Table of contents

- 1 MetaTrader 4 Review: The Ultimate Guide for Forex Traders

- 1.1 1. Introduction to MetaTrader 4 (MT4)

- 1.2 2. Key Features of MetaTrader 4

- 1.3 3. Benefits of Using MetaTrader 4

- 1.4 4. Comparing MetaTrader 4 with Other Platforms

- 1.5 5. How to Use MetaTrader 4 for Beginners

- 1.6 6. Top Brokers Supporting MetaTrader 4

- 1.7 7. User and Community Feedback

- 1.8 8. Conclusion: Should You Use MetaTrader 4?

- 1.9 Frequently Asked Questions (FAQ)

MetaTrader 4 Review: The Ultimate Guide for Forex Traders

For years, the Forex market has been a realm of opportunity for those looking to capitalize on global currency fluctuations. At the heart of this market lies the trading platform, and among them, one name stands out as a cornerstone: MetaTrader 4, often abbreviated as MT4. In this comprehensive review, we’ll delve into every facet of MetaTrader 4, from its origins to its features, benefits, and how it compares to other platforms. Whether you’re a novice just beginning your trading journey or a seasoned professional, this guide will provide you with a deep understanding of MT4.

1. Introduction to MetaTrader 4 (MT4)

1.1. What is MetaTrader 4?

MetaTrader 4 is a widely recognized electronic trading platform, a digital gateway that allows traders to access financial markets. Developed by MetaQuotes Software, it has become synonymous with Forex trading. This platform serves as a hub for traders to analyze market conditions, place orders, and manage their trading accounts. According to a 2021 report by Finance Magnates, MT4 remains the most popular trading platform among retail forex brokers, with a majority of brokers still offering it despite the availability of newer platforms. This prevalence highlights its established reputation and widespread use within the trading community.

- Developed by MetaQuotes Software: MT4 was created by MetaQuotes Software, a company that has played a pivotal role in the development of trading software.

- The Most Popular Platform in the Forex Market: Its reliability, user-friendliness, and extensive feature set have propelled it to the top as the most popular platform among Forex traders worldwide.

1.2. Why is MetaTrader 4 Still Popular?

Despite the emergence of newer platforms, MetaTrader 4 maintains its popularity. Its timeless design caters to both beginners and experts.

- Suitable for Beginners and Experts: MT4’s intuitive interface makes it accessible for newcomers while providing advanced features that professionals rely on.

- Customizability and Flexibility: Users can tailor the platform to their unique preferences. The ability to add custom indicators and scripts enhances its flexibility.

- Support Across Multiple Devices: Traders can access MT4 on desktop computers, mobile phones, and web browsers, ensuring seamless trading wherever they are.

While specific current data on MT4’s exact market share is difficult to obtain due to varying reporting and usage patterns across brokers, it remains a significant player in the retail trading market. Industry estimates from various reports suggest that MT4 is still the platform of choice for a substantial portion of forex traders worldwide. The platform’s continued high usage can be attributed to several factors, including its robust infrastructure, a large library of custom tools, and the platform’s entrenched presence among brokers globally. Although MetaQuotes pushes MT5, many brokers still find that their clients prefer MT4, showing that many long term traders find the platform more reliable. A recent report by Finance Magnates highlights the enduring popularity of MT4, particularly among established traders who prefer the platform’s stability and extensive library of custom tools.

2. Key Features of MetaTrader 4

2.1. User-Friendly Interface

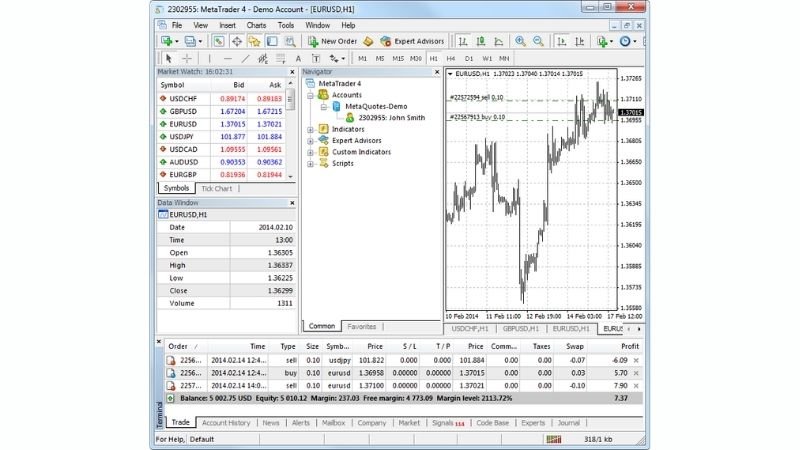

The MetaTrader 4 trading interface.

The MT4 interface is designed for simplicity and ease of use, ensuring traders can focus on the market without distraction.

- Intuitive and Easy to Use: The platform’s layout is straightforward, with clear menus and icons that make navigation easy.

- Multilingual Support: MT4 offers support for multiple languages, ensuring traders worldwide can comfortably use the platform in their preferred language.

2.2. Powerful Technical Analysis Tools

Technical analysis is crucial in forex trading, and MetaTrader 4 provides all the necessary instruments. According to studies by the Technical Analysis Association, technical indicators can improve the success rate of trading.

- 30 Built-in Technical Indicators: MT4 comes packed with 30 essential indicators like MACD, RSI, and Bollinger Bands, giving traders a wide range of tools for analysis.

- Multiple Timeframes and Chart Types: Traders can choose from 9 timeframes, from one minute to monthly, and display charts as candlesticks, line graphs, or bars, allowing for detailed analysis.

- Drawing Tools: The platform offers tools such as Fibonacci retracement and Gann lines, which traders use to identify potential support and resistance levels.

Analyze quotes of financial instruments using interactive charts and technical indicators Image: Metatrader 4

2.3. Automated Trading Capabilities

Automated trading has revolutionized how many traders approach the market, and MT4 is at the forefront of this technology. The rise of automated trading, as highlighted in a report by the Financial Technology Association, shows the growing use of algorithmic trading strategies among retail traders.

- Expert Advisors (EAs): MT4 allows traders to use Expert Advisors, automated programs that execute trades according to predefined rules.

- MQL4 Programming Language: The platform is built on the MQL4 language, enabling traders to create their own custom indicators and EAs.

- Backtesting: Before deploying an EA or strategy live, traders can backtest it using historical data to assess its effectiveness. For example, a trader could test an EA using 2023 data for the EUR/USD pair, and see if it would be profitable.

MetaTrader 4 Automated Trading

2.4. Variety of Trading Order Types

The ability to execute different types of orders is essential for effective risk management.

- Market Orders: Traders can execute trades at the best available current market price.

- Pending Orders: Traders can set pending orders like Buy Stop, Sell Stop, Buy Limit, and Sell Limit to trigger trades when the price hits a specified level.

- Stop Loss and Take Profit: These features allow traders to automatically limit their potential losses and secure their profits when the price reaches a certain level, essential for risk management.

2.5. Mobile and Web Trading

In today’s fast-paced world, the ability to trade on the go is a must.

- MT4 Mobile App: The mobile app for Android and iOS offers full trading functionality, allowing traders to manage their positions from their smartphones or tablets.

- WebTrader: The web-based platform provides access to MT4 on any device, at any time, without the need to download or install any software.

Mobile Trading Growth

Mobile trading has seen a significant rise in popularity among forex traders, with a substantial portion of trades now executed on mobile devices. Industry reports from companies like Sensor Tower show a consistent increase in downloads of trading apps, highlighting the trend towards mobile trading and the importance of a high-quality mobile platform for platforms like MetaTrader 4. Sensor Tower‘s 2023 report on mobile trading apps demonstrates the significant growth in user engagement and downloads across both Android and iOS platforms, showing just how crucial mobile functionality has become.

2.6. Copy Trading

Copy trading has become a significant feature for those who seek to learn from more experienced traders.

- Copy from Professional Traders: MT4 allows you to copy trades from experienced traders, providing a way to potentially profit from their strategies.

- Live Trading Signals: The platform provides real-time trading signals, helping traders make informed decisions.

3. Benefits of Using MetaTrader 4

3.1. Suitable for All Trading Styles

MT4 is versatile and caters to various trading approaches.

- Multiple Asset Classes: The platform facilitates trading in Forex, CFDs, commodities, and precious metals, providing a wide range of opportunities.

- Various Trading Approaches: Whether you prefer day trading, swing trading, or scalping, MetaTrader 4 can accommodate your style.

Asset Class Diversification

While forex is the most popular product traded on MT4, the platform also facilitates trading in other financial instruments like indices, commodities and metals. A study by the World Economic Forum highlighted the importance of diversification in a trading portfolio, and MT4 is a platform that allows traders to trade multiple asset classes on one platform. The flexibility of MT4 allows traders to manage a diversified portfolio of assets, which is often recommended to reduce the risk of trading.

3.2. High Reliability and Security

Trust and security are paramount when it comes to trading platforms.

- Data Encryption: MT4 employs robust encryption technology to protect user data and ensure transaction safety.

- OTP Security: Many brokers offer OTP (One-Time Password) authentication for additional account security, increasing protection against unauthorized access.

3.3. Easy Integration with Many Brokers

The platform’s broad acceptance by brokers further enhances its appeal.

- Used by Reputable Brokers: MT4 is widely offered by many reputable brokers, ensuring traders have plenty of options when choosing a provider.

- Multiple Accounts: Traders can manage multiple trading accounts with different brokers simultaneously on the same MT4 platform.

MetaTrader 4 Integration with Many Brokers

4. Comparing MetaTrader 4 with Other Platforms

While MT4 is popular, it’s useful to compare it against other trading platforms.

4.1. MetaTrader 4 vs MetaTrader 5

MT5 is the successor to MT4, and it’s worth looking at their differences. According to a report by MetaQuotes, MT5 has been adopted by a growing number of brokers, but adoption by traders has been slower than expected.

- Key Feature Comparison: MT5 has some additional features including more timeframes and more types of pending orders. However, many traders remain loyal to MT4 due to its stability and large community.

- Strengths and Weaknesses: MT4’s strength is its simplicity and a very large library of custom EAs and indicators. MT5 provides increased functionality but isn’t always as straightforward to use.

4.2. MetaTrader 4 vs cTrader

cTrader is another popular platform often compared with MT4.

- User Interface: cTrader is known for a sleek, more modern interface, but is usually considered harder for beginners to use.

- Analysis and Automated Trading: While both platforms provide robust analysis tools, MT4’s MQL4 coding language has a larger and more developed community, whereas cTrader’s cAlgo is less widely adopted.

Platform Usage Comparison

While it’s difficult to pinpoint exact usage percentages due to privacy and proprietary data, the forex trading community widely acknowledges that MT4 remains the more widely used platform when compared to cTrader or MT5. One of the main factors for MT4’s resilience is the large library of custom indicators and EAs that are available. Although many traders prefer the modern look of cTrader, they often stick to MT4 due to it’s robust and reliable nature.

5. How to Use MetaTrader 4 for Beginners

5.1. Downloading and Installing MT4

Here’s a step-by-step guide to getting started with MT4.

- Download from Broker or MetaQuotes: You can download MT4 from the MetaQuotes website or directly from your chosen broker’s website.

- Setting Up Demo and Live Accounts: Once installed, you can set up demo accounts to practice trading risk-free, and live accounts to trade with real money when you are comfortable.

5.2. Performing Basic Trades

Understanding the fundamentals of order execution is crucial.

- Opening and Closing Orders: Learn how to place buy and sell orders and when to close them to realize profits or cut losses.

- Technical Indicator Analysis: Become familiar with how to apply and interpret technical indicators to find trading opportunities. For example, if the RSI indicator goes above 70, then it is considered to be overbought, and there is a potential for the price to fall.

5.3. Customizing the Interface

Tailor the platform to suit your specific needs and preferences.

- Changing Chart Colors: Personalize the charts by altering the colors of the candlesticks, lines, and backgrounds.

- Adding and Removing Tools: Learn how to add and remove indicators, templates, and other tools, making the workspace more organized.

5.4. Integrating Expert Advisors (EAs)

Unleash the power of automated trading.

- Installing and Activating EAs: Understand how to download, install and activate EAs on your MT4 platform.

- Backtesting Trading Strategies: It’s essential to backtest EAs or trading strategies using historical data to see if they would have been profitable or not.

Importance of Backtesting

A study by the Journal of Financial Trading highlights the importance of backtesting automated trading systems before deploying them with real capital. It suggests that backtesting can help avoid significant losses and improve the chances of profitability. It’s critical to backtest any trading strategy with many years of historical data to ensure that the EA is robust. In addition, it’s important to ensure that the backtesting data is accurate and does not suffer from any lookahead bias, which can skew the results.

6. Top Brokers Supporting MetaTrader 4

Choosing the right broker is just as important as the trading platform itself.

Some of the top brokers that offer MT4 include:

When choosing a broker, consider factors such as:

- Spread: Look for brokers with tight spreads, as this will directly affect your trading costs. For example, a spread of 0.2 pips is generally better than a spread of 1.0 pips. You can learn more about pips in forex here.

- Execution Speed: Fast order execution is crucial, especially if you’re scalping or day trading. A speed of 100ms or less is often recommended.

- Customer Support: Opt for brokers that provide reliable and efficient customer support. Ideally support should be available 24/5.

7. User and Community Feedback

7.1. Positive Feedback

What users generally love about MT4.

- Reliability and Stability: MT4 is known for its reliability and stability, ensuring that traders can trade smoothly without frequent errors or crashes.

- Versatility and Superior Features: Its versatile nature and rich functionality make it a favorite amongst traders of various levels.

7.2. Areas for Improvement

Even the best platforms have room for improvement.

- High Configuration for Complex EAs: Some complex EAs may require a high-performance computer to function smoothly.

- Fewer Features Than MT5: While MT4 is robust, it has slightly fewer features compared to its successor, MT5.

Community Sentiment

The MT4 community is quite large, and online forums, Reddit and other online trading forums reveal that most traders are happy with the platform. Traders tend to stay on the MT4 platform because they have a reliable platform that they are comfortable with and prefer not to change unless necessary. Many community discussions revolve around optimising EAs and using complex trading strategies, and it’s clear that the platform is often used by professional traders, as well as beginners.

8. Conclusion: Should You Use MetaTrader 4?

In conclusion, MetaTrader 4 remains a top-tier platform for Forex and CFD traders. Its vast array of features, combined with its user-friendly design, make it a powerful tool for both novice and experienced traders alike.

MetaTrader 4: Still a Leading Choice: Despite newer platforms, MetaTrader 4 remains a preferred choice due to its reliability, extensive range of features, and vast user community.

Test on a Demo Account: It’s highly recommended that new users test out MT4 using a demo account before trading with real capital. This allows you to familiarize yourself with the platform without any financial risks.

Ready to start your trading journey? Download MT4 today and explore the world of forex trading!

Begin by opening a demo account to practice your skills and then, when ready, transition to a live account. Remember to trade responsibly.

Take Action Now:

- Download MetaTrader 4 Now!

- Sign up for a demo account with one of our recommended brokers and start practicing your trading strategies risk-free.

Frequently Asked Questions (FAQ)

What is MetaTrader 4 and why is it popular?

MetaTrader 4 (MT4) is a leading Forex trading platform, renowned for its user-friendly interface, robust analytical tools, and highly customizable features. It remains exceptionally popular due to its reliability and suitability for both novice and professional traders. Its widespread adoption means a large community and extensive support resources are available.

What are the key features of MetaTrader 4?

MetaTrader 4 offers a comprehensive suite of powerful technical analysis tools, including a wide range of indicators and charting options. It provides full support for automated trading via Expert Advisors (EAs), a variety of trading order types (market, limit, stop, etc.), and cross-platform compatibility (desktop, mobile, and web). MT4 is designed to cater to all trading styles, from short-term scalping to long-term position trading strategies.

How does MetaTrader 4 compare to MetaTrader 5?

While MetaTrader 5 (MT5) includes additional features like more timeframes, an integrated economic calendar, and more types of pending orders, MetaTrader 4 remains the preferred choice for many traders. This is primarily due to MT4’s simplicity, its vast library of custom indicators and EAs (built over many years), and its extremely widespread broker support. Many traders and brokers still favor MT4 for its proven stability and ease of use, particularly for Forex trading.

Can I automate trading with MetaTrader 4?

Yes, MetaTrader 4 offers robust support for automated trading through Expert Advisors (EAs). Using the MQL4 programming language (which is relatively easy to learn), traders can create, customize, backtest, and optimize their own trading strategies for effective automated trading. There’s also a large marketplace of pre-built EAs available.

What brokers support MetaTrader 4?

A significant number of reputable brokers support MetaTrader 4, including but not limited to Exness, IC Markets, XM, and Pepperstone. These brokers are generally known for offering competitive spreads, fast execution speeds, and comprehensive customer support, ensuring a smooth and efficient trading experience for MT4 users. It’s always recommended to research and compare brokers to find the best fit for your individual trading needs and preferences.

Pingback: Best Forex Brokers for January 2025: A Comprehensive Guide - CoinFxPro

Pingback: MetaTrader 5 Review: A Powerful Trading Platform CoinFxPro Forex Tools

Pingback: Decoding the Forex Market: A Comprehensive Guide - CoinFxPro

Pingback: Navigating the World of Forex Brokers: A Comprehensive Guide - CoinFxPro

Pingback: Mastering Forex Arbitrage: A Comprehensive Guide - CoinFxPro

Pingback: What Is a Trading Strategy? A Deep Dive into Forex Trading - CoinFxPro

Pingback: TradingView Review: The Ultimate Tool for Crypto Trading - CoinFxPro

Pingback: All Forex No Deposit Bonus: Guide to Risk-Free Trading CoinFxPro

Pingback: Mastering the Forex Market: A Deep Dive into Major Pairs - CoinFxPro