash requires a strategic approach. Here are some strategies that can help investors:

Financial Risk Management

Dollar-Cost Averaging (DCA)

Dollar-Cost Averaging involves investing a fixed amount of money at regular intervals, irrespective of the price. This helps reduce the risk of buying at the market peak and allows you to capitalize on price dips. If a project offers a node sale, you might consider using DCA over time to buy multiple nodes at different price points. By buying in small increments on a regular basis, the average cost of buying your crypto is reduced, as you are buying some at higher prices but also at some of the dips.

Diversifying Your Investment Portfolio

Diversifying investments across different cryptocurrencies can help mitigate the risk. Instead of betting everything on a single crypto, spread your investments. This includes spreading your investment across multiple node networks, if possible. It can be risky to put all your resources into one area, and this diversification can allow you to spread that risk. You may also consider adding in some more stable investments like “blue chip” cryptocurrencies such as Bitcoin and Ethereum.

Focusing on the Long Term

Holding Top Cryptocurrencies

Focus on established cryptocurrencies like Bitcoin and Ethereum, which have better chances of surviving the market downturn. These are sometimes considered “blue chip” cryptos and are less likely to completely fail compared to newer and unproven projects. Projects offering node sales will also be judged on the potential of the crypto itself. These cryptocurrencies tend to have greater market liquidity which makes them slightly more stable than smaller tokens. In addition, they are more likely to attract institutional investment.

Bitcoin and Ethereum.

Investing in Real Value Projects

Invest in projects with solid fundamentals, real-world use cases, and a strong team. Look for projects that offer actual solutions and are more likely to recover. When you assess a node sale, try to evaluate the underlying project the node is supporting as well. Projects that offer real value tend to have stronger staying power and will often be more likely to survive market fluctuations. Look for robust teams with proven track records.

Maintaining a Strong Mindset

Avoiding FOMO and Panic Selling

Avoid making impulsive decisions based on emotions. Stay calm, avoid FOMO, and resist the temptation to panic sell. Market sentiment can quickly turn around, so it’s important to avoid making rash decisions. Try to step back from daily price checks, or from getting caught up in social media hype and panic. Making these short term emotional decisions can lead to substantial losses.

Learning from Past Market Crashes

Analyze past market crashes to understand the typical patterns and behavior of the crypto market. This historical perspective can help you stay grounded and make more informed decisions. Looking back at successful node networks can help determine the potential upside of any new offering. Understanding market cycles and patterns will allow you to better plan for the future. You should also note that past performance is not indicative of future success.

Monitoring News and Technical Analysis

Utilizing Price and Volume Tracking Tools

Use tools to track price movements and trading volumes to make informed decisions. This can help you identify buying opportunities and sell-off points. There are many free tools available, such as CoinGecko and CoinMarketCap. Technical analysis can help you identify support and resistance levels for assets, which can provide entry and exit points. Also look at how the volume changes, as this can often indicate changes in trends.

Consulting Reliable News Sources

Follow reputable crypto news outlets such as CoinDesk, CoinTelegraph, and Decrypt. These sources provide valuable insights and analysis that can guide your investment strategies, particularly with relation to node sales. Make sure to be wary of “paid content” or “sponsored posts” on websites. It is useful to read multiple different sources before making your decisions.

V. Predictions and Lessons from Cryptocurrency Market Crashes

Future Predictions for the Market

Will Crypto Recover?

The crypto market has proven to be resilient. While there are no guarantees, history suggests that the market has the potential to recover after a crash, often emerging stronger than before. However, there are no guarantees, and some projects may not recover. For node sales, understanding the development and ecosystem is key. The potential of crypto to reshape the world has not gone away, but it is also important to remember that many individual projects and tokens may disappear. The future of crypto is not guaranteed, but as technology and user confidence grows, the future is still full of potential.

A crypto recovery.

The Role of Blockchain in Shaping Finance

Blockchain technology has the potential to transform finance and many other industries. Regardless of market crashes, the potential of the underlying technology should not be underestimated. Look at the underlying use of the nodes you are considering to ensure it aligns with the future you envision. The use cases for blockchain are constantly expanding, and innovation within the space continues to grow.

Key Lessons Learned

Importance of Thorough Research

Conduct thorough research before investing in any crypto project. Understand the technology, the team, and the project’s real use cases before allocating capital. Always investigate before buying into any node sale and make sure the project’s goals align with your own. Be skeptical of projects that promise high returns with very little effort. It is vital that you also understand the risks of any potential project that you may want to get involved with.

Understanding the Cyclical Nature of the Market

The crypto market is cyclical, with periods of growth followed by periods of decline. Understanding this pattern can help you avoid emotional responses. Avoid being caught in a hype cycle and understand that market fluctuations are normal. It’s very difficult to time the market, so you are likely to miss the peaks and the troughs. This understanding can mean that you are better prepared both psychologically and financially for any downturns.

Enhancing Risk Awareness

Be aware of the inherent risks associated with investing in cryptocurrencies and do not put in money that you cannot afford to lose. Risk assessment is key, especially when entering something as speculative as buying into a node network. Ensure that you understand the risks of any project, and make sure to plan accordingly. The crypto markets are still relatively new, and it can be hard to make any projections about future movements or outcomes. Do not allow yourself to be pressured by anyone to invest large sums of money.

VI. Conclusion

Summary of Key Points

This article has covered the definition of a cryptocurrency market crash, its causes, consequences, and strategies for navigating these turbulent times. Understanding how factors like macroeconomic events, market behavior, and node network activity influence the broader crypto market will give you the confidence to move forward.

Final Advice

Before investing your capital in cryptocurrency, invest in your knowledge. Arm yourself with the best information possible to better protect your assets and plan for the future. Don’t blindly buy into hype, and always do your own research, especially before investing into any node sale. Look at reviews and seek out a variety of independent opinions before you make a final decision. It can also be wise to start with small amounts.

Be proactive. Research and develop an investment strategy to protect your assets during times of market volatility. Learn how to analyse node networks, understand tokenomics and the broader ecosystem, and invest wisely in the future of crypto and Web3.

Pingback: ChartPrime Review: Is It the Ultimate Trading Tool? CoinFxPro

Pingback: NFT Staking: Blending Digital Collectibles with Staking Rewards - CoinFxPro

Pingback: The Fee Switch: Should Projects Share Revenue? - CoinFxPro

Pingback: Metaverse Coin List for Beginners: Coins with Potential in 2025

Pingback: The Ultimate Guide to Governance Tokens in 2025 - CoinFxPro

Pingback: What are Altcoins? A Deep Dive into the World Beyond Bitcoin

Pingback: What is Cryptocurrency? A Comprehensive Guide to Digital Assets

Pingback: A Comprehensive Guide to Cryptocurrency Trading CoinFxPro

Pingback: What is a Crypto Stock and How Does it Work? CoinFxPro

Pingback: What Causes Crypto to Go Up and Down? A beginner's guide