Table of contents

- 1 All Forex No Deposit Bonus: Your Comprehensive Guide to Free Trading

- 1.1 What is a Forex No Deposit Bonus?

- 1.2 How Does a Forex No Deposit Bonus Work?

- 1.3 Best Forex Brokers with No Deposit Bonus

- 1.4 Benefits of Forex No Deposit Bonus

- 1.5 Risks of Using a Forex No Deposit Bonus

- 1.6 Withdrawal Conditions for No Deposit Bonus

- 1.7 Forex Bonus and Risk Management Strategies

- 1.8 No Deposit Bonus vs Deposit Bonus in Forex

- 1.9 Conclusion

- 1.10 Additional Information on Brokers Offering No Deposit Bonuses

- 1.11 Frequently Asked Questions (FAQs) About Forex No Deposit Bonus

- 1.11.1 What is a Forex no deposit bonus?

- 1.11.2 How does a Forex no deposit bonus work?

- 1.11.3 What are the benefits of a Forex no deposit bonus?

- 1.11.4 What are the risks of using a Forex no deposit bonus?

- 1.11.5 What are the withdrawal conditions for a Forex no deposit bonus?

- 1.11.6 How do I choose the best broker with a Forex no deposit bonus?

All Forex No Deposit Bonus: Your Comprehensive Guide to Free Trading

What is a Forex No Deposit Bonus?

A Forex no deposit bonus is precisely what it sounds like: a promotional offer from a Forex broker that provides new traders with a specific amount of trading capital without requiring an initial deposit. Think of it as a “free trial” or a “welcome gift” that allows you to start trading live in the market, potentially generating real profits without any upfront financial commitment. This is in stark contrast to traditional trading where you would have to first fund your account to participate in the market. For instance, a broker might offer a $30 no-deposit bonus, enabling a new trader to place trades on currency pairs and gain a sense of how the market works with real funds.

Why Do Brokers Offer No Deposit Bonuses?

Forex brokers offer these bonuses for several reasons. Firstly, it’s a potent marketing tool to attract new clients. In a competitive industry, offering a no deposit bonus can make a broker stand out from the crowd. Secondly, it allows potential traders to experience the broker’s platform and services firsthand. This firsthand experience can lead to traders becoming long term clients. Essentially, it’s a way for brokers to showcase the quality of their platform and build a trader base. By allowing traders to use their platform risk free, brokers hope to demonstrate the value of their offering.

How Does a Forex No Deposit Bonus Work?

The mechanism of a forex no deposit bonus is generally straightforward, although specifics may vary between brokers. Here’s a typical scenario:

- Account Registration: You register with a Forex broker offering a no deposit bonus.

- Verification: You may need to complete a verification process, usually by providing identification documents. This is a standard security and compliance measure.

- Bonus Credited: Once your account is verified, the broker will credit your trading account with the bonus amount. This amount varies, usually ranging from $10 to $100. For example, some brokers might offer a $25 no-deposit bonus, while others might go as high as $50 or even $100 for special promotions.

- Trading: You can now use this bonus to trade various currency pairs.

- Profit Withdrawal: If your trading results in a profit, you can withdraw a part or all of it, subject to the broker’s terms and conditions (more on that later).

It is crucial to thoroughly understand the terms and conditions attached to the no deposit bonus. This will ensure you are well aware of the requirements and limitations involved.

Best Forex Brokers with No Deposit Bonus

Finding the right broker with a reliable no deposit bonus can be challenging, as offers frequently change. Moreover, not all brokers are equal; some are more reputable than others. Here are a few things to look for when selecting a broker that is offering all forex no deposit bonus:

- Regulation: Always choose brokers regulated by reputable financial authorities. This ensures the safety of your funds and fair trading practices. Examples of such regulators include ASIC (Australia), FCA (UK), CySEC (Cyprus) and more. For example, an ASIC regulated broker adheres to strict standards aimed at protecting the interests of Australian traders.

- Platform Reliability: Check for platform reviews and reliability before committing. Look for a platform that is stable, fast, and provides the tools you need for successful trading. You can check out reviews of MetaTrader 4, MetaTrader 5, TradingView and 3Commas to get an idea of platform quality.

- Bonus Terms: Scrutinize the bonus terms and conditions, paying attention to withdrawal requirements, lot size restrictions, and validity period. For example, some bonuses might require trading a minimum of 5 standard lots within 30 days before any profits can be withdrawn.

- Customer Support: Quality support is crucial, especially when dealing with bonuses or any technical issues. It’s often a good idea to test the customer support responsiveness before committing.

- Tradable Instruments: Ensure the broker offers the currency pairs and other instruments you wish to trade. Some brokers may specialize in certain types of trading instruments.

It’s important to note that specific brokers and bonus offers can change frequently. Always verify the information through the official channels of the broker. Doing your own research is always a great idea to ensure you are selecting the best option for you. Websites like ForexBrokers.com offer comprehensive broker reviews and can be a valuable resource.

Benefits of Forex No Deposit Bonus

The allure of all forex no deposit bonus is understandable. Here are the key benefits that make these offers so attractive:

- Risk-Free Trading: The most significant benefit is the opportunity to trade without risking your own money. You are exposed to real market conditions, but the financial risk is reduced, at least initially.

- Platform Familiarization: It allows new traders to explore the broker’s trading platform without commitment. This is ideal for those who want to learn the platform’s interface and features.

- Strategy Testing: You can use the bonus to experiment with various trading strategies, understand market movements, and fine-tune your approach without losing your personal funds. For instance, you could test a scalping strategy or a swing trading strategy to see what suits you best.

- Real Market Experience: Trading with a no deposit bonus provides a real-world trading experience. You learn how to execute trades, manage risk, and get a taste of market dynamics. This firsthand experience is invaluable.

- Profit Potential: Although the bonus itself is not withdrawable, the profits you earn from trading with it are, often times, withdrawable, under certain conditions. This means you can turn a free bonus into real money.

Risks of Using a Forex No Deposit Bonus

While the all forex no deposit bonus sounds amazing, it’s not without its drawbacks. Understanding the risks is key to using these offers wisely:

- Unrealistic Expectations: The term “no deposit” may lead to unrealistic expectations. Many traders may anticipate making large sums of money rapidly. Forex trading involves risk, and no deposit bonuses are not a guaranteed path to profits. According to a survey by the National Futures Association (NFA), approximately 70% of forex traders lose money. This statistic highlights that it takes time and effort to develop profitable strategies.

- Stringent Withdrawal Conditions: These bonuses come with strict withdrawal rules. These conditions may include minimum trade volume, minimum profit requirements or other restrictions that make it difficult to cash out. For example, you might need to trade a certain number of lots or achieve a specific profit target to withdraw funds.

- Potential Scams: Some unregulated brokers may use no deposit bonuses as a bait to lure in unsuspecting traders. The safety of your information and funds could be at risk when you use unregulated brokers. This is why regulation is crucial.

- Trading Pressure: Some traders might feel undue pressure to trade aggressively to meet withdrawal criteria. This can lead to hasty, ill-considered decisions that result in losses. It’s important to remain disciplined and stick to a trading plan.

- Limited Bonus Size: No deposit bonuses tend to be relatively small, limiting the earning potential. It’s not realistic to expect significant profits from such small capital, but rather to use it for testing and learning.

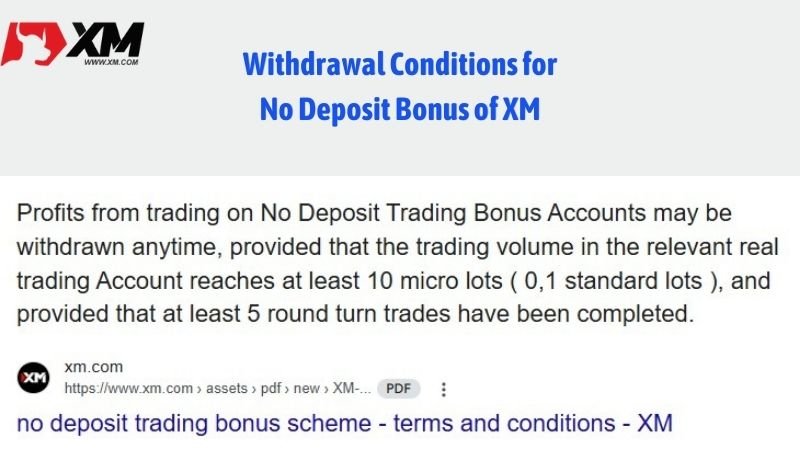

Withdrawal Conditions for No Deposit Bonus

The withdrawal conditions are usually the trickiest part of a forex no deposit bonus. These conditions are designed to protect the broker from potential abuse of their bonus program. While these conditions vary from broker to broker, here are some common stipulations you should be aware of:

- Minimum Trading Volume: Brokers may require you to trade a certain number of lots (a standard unit of trade) before allowing any withdrawal of profits. For example, a broker may require trading 10 lots for every $5 of bonus received. If you received a $20 bonus, you would be required to trade 40 lots. You can learn more about pips in forex and how they relate to lot sizes.

- Minimum Profit Threshold: Some brokers will set a minimum profit requirement that you must achieve before you can withdraw any profits. For instance, you might need to generate a profit of $50 before you can request a withdrawal.

- Time Limit: Bonuses often come with a validity period. You may have to meet all withdrawal conditions within this specific timeframe. If the time limit expires before the conditions are met, you may lose your bonus and any profits generated. This can be as short as 14 days or as long as 90 days.

- Deposit Requirement: Sometimes brokers require you to make a deposit before you can withdraw profits derived from the no-deposit bonus. This is often done to verify your payment method and identity.

- Account Verification: You will need to have fully verified your account before you can withdraw profits. This often requires submitting copies of your ID and proof of address.

Always carefully read and understand the specific terms and conditions of the bonus offer before engaging in trading. This step is crucial to avoid any disappointments or misunderstandings.

Forex Bonus and Risk Management Strategies

When using a forex no deposit bonus, risk management is even more crucial. Since you are trading with “free” money, the temptation to take on more risk can be higher. Here are some strategies to consider:

- Start Small: Regardless of the bonus amount, begin with small trade sizes. This is good practice for proper risk management and allows you to gradually test the waters. For example, if you have a $50 bonus, you could begin by risking only $1 or $2 per trade.

- Use Stop-Loss Orders: Always use stop-loss orders to protect your account from significant losses. A stop loss order will automatically close your position if the market goes against you beyond a predefined price. This is a simple but effective way to protect your capital.

- Understand Leverage: Forex trading involves leverage, which can magnify both profits and losses. Use leverage judiciously and understand the risks involved. A good practice is to start with a lower leverage ratio, such as 1:10 or 1:20, and gradually increase it as you get more experienced.

- Diversify Your Trades: Avoid putting all your bonus capital into a single trade or currency pair. This will reduce the risk of any one trade greatly impacting your overall account. Diversification involves spreading your capital across various currency pairs, reducing the overall risk.

- Learn Continuously: Forex trading is a dynamic field. Continuously educate yourself on market trends, trading strategies, and risk management techniques. There are numerous resources, such as online courses, webinars, and books, available to enhance your knowledge.

No Deposit Bonus vs Deposit Bonus in Forex

It’s also essential to differentiate between a forex no deposit bonus and a deposit bonus. Here’s a breakdown of the key differences:

No Deposit Bonus:

- No Initial Deposit: Requires no initial funding.

- Smaller Bonus Amount: Usually smaller than deposit bonuses.

- More Restrictive Terms: Often comes with stricter withdrawal conditions.

- Ideal For Beginners: Perfect for testing a broker’s platform and exploring strategies without personal financial risk.

Deposit Bonus:

- Requires Initial Deposit: You need to deposit your funds.

- Larger Bonus Amounts: Deposit bonuses are generally larger. For example, a broker might offer a 100% deposit bonus up to $1,000, effectively doubling your trading capital.

- More Lenient Conditions: Can be more straightforward when it comes to withdrawals. For instance, you might only be required to trade a certain volume of lots to withdraw your profits.

- Suitable For Active Traders: Designed for traders who are willing to invest their own capital to get the bonus.

When choosing between these types of bonuses, assess your trading experience, goals and risk tolerance. If you are new to Forex trading, a no deposit bonus is an ideal starting point. For experienced traders looking to boost their trading capital, deposit bonuses could be more suitable.

Conclusion

The all forex no deposit bonus presents a remarkable opportunity to step into Forex trading without financial risk. However, success is dependent on carefully understanding all the terms and conditions, managing risk, and choosing a reputable broker. While the bonus can help kickstart your trading journey, remember that Forex trading is inherently risky. Approach it with knowledge, caution, and a commitment to continuous learning. By using this guide as your compass, you can navigate the world of Forex no deposit bonuses and potentially pave the way for profitable trading.

Additional Information on Brokers Offering No Deposit Bonuses

While specific offers can change rapidly, here’s some information about brokers that have been known to offer no deposit bonuses. Please note that these details should be verified directly with the brokers as promotions change frequently:

No Deposit Bonus Details: RoboForex has offered no deposit bonuses in the past, often as part of special promotions. These bonuses may require traders to complete a verification process and meet specific trading volume requirements before withdrawals.

When they offered: In 2024, RoboForex had a $30 Welcome Bonus for new clients.

Terms and Conditions When Offered: Typically, these bonuses come with conditions such as a minimum trading volume requirement and a profit withdrawal limit. They often have a time limit for the bonus use and must be used within a specified period after receiving it, such as 30 days.

No Deposit Bonus Details: FBS periodically offers a no deposit bonus, sometimes called a “Level Up Bonus,” to new clients. The amount and conditions can vary.

When they offered: FBS has offered a $100 bonus for new clients to start trading.

Terms and Conditions When Offered: Usually, traders need to trade a specific number of lots to withdraw any profit made from the bonus. There might be a limit on how much profit can be withdrawn, often capped at the bonus amount received or a little more. It’s also common for the bonus to have an expiry date, requiring traders to meet the requirements within a fixed timeframe.

No Deposit Bonus Details: Tickmill has, on occasion, provided no deposit bonuses, often for a limited period. These bonuses are aimed at allowing new clients to try their services risk-free.

When they offered: Tickmill had a $30 Welcome Account for new customers at various times.

Terms and Conditions When Offered: The conditions usually involve a trading volume requirement, a time limit, and a maximum withdrawal amount. Typically, to withdraw the profits made from the bonus, traders must trade a certain number of standard lots. The timeframe given to meet these requirements can be tight and requires active trading.

Disclaimer: Bonus offers and conditions can change rapidly. Always verify the current offers and their terms and conditions directly with the respective brokers. This list is not exhaustive, and there are many other brokers that may offer no deposit bonuses periodically. Always exercise due diligence when selecting a broker, and be sure to trade within your risk tolerance.

Frequently Asked Questions (FAQs) About Forex No Deposit Bonus

What is a Forex no deposit bonus?

How does a Forex no deposit bonus work?

What are the benefits of a Forex no deposit bonus?

- Test broker platforms and services before making a deposit.

- Gain real-market experience without the fear of losing money.

- Develop and refine trading strategies in live trading conditions.

- Potentially generate profits without investing their own capital.

Additionally, this bonus provides traders with a safe learning environment and helps them transition from demo to live trading.

What are the risks of using a Forex no deposit bonus?

- Strict withdrawal conditions that may limit profit accessibility.

- The possibility of falling for scams from unregulated brokers.

- High trading volume requirements that could lead to excessive risk-taking.

- Limited trading opportunities due to restricted asset selection.

- Short validity periods that pressure traders into making quick decisions.

To mitigate these risks, traders should carefully read bonus terms and choose reputable brokers with transparent policies.

What are the withdrawal conditions for a Forex no deposit bonus?

- Meeting a minimum trading volume or turnover requirement.

- Maintaining an active account for a set period.

- Completing identity verification to comply with anti-money laundering regulations.

- Some brokers may require a small deposit before permitting withdrawals.

Traders should carefully review the broker’s terms before attempting to withdraw funds.

How do I choose the best broker with a Forex no deposit bonus?

- Regulated brokers with licenses from authorities like FCA, CySEC, or ASIC.

- Clear and transparent bonus terms without hidden conditions.

- A reputable trading platform with a user-friendly interface and advanced tools.

- Strong customer support that assists traders with inquiries and issues.

- Good reviews from traders who have successfully used and withdrawn profits from the bonus.

By carefully evaluating these factors, traders can maximize the benefits of a Forex no deposit bonus while avoiding potential pitfalls.