Table of contents

- 1 Understanding Pips in Forex: A Trader’s Essential Guide

Understanding Pips in Forex: A Trader’s Essential Guide

In the dynamic world of Forex trading, mastering the nuances of price movements is crucial for success. Among the fundamental concepts every trader must grasp is the notion of a “pip.” But what are pips, and why are they so important? This comprehensive guide will dissect pips, exploring their significance, calculation, and role in various trading strategies.

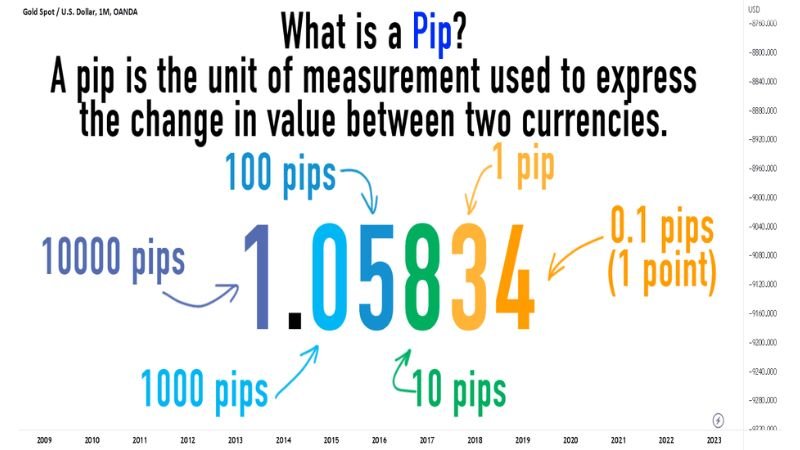

What is a Pip in Forex Trading?

A pip, or “percentage in point,” is the smallest unit of price movement in the foreign exchange market. Think of it as the equivalent of a cent in USD, but for currency pairs. It’s the standard measure of how much the price of one currency has moved against another. For most currency pairs, a pip is the fourth decimal place. For example, in a pair like EUR/USD, if the price moves from 1.1050 to 1.1051, that’s a one-pip increase. However, there are exceptions. For instance, for currency pairs involving the Japanese Yen, a pip is measured at the second decimal place.

Why Pips Matter

Understanding pips is foundational for several reasons:

- Measuring Profit and Loss: Pips are how traders calculate gains and losses. A change of just a few pips can translate into significant amounts depending on the lot size traded. For example, a 20-pip gain on a standard lot (100,000 units) in a EUR/USD trade is roughly equivalent to a $200 profit, while a 20-pip loss would amount to approximately -$200.

- Defining Trading Risk: Setting stop-loss and take-profit orders depends heavily on pips. Understanding how many pips you’re willing to risk per trade is critical for risk management. If you risk 50 pips on a trade with a standard lot, you are risking approximately $500 on that trade.

- Comparing Trading Performance: Pips provide a universal metric to assess the effectiveness of different trading strategies. Whether you made 100 pips on a swing trade or 10 pips on a scalping strategy, pips are the standard unit for evaluating your profitability across any trading method.

How to Calculate Pips in Forex

Calculating pips isn’t complex, but it requires careful attention to the currency pair and its decimal places. Here’s how it’s done:

Standard Currency Pairs

Most major pairs, like EUR/USD, GBP/USD, AUD/USD, and NZD/USD, use a four-decimal-place format. Therefore, one pip is equal to 0.0001 in the price. For example, if the EUR/USD pair moves from 1.1200 to 1.1205, this constitutes a 5 pip increase. Similarly, if the price of the AUD/USD pair shifts from 0.6530 to 0.6540, it is a 10 pip increase.

.

.

Currency Pairs with JPY

Pairs involving the Japanese Yen (JPY) are an exception. These are quoted to two decimal places, where one pip is 0.01. For example, if USD/JPY moves from 145.20 to 145.23, this is a 3 pip increase. Similarly, if the price of EUR/JPY moves from 160.50 to 160.65, it constitutes a 15 pip increase.

Value of a Pip in Forex

While pips indicate the change in price, their value in monetary terms varies based on your trade size (lot size) and currency pair. Here’s a simple breakdown:

Standard Lot

A standard lot is 100,000 units of the base currency. For most pairs, one pip is worth approximately $10 when trading a standard lot. For example, if you buy one standard lot of EUR/USD and the price moves up by 10 pips, you make about $100 (10 pips * $10/pip). Conversely, a 10-pip loss results in about -$100.

Mini Lot

A mini lot is 10,000 units of the base currency. In this case, one pip is worth approximately $1. Trading a mini lot of EUR/USD and gaining 10 pips would yield about $10 in profit.

Micro Lot

A micro lot is 1,000 units of the base currency. Here, one pip is worth approximately $0.10. So, a 10-pip profit on a micro lot would be around $1.

Here’s a simple table summarizing the pip values based on lot sizes:

| Lot Size | Units | Pip Value |

|---|---|---|

| Standard Lot | 100,000 | ~$10 per pip |

| Mini Lot | 10,000 | ~$1 per pip |

| Micro Lot | 1,000 | ~$0.10 per pip |

The exact value may vary slightly based on the specific currency pair. For a more detailed understanding of pip values and how they relate to different currency pairs, consider exploring resources like this Investopedia article on pips.

Importance of Pips in Forex Trading

The importance of pips extends beyond mere price measurement; they are integral to strategy, risk management, and profitability.

Risk Management

Pips help traders determine appropriate stop-loss levels. For example, a trader might decide to set a stop-loss at 20 pips below their entry point. Without understanding pips, it’s impossible to define and control risk properly. If a trader buys EUR/USD at 1.1000, and they set a stop loss at 1.0980, they are limiting their loss to 20 pips on that trade. A risk management strategy often involves setting a stop-loss order at a certain number of pips away from the entry point.

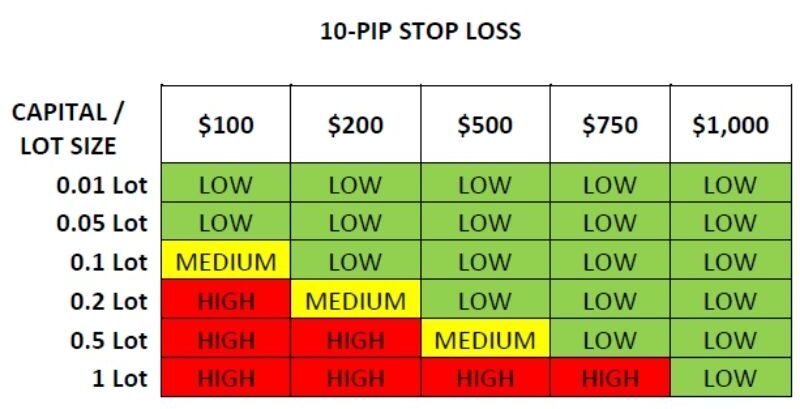

Assess the risk level when pips fluctuate

Profit Targets

Similarly, take-profit levels are often defined in pips. If you aim to make 50 pips on a trade, you need to know what that 50-pip movement translates to in monetary terms, based on your lot size. For instance, if you are using a mini lot, 50 pips profit will give you approximately $50 in profit.

Trading Strategy

Many trading strategies are explicitly based on pip movements. For example, scalping strategies might aim to capture just a few pips per trade, relying on high volumes and frequent trades to accumulate profits. Day traders may aim for 20 to 50 pips per trade, while swing traders often target 100 or more pips per trade. If you are looking for some direction on how to start trading, you may want to look at some of the popular trading strategies.

Pip-Based Trading Strategies

Various trading strategies revolve around pip movements, each with different goals and risk profiles.

Scalping

Scalping involves making multiple trades to capture small pip profits. This method requires extremely high frequency trading with tight stop-losses and take-profit levels. Traders in this category often target just a few pips per trade and trade multiple times throughout the day. For example, a scalper may aim for 5 to 10 pips per trade, making numerous trades in an hour. Given the fast pace nature of scalping, traders must use a Forex pip calculator to be sure that their profits and losses are being tracked accurately.

Day Trading

Day traders close their positions before the end of the trading day to avoid holding positions overnight. Their goal is to capture opportunities that arise within a single day. They may target gains of 20-50 pips on trades, aiming to close all positions by the end of each trading day. Day traders often analyze price charts and technical indicators to identify trends and profit from fluctuations within the day. You can use tools such as Netdania Charts, Tradingview, or ChartPrime to assist you in your technical analysis.

Swing Trading

Swing trading involves holding positions for several days or even weeks. This strategy is based on profiting from larger price fluctuations. A swing trader may aim for gains of 50-200 pips per trade, capitalizing on market trends and larger price swings. Swing traders often look at fundamental analysis in addition to technical analysis to determine potential price movement in the market. It’s important to understand the importance of Forex sentiment when swing trading.

Pips in Day Trading and Swing Trading

Pips in Day Trading

In day trading, pips are critical for setting realistic targets and stop losses. For example, a day trader might aim for 20 pips of profit on a single trade and set a stop-loss of 10 pips to control risk. Day trading is very active, requiring constant monitoring and quick decision making. The fast-paced nature of day trading means even a few pips can result in substantial gains or losses throughout the day, hence precision and calculation of pips are of the utmost importance.

Pips in Swing Trading

Swing traders tend to target larger pip gains because they hold their trades for longer periods. A swing trader may aim for 100 pips on a trade and set a stop-loss of 50 pips. They’re looking to capitalize on broader market trends and larger price movements over several days or weeks. Thus, understanding the pip value allows them to evaluate their risk to reward properly.

Pip Risk Management in Forex

Effective risk management is the foundation of any profitable trading strategy, and pip calculations are essential for it. Here are several strategies traders use to protect their capital:

Stop-Loss Orders

Stop-loss orders are placed at a specific pip level to limit potential losses. Understanding the relationship between your stop loss and the potential monetary loss is critical for risk control. This allows traders to automatically close their trades and prevent further losses. Setting stop losses ensures you don’t lose more than you are willing to risk. For example, a trader might set a stop-loss at 30 pips below their entry point to prevent significant losses on a single trade.

Position Sizing

Position sizing is the process of determining how much of your capital to use on any given trade. Using the pip value in this process allows traders to size their position such that their risk level will not put their capital in danger. You don’t want to be in a position where 20 pip loss will blow your entire trading account. If a trader knows that their stop-loss is 20 pips away from their entry point, they may determine that they only want to risk 1% of their capital on this trade. Therefore, they will size their position accordingly to keep their risk at 1% of their capital.

Risk-Reward Ratio

The risk-reward ratio is the measure of how many pips you’re aiming to profit for every pip you’re willing to risk. Most traders will aim for at least a 1:2 risk reward ratio, meaning that for every pip they risk, they expect to gain two. For example, if your stop-loss is set at 20 pips, your take profit target should be a minimum of 40 pips to maintain a 1:2 risk reward ratio.

Forex Pip Calculator Explained

To simplify the calculation of pip values, traders often use Forex pip calculators. These tools automatically compute the value of a pip based on the currency pair, lot size, and account currency. It is a quick and easy way to determine how much your profit or loss will be in monetary terms.

Example of a forex pip calculator interface.

How to Use a Pip Calculator

Most pip calculators require the user to input the currency pair, lot size, and, sometimes, their account currency. Once these parameters are entered, the calculator instantly displays the value of one pip, which helps traders understand the potential gain or loss for any trade.

Benefits of Using a Pip Calculator

- Accuracy: Minimizes errors in manual calculation, which is especially important when trading in fast moving markets.

- Time-Saving: Saves time by instantly providing the pip value.

- Risk Management: Facilitates risk assessment by allowing traders to quickly understand how much money they’re risking per trade based on pip movement.

Conclusion

Understanding pips in Forex is fundamental for every trader. Whether you’re a beginner or an experienced professional, a firm grasp of pips, what is a pip in forex trading, how to calculate pips in forex, and their implications is essential for navigating the market successfully. Pips are not just a number; they are the building blocks of your trading strategy, risk management, and overall profitability. Using a Forex pip calculator, understanding the value of a pip in forex, and integrating pip risk management in forex into your process is key to becoming a successful trader.

By mastering the concepts of pips, you’ll be better equipped to make informed trading decisions, manage your risk effectively, and pursue your financial goals in the dynamic world of forex trading. Remember, consistency in learning and practice are key to turning this knowledge into trading success.

If you are interested in learning more about the Forex market, you may want to read about how to start Forex trading, learn about the best Forex brokers, understand what Forex major pairs are, or explore strategies like Forex arbitrage or even the Quasimodo Forex strategy.

Pingback: What Is a Trading Strategy? A Deep Dive into Forex Trading - CoinFxPro

Pingback: Mastering Forex: A Guide to Currency Pairs CoinFxPro

Pingback: All Forex No Deposit Bonus: Guide to Risk-Free Trading CoinFxPro

Pingback: Navigating the World of Forex Brokers: A Comprehensive Guide - CoinFxPro

Pingback: How to Start Forex Trading: A Beginner's Guide CoinFxPro