Table of contents

- 1 CoinTracker Reviews: A Deep Dive into Crypto Portfolio and Tax Management

CoinTracker Reviews: A Deep Dive into Crypto Portfolio and Tax Management

Navigating the world of cryptocurrency can be exhilarating, but keeping track of your investments and ensuring tax compliance can be daunting. That’s where tools like CoinTracker come into play. As the cryptocurrency market continues to expand, with over 20,000 different cryptocurrencies and countless exchanges, managing your portfolio becomes complex. This complexity not only affects individuals but also impacts the broader financial system, making robust tracking tools essential. In this comprehensive review, we’ll explore CoinTracker’s features, pros, cons, and how it stacks up against the competition. Whether you’re a seasoned trader or a beginner dipping your toes into crypto, understanding the utility of portfolio management tools is critical for financial success and compliance.

Reviews play a vital role in helping both new and experienced users decide on the best tools for their crypto journey. This article will cover the key points of CoinTracker, providing you with a thorough understanding of its capabilities to help you make an informed decision. From portfolio tracking to tax compliance, we’ll delve into the core aspects that make CoinTracker a notable tool in the crypto space.

What is CoinTracker?

CoinTracker is a cryptocurrency portfolio tracking and tax compliance software designed to help investors manage their digital assets effectively. It’s a platform that simplifies the complexities of crypto finance by offering a unified solution for tracking transactions across multiple exchanges and wallets. Whether you’re dealing with Bitcoin, Ethereum, or any of the thousands of other cryptocurrencies, CoinTracker aims to provide clarity and control over your holdings. Its primary purposes are two-fold: portfolio management and tax reporting.

![]()

With CoinTracker, you can gain a comprehensive view of your entire portfolio, see how your investments are performing, and understand your tax obligations. It serves as a centralized hub for all your crypto activities, providing a detailed overview of your profit and loss, asset allocation, and tax liability. This tool is particularly appealing to different types of investors. Day traders and frequent transactors can benefit from the real-time tracking and performance analytics, while long-term holders can use it for tax reporting and portfolio optimization. Moreover, it’s useful for anyone participating in staking, lending, or other yield-generating activities, as it accurately reflects the earnings and related taxes from these sources.

Features of CoinTracker

CoinTracker is packed with a range of features that make it a powerful tool for crypto investors. Here’s a breakdown of its main functionalities:

Portfolio Tracking Across Multiple Exchanges

One of the most significant advantages of CoinTracker is its ability to track your portfolio across a wide range of exchanges. Instead of manually logging transactions on multiple platforms, CoinTracker syncs with popular exchanges like Binance, Coinbase, Kraken, and many others. This feature provides a consolidated view of your digital assets, simplifying portfolio management. By supporting API integrations, CoinTracker ensures real-time updates, which are crucial for traders who make frequent decisions.

Tax Calculation and Compliance Tools

Navigating cryptocurrency taxes can be incredibly complex. CoinTracker simplifies this by calculating your crypto tax obligations automatically. The platform takes into account different tax laws in various jurisdictions and applies cost-basis methods like FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) to generate accurate tax reports. These reports are designed to be easily integrated with tax preparation software or shared with your accountant, making the tax filing process less daunting. CoinTracker supports several tax forms, including Form 8949 in the USA, and tax reports for other countries, making it a go-to tool for global crypto investors.

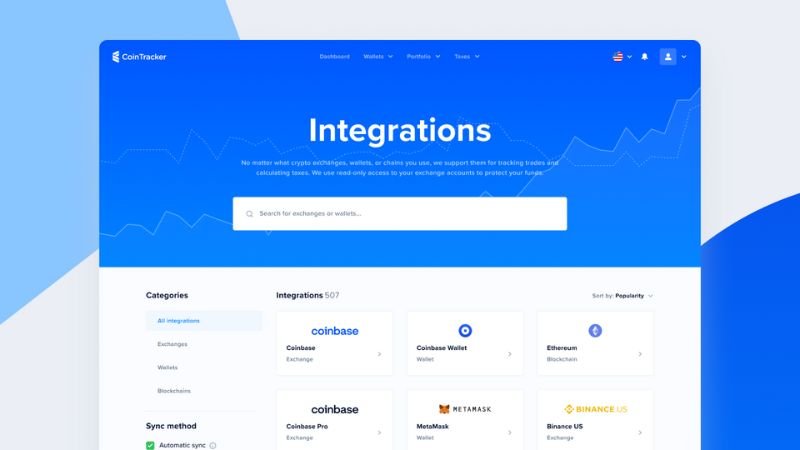

Integration with Major Platforms

CoinTracker’s compatibility with a variety of exchanges and wallets is a key strength. By supporting integrations with popular platforms such as Binance, Coinbase, Kraken, and wallets like MetaMask, Ledger, and Trezor, CoinTracker ensures that users can connect their accounts seamlessly. This extensive integration network allows for comprehensive tracking, regardless of the platform you use to trade or store your crypto. The ability to automatically import transaction data minimizes the risk of manual errors, making the platform more reliable and user-friendly.

Real-Time Updates and Analytics

With real-time updates, you can monitor your crypto investments at a glance. CoinTracker provides an overview of your profit and loss, asset allocation, and portfolio performance. These analytics give you insights into your trading strategies and asset performance. Whether you’re interested in daily fluctuations or long-term trends, CoinTracker presents the data in a clear and easily understandable format. This immediate access to information helps you make more informed decisions.

Mobile App Functionality

For those who need to track their investments on the go, CoinTracker offers mobile apps for iOS and Android. The mobile app provides access to most of the core features found on the web version, including portfolio monitoring, transaction tracking, and tax reports. This ensures that you can stay informed about your crypto investments regardless of your location.

Support for NFTs and Multi-Currency Investments

CoinTracker also supports the tracking of Non-Fungible Tokens (NFTs) and multi-currency investments. As the NFT market becomes increasingly popular, CoinTracker’s ability to track NFT values and transactions is a significant advantage. Additionally, the platform supports multiple currencies, allowing users to easily manage investments denominated in different currencies, which is a crucial feature for those with a global portfolio. This breadth of coverage ensures that users have a holistic view of their digital assets.

Pros and Cons of CoinTracker

Like any tool, CoinTracker has its strengths and weaknesses. Here’s a closer look at the pros and cons:

Advantages:

- Easy Setup and User-Friendly Interface: CoinTracker is known for its intuitive design, making it easy for both beginners and experienced users to navigate. The setup process is straightforward, and users can quickly import their transaction data and start tracking their portfolio.

- Comprehensive Tax Reporting: The platform’s comprehensive tax reporting capabilities are a major advantage. By considering different tax laws and cost-basis methods, CoinTracker produces accurate and usable tax reports, reducing the stress of tax season for crypto investors.

- Wide Range of Integrations: CoinTracker’s extensive support for various exchanges and wallets is a significant benefit, allowing for seamless data import and real-time tracking. This ensures that users can connect all their accounts without any hassle.

- Reliable Customer Support: Many users appreciate CoinTracker’s responsive and helpful customer support team. They are available to assist with any issues or questions that arise.

Disadvantages:

- Pricing for Advanced Features: While CoinTracker offers a free tier, accessing the full suite of features and generating comprehensive tax reports often requires a paid subscription. The cost may be prohibitive for some users, particularly those with smaller portfolios.

- Some Limitations for Certain Exchanges: Although CoinTracker supports many exchanges, some smaller or less common platforms may not have direct integration, requiring manual data input or CSV imports. This can be a hassle for users who utilize a wide variety of exchanges.

- Room for Improvement in NFT Tracking: While CoinTracker does support NFTs, some users have noted that its NFT tracking capabilities are not as robust or comprehensive as those offered by some competitors.

How to Use CoinTracker

Getting started with CoinTracker is simple. Here’s a step-by-step guide:

Step-by-Step Setup Guide:

- Create an Account: Visit the CoinTracker website and sign up for a free account. You can use your email or connect with Google or Facebook.

- Connect Wallets and Exchanges: Once you’re logged in, connect your exchange and wallet accounts. CoinTracker supports API and CSV imports. Connecting via API is generally the fastest and most accurate option, as it allows for automatic syncing.

- Import Historical Data: Import your historical transaction data. If you have a lot of historical data, this process might take a few minutes. Be sure to double-check that everything is correct, as incorrect entries will impact the accuracy of your reporting.

- Generate Portfolio Insights and Tax Reports: After importing your data, you can view your portfolio insights. From here you can monitor profit/loss, and view your tax liability, and generate comprehensive tax reports for the specific tax year.

Tips for Getting the Most out of CoinTracker:

- Regularly sync your wallets and exchanges to keep your data up-to-date.

- Review your transaction history to verify its accuracy.

- Take advantage of the educational resources provided by CoinTracker.

- Explore the different features of the platform, such as portfolio analysis and tax optimization.

Comparing CoinTracker with Competitors

The market for crypto portfolio and tax management tools is competitive. Here’s how CoinTracker stacks up against some of its key rivals:

Competitors such as Koinly, CryptoTrader, and ZenLedger all offer different levels of features, pricing, and ease of use. Here’s a comparison table:

| Feature | CoinTracker | Koinly | CryptoTrader.Tax | ZenLedger |

|---|---|---|---|---|

| Portfolio Tracking | Comprehensive | Comprehensive | Basic | Comprehensive |

| Tax Reporting | Advanced | Advanced | Basic | Advanced |

| Number of Integrations | Extensive | Extensive | Moderate | Extensive |

| NFT Support | Basic | Moderate | Basic | Advanced |

| Pricing | Subscription-based | Subscription-based | Pay-per-report | Subscription-based |

| Usability | Very User-Friendly | User-Friendly | Moderate | User-Friendly |

CoinTracker is often favored for its user-friendly interface and comprehensive tax reporting. Koinly is another strong contender with a large integration base. CryptoTrader.Tax is more suited to those looking for a simpler tax reporting tool with a pay-per-report model. And finally, ZenLedger offers a wide range of services, including advanced NFT tracking, and is preferred by users with more complex portfolios.

CoinTracker’s strengths lie in its easy setup, integration capabilities, and comprehensive tax reporting, making it a better fit for users who prioritize user-friendliness and want detailed tax reports. Each platform provides unique features and pricing, so choosing the right one depends on your specific needs, investment style, and budget. For instance, if you have a diverse portfolio with a heavy focus on NFTs, you might consider ZenLedger. If you’re seeking a balance of comprehensive features and user-friendliness, CoinTracker is an excellent option.

Real User Reviews and Feedback

User feedback provides valuable insights into how CoinTracker performs in real-world scenarios. Here’s a summary of common praises and complaints:

Many users on platforms like Trustpilot and Reddit have praised CoinTracker for its intuitive interface and thorough tax reports. The ability to sync with multiple exchanges and wallets is often highlighted as a major plus. Users also frequently commend the responsive customer support team.

However, some users have noted that pricing can be a barrier, especially for users with smaller portfolios. Others have reported limitations in tracking certain types of transactions or with some less common exchanges. There are also some users that have stated there is room for improvement in NFT tracking. CoinTracker consistently releases updates based on user feedback to address reported issues, improving their platform over time. These updates often include bug fixes, new features, and increased support for various exchanges and platforms. For example, several users requested better support for DeFi transactions, and CoinTracker responded by updating their platform to include specific tracking for these transactions.

Conclusion

CoinTracker stands out as a valuable tool for both new and experienced cryptocurrency investors. With its comprehensive features for portfolio management and tax compliance, it simplifies the complexities of crypto finance. The user-friendly interface, extensive integrations, and reliable customer support make CoinTracker a popular choice among many global crypto investors. Although it has some limitations, particularly regarding pricing and some less common platforms, it’s a powerful option for managing and tracking crypto portfolios. As the crypto market continues to evolve, CoinTracker helps users stay compliant, informed, and prepared.

If you are looking for a tool to simplify your crypto portfolio management and tax reporting, CoinTracker is worth considering. We encourage you to take advantage of their free trial to test its capabilities. Click here to sign up for CoinTracker and take control of your crypto finances.

Frequently Asked Questions (FAQ)

What is CoinTracker and how does it work?

CoinTracker is a comprehensive cryptocurrency portfolio tracker and tax calculator. It automatically syncs with your wallets and exchanges, providing real-time portfolio updates and generating accurate tax reports for easier tax filing. It simplifies crypto management and supports various accounting methods.

What are the key features of CoinTracker?

Key features include automated portfolio tracking across numerous exchanges and wallets, real-time data updates, and sophisticated tax reporting tools. CoinTracker also offers NFT support and integrates seamlessly with major platforms like Coinbase, Binance, and MetaMask for easy portfolio management and accurate tax reporting.

Is CoinTracker suitable for beginners?

Absolutely! CoinTracker features a user-friendly interface and a simple setup. It automates complex tasks such as tax reporting and portfolio tracking, making it perfect for beginners. It guides new users, simplifying the entry into cryptocurrency management and tax compliance.

How does CoinTracker handle tax compliance?

CoinTracker expertly handles tax compliance by calculating gains/losses using methods like FIFO, LIFO, and HIFO. It generates tax forms (e.g., Form 8949 for the US) and supports many international tax regulations. It helps users accurately and efficiently prepare their crypto taxes.

What are the pros and cons of using CoinTracker?

Pros: Real-time portfolio tracking, detailed tax reports, broad exchange/wallet support, and good customer service. Cons: Advanced features require payment; some less common exchanges may not be supported. Some users report occasional issues with NFT tracking that is continuously improving.

Our Communication Channels

Disclaimer: Disclaimer: The information provided in this article does not constitute investment advice from Coinfxpro. Trading Forex and cryptocurrencies involves high risks and may not be recognized or protected by the laws of certain countries. Please consider carefully before investing.

Pingback: How Bubblemaps Crypto Tools Revolutionize Blockchain Analytics

Pingback: The Fee Switch: Should Projects Share Revenue? - CoinFxPro

Pingback: Mastering the Crypto Market: Understanding Your Break Even Point - CoinFxPro

Pingback: What is Binance App? A Comprehensive Guide CoinFxPro Trading Tools

Pingback: Koinly Reviews: The Complete Crypto Tax and Portfolio Guide CoinFxPro