Table of contents

- 1 ZuluTrade Review: Is It the Right Copy Trading Platform for You?

- 1.1 1. Introduction to ZuluTrade

- 1.2 2. Key Features of ZuluTrade

- 1.3 3. Trading Fees and Costs on ZuluTrade

- 1.4 4. Who is ZuluTrade For?

- 1.5 5. Comparison of ZuluTrade with Other Platforms

- 1.6 6. Pros and Cons of ZuluTrade

- 1.7 7. How to Get Started with ZuluTrade

- 1.8 8. Community and User Reviews

- 1.9 9. Conclusion: Is ZuluTrade Worth Using?

- 1.10 FAQs about ZuluTrade & Crypto Copy Trading

- 1.10.1 What is ZuluTrade and how does it work for crypto?

- 1.10.2 What are the benefits of using ZuluTrade for crypto copy trading?

- 1.10.3 How do I choose the best crypto signal providers on ZuluTrade?

- 1.10.4 Does ZuluTrade fully support cryptocurrency trading?

- 1.10.5 Are there any risks in using ZuluTrade for crypto?

ZuluTrade Review: Is It the Right Copy Trading Platform for You?

In the fast-paced world of online trading, finding the right platform can be the key to success. ZuluTrade has emerged as a prominent name in the realm of copy trading, attracting both novice and experienced traders. This comprehensive zulutrade review will delve into its features, benefits, drawbacks, and everything you need to know before getting started. We will also include external data and reports to provide a deeper understanding of the platform.

ZuluTrade is a popular social copy trading platform that allows users to automatically copy the trades of experienced traders (Signal Providers). It connects followers with traders, enabling the replication of successful strategies across various financial markets like Forex, stocks, and cryptocurrencies. Key features include a vast network of signal providers, detailed performance analytics, and flexible risk management tools.

1. Introduction to ZuluTrade

1.1. ZuluTrade Overview

What is ZuluTrade?

ZuluTrade is a social copy trading platform that allows users to automatically copy the trades of experienced traders (also known as Signal Providers) across various markets. It essentially connects followers with traders, creating a network where profitable strategies can be shared and replicated. This approach opens doors for those who are new to trading, as they can learn and potentially profit by mirroring the strategies of seasoned professionals. It’s crucial to remember, however, that while this system simplifies market access, it does not eliminate the inherent risks of trading, and careful selection of signal providers is key. For beginners, understanding how to start forex trading or cryptocurrency trading is a great place to start before using a platform like ZuluTrade.

History and Development of ZuluTrade

Founded in 2007, ZuluTrade has been a pioneer in the copy trading space, continually adapting to the evolving needs of the market. Over the years, it has expanded its offerings, improved its platform, and built a strong community of traders and followers globally. The platform’s longevity and continual updates are a testament to its commitment to providing reliable services. ZuluTrade was among the first platforms to introduce the concept of social trading and copy trading, and since then, the platform has undergone significant technological upgrades to maintain its competitive edge. For instance, in 2019, ZuluTrade introduced advanced machine learning algorithms to assist users in selecting signal providers, showcasing their dedication to using cutting-edge technologies.

ZuluTrade’s Position in Copy Trading and Financial Markets

ZuluTrade holds a significant position in the copy trading sector, known for its extensive network of signal providers and wide range of trading instruments. Its reputation is built on user accessibility and innovation in social trading. ZuluTrade’s model has significantly influenced the financial industry, making it easier for a wider population to engage in online trading. Their focus on transparency through detailed performance analysis of signal providers has also added to the credibility of copy trading as a whole. According to a report by Finance Magnates, ZuluTrade is one of the top three copy trading platforms globally, highlighting its market relevance and reach.

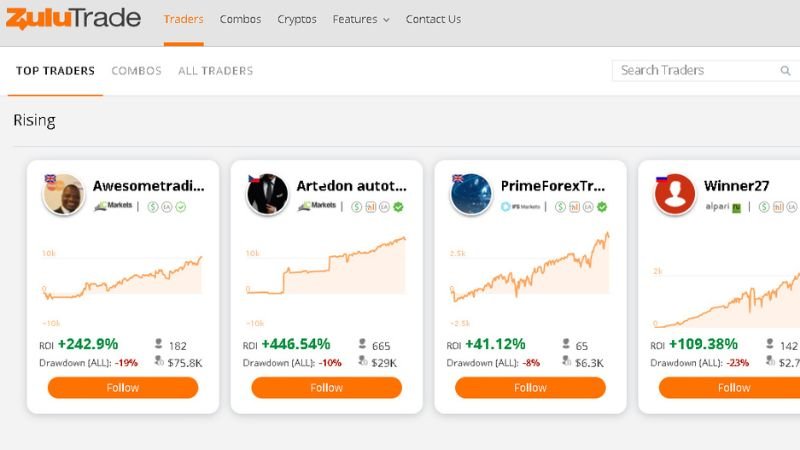

Zulutrade interface

1.2. Why Choose ZuluTrade?

ZuluTrade has gained popularity among both beginners and professionals because:

- It allows new traders to get involved in the markets by copying experienced traders.

- Professional traders have opportunities to monetize their expertise by becoming signal providers.

- The platform offers a high level of customization, meaning you can choose which traders to follow and how much of your capital to allocate.

Key Highlights of ZuluTrade Compared to Other Platforms:

What sets ZuluTrade apart is its vast selection of signal providers, detailed performance analytics and flexible risk management tools. While other platforms may focus primarily on one niche, ZuluTrade offers a broad range of traders, instruments and features. According to a study by Investopedia, the level of control ZuluTrade gives its users regarding customization and the choice of signal providers makes it more attractive to traders seeking flexibility.

2. Key Features of ZuluTrade

2.1. Copy Trading

Concept and Operation of Copy Trading on ZuluTrade

Copy trading on ZuluTrade involves selecting experienced traders (signal providers) and automatically replicating their trades in your account. When a signal provider opens a trade, the same trade is opened in your account, maintaining proportions based on your investment settings. This process leverages algorithms that ensure that your account mirrors the trades of the signal provider proportionately. It is important to note that while the trades are copied automatically, the responsibility of risk management and selection of the right providers still falls on the users. This automation simplifies the trading process and makes it accessible for new traders, but it is vital to have some understanding of trading before getting involved.

Benefits of Copying Trades from Professional Traders

- Access to expertise: Allows new traders to learn from seasoned professionals and potentially earn profits in the process.

- Time-saving: Automates trading, so users don’t have to analyze markets or make decisions themselves.

- Diversification: Enables followers to diversify their risk across multiple strategies.

Copy trading offers new users the ability to engage with complex markets without the same level of required market knowledge. This can be advantageous but also needs to be approached carefully. The learning aspect is often overlooked; as users watch their selected signal providers trade, they can learn from their approach and possibly improve their own understanding of the market.

How to Choose Suitable Signal Providers

Selecting the right signal providers is critical. Consider factors such as:

- Profitability: Look at their historical return, but also be aware of past performance is not indicative of future results. While past performance is not a guarantee of future profits, it provides an indication of their past success. Analyze their ROI over longer periods for a more comprehensive understanding.

- Drawdown: Check how much their account has dropped before reaching new highs to understand potential risk. This metric helps you evaluate how well the provider handles losses. High drawdowns might indicate a high-risk strategy, while smaller drawdowns may mean lower risk, but potentially lower reward as well.

- Trading Style: Understand their strategies. Do they fit your risk tolerance? Ensure the provider’s strategy aligns with your own investment goals and risk tolerance. Some providers may use high-frequency trading, while others may opt for long-term positions.

- Stability: How long have they been trading, and how consistent is their performance? A track record over an extended period demonstrates more reliability. Consistent returns over time show consistency, rather than isolated successes.

It is also advisable to follow more than one signal provider to diversify your risk. Do not put all your capital into one provider, even if they have consistently performed well. Risk diversification is crucial in trading.

ZuluTrade allows you to explore a wide range of signal providers and their performance.

2.2. Diverse Trading Assets

Supported Asset Types: Forex, Stocks, Cryptocurrencies, CFDs

ZuluTrade provides access to a variety of trading instruments, including Forex, stocks, cryptocurrencies, and CFDs, enhancing opportunities for portfolio diversification. For instance, you might choose to follow one trader specializing in Forex and another in crypto, thus distributing your risk and diversifying your portfolio. According to recent data from the platform, Forex remains the most traded instrument on ZuluTrade, while crypto is gaining in popularity.

Flexibility in Building a Diverse Investment Portfolio

The platform’s flexibility allows users to build a diverse investment portfolio, distributing their risk across various assets and signal providers. This can be achieved by following providers specializing in different instruments and different risk profiles. A diverse portfolio often helps in mitigating risks by balancing the impact of losses in one asset class with gains in another. For instance, diversifying across stocks, forex, and crypto, you can create a balanced portfolio that is less vulnerable to fluctuations in a single market.

2.3. Risk Management Features

Risk Management Tools Such as Stop Loss, Take Profit

ZuluTrade provides several risk management tools, such as Stop Loss and Take Profit orders, which allow you to define your risk per trade. These tools are essential for protecting your capital, especially when copying the trades of others. Stop-loss orders are crucial in limiting potential losses, while take-profit orders help to secure profits when a trade hits a certain level. These tools are not automatic; you need to set them up according to your risk preferences. This functionality provides traders with the autonomy to manage risks effectively.

Importance of Protecting Capital in Copy Trading

Copy trading carries its own risks, and risk management tools are essential to protect capital. It is paramount to remember that even experienced traders can encounter losses. Therefore, risk management tools should always be employed effectively. According to a survey by the European Securities and Markets Authority (ESMA), most users of copy trading platforms do not adequately use risk management tools. They over-rely on the perceived skill of signal providers. This lack of self-management contributes to avoidable losses. Educating yourself on the usage of risk management tools is imperative before engaging with any copy-trading platform.

2.4. Performance Evaluation

Detailed Evaluation System for Signal Providers

ZuluTrade provides detailed analytics to evaluate the performance of signal providers. This information includes their historical profitability, maximum drawdown, and trading styles. Users can leverage these tools to select the most appropriate providers for their trading goals. The platform provides a lot of useful data on every signal provider, including their win/loss ratio, average trade length, and types of instruments they usually trade. Taking time to review and understand these metrics can increase your chances of success in the market.

How to Use Performance Tools to Track Trades

By regularly tracking signal provider’s performance metrics, you can make informed decisions about continuing or changing your strategy and adjusting the risk as needed. This ongoing analysis is key to optimizing your copy trading performance. ZuluTrade’s system updates in near real-time, meaning that the data you have access to is current and relevant. This allows users to dynamically adjust their strategy and selections to maximize profitability and minimize potential losses. Remember, trading is a continuous learning process that demands constant monitoring and adjustment.

2.5. User Interface and Experience

User-Friendly Web Interface

ZuluTrade’s web interface is designed to be intuitive and easy to navigate. Even new users can quickly learn how to find signal providers, manage their accounts, and track their performance. The platform uses visual aids, such as graphs and charts, to simplify complex trading information. The visual representation of data makes it easier for users to track and interpret the performance of signal providers. The interface is designed to cater to both experienced and novice traders, with various customizable widgets.

ZuluTrade Mobile App: Features and Efficiency

The ZuluTrade mobile app provides all the essential functions for on-the-go trading and monitoring. Whether you’re checking your portfolio performance, adding new signal providers, or adjusting risk settings, the mobile app makes it easy to manage everything from your smartphone. The mobile app features almost the same functionality as the web platform, allowing users to control their trading activities wherever they are. User reviews highlight the convenience and ease of use of the app, making it a suitable tool for modern traders.

The ZuluTrade mobile app offers convenient access to your trading account from anywhere.

3. Trading Fees and Costs on ZuluTrade

3.1. ZuluTrade Fee Structure

Details of Commissions and Trading Fees

ZuluTrade generally operates on a commission basis or markup in spreads. The exact fees can vary depending on the broker you are connected to. It’s important to check your broker’s fee schedule to understand the costs you may incur. Fees can be charged per lot traded, or they might be included in the spread provided. The fees that a trader will pay are largely dependent on their selection of a broker and it is advisable to check this prior to signing up. ZuluTrade does not directly control these fees but rather, it is up to the broker you choose to use.

Comparison of Fees with Other Copy Trading Platforms

Compared to some other copy trading platforms, ZuluTrade’s fees may be considered on the higher end. However, this can be offset by the large selection of signal providers and customization options. Thoroughly compare ZuluTrade fees to other alternatives to ensure they align with your budget and trading strategy. When compared to platforms such as eToro and Myfxbook, ZuluTrade’s fees tend to be more variable as they are broker-dependent, and some broker’s fees may be on the higher side. It is highly advisable to compare fee structures across different platforms before making any commitments.

3.2. Hidden Costs

Additional Fees Users Need to be Aware Of

Beyond commission and spreads, there might be other costs such as inactivity fees, which may apply if you do not trade for extended periods. Understanding these hidden costs is necessary to manage trading expenses effectively. Inactivity fees can sometimes be significant if the account remains idle for an extended period. Also, check for any additional fees related to withdrawals or deposits and currency exchange. Being aware of these costs will allow traders to plan their activities and avoid unexpected charges.

How to Optimize Costs When Using ZuluTrade

To optimize costs on ZuluTrade, choose brokers with lower fees, engage in regular trading to avoid inactivity fees, and carefully monitor the expenses on your account. Researching and comparing the fee structures of the different brokers that ZuluTrade supports can save a lot of money for the user. Actively trading is important to avoid inactivity fees, and keeping an eye on the total expenses charged to your account regularly allows better control over trading costs.

4. Who is ZuluTrade For?

4.1. Beginners

Why ZuluTrade is a User-Friendly Platform for Beginners

ZuluTrade is an excellent platform for beginners, allowing them to enter the world of trading by following experienced signal providers. The platform is designed to be user-friendly, with guidance on how to select and manage investments. The copy-trading element of ZuluTrade is designed to enable people with no trading experience to enter the market. The platform provides support and resources for novice users to improve their understanding of trading fundamentals, but it is important to keep in mind that copy trading should not be approached without having at least a basic understanding of the principles. Understanding concepts like pips in forex can be very useful for new users.

Resources for Learning: Documentation, Demo Accounts

ZuluTrade offers valuable learning resources, including documentation and demo accounts, allowing new traders to practice and familiarize themselves with the platform without risking real capital. The demo account feature is a fantastic way to practice and learn. The demo account functionality is particularly beneficial as it allows users to replicate real market conditions without the fear of financial loss. Taking time to explore and test different approaches in a risk-free environment allows users to develop an understanding and confidence before getting involved in real trading.

4.2. Professional Traders

Opportunities for Profit as a Signal Provider

ZuluTrade also offers professional traders an opportunity to monetize their expertise by becoming signal providers and earning commissions from their followers. As a signal provider, your trading style and success are made visible to potential followers. The platform allows signal providers to manage risk and control the number of followers they allow. This can be beneficial for professionals who want to generate a second income from their market knowledge. Becoming a signal provider is not just about profit, it can also be about establishing credibility and building a reputation within the trading community.

Evaluation of Features Suitable for Experienced Traders

Experienced traders can also find value in ZuluTrade, as it provides a platform to monetize their skills and expand their outreach. However, it’s important to note that the platform’s effectiveness as a professional tool varies. Experienced traders often use ZuluTrade as a means of scaling their strategies, and they appreciate the detailed analytics that the platform provides. It is important for seasoned traders to consider how the platform fits their needs, as copy-trading may not be their only area of trading activity.

5. Comparison of ZuluTrade with Other Platforms

5.1. ZuluTrade vs eToro

Similarities and Differences Between the Two Platforms

Both ZuluTrade and eToro are popular social trading platforms, but they differ in how they operate. eToro offers a wider range of financial instruments including stock and ETF, whereas ZuluTrade focuses mainly on forex and CFDs with a strong emphasis on copy trading. eToro’s interface is often described as more beginner-friendly and intuitive, while ZuluTrade provides more options for customization and flexibility. While eToro offers a broader trading experience across multiple financial markets, ZuluTrade focuses more on a deep and detailed approach to the copy-trading aspect.

Advantages and Limitations of ZuluTrade Compared to eToro

ZuluTrade offers more flexibility in terms of broker selection and customisation of trades. eToro is known for its user-friendly interface, which might be more appealing to beginners, but it lacks some flexibility that ZuluTrade offers. ZuluTrade users can select a broker based on their needs, providing a wider array of options, while eToro requires the use of its own proprietary platform. This flexibility often leads experienced traders to gravitate toward ZuluTrade, while beginners may find eToro easier to use. However, the level of control with ZuluTrade also entails more responsibility in risk management.

5.2. ZuluTrade vs Myfxbook

Differences in Features, Fees, and User Community

Myfxbook is more of a service for analyzing trading results rather than a platform for copy trading, whereas ZuluTrade is focused on copy trading. While Myfxbook provides useful analytical tools, it doesn’t facilitate direct access to copy trading. Myfxbook users can upload their trading history, while ZuluTrade users engage directly in copy trading. Myfxbook acts as a third party reporting agency for traders, while ZuluTrade is a platform where trading activities are carried out. The two platforms serve different purposes in the trading ecosystem.

5.3. ZuluTrade vs Traditional Platforms

Why ZuluTrade Stands Out in the Copy Trading Trend

ZuluTrade’s dedication to copy trading sets it apart. Instead of providing you with traditional trading tools, ZuluTrade allows you to directly learn and copy from experienced traders. This functionality makes it a key player in the modern trend of social trading. ZuluTrade has been at the forefront of the social trading movement, which has revolutionized how traders of all experience levels participate in the market. ZuluTrade has made trading more accessible and educational, creating a collaborative environment for all its users.

6. Pros and Cons of ZuluTrade

6.1. Advantages

- Convenient Copy Trading Feature: Automates trading by copying successful traders.

- Variety of Trading Assets: Access to forex, stocks, cryptocurrencies and CFDs.

- Easy-to-Use Interface: Simple and user-friendly interface for both web and mobile.

- Effective Risk Management Tools: Offers stop loss and take profit options for capital protection.

ZuluTrade offers a robust copy-trading infrastructure which simplifies market access. Users have access to a wide range of assets, promoting diversification, and the platform itself is easy to use. The risk management tools available on ZuluTrade help the user protect their capital.

6.2. Disadvantages

- Higher Fees: Can have higher fees compared to some other platforms.

- Dependence on Signal Provider Performance: Your results are highly influenced by the performance of the signal provider you choose.

- Limited for Traders Not Interested in Copy Trading: Not very suitable for users who wish to trade independently.

ZuluTrade has relatively higher fees compared to some other copy trading platforms, and your success is contingent on the performance of the signal provider, which makes it less suitable for users who prefer independent control over their trades.

7. How to Get Started with ZuluTrade

7.1. Account Registration

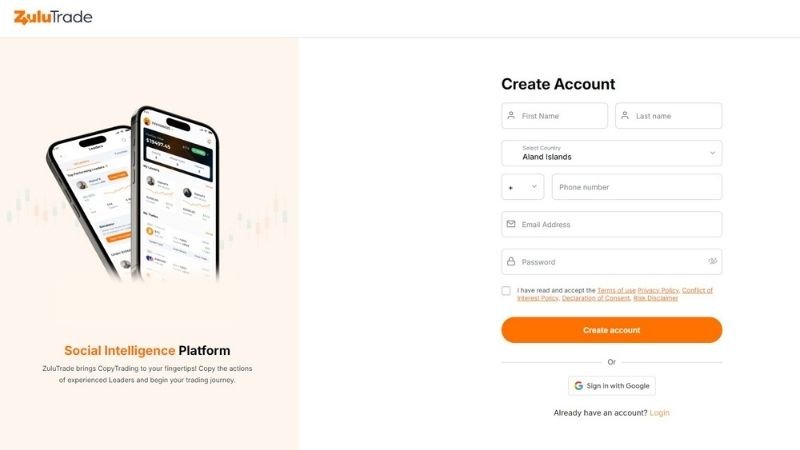

Detailed Guide to Creating an Account

To register an account on ZuluTrade, visit their website, and complete the registration by providing the required details. Then, you will need to connect your ZuluTrade account with one of their supported brokers. The registration process requires basic personal details, as well as some identification documents. Users should ensure that they meet the criteria of the platform before creating an account. Once the account is set up, you need to choose a broker to link with ZuluTrade, which will be used to handle actual trading activity.

Zulutrade review Create account

How to Connect with Brokers Supporting ZuluTrade

ZuluTrade integrates with multiple brokers, offering several options. Choose a broker that fits your trading needs and make the required connection through the ZuluTrade platform. Different brokers offer different fee structures and trading instruments. Users should choose a broker that suits their needs in terms of the number of assets that are traded and the associated fees. The broker is essentially your trading interface and choosing the correct one is essential to a positive experience.

7.2. Selecting Signal Providers

Factors to Consider when Choosing Signal Providers

Consider profitability, drawdown, trading style, and stability when choosing signal providers. Look at their detailed performance metrics and do your research. The providers’ historical performance is not indicative of future performance but it gives a good idea about their trading style. Remember, the more stable the performance metrics, the more reliable the signal provider often is. Prioritize those that match your risk tolerance and trading goals.

How to Use Search and Filter Tools

ZuluTrade provides powerful search and filter tools that enable users to narrow down signal providers based on their trading style, asset types, and performance. These tools can significantly streamline the provider selection process. The search and filter options help to locate signal providers that fit your criteria quickly. You can also use the filters to look for different types of signal providers based on their strategies. This will help to diversify your portfolio of signal providers.

7.3. Demo and Real Trading

Benefits of Using a Demo Account

Using a demo account helps new users familiarize themselves with ZuluTrade and its platform, test different providers, and risk-free and learn how copy trading operates before risking real capital. It also helps in identifying the best strategies for you. The demo account is a great way to get used to how ZuluTrade works and test out a number of signal providers and find the ones that are most suitable. Demo accounts help to learn the practical aspects of trading in the market without the stress of financial loss.

How to Safely Transition to Real Trading

After gaining sufficient experience with the demo account, start real trading with small amounts and gradually increase it as you gain confidence and understanding. It’s a good practice to begin with small capital and to increase your amounts slowly. This allows users to familiarize themselves with all aspects of the platform without the immediate risk of substantial financial loss. Trading is a learning process, and it’s crucial to gain an understanding before adding large sums of capital to your account.

8. Community and User Reviews

8.1. Positive Feedback

Aspects Highly Rated by Users: Convenience, Interface, Customer Support

Users generally praise ZuluTrade for its convenience, user-friendly interface, and customer support. The platform’s ability to connect traders with a wide range of signal providers is often praised. Many users find the platform very intuitive and easy to use, which makes it attractive to new users. The positive reviews often highlight the convenience that the platform offers to users.

Success Stories from Users

Many users have reported success using ZuluTrade to enhance their trading results by copying successful traders. While results may vary based on a variety of factors, many users have had positive experiences on the platform. Many success stories come from users who have carefully researched their signal providers and who have used the platform’s risk-management features. Individual success rates vary based on the user’s ability to choose the correct signal provider. It is important to approach such claims with caution and use discretion before making investment decisions.

8.2. Areas for Improvement

Commonly Reported Limitations: Fees, Risks from Signal Providers

Some users have mentioned concerns about the fees and the risks associated with relying on signal providers. It is essential to carefully manage your exposure to these risks. It is widely known that the fees may be higher compared to other platforms, and this is an area that users have consistently flagged. There are also risks involved with selecting a signal provider without thoroughly assessing their track record and risk. Users must be aware that selecting signal providers who have a history of success does not guarantee future profits.

Feedback on Features and Potential Enhancements

Feedback often involves requests for more advanced analytical tools and even more options for risk management. The platform remains focused on enhancing its services to meet customer needs. Some traders would also like to see more advanced technical tools that allow them to analyze the strategies of the signal providers more thoroughly. The platform is constantly taking feedback from its users and working to make the necessary improvements to cater to the evolving needs of traders.

9. Conclusion: Is ZuluTrade Worth Using?

In conclusion, ZuluTrade stands as a robust copy trading platform, catering to both beginners and professionals. Its strengths lie in its extensive network of signal providers, variety of assets and user-friendly interface. However, the platform’s fees are higher than some competitors, and relying on other’s strategies carries inherent risks. Ultimately, ZuluTrade can be a valuable tool for those who understand these aspects and use it wisely. By selecting the right providers and managing their risk effectively, traders can benefit from ZuluTrade’s unique approach to social trading. ZuluTrade offers an accessible way to participate in the market, but this should be done with caution and proper understanding of both the platform and trading in general.

FAQs about ZuluTrade & Crypto Copy Trading

What is ZuluTrade and how does it work for crypto?

ZuluTrade is a leading social copy trading platform. It allows you to automatically copy the trades of experienced cryptocurrency and forex traders. You link your brokerage account, select traders to follow, and their trades are mirrored in your account, offering a hands-off approach to crypto investing. It provides diversification and automation.

What are the benefits of using ZuluTrade for crypto copy trading?

ZuluTrade offers several key benefits: access to seasoned crypto traders, automated trade execution (saving you time), and the ability to diversify your portfolio by following multiple strategies. It simplifies crypto trading, especially for newcomers, providing a potential path to learn and profit from experienced market participants. The platform is also user friendly.

How do I choose the best crypto signal providers on ZuluTrade?

Thoroughly analyze each provider’s historical performance, focusing on metrics like ROI, maximum drawdown, average trade length, and trading style. Prioritize those with consistent, long-term positive returns. Diversify your risk by following several providers with different strategies, and *always* review their risk score and user reviews on the platform.

Does ZuluTrade fully support cryptocurrency trading?

Yes, ZuluTrade offers robust cryptocurrency trading support, alongside traditional assets like Forex, stocks, and CFDs. This robust offering enables you to easily construct a diversified investment portfolio that includes various digital assets, allowing you to choose among the most popular, and also providing access to newer and minor coins. It’s a powerful feature.

Are there any risks in using ZuluTrade for crypto?

Yes, copy trading, including crypto, involves inherent risks. Past performance doesn’t guarantee future results. It’s crucial to use ZuluTrade’s risk management tools like Stop Loss orders, diversify your investments across multiple signal providers, and *never* invest more than you can afford to lose. Market volatility is a significant factor always to consider.

Ready to explore the world of copy trading? Sign up for a free ZuluTrade demo account today and start learning from experienced traders!