Table of contents

- 1 Crypto’s Sneaky Trap: How to Identify the Bait and Switch Scam

Crypto’s Sneaky Trap: How to Identify the Bait and Switch Scam

Alright, let’s be honest – the crypto space is often fascinating, ripe with opportunity, but also, dare we say a bit rough and ready. Sadly, there are bad people that try to take advantage of others, and one of their most often-used tricks is the “Bait and Switch” scam. It’s nasty, but if you know what to look for, you can totally miss it. Let’s unpack that so you can secure your crypto.

So What Is a “Bait and Switch,” Exactly?

It’s like this: A super cool thing — shiny — and it’s advertised maybe for cheap (that’s the “bait”). You get all giddy, and then suddenly discover it’s either crumby or doesn’t even exist in the first place (that’s the “switch”). In crypto, this takes all sorts of forms and can fool even people who consider themselves pretty savvy. It’s all about luring you in and then replacing the offer with something far less (or nothing).

How These Schemes Work in Crypto

These scams are pretty slick. Here are some of the common ways they appear:

- Fraudulent ICOs or IDOs: Picture a new crypto product, with high-flying promises, and big names behind it (or at least they say they are). They want you to purchase their new coin or token. You give them your money, and poof! The project disappears, or the token turns out to be worthless. That shiny “new thing” is just junk.

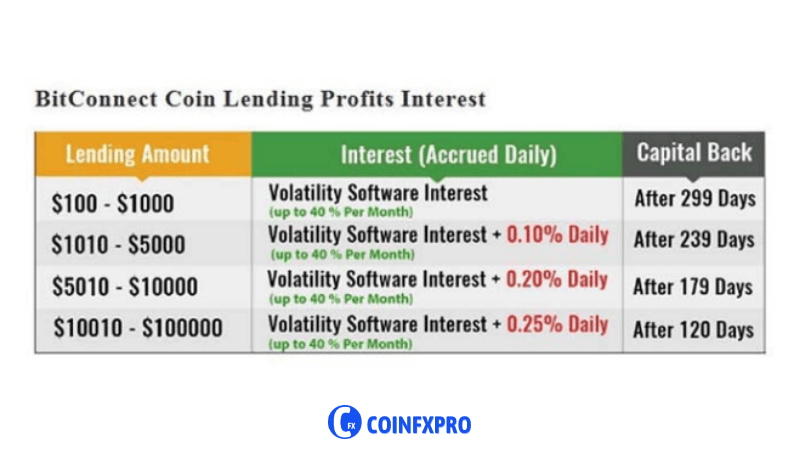

- Pump-and-Dump Schemes: One group of people pumps up a coin saying it’s going to the moon. Tons of folks buy in, the price skyrockets and then the hype team dumps all their coins on top at the peak, leaving everyone else holding the bag as the price plummets. It’s a cruel rollercoaster.

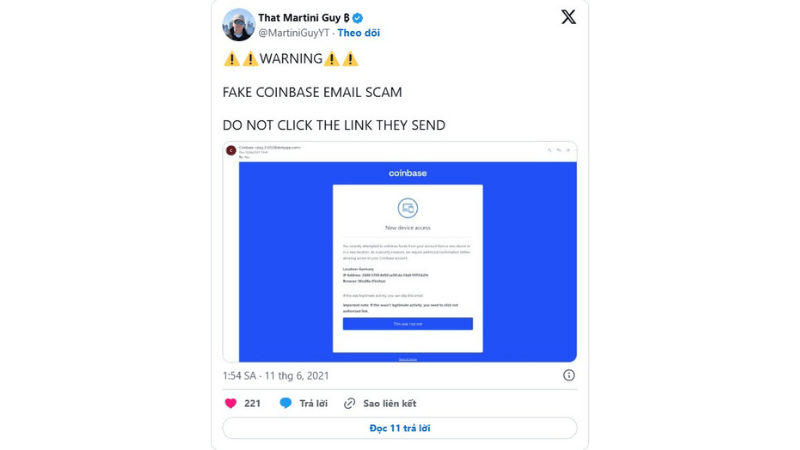

- Impersonation Scams: In these, Scammers represent themselves as the trusted crypto exchange or project and present deals that are too good. But once you give them your money, you’ll find out they are not who they pretend to be.” They are simply pretending to have your best interests in mind to take your money.

- Phishing Attacks: kinds of emails or messages that appear to come from a legitimate crypto company. They trick you into a phony site designed to get your login info in the right screen, and then the baddies suck it all out, using your account to steal your loot. It’s a mean trick, and simple to fall for if you’re not on your guard.

Why do these scams work so well in crypto?

You may be asking yourself how do folks get suckered by these things. Well, here are a few reasons:

- No Rules: The crypto world is still very much the Wild West. There are not many regulations, so easier for the scammers to get away with things. Given the anonymity and borderlessness of cryptocurrency transactions, tracking down scammers is no easy feat.

- It’s Complicated: Let’s face it, crypto can be difficult to understand. Scammers use techie jargon and complicated processes to trick new-comers in the space.

- FOMO (Fear of Missing Out): The speculation surrounding cryptocurrency can lead individuals to believe they are missing out on potentially massive gains. A lot of people see something hyped and just jump right in without doing their due diligence. Fraudsters thrive on that sensation.

- Anonymity: It’s difficult to know who is behind some of these projects. Scammers disguise themselves with false names, so it is much more difficult to find them.

Real-Life Examples of Bait and Switch Fails

To better understand how these scams unfold, let’s explore a few real stories.

The Tale of the Vanishing ICO

In 2018, there was this project called “XYZ Coin.” It had a flashy website, a “great” idea, and a team that looked legit. They were promising huge payouts to holders of their new token, people invested huge and they walked away with the money. The thing never even launched on an exchange. The promise of the innovative project was the “bait,” and their disappearing act was the “switch.”

Pump-and-Dump: The ABC Token History

In 2020, something strange happened and the price of “ABC Token” shot up. It got hyped everywhere. And, as more and more people bought in, the price went higher and higher, until it suddenly collapsed. The hypers sold their coins at the top and made big profits at the expense of everyone else, who lost big. The “bait” was the initial price jump, and the “switch” was the price collapse.

Identifying a Bait and Switch Scam: Warning Signs to Look For

Recognizing a bait and switch scam takes diligence and an awareness of common strategies. Here’s a more in-depth look at red flags to help you explore the crypto space with greater safety:

- Guaranteed Profits: Promises of guaranteed returns are a huge red flag, as described above. No bona fide investment, particularly in the erratic crypto space, can guarantee you a return. This tactic is common amongst scammers, luring in gullible investors with the illusion of easy profits. Beware of any project which guarantees a positive result, because they are probably preparing you for a loss in advance.

- Secretive Teams: Transparency can pave the way for real crypto projects. When a project’s team is anonymous or they are using pseudonyms, and you can’t verify what you need to know about them, this is a red flag. Real projects generally have public information (ie. profiles) and proven experience in that area. Information about team members and their previous endeavors should be easily obtainable.

- Pressure Tactics: High-pressure sales tactics are a sure sign of a scam. If you are pressured to invest “now” or that the opportunity is “limited”, you are probably dealing with someone trying to convince you to pull the trigger without doing your own due diligence. Legitimate opportunities don’t try to hurry you, and the more urged you feel, the more wary you should be.

- Expectations set in the sky: Take incredible care when assessing anything stating exaggerated figures, partnerships, and technical innovations. Fraudsters will employ these techniques to attract you in and also build a sense of urgency. Always check such claims with independent sources, and exercise due caution when it sounds too good to be true.

- No Community Engagement THere Is no crypto project without a thriving community. A project without a real social media presence — few followers, or even a entombed forum, is a big red flag. There are real projects with active communities discussing and asking questions. The lack of this suggests that it is a bait and switch scam.

- Fluctuating Prices: Watch out for coins that experience rapid price increases followed by an equally rapid fall. These patterns are often the telltale signs of a pump-and-dump scheme. By pumping prices with some hype, these schemes then return to the market that have many holding so-called ‘coins’, that are now all but worthless after taking their positions.

- Complicated or Dodgy Whitepapers: A project should be able to explain the project and its tech in clear language within the whitepaper. Lazy or absurdly verbose wording without much explanation can also be a warning sign that the project is trying to obfuscate rather than better explain the project so that you’re more likely to invest rather than having a full understanding of what they’re doing.

- This point is good because a useful project should be a project that has a use case and is already producing products that work. If there is no clear description of a project or no potential product to support what the team is selling — stay away. This usually means that the project is not producing any actual valuable development.

- Unprofessional Communication: Watch out for communication that contains loads of errors, is unprofessional or sounds too salesy. Real businesses use proper business communication peak deactivate should be your red flag.

Always be on the lookout for these scams!

How to Protect Yourself From These Scams

Don’t panic; there are ways to keep yourself safe. Here’s what you can do:

- DYOR: Don’t just dive in head first. Research the project, the team, the technology, and everything else. Seek out trusted sources of information instead of depending on others’ opinions.

- Use Trusted Exchanges: Use popular, regulated, and secure exchanges for buying cryptocurrencies. Avoid putting your money on lesser known or recent platforms.

- Suspicious of Impromptu Deals: If someone wants you to invest, be careful. This is particularly true when the request comes from the mouth of someone you don’t know. If it sounds too good to be true, it’s likely a scam.

- Double-Check Everything: Claims shouldn’t be taken at face value. Check any information you get from other sources.

- Cold Wallet: Store your crypto in a hardware wallet that is not connected to the internet

- Talk to Experts: If you don’t trust your own knowledge, seek advice from a financial adviser who knows about crypto.

- Be Informed: Following crypto updates will help you protect yourself from scams.

Conclusion: Keep Your Eyes Peeled and Your Head Safe!

Yes, the crypto universe can be a wonderful place to invest and grow your wealth, just be aware of the pitfalls and remain vigilant. By knowing what a scam like the Bait and Switch is, you can protect yourself and your money. Do your due diligence, be cautious, and always remember – safeguard your assets and look for good buys!

Frequently Asked Questions (FAQs)

What is a ‘Bait and Switch’ scam in the crypto?

What Is a Crypto ‘Bait and Switch? The moment the investor takes the bait, though, the terms shift, or the asset that was promised is swapped for one of much lower value, sometimes with devastating financial consequences for the victim.

What happens in Bait and Switch scams in crypto?

These scams typically begin with misleading marketing, such as fake ICOs or pump-and-dumps. Scammers hype it up, claiming huge gains to be made. The offer then changes or disappears after investors contribute. Victims get nothing or useless tokens after costly research and due diligence before investing in any crypto project.

Bait and Switch Scam — The Red Flags:

Unrealistic returns, aggressive sales tactics and lack of detail about the project are all warning signs. Scam Alert: Fake celebrity endorsements, vague or badly written whitepapers with no clear roadmap, and anonymous teams all are very strong signs that a possible scam is afoot. So be extremely suspicious of anything that sounds too good to be true.

How can I protect against crypto scams?

Akin to all aspects of life, due diligence should be exercised on all investments and only recognized exchanges and wallets should be used to protect yourself. Verify the authenticity and credentials of the team and research the trustworthiness of the project whitepaper. Avoid any investment that promises high returns with little or no risk, and never give your private keys or sensitive information on the Internet.

What to do if you think it’s a crypto scam?

If you suspect it is a scam, cease all communication or transaction with the suspected scammer immediately. Involve the proper authorities — the SEC, the FTC or your local cybercrime unit. Also, report to your bank and crypto exchange and warn the crypto community about your experience so that no one else falls prey to them.

Pingback: How Bubblemaps Crypto Tools Revolutionize Blockchain Analytics

Pingback: Mastering the Crypto Market: Understanding Your Break Even Point - CoinFxPro

Pingback: What is Binance App? A Comprehensive Guide CoinFxPro Trading Tools

Pingback: Cryptocurrency Trading Strategies: A Comprehensive Guide CoinFxPro

Pingback: Understanding Cryptocurrency Regulations and Their Importance