Table of contents

- 1 Cryptocurrency Regulations: A Comprehensive Guide to Global Policies [2025]

- 1.1 What Are Cryptocurrency Regulations?

- 1.2 Global status of cryptocurrency regulations

- 1.3 Challenges in Cryptocurrency Regulations

- 1.4 Impact of Cryptocurrency Regulations

- 1.5 The Future of Cryptocurrency Regulations

- 1.6 Key Takeaways

- 1.7 Frequently Asked Questions (FAQ)

- 1.7.1 What are cryptocurrency regulations?

- 1.7.2 Why are cryptocurrency regulations important?

- 1.7.3 Which countries have the strictest cryptocurrency regulations?

- 1.7.4 How do cryptocurrency regulations affect businesses?

- 1.7.5 What is KYC in crypto, and why is it important?

- 1.7.6 Can I avoid KYC when buying or selling cryptocurrency?

- 1.7.7 What is the future of cryptocurrency regulations?

- 1.8 References

Cryptocurrency Regulations: A Comprehensive Guide to Global Policies [2025]

The cryptocurrency landscape has seen significant growth over the past few years, attracting both institutional and retail investors. This rapid expansion has not been without significant volatility, and governments and regulatory agencies around the globe are simultaneously becoming more engaged with it. Cryptocurrency regulations are no longer optional for workers in the digital asset market.

Why are these regulations required? Aims to protect investors from fraud and scams, prevent money laundering and terrorist financing, and preserve overall financial stability are the core justifications. Conventional monetary rules were not designed for the unique challenges of the decentralized and often pseudonymous nature of cryptocurrencies.

What Are Cryptocurrency Regulations?

Cryptocurrency regulations refer to the laws and guidelines established by governments and regulatory authorities to regulate the issuance, trading, and usage of digital currencies. These structures that enshrine different policy goals and priorities may vary considerably from one country to another. The primary aim, however, is to create a safer and more open atmosphere for the growing cryptocurrency sector.

Here are a number of key reasons that explain why these regulations are important.

- Investor Protection: One of the common issues, as the cryptocurrency market is known to be volatile, is fraud. Regulations aim to mitigate these risks by establishing policies such as disclosure standards, fraud prevention mechanisms, and investor education programs.

- Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT): Since cryptocurrencies are pseudonymous by nature, they can be abused to facilitate illegal activity. By design, regulations—especially those related to “Know Your Customer” (KYC) processes—are meant to deter money laundering and terrorist financing.

- Financial Stability: The sudden boom of the cryptocurrency market has raised concerns about how it could impact the wider financial system. Regulations are meant to mitigate systemic risks and ensure that international financial markets remain stable.

- Market Integrity: Regulations strive to create fair and transparent markets. They hope to prevent insider trading, market manipulation, and other moves that can undermine confidence in the cryptocurrency ecosystem. You might want to learn more about cryptocurrency trading strategies to get a handle on the mechanisms of the market.

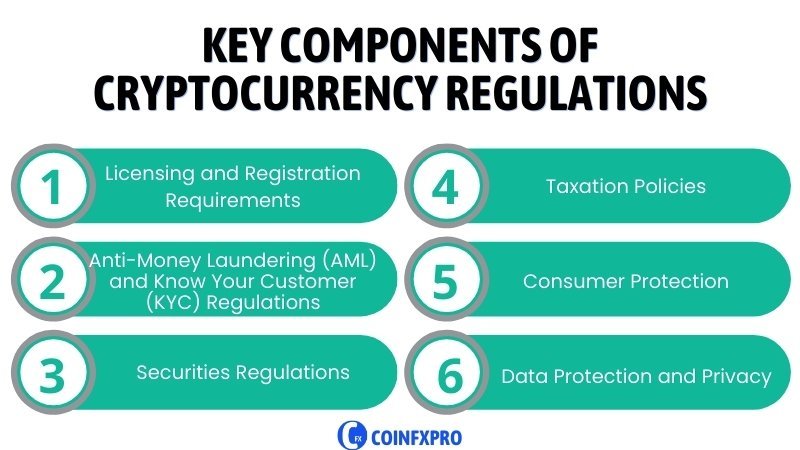

KEY THINGS OF CRYPTOCURRENCY REGULATIONS

While there are specific regulations that vary from jurisdiction to jurisdiction, the majority of regulatory frameworks include several critical components:

Quick Overview Mandatory Licensing and Registration: Many countries have various requirements for cryptocurrency exchanges and other companies in the industry to license or register with relevant authorities. This process often includes background checks, capital requirements, and operational standards compliance. It ensures a baseline level of professionalism and helps filter out bad actors.

Know Your Customer (KYC) and Anti-Money Laundering (AML) Regulations: These regulations are designed to prevent people from utilizing cryptocurrencies in illegal activities. Though KYC guidelines mandate that exchanges and other service providers verify that their customers are who they claim to be, AML practices require the reporting of suspicious financial activity.

Securities Regulations: Speculation about whether cryptocurrencies should be classified as securities is arguably one of the most contentious debates in the context of crypto regulation. If a cryptocurrency is determined to be a security, it is also subject to current securities regulations, which often include stringent requirements for trading, disclosure, and registration. One example is the U.S. Securities and Exchange Commission (SEC), which has taken a stiff approach on the issue.

Taxation Policies: Globally, every government is under siege over how to tax cryptocurrency holdings and transactions. Tax rules can vary widely from country to country; in some, cryptocurrency gains are treated as capital gains, in others, as income. In the United States, the Internal Revenue Service (IRS) provides standards for crypto taxation.

Consumer Protection: In general, these policies aim to protect the rights of consumers of cryptocurrency services. That could include requirements for dispute resolution protocols, safe custody of assets, and clearly defined risk disclosures. Using a secure AI wallet is another way to improve security.

Data Protection and Privacy Regulations: Regulations such as the General Data Protection Regulation (GDPR) in the EU also regulate how cryptocurrency companies deal with user data.

Global status of cryptocurrency regulations

Each country has taken a different approach, at the end of the day, based on their own interests and context, and so the circle of regulations around crypto is very wide. A few of these important domains are:

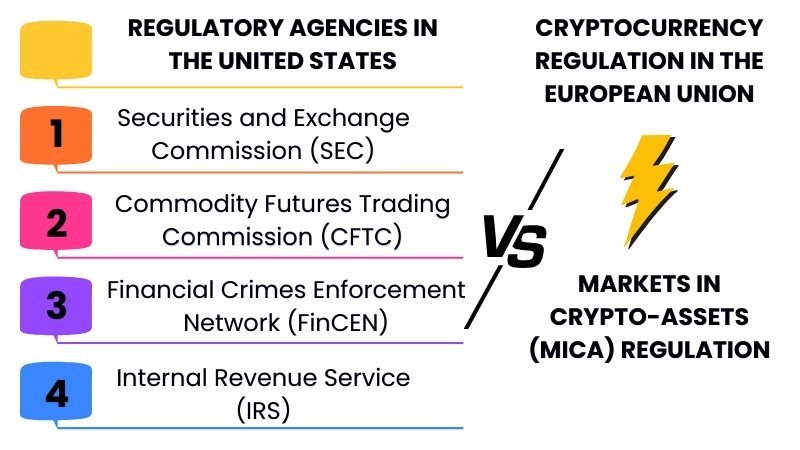

The US

The regulatory landscape for crypto is, in the U.S. at least, complicated and fragmented. A few agencies that are involved include:

The Securities and Exchange Commission (SEC) brought enforcement action against companies for apparent violations of securities laws through initial coin offerings (ICOs) or other activities. The SEC views a number of cryptocurrencies as securities.

The Commodity Futures Trading Commission (CFTC) regulates the derivatives markets, including options and futures on cryptocurrencies.

The Financial Crimes Enforcement Network of the United States (FinCEN) focuses mainly on anti-money laundering (AML) and know-your-customer (KYC) requirements—it requires that cryptocurrency exchanges register as money services businesses (MSBs).

Internal Revenue Service (IRS): The IRS classifies cryptocurrencies as a form of property for tax purposes, making capital gains tax applicable on profits and losses.

The United States’ ambiguous and inconsistent policies are leaving businesses and investors with uncertainty. The best institution to oversee the crypto market is still to come, and whether new regulation is needed to deal with the unique challenges of digital assets is still up for debate.

For example, the SEC’s ongoing legal battle against Ripple Labs—which alleges that the firm’s XRP coin is an unregistered security—is a landmark case that could set the tone for the entire crypto market moving forward. Here is more information about the Ripple cryptocurrency

Statistic: A 2023 CNBC article reported that the United States fined over $5 billion in cryptocurrency incidents. Replace this placeholder link (CNBC) with the link to the actual report on CNBC.

The European Union

With the Markets in Crypto-Assets (MiCA) Regulation, the European Union aims to pursue a more comprehensive and consistent approach to regulating cryptocurrencies. The MiCA proposed legislation would aim to establish consistent regulatory requirements across each of the member states governing crypto assets. It talks about different topics like:

- Crypto-Asset Issuance and Trading: MiCA lays down rules regarding the issuance of different types of crypto-assets, including utility tokens and stablecoins.

- Crypto-Asset Service Providers (CASPs) are regulated and authorized: Exchanges, custodians, and other CASPs will need to be authorized and subject to robust operational standards.

- Mitigating market abuse: MiCA institutes provisions that protect against insider trading, market manipulation, and other forms of market abuse.

- Consumer protection: The proposal gives top priority to the need to provide customers with clear and transparent information as well as strong investor protections.

MiCA is expected to enter into force in 2024 in its entirety. The rule is a step towards greater investor protection and transparency. Its single regulatory framework across the EU is also expected to enhance businesses’ operational efficiency for crypto firms doing business in the region.

Asia

Asia has a patchwork of regulatory regimes regarding cryptocurrencies:

- Japan: Japan was one of the first countries in the world to recognize Bitcoin as legal tender and has so far established a relatively clear regulatory framework for cryptocurrency exchanges. Japan’s cryptocurrency sector is regulated by the Financial Services Agency (FSA).

- China: China has taken a tough line on cryptocurrencies, banning cryptocurrency exchanges and initial coin offerings (ICOs). The government has focused on developing a digital counterpart to the yuan, a central bank digital currency (CBDC) of its own.

- South Korea: The South Korean cryptocurrency economy is robust, but regulatory agencies have gone slow. The country has established strict Anti-Money Laundering (AML) and Know Your Customer (KYC) legislation and banned anonymous cryptocurrency trading accounts.

- Singapore: Backed by a legal framework that intends to balance innovation and risk mitigation, Singapore is positioning itself as the hub of crypto innovation. Regulatory framework The Monetary Authority of Singapore (MAS) is the primary regulatory authority.

- India: India indeed has a very nuanced and dynamic stance on cryptocurrencies. The authorities have long considered banning cryptocurrencies; however, it has also recently introduced a hefty tax on crypto transactions to the tune of a 30% tax on profits and 1% Tax Deducted at Source (TDS). This means moving’ toward regulation, not total prohibition.

Emerging Markets

Many developing market economies are struggling to set rules for cryptocurrencies. These countries have the challenge of ensuring that the risk of the crypto market is balanced with the need to promote financial innovation and equality. Some examples are:

- Nigeria: First, the Central Bank of Nigeria prohibited crypto transactions, but it now has rules for providers of crypto assets. This indicates that regulation is on the right track.

- Vietnam: Vietnam has no specific laws on cryptocurrencies yet, but the government is investigating the issue as well and is considering different regulatory approaches.

- El Salvador: In 2021, the country of El Salvador made Bitcoin legal currency. This decision has been lauded and denounced worldwide.

In these developing countries, a large number of people also use cryptocurrencies. They are because banking services are inaccessible and costs are exorbitant.

Challenges in Cryptocurrency Regulations

While moves are toward gathering regulations for cryptocurrencies, a number of significant issues still need to be tackled:

Lack of Global Consistency

The lack of one single set of rules that governs everywhere is a huge issue for the crypto business. The issue businesses face when they operate in multiple countries is that the regulations in each country are different. That might create regulatory arbitrage, where companies choose to operate in countries with looser regulations, leaving regulators in other countries with less muscle.

Balancing Innovation and Control

Regulators need to balance allowing new ideas to flourish in the crypto space while keeping risk in check. Overregulation would stifle creativity and drive companies to regions with more lax regulations. But too few rules could leave investors susceptible to fraud, hurting the economy’s stability. Finding the right balance is a big task. Knowledge of the break-even point in crypto trading is also needed to control risks.

Evolving Nature of Technology

The technology behind cryptocurrency, specifically blockchain technology, is evolving at a very fast pace. New ideas keep coming up, like decentralized finance (DeFi) or non-fungible tokens (NFTs), making it even harder for parties to comply with them. Regulators must be nimble and adaptable in order to keep pace. You may also want to ask, what are altcoins, and how are they regulated?

To give one example, DeFi only exploded in recent years, much quicker than regulators can hope to comprehensively understand and address the different risks it poses. This has prompted calls for more tailored regulations in this domain.

Impact of Cryptocurrency Regulations

Cryptocurrency regulations have a significant impact on various stakeholders:

About Investors

Stronger laws and regulations could better protect buyers by reducing the potential for fraud and other scams. They can also help make the environment for investing more stable and predictable. Clarifying tax regulations may also help investors understand what they need to do to ensure they don’t get fined. As we mentioned in our best crypto exchanges piece, choosing the right one is crucial for the safety of investors.

Getting Business

Companies have to invest money in methods and procedures to ensure compliance, which costs them money. But regulations can also make the crypto business seem more legitimate, which can attract institutional investors and make it more popular.

On the Market

Setting rules can smooth out markets and make them more transparent. Regulations like those can help keep the playing field more equal for everyone by addressing issues of market manipulation and illegal trading, among other things. And be cautious of potential risks, such as bait-and-switch scams in the crypto space.

The Future of Cryptocurrency Regulations

Several key trends are likely to shape the future of cryptocurrency regulations:

Expanding International Standards: Governments in individual countries are recognizing that regulating cryptocurrency requires collaboration, which has contributed to the growth of international standards. Leaders at organizations such as the Financial Stability Board (FSB) and the G20 are working on joint rules and standards.

More scrutiny of decentralized finance (DeFi): DeFi has its own legal quagmire since it’s decentralized and doesn’t use intermediaries: It’s likely rules will apply uniquely to DeFi protocols and apps alike.

Use of Technology for Regulation (RegTech): Technology like blockchain is being explored by regulators to surveil the law and ensure compliance. This is done, including through the use of smart contracts to ensure rules of behavior are automatically followed and on-chain analytics to monitor suspicious behavior.

Central Bank Digital Currencies (CBDCs)— Many central banks are considering creating CBDCs, which would also have a huge impact on the world of crypto. CBDC regulation will be a very important issue.

Environmental, Social, and Governance (ESG) Considerations: The impact of crypto mining on the climate (PoW systems in particular) is being studied more and more. Regulators could incentivize more environmentally friendly mining practices.

Statistic: According to a PwC study, 70% of financial institutions will use blockchain technology by 2025. PwC Report Note: This is a more relevant PwC link, not a general one. Check and confirm if you must see the exact URL of the report.

Key Takeaways

Cryptocurrency regulation is essential for national interests, to safeguard investors, combat crime, and maintain economic stability.

Countries have adopted varying approaches to crypto regulation, from being pro-crypto (EU, Japan) to being anti-crypto (China).

The U.S. rules are a patchwork of varying regulations, though the EU is trying to align their rules closer to MiCA.

“Addressing global inconsistency, striking a balance between innovation and control, and staying ahead of the curve on tech advancement are among the biggest challenges in crypto regulation.

However, the implementation of international standards, increased emphasis on DeFi, and application of RegTech in these areas are some events that will shape the future.

- Compliance is becoming more important than ever.

Frequently Asked Questions (FAQ)

What are cryptocurrency regulations?

Cryptocurrency regulations are the constantly changing laws and regulations set by the global financial and government authorities. The intent of these frameworks is to devise norms in how decentralized currencies like Bitcoin and Ethereum can be used and traded, who can issue coins and tokens, what is taxable income, and activities derived from them such as ICOs and DeFi. The specifics vary widely from state to state.

Why are cryptocurrency regulations important?

There are plenty of reasons why cryptocurrency rules could prove important. Their purpose is to maintain the economy’s stability, to protect investors from scams and fraud, and to prevent illegal activities like money laundering and funding for terrorism. Regulations also allow for clearer laws, aiding in more people using and trusting the crypto environment.

Which countries have the strictest cryptocurrency regulations?

China, for example, used to have some of the most stringent rules surrounding cryptocurrencies. For instance, they started banning some cryptocurrency platforms and ICOs altogether. Bolivia and Algeria are other mid members of the list with stringent rules, alongside China. But rules are never static anywhere, including China.

How do cryptocurrency regulations affect businesses?

Cryptocurrency regulations impose compliance requirements on businesses, such as exchanges and custodians, which can involve operational costs. However, clear regulations can also enhance credibility, attract institutional investors, and provide legal certainty, ultimately fostering long-term growth and a more stable environment.

What is KYC in crypto, and why is it important?

KYC, or “know your customer,” is a procedure that most cryptocurrency companies and banks require of their customers. It includes verifying that customers are who they say they are by obtaining personal information and proof of identity. Conducting a Know Your Customer (KYC) is essential to stay compliant with the rules for Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF), to prevent scams, and to foster trust.

Can I avoid KYC when buying or selling cryptocurrency?

Some DEXs or P2P platforms may provide options without KYC, but KYC-free transactions are becoming increasingly difficult to come by—especially for larger transactions. Non-KYC platforms carry higher risks of scams, access to legal support, and oversight by regulators. So it’s better to know what the risks are.

What is the future of cryptocurrency regulations?

This includes the possibility that over time, global regulators of crypto will coordinate more across borders, place greater focus on decentralized finance (DeFi) and stablecoins, and utilize the latest technologies such as blockchain analytics to enforce rules and see they are being followed. Expect more detailed and complex rules coming our way.

Pingback: What Does Decentralized Mean in Crypto? A Beginner's Guide? CoinFxPro

Pingback: Crypto’s Sneaky Trap: How to Identify the Bait and Switch Scam - CoinFxPro

Pingback: What Causes Crypto to Go Up and Down? A beginner's guide

Pingback: What is a Crypto Stock and How Does it Work? CoinFxPro