Table of contents

- 1 What is a Non-Custodial Wallet?

- 2 Custodial vs. Non-Custodial Wallets: A Detailed Comparison

- 3 Choosing the Right Non-Custodial Wallet: A Step-by-Step Guide

- 4 Using a Non-Custodial Wallet Securely: Best Practices

- 5 Conclusion: Embracing Self-Custody

- 6 Frequently Asked Questions (FAQ)

- 6.1 What is a non-custodial wallet?

- 6.2 Are non-custodial wallets safe?

- 6.3 What are some examples of non-custodial wallets?

- 6.4 How do I recover my funds if I lose my non-custodial wallet?

- 6.5 What is the difference between a hot wallet and a cold wallet?

- 6.6 Can I lose my crypto if I use a non-custodial wallet?

What is a Non-Custodial Wallet? Comparison with Custodial Wallets & How to Choose the Right One

A non-custodial wallet is a type of cryptocurrency wallet that allows you and only you to have full control over your private keys. These keys are necessary for using and managing your digital assets. Non-custodial wallets grant you full ownership and responsibility for your crypto, unlike custodial wallets that involve a third party holding your keys. This means—although you have improved security and autonomy—you are also entirely responsible for keeping keys safe: if you lose them you lose your funds.

What is a Non-Custodial Wallet?

A non-custodial, or self-custodial, wallet is a type of wallet where you, and only you, are in control of your private keys. In cryptocurrencies, private keys are the cryptographic secrets that enable you to spend your coins. Treat them like the keys to your digital vault. Essentially, a non-custodial wallet allows you to completely own, and take full responsibility for your digital assets.

This is in stark contrast to custodial wallets, where a third party (a.k.a a cryptocurrency exchange) holds your private keys for you. While this is convenient, custodial solutions create a counterparty risk — you are having to trust that third party to safeguard your funds and stay solvent.

For advanced crypto users and high-balance traders, the security benefits of non-custodial wallets and receiving security tokens are often worth the extra hassle. For newcomers, however, the learning curve can be steeper than with custodial choices. Ultimately, the choice comes down to your risk tolerance, technical skills, and the value of the assets you’re securing.

Key Takeaways:

- Non-custodial wallets give you complete control over your private keys and cryptocurrency.

- You are responsible for the security of your private keys and seed phrases.

- Custodial wallets are managed by a third party, offering convenience but less control.

- Choosing between custodial and non-custodial depends on your risk tolerance and technical expertise.

- Hardware wallets offer the highest level of security for non-custodial storage.

Custodial vs. Non-Custodial Wallets: A Detailed Comparison

To fully understand the “non custodial wallet meaning,” it’s vital to compare it directly with its custodial counterpart. Here’s a breakdown of the key differences:

| Feature | Non-Custodial Wallet | Custodial Wallet |

|---|---|---|

| Private Key Control | User has sole control | Third-party (exchange, service provider) controls |

| Security | Higher, but the user is responsible for security. Loss of private key = loss of funds. | Dependent on the security practices of the custodian. Vulnerable to exchange hacks. |

| Account Recovery | No recovery possible if the private key or seed phrase is lost. | Typically possible through KYC/AML verification and customer support. |

| Responsibility | Fully on the user. | Shared between the user and the custodian. |

| Convenience | Requires more technical understanding and responsibility. | Generally easier to use, especially for beginners. |

| Transaction Speed | Can depend on network congestion, user selected fees. | Often faster for internal transfers within the exchange ecosystem. |

| Privacy | Higher, as transactions don’t necessarily need to be linked to your identity until you interact with a centralized service. | Lower, as exchanges typically require KYC/AML information. |

Real-World Examples:

- Custodial Wallets: Binance, Coinbase, Kraken, Gemini, Crypto.com exchange wallets.

- Non-Custodial Wallets: MetaMask, Trust Wallet, Ledger Nano S/X, Trezor Model T/One, Exodus, Electrum.

In Summary: Non-custodial wallets prioritize security and control, placing the onus of responsibility squarely on the user. Custodial wallets offer convenience and ease of use, but at the cost of relinquishing control over your private keys.

Fast Fact: The term “not your keys, not your coins” is a popular saying in the crypto community, emphasizing the importance of controlling your private keys through a non-custodial wallet.

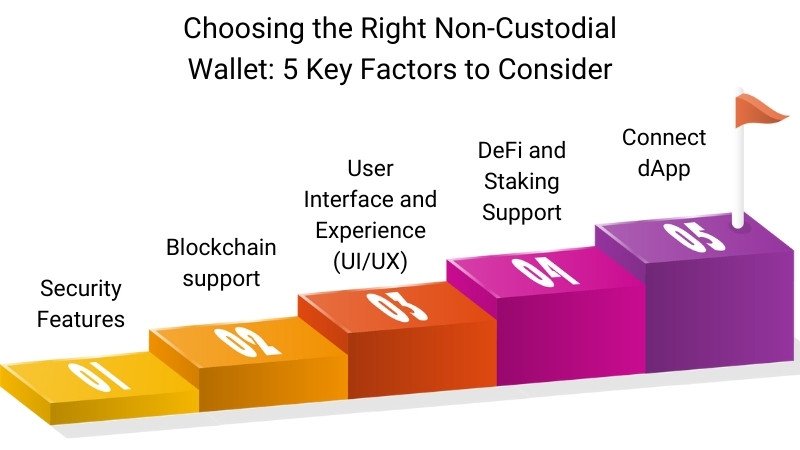

Choosing the Right Non-Custodial Wallet: A Step-by-Step Guide

Selecting the right non-custodial wallet is crucial for a secure and efficient crypto experience. Here are the key factors to consider, explained by an expert:

Key Considerations:

- Security Features:

- Seed Phrase Backup: Does the wallet generate a seed phrase (a sequence of words) that can be used to recover your assets if your device is lost or corrupted? This is a must-have requirement.

- Two-Factor Authentication (2FA): Does the wallet have two-factor authentication (2FA)? It’s not a cure-all, but it’s an important layer of protection.

- Phishing Protection: Does that wallet have integrated functionality to detect if a website or a dApp is trying to trick the user?

- Open-Source Code: Is the wallet open source and audited by the community? This adds to transparency and helps to perform autonomous security evaluations. Another indicator of wallet security is the transparency of open wallet source code, as revealed in a 2022 blockchain security study.

- Hardware Wallet Integration: Does the wallet support hardware wallets (Ledger, Trezor) in order to ensure the highest level of security?

- Blockchain support:

- Single or multi-chain support: Does the wallet support a single blockchain (Bitcoin only) or multiple blockchains (could be Ethereum, Solana, Binance Smart Chain, etc.)? Select a wallet that is compatible with the cryptocurrencies you use.

- EVM compatibility: If you wish to interact with dApps operating on Ethereum, confirm that your wallet supports the Ethereum Virtual Machine (EVM).

- User Interface and Experience (UI/UX):

- User-friendliness: Is the wallet intuitive and easy to use, even for the inexperienced?

- Supported platform (mobile, desktop, or web): Does the wallet have the platforms you want ( mobile app, desktop app, browser extension)?

- DeFi and Staking Support:

- Staking: Does the wallet enable you to stake cryptocurrencies to earn rewards directly?

- DeFi features: Can the wallet easily connect to decentralized finance platforms (DeFi) for borrowing, lending, and farming?

- NFT support: Does the wallet support NFT storage and trading? NFT trading surged until the beginning of 2024, as reported by a CNBC article.

- Connect dApp:

- Web3 browser: Does the wallet include a Web3 browser or dApp browser that lets you engage with decentralized apps?

- WalletConnect support: Does the wallet support WalletConnect, the protocol that interlinks wallets and dApps?

Popular Non-Custodial Wallet Options:

Here’s a brief overview of some of the most popular non-custodial wallets, categorized by their strengths:

| Wallet | Security | Blockchain Support | User Experience | DeFi/Staking Support | Notes |

|---|---|---|---|---|---|

| MetaMask | ⭐⭐⭐ | Ethereum, EVM-compatible chains | Good (Browser extension & mobile app) | Excellent (Extensive dApp integration) | Popular choice for DeFi users. |

| Trust Wallet | ⭐⭐⭐ | Multi-chain (Wide range of supported assets) | Excellent (Mobile-focused, user-friendly) | Good (Built-in staking and swap features) | Good all-around option, especially for mobile users. |

| Ledger Nano S/X | ⭐⭐⭐⭐⭐ | Multi-chain | Good (Requires physical device interaction) | Good (via Ledger Live app) | Hardware wallet – highest level of security. |

| Trezor Model T/One | ⭐⭐⭐⭐⭐ | Multi-chain | Good (Requires physical device interaction) | Good (via Trezor Suite) | Hardware wallet – another top-tier security option. |

| Exodus | ⭐⭐⭐⭐ | Multi-chain | Excellent (Beautiful and intuitive interface) | Limited (Some staking options available) | Great for beginners who prioritize ease of use. |

| Electrum | ⭐⭐⭐⭐ | Bitcoin only | Advanced (For experienced users) | No | Lightweight and customizable Bitcoin wallet. |

Note: The security ratings (stars) are subjective and based on general reputation and features. Always do your own research.

Based on User Profile Recommendations:

- For first-timers, I shall recommend Trust Wallet or Exodus; they provide easy-to-understand screens and adequate overall usability.

- DeFi Enthusiast: The most used browser extension to interact with DeFi apps on Ethereum.

- Maximum Security: Ledger or Trezor hardware wallets are the gold standard.

- Bitcoin Maximalist: Electrum is pro-Bitcoin with tons of features.

Using a Non-Custodial Wallet Securely: Best Practices

Knowing the non-custodial wallet meaning is just the first step. Correct use is paramount to make sure your funds are safe.

- Never Share Your Private Key or Seed Phrase: The first rule of crypto is also the most important one. If someone gets access to your private key or seed phrase, they can take your funds. Handle it the way you would the most sensitive information you have.

- Securely back up your seed phrase:

- Offline Storage: Write your seed phrase on several pieces of paper and hide them in a few different places (e.g., safety deposit box, fireproof safe).

- Avoid Digital Storage: Never save your seed phrase on your computer, phone, or in the cloud (Google Drive, Dropbox, etc.). These are open to hacking.

- Use Metal Backup: If you want something tougher, you can use metal seed phrase backup devices (Cryptosteel, Billfodl, etc.).

- Use a Hardware Wallet for Large Holdings: If you’re holding a good amount of cryptocurrency, buy a hardware wallet. These devices are offline, which means that your private keys are stored with no connection to the internet, making them practically secure from online threats.

- Be Wary of Phishing Attacks: Phishing attacks are ways to get you to give up your private key or seed phrase. Verify website URLs, trust no unsolicited email or message you receive, and never input your seed phrase on a web app unless you are certain of it.

- Use a Strong Password and 2FA: If it is an option (and most are), only use a wallet that has password protection + 2FA. Even with a strong password and setting up 2FA, neither of them can prevent you from losing your funds if you lose your seed phrase.

- Update Software: Always keep your wallet software (and your OS) up to date. So, updates routinely come with security patches that guard against known flaws.

- Verify Transaction Details Carefully: Always double-check the recipient’s address and the amount before confirming a transaction. Transactions made by cryptocurrency are non-reversible.

- Avoid Connecting to Untrusted dApps: Only connect to dApps that you trust your wallet with. If you use a malicious DApp, it can steal your funds! Just be sure you do your research before doing any dApp.

- Know the Risks: Know that you’re the only person responsible for your funds’ security. There is no way to retrieve your coins if you lose your private key or seed phrase.

Conclusion: Embracing Self-Custody

In this guide, we have thoroughly looked in detail into the meaning of non-custodial wallets, a deep comparison with custodial wallets, and the steps to safely choose and use non-custodial wallets. Custodial wallets are convenient but also mean that an intermediary has access to your assets, whereas non-custodial wallets provide genuine ownership and complete control over your assets. But along with this control comes a responsibility: you are your own “bank”.

If you stick to these security principles, you’ll be able to safely participate in the DeFi space and keep your crypto safe!

The journey to owning our own assets is a lifelong learning journey, so keep learning! Start small, keep learning, and always keep security at the top of your mind. The crypto market is ever-changing, and keeping up with the latest news is crucial to securing your investment!

Frequently Asked Questions (FAQ)

What is a non-custodial wallet?

Are non-custodial wallets safe?

What are some examples of non-custodial wallets?

How do I recover my funds if I lose my non-custodial wallet?

What is the difference between a hot wallet and a cold wallet?

Can I lose my crypto if I use a non-custodial wallet?

Sources:

- A Survey on Blockchain Security: Attacks and Countermeasures (ResearchGate)

- NFT trading volume surged at the end of 2023 (CNBC)

- Investopedia (For general cryptocurrency definitions and concepts)

- Ethereum.org Wallets Page