Table of contents

- 1 Navigating the World of Forex Brokers: A Comprehensive Guide

- 1.1 Understanding the Role of a Forex Broker

- 1.2 How to Choose a Forex Broker: A Step-by-Step Guide

- 1.3 Key Broker Categories

- 1.4 Top Forex Brokers for Beginners

- 1.5 Forex Broker Comparison

- 1.6 Forex Brokers and Trading Tools

- 1.7 Forex Brokers with Leverage

- 1.8 Forex Brokers for Scalping

- 1.9 Forex Broker Platforms

- 1.10 Forex Brokers for Mobile Trading

- 1.11 Forex Brokers with High Liquidity

- 1.12 Forex Broker Customer Support

- 1.13 Top Forex Brokers Worldwide

- 1.14 Conclusion: Making the Right Choice

- 1.15 Frequently Asked Questions (FAQ) – Forex Brokers

The foreign exchange market, commonly known as Forex, is a colossal and ever-shifting marketplace where currencies are traded around the clock. For individuals keen on entering this dynamic arena, selecting the right Forex broker is not just a step, but a critical leap toward success. A broker serves as your essential gateway to the Forex market, providing the platform, essential tools, and indispensable services needed to engage in successful trading. However, with countless brokers vying for your attention, the crucial question arises: How does one discern and select a broker that perfectly aligns with their unique trading style, risk appetite, and financial aspirations? This comprehensive guide is designed to peel back the layers, offering an in-depth look at everything you need to know about Forex brokers, from the fundamental criteria for selection to specialized considerations tailored for various types of traders.

Understanding the Role of a Forex Broker

Before diving into the complex selection process, it’s vital to understand the pivotal role a Forex broker plays in your trading journey. They are, in essence, the indispensable intermediaries that grant you access to the interbank Forex market. Brokers provide not just trading platforms but also a suite of tools designed for in-depth market analysis and the all-important capacity to execute trades. Crucially, they are also the custodians of your trading funds, underscoring the need to select a regulated and reputable provider.

The Key Functions of a Broker

- Providing a Trading Platform: The platform is your digital workspace, where you’ll analyze market trends, formulate strategies, and execute trades. A user-friendly and efficient platform is crucial for seamless trading.

- Offering Trading Tools: Advanced charting software, economic calendars, and in-depth market analysis are essential tools that empower traders to make informed decisions. These tools are not optional, but integral to successful trading strategies. You can see some great options on our Netdania Charts page, or our Tradingview review page.

- Leverage: This powerful tool enables traders to control larger positions with a smaller amount of capital. While it can amplify gains, it also magnifies potential losses, hence requires careful and judicious use.

- Order Execution: Efficiency and speed are paramount. Swift and accurate order execution is critical for capitalizing on market opportunities, especially in volatile conditions.

- Account Management: Brokers are also responsible for handling deposits and withdrawals, and meticulously tracking your trades, providing a complete overview of your trading activity.

- Customer Support: Reliable customer support is indispensable. Prompt and effective assistance is crucial when you face technical glitches, need clarification, or simply require general guidance.

How to Choose a Forex Broker: A Step-by-Step Guide

Selecting the right Forex broker is a decision that requires careful consideration and thorough due diligence. It’s not a task to be rushed; rather, it’s a critical component of your long-term trading strategy. Here’s a step-by-step guide designed to assist you through this process:

Forex Brokers: Key Considerations

- Regulation: Ensure the broker is regulated by a reputable financial authority (e.g., FCA, CySEC, ASIC).

- Platform: Choose a platform that is user-friendly and offers the tools you need.

- Spreads & Fees: Compare spreads, commissions, and other fees.

- Leverage: Understand the leverage offered and its associated risks.

- Customer Support: Test their responsiveness and helpfulness.

Step 1: Determine Your Needs

Before you start evaluating different brokers, it’s essential to have a clear understanding of your personal trading requirements and objectives. Consider these crucial factors:

- Trading Style: Are you a scalper aiming for quick profits, a day trader seeking opportunities within the day, a swing trader targeting medium-term gains, or a long-term investor? Your style will heavily influence your choice of broker.

- Experience Level: Are you a novice taking your first steps in trading, or an experienced trader with a proven track record? Beginners may need more educational resources and simpler platforms, while experienced traders may look for advanced tools.

- Capital: How much capital are you intending to deposit into your trading account? Your initial deposit will influence the types of accounts and leverage options available to you. For example, a low minimum deposit Forex broker could be a great fit for beginners.

- Trading Goals: What are your long-term financial objectives? Are you aiming for consistent income, long-term growth, or something else? Aligning your broker with your goals is vital.

Step 2: Research and Compile a List of Potential Brokers

Once you have a clear understanding of your trading needs, begin the research phase. This is where you gather information about potential brokers. Here’s how to approach it:

- Read Forex Broker Reviews: Consult trusted online resources, forums, and reputable review sites to gauge a broker’s reputation. Look for consistent patterns in feedback from multiple sources.

- Compile a List: Based on your preliminary research, create a list of brokers that appear to meet your initial criteria. This shortlist will serve as the basis for further evaluation.

- Look for Regulated Forex Brokers: This cannot be emphasized enough: regulation is paramount. Always ensure that the broker is overseen by a well-respected financial authority. Look for bodies like the FCA (UK), CySEC (Cyprus), ASIC (Australia), or SEC (US). These bodies ensure that brokers adhere to strict financial guidelines and protect traders’ funds, as detailed in this article on regulated brokers.

Step 3: Evaluate Key Broker Features

With a shortlist in hand, it’s time to get into the details and compare specific features. Consider the following points very carefully:

- Trading Platforms: Evaluate the user interface, stability, and the range of features of each trading platform provided by the brokers. A powerful platform should offer seamless trading without any unnecessary complexities.

- Spreads and Commissions: Understand the cost structure for each broker. Compare the spreads offered on different currency pairs and analyze any commission structures in place. Depending on your trading volume and style, you may prefer Forex brokers with low spread or Forex brokers with no commission. For instance, this page explains what forex spreads are and how they work.

- Leverage: Understand the leverage offered and its direct impact on your risk profile. Be careful when choosing a Forex broker offering leverage. Always remember that leverage can magnify both gains and losses.

- Account Types: Determine if the available account types are suited to your trading volume, strategy, and risk tolerance. Some accounts cater to beginners with low minimum deposits, while others are designed for high-volume professional traders.

- Payment Options: Ensure that the deposit and withdrawal options provided are not just convenient, but also secure and reliable for you. A diverse range of payment methods is usually a sign of a reputable broker.

- Customer Support: Test the responsiveness and helpfulness of the support team before committing to a broker. Contact support with a simple query to gauge their efficiency and quality of service.

- Trading Instruments: Verify that the broker offers access to all the currency pairs, along with other assets, that you are interested in trading. Diversification is important for mitigating risk.

Step 4: Open a Demo Account

Many reputable brokers offer demo accounts, which mirror the live trading environment but use virtual funds. These accounts provide a fantastic opportunity to get familiar with the broker’s trading platform and its various tools without risking real money.

Step 5: Open a Live Trading Account

Once you are completely satisfied with a broker after testing it out through a demo account, you are now prepared to open a live account. This will require completing identity verification, funding your account, and then you’ll be set to start. Follow the broker’s step-by-step guide for how to open a Forex trading account.

Key Broker Categories

Not all brokers operate in the same way. Here are some key categories to be mindful of:

ECN Forex Brokers

ECN Forex brokers (Electronic Communication Network) offer direct access to liquidity providers. This can lead to tighter spreads and faster trade execution, as your orders are matched directly with other market participants. These brokers typically earn revenue through commissions.

An example of an ECN (Electronic Communication Network) model.

Market Maker Forex Brokers

Market maker Forex brokers act as the counterparty to your trades. This does not inherently put you at a disadvantage, but it’s important to be aware of their role. These brokers often offer fixed spreads and do not always charge direct commissions on every trade, instead deriving their income from the spread.

An example of a Market Maker model.

Commission Free Forex Brokers

Many brokers these days offer Commission free Forex brokers accounts. In these accounts, you won’t pay a fee for each trade; instead, brokers make a profit through a slightly wider spread. This can be an attractive option for high-volume traders or beginners looking to avoid per-trade fees.

Top Forex Brokers for Beginners

For beginners, the choice of broker can be a make-or-break decision. It’s critical to select a broker that provides a user-friendly environment, and also comprehensive educational resources. The Top Forex brokers for beginners tend to have the following features:

- Intuitive Trading Platforms: Platforms that are easy to navigate, even for those who are using them for the first time, are a must.

- Educational Resources: These could include webinars, detailed tutorials, and articles designed to help beginners learn the basics of forex trading.

- Demo Accounts: Essential for beginners, demo accounts provide a risk-free way to practice trading before risking any real capital.

- Low Minimum Deposit Forex Brokers: Allowing beginners to start with a small amount of capital, reduces the risk while allowing them to get comfortable with the trading platform.

- Excellent Customer Support: Responsive and helpful assistance whenever needed, helping newcomers with all the questions they are bound to have.

Forex Broker Comparison

Comparing different brokers side-by-side is a vital step for making an informed and strategic decision. You should pay attention to the following areas:

- Fees and Spreads: The transaction costs have a direct effect on your profitability. Analyze and understand the fees and spreads charged by each broker.

- Available Platforms: Investigate the trading platforms offered, including popular ones like MetaTrader 4, MetaTrader 5, and any proprietary platforms. Each platform has its pros and cons.

- Trading Tools: Check what types of analytical tools each broker includes. A good set of trading tools is essential for your success.

- Asset Range: Make sure that the broker offers access to the range of financial products you want to trade, such as currency pairs, stocks, commodities, and indices.

- Regulation: Ensure the broker is properly regulated in its respective region and in any jurisdiction you want to be protected by.

A meticulous Forex broker comparison will help you pinpoint the broker that best matches your trading style, your specific preferences, and your level of expertise.

Forex Brokers and Trading Tools

The availability of powerful and effective tools is another crucial consideration. The Best Forex brokers for trading tools provide a variety of resources, including:

- Advanced Charting: Sophisticated charting packages with a diverse range of technical indicators. These indicators are essential for identifying potential entry and exit points.

- Economic Calendars: Real-time updates on significant economic releases, as these can cause market volatility.

- Market Analysis: Professional research and commentary from market analysts, can be very helpful when developing your own trading strategy.

- Automated Trading Capabilities: Support for algorithmic trading and expert advisors (EAs). This allows you to execute trades automatically based on predetermined criteria.

Forex Brokers with Leverage

Leverage, while a potentially powerful tool, also carries significant risks. Forex brokers offering leverage are extremely common, and the amount of leverage usually ranges from 1:1 up to 1:500, or even higher. Consider these points:

- Understanding Leverage: It’s a double-edged sword that can magnify your profits, but also your losses. Therefore it needs to be used cautiously.

- Risk Management: Always employ strict risk management techniques when using leverage, to protect yourself from unforeseen risks.

Forex Brokers for Scalping

Scalping, a high-frequency trading strategy, aims to make small profits from a high number of trades. Forex brokers for scalping need to have:

- Fast Execution: Quick and efficient order execution is a must, as even a second delay can be costly.

- Tight Spreads: Low transaction costs are essential for scalpers, as they are looking for minimal profit margins.

- Minimal Slippage: Even minimal slippage can have a huge impact on profitability, as slippage eats into your very tight profit margins.

Forex Broker Platforms

The trading platform is where you’ll be spending most of your time when trading, therefore choose a broker that uses the best platform for your specific needs:

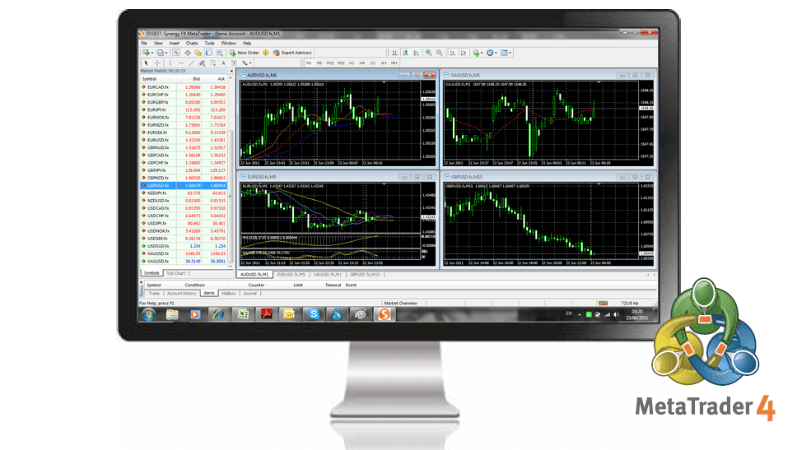

MetaTrader 4 (MT4)

One of the most popular platforms, MT4 is known for its simple design and high level of robustness. A very large number of brokers offer MetaTrader 4.

The popular MetaTrader 4 platform.

MetaTrader 5 (MT5)

The advanced version of MT4, MT5 offers more features and supports a wider range of markets. A growing number of brokers are offering MetaTrader 5.

The more advanced MetaTrader 5 platform.

Proprietary Platforms

Some brokers provide their own unique trading platforms, each with their own features and tools.

Forex Brokers for Mobile Trading

In today’s fast-moving world, mobile trading is no longer a luxury, but a necessity. Forex brokers for mobile trading offer:

- User-Friendly Apps: These mobile apps need to be intuitive and easy to use, even while on the move.

- Full Functionality: They should offer all the features available on the desktop platform, so you don’t feel limited by the app.

- Real-Time Data: Up-to-date market information and price charts are required for making informed trading decisions, at any time and any place.

Forex Brokers with High Liquidity

Liquidity is essential for smooth trading, as it determines how easily you can enter and exit trades. Forex brokers with high liquidity provide:

- Tight Spreads: Low transaction costs are a clear indicator of high liquidity.

- Efficient Execution: The ability to execute orders quickly and efficiently.

- Minimal Slippage: Stable prices are essential when you are trying to get the price you expect.

Forex Broker Customer Support

Reliable and responsive customer support is a must for every trader. Look for brokers that offer:

- Multiple Channels: Support options such as email, phone, and live chat.

- 24/5 Availability: Support should be available during the trading week.

- Knowledgeable Staff: Support personnel need to be well-trained and knowledgeable about the platform and trading in general.

Top Forex Brokers Worldwide

While the best broker for you will depend on your individual needs, here’s a look at some of the well-known and reputable Forex brokers in the global market, along with their general strengths and weaknesses:

- IG

- Strengths: Wide range of markets, strong regulatory oversight, robust platform, excellent educational resources, good for both beginners and experienced traders.

- Weaknesses: Can have higher spreads compared to some other brokers.

- Interactive Brokers

- Strengths: Access to a vast range of markets and instruments, competitive pricing, powerful trading platform, ideal for professional traders.

- Weaknesses: Platform can be complex for beginners, customer service is not always the most responsive.

- eToro

- Strengths: User-friendly platform, strong social trading features, good for beginners, offers a variety of assets.

- Weaknesses: Spreads can be higher than other brokers, limited advanced tools.

- CMC Markets

- Strengths: Wide range of trading instruments, strong proprietary platform, good educational materials, known for a good research portal.

- Weaknesses: Can be complex for beginners, some users find the interface clunky.

- XTB

- Strengths: Low fees, user-friendly platform, good for both beginners and advanced traders, very good educational resources.

- Weaknesses: Limited range of markets compared to some of the biggest brokers.

- Pepperstone

- Strengths: Tight spreads, fast execution, good for scalpers, good range of platforms including MT4 and MT5, good customer service.

- Weaknesses: Limited educational content for beginners.

- FXCM

- Strengths: Wide range of currency pairs, strong platform, good educational content and research tools, very long history in the industry.

- Weaknesses: Can have some negative reviews, some users find the customer support slow.

- Oanda

- Strengths: Reputable broker with a long history, very well regulated, good platform, good customer support.

- Weaknesses: Can be seen as a bit less innovative compared to some newer brokers.

- Saxo Bank

- Strengths: Wide range of assets, very strong and innovative platforms, good for professional traders.

- Weaknesses: High minimum deposit, may not be ideal for beginners.

- Plus500

- Strengths: Simple and user-friendly interface, good for beginners, wide range of instruments.

- Weaknesses: Limited educational resources, lacks some of the advanced trading tools.

- Enesss

- Strengths: Offers a variety of trading instruments including Forex, commodities, and indices, provides access to both MT4 and MT5 platforms, and has a strong focus on customer support, including 24/7 assistance and educational materials, caters to both beginners and experienced traders with various account types and leverage options..

- Weaknesses: Being a relatively new broker, it may have a shorter track record compared to more established names, may have limited regulatory information, some users may find the range of instruments or platform functionality less extensive than other larger brokers.

Disclaimer: This is not an exhaustive list and it is not an endorsement of any specific broker, please do your own research to find the best broker for your individual needs. Always prioritize brokers that are regulated in your region.

Conclusion: Making the Right Choice

Choosing the right Forex broker is a crucial decision that will have a significant impact on your entire trading career. By taking the time to properly assess your personal needs, research different brokers, and diligently compare key features, you’ll find a partner that aligns perfectly with your trading style, goals, and financial aspirations. Remember to prioritize regulation, security, and customer support above all when you are making your final decision. With the right broker by your side, you will be able to trade with confidence and significantly increase your odds of success in the exciting world of Forex trading.

Pingback: Best Forex Brokers for January 2025: A Comprehensive Guide - CoinFxPro

Pingback: TradingView Review: The Ultimate Tool for Crypto Trading - CoinFxPro

Pingback: Decoding EUR/USD: A Comprehensive Guide with MarketWatch

Pingback: What is Netdania Charts? A Complete Guide for Forex Traders - CoinFxPro

Pingback: MetaTrader 5 Review: A Powerful Trading Platform CoinFxPro Forex Tools

Pingback: All Forex No Deposit Bonus: Guide to Risk-Free Trading CoinFxPro

Pingback: Mastering Forex: A Guide to Currency Pairs CoinFxPro Forex

Pingback: ZuluTrade Review: Is It the Right Copy Trading Platform for You? - CoinFxPro

Pingback: MetaTrader 4 Review: The Ultimate Guide for Forex Traders - CoinFxPro

Pingback: How to Start Forex Trading: A Beginner's Guide CoinFxPro