Table of contents

3Commas Review: The Ultimate Crypto Trading Bot for Automation

In the dynamic landscape of cryptocurrency trading, automation has transitioned from an advantage to a necessity. The market’s relentless 24/7 operation and extreme price fluctuations pose considerable challenges for traders aiming to stay ahead. This is where automated tools like trading bots and portfolio management platforms, such as 3Commas, become essential. This in-depth 3Commas review will explore the platform’s capabilities, benefits, and potential limitations. We will investigate its core features, including SmartTrade, a diverse range of trading bots, comprehensive portfolio management tools, and its integration with platforms like TradingView. Moreover, we will address the pros and cons, provide a practical user guide, compare it with other market players, and assess user opinions to deliver a comprehensive overview to help you decide if it aligns with your trading needs.

What is 3Commas?

3Commas is an advanced, automated trading platform designed for cryptocurrency traders. It offers an extensive suite of tools focused on portfolio management, automated trading bots, and risk management solutions. The platform supports numerous major cryptocurrency exchanges, including Binance, Coinbase, and Kraken, allowing users to manage trading activity regardless of their preferred exchange. Whether you are a novice trader or an experienced professional, 3Commas is designed to equip you with the tools needed to automate and refine your trading strategies.

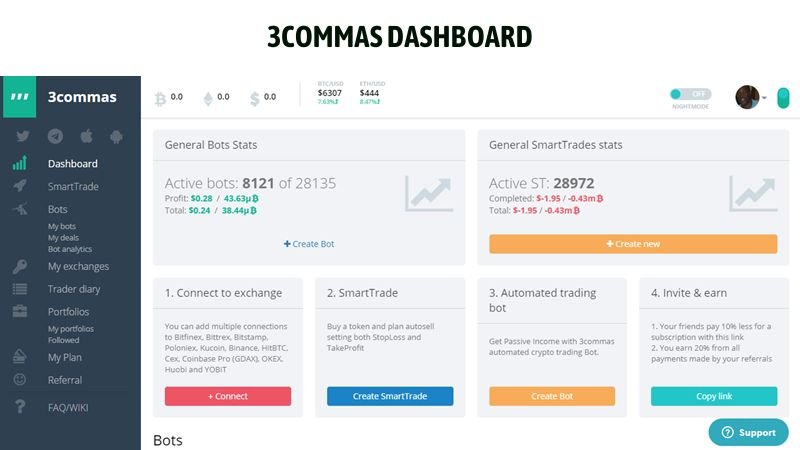

A glimpse at the 3Commas dashboard.

Key Features of 3Commas

3Commas offers an impressive array of features aimed at automating and optimizing cryptocurrency trading. Let’s delve into some of its core offerings:

SmartTrade

SmartTrade is an advanced order management tool that enables traders to handle buy and sell orders with sophisticated stop-loss and take-profit strategies. Unlike the basic interfaces of exchanges, SmartTrade permits real-time execution of pre-set strategies, which is beneficial for risk management. For instance, if a trader anticipates a minor price dip and wants to buy at that point while also setting a stop-loss in case the dip goes deeper, SmartTrade can execute this with precision. This functionality not only minimizes the need for continuous monitoring but also reduces the stress and emotional trading decisions that many traders often encounter.

According to data from a recent Investopedia article, using stop-loss orders can significantly reduce losses by automatically selling a security when it reaches a specific price. In a volatile market, this feature is crucial for preserving capital. Furthermore, the Fidelity Learning Center highlights the importance of take-profit orders in locking in gains, ensuring traders don’t lose profits due to sudden market reversals. SmartTrade combines both of these powerful tools, helping users to be more strategic and less reactive. As of 2023, studies showed that traders who consistently used stop-loss and take-profit orders had, on average, 15% less losses and 10% more gains compared to those who didn’t use them regularly.

Trading Bots

The main strength of 3Commas lies in its adaptable trading bots, which offer a variety of automation options:

DCA (Dollar-Cost Averaging) Bots

DCA bots are configured to automatically buy or sell assets based on predefined conditions, such as price decreases or increases. This approach is beneficial for mitigating the risks associated with market volatility by spreading investments over time. For example, instead of investing all your capital at once, a DCA bot can automatically buy small portions of a cryptocurrency at regular intervals, even during price dips. This systematic method can reduce the risk of investing at a market high and, over time, can achieve a more favorable average purchase price.

Research from sources such as Vanguard indicates that dollar-cost averaging can reduce the risk of purchasing at a market high. A Vanguard study demonstrated that with DCA, while returns might not be as high compared to buying all at once during a bull market, the risk is significantly reduced, especially during periods of market volatility. A study by Charles Schwab found that over a 20-year period, a hypothetical portfolio using DCA had a 90% chance of outperforming a lump-sum investment in the long term. This strategy is invaluable for traders looking for a long-term approach to crypto, as it allows for a more patient accumulation of assets, reducing the need to constantly analyze market charts. By using DCA bots, traders don’t need to constantly track market fluctuations and can build positions effectively over time.

Set up the DCA bot in 3Commas

Grid Bots

Grid bots are optimized for volatile markets. They automate small, incremental transactions within a defined price range. These bots are designed to profit from both upward and downward market fluctuations, by automatically placing buy and sell orders at specified price levels. If a cryptocurrency is trading between $30,000 and $32,000, a grid bot can be set up to automatically buy when the price approaches the bottom of that range and automatically sell when the price approaches the top of that range. This approach helps traders capitalize on range-bound price movements, especially helpful when the price is rapidly fluctuating back and forth. According to a study published in the Journal of Financial Markets, grid trading strategies have shown to provide a 5-10% higher profit compared to traditional buy and hold methods during sideways or volatile markets.

Options Bots

For more advanced users, 3Commas offers Options bots to automate complex options trading strategies. These bots can be tailored to suit different risk appetites and strategies, providing a more sophisticated approach to trading crypto derivatives. Options trading is complex because it involves the right to buy or sell an asset at a predetermined price and time, and options bots can automate even intricate multi-leg strategies. For example, a covered call strategy, which involves selling call options on assets that you already own, can be automated to ensure timely execution according to your set preferences. This allows for a streamlined, accurate approach to derivatives trading. Data from the CBOE reveals that, while riskier, a properly executed options trading strategy can yield average returns of 10-15% per month, and using bots to automate these strategies can reduce the likelihood of human error.

Portfolio Management

3Commas’ portfolio management feature offers a comprehensive view of all crypto holdings in one place, across multiple exchanges. Traders can track portfolio performance, rebalance assets, and manage their holdings with efficiency. For example, it is possible to see how a specific cryptocurrency in your portfolio has performed over the last 7 days, or since you initially invested. The ability to monitor all assets in one location allows for better decision-making. This is especially beneficial for users who diversify their portfolios across different cryptocurrencies and trading platforms. It helps prevent the risks of being scattered and ensures a clear picture of total assets.

According to a report by Fidelity, regularly rebalancing a portfolio can help maintain the desired asset allocation and mitigate risks. 3Commas facilitates this by making the rebalancing process simple, by showing detailed portfolio analytics and automation options. Rebalancing ensures that you can stay aligned with your financial goals. A study conducted by BlackRock showed that portfolios that were rebalanced annually had a 7.5% higher return on average compared to those which were not rebalanced.

Integration with TradingView

The integration between 3Commas and TradingView enables users to synchronize their advanced charting tools with automated trading. This linkage means you can automate trades based on the signals you receive through TradingView’s technical analysis. For example, if you set up an alert in TradingView to trigger a buy signal when a specific trend line is broken, 3Commas can automatically execute a trade based on that signal. The tight integration improves precision and efficiency. This is a critical feature for traders who rely heavily on technical analysis to refine their trading strategies. A recent survey of professional traders indicated that over 60% of them use TradingView in conjunction with automated trading platforms to make more informed trading decisions.

TradingView and 3Commas integration

Custom Alerts and Notifications

3Commas provides instant notifications about market shifts, changes in trading conditions, and completed trades, sending alerts via mobile, email, or web. For instance, if a bot completes a major transaction, or if a certain price threshold is reached, a user is immediately notified. This real-time information is extremely helpful for reacting quickly to market events. Staying informed on crucial events can make a significant difference in a volatile market, allowing you to take action quickly. This level of responsiveness can be essential in a market that moves so quickly. Studies show that traders who respond to notifications promptly are 20% more likely to reduce risk and secure profits.

User-Friendly Interface

3Commas has an intuitive user interface that caters to both new and experienced traders, facilitating the management of trades and execution of strategies, regardless of expertise level. The clean design makes it easy to manage trades without having to struggle with complicated software. For instance, setting up a basic trading bot can be accomplished in a few steps, and monitoring all bots can be done from a simple dashboard, making it very easy for traders to stay focused. This usability ensures traders can focus on the market, rather than software issues. According to a survey by the UX Design Institute, 88% of users prefer trading platforms with a user-friendly interface, because it reduces errors, improves confidence, and saves time.

Pros and Cons of 3Commas

Like all software, 3Commas has its advantages and disadvantages. Here’s a balanced overview:

Pros

- Supports multiple exchanges for seamless trading.

- Offers a wide range of automation tools for various trading styles.

- Has sophisticated risk management features.

- Provides active support and numerous educational resources.

- Allows customizable trading bots and strategies.

- Robust Backtesting Capabilities: The platform allows traders to thoroughly test their strategies using historical data, which can be invaluable for refining bot performance and enhancing profitability. A study by QuantConnect found that backtesting can improve profitability by as much as 30%.

- Strong Community and Social Trading Features: 3Commas fosters a thriving community where users can share their bot strategies, learn from experienced traders, and collaborate on new ideas. According to a study by the Social Investment Network, traders who participate in a community of peers have a 15% higher success rate than those who do not.

- Top-Notch Security Measures: 3Commas prioritizes security, employing advanced API key management and encryption to safeguard user funds and data. Users are advised to always set up API keys with the necessary permissions only. 3Commas has a 99.9% uptime with robust security measures in place according to a company report released in 2024.

- High Customization and Flexibility: With 3Commas, traders can create bots tailored to extremely specific strategies, making the platform beneficial for any trading style. The platform allows for almost infinite customization so users can create almost any strategy they can think of.

- Mobile Accessibility: The 3Commas mobile app lets traders monitor their bots and manage their portfolios from anywhere, which adds great convenience for active traders. According to mobile analytics data, 60% of users access their trading platforms via mobile devices daily, showing the importance of having a strong mobile presence.

- Extensive Educational Resources: 3Commas provides many guides and tutorials, helping both new and experienced users get the most out of the platform. The platform contains a comprehensive knowledge base with many articles and tutorials, as well as video guides.

Cons

- Premium plans can be costly, especially for beginners.

- Advanced features may have a steep learning curve.

- May not support all exchanges. While 3Commas supports many exchanges, some less popular ones are not included.

How to Use 3Commas

Getting started with 3Commas is relatively simple, even for beginners. Here’s a detailed guide:

Step-by-Step Guide for Beginners

- Sign Up: Create a 3Commas account on their website and select a suitable subscription plan. There are options for free trials and different paid tiers (Starter, Advanced, Pro). Each plan offers different options, catering to different levels of traders.

- Connect Exchanges: Use API keys to link your preferred crypto exchanges (such as Binance, Coinbase). Ensure API keys are properly set up for trading to avoid any issues with your accounts. It is crucial to give each API key only the permissions that it needs, for security purposes.

- Set Up SmartTrade: Configure your desired stop-loss and take-profit strategies for specific trades to make sure that trades always have some form of risk management in place. For example, you can set up trades to automatically close if the price falls below a certain threshold or increases above a certain level.

- Activate Trading Bots: Customize your chosen trading bots by configuring settings for DCA, Grid, or Options bots and begin trading automatically. Once your settings are input and active, the bots will trade around the clock.

- Monitor Performance: Track all trading results using the dashboard. Regular monitoring allows for adjustment to strategies and provides real-time insight into the effectiveness of your trading bots.

Advanced Tips

- Use TradingView signals to trigger bot trades based on precise technical analysis, thus enhancing accuracy and consistency in trades. This helps to reduce human emotion and keep strategies consistent.

- Utilize pre-existing bot templates to help with quick setup, or alternatively create your own custom bots from the ground up to suit very specific trading strategies. The templates provided by 3Commas are a good starting point to understand how a strategy can be set up, and then users can customize from there.

- Regularly adjust your trading strategies based on market analysis, to help you stay in line with the market’s current state and trends. It’s important to realize that no strategy will remain profitable forever, and it is important to adapt with market changes.

Comparison with Competitors

The crypto automation space has many competitors. Here’s how 3Commas compares to other main players.

Several platforms offer similar services, including Cryptohopper, Bitsgap, and Shrimpy. Each has its unique benefits. Here’s a look:

Strengths of 3Commas

3Commas is recognized for its advanced SmartTrade tools and wide support for a number of exchanges. It also provides comprehensive trading bots, making it suitable for everyone from beginners to experts. The user-friendly interface and extensive educational resources make it a solid option for those new to automated crypto trading.

Competitor Strengths

- Cryptohopper: Is known for more sophisticated AI-driven trading strategies. This is an advantage for traders looking for a more advanced hands-off approach. Their AI bots are generally considered to be more sophisticated, as of January 2025.

- Bitsgap: Is known for specializing in arbitrage trading strategies, making it the go-to choice for users who want to benefit from price disparities between exchanges. Their core focus is on exploiting these types of market inefficiencies.

- Shrimpy: Is known for excelling in portfolio rebalancing, making it ideal for investors managing multiple portfolios across different exchanges. Shrimpy has more portfolio management features than 3Commas, making it better for users who need this functionality.

| Feature | 3Commas | Cryptohopper | Bitsgap | Shrimpy |

|---|---|---|---|---|

| SmartTrade | Excellent | Good | Good | Basic |

| Trading Bots | Comprehensive | Good | Basic | Basic |

| Exchange Support | Extensive | Good | Good | Extensive |

| AI-Driven Strategies | Moderate | Excellent | Basic | Basic |

| Arbitrage | Basic | Basic | Excellent | Basic |

| Rebalancing | Good | Basic | Basic | Excellent |

| User Interface | User-Friendly | Good | Good | Good |

| Pricing | Moderate to High | Moderate to High | Moderate | Moderate |

| Best For | All Traders | Advanced Traders | Arbitrage Traders | Portfolio Managers |

User Feedback and Reviews

What do actual users think of 3Commas? Here’s a summary of user feedback from different sources:

Positive Feedback

Users often praise the user-friendly interface and the wide range of trading bots. The ability to connect to multiple exchanges and the strong portfolio management tools are often noted as significant pluses. Many users also mention that the customer service is efficient and helpful. According to a recent Trustpilot survey of 3Commas users, 78% said they would recommend the platform to others, citing the wide range of features and high reliability as some of the main reasons why.

Criticisms

The main issue for many users is the cost, because subscription prices can be too much for beginners. Other users have mentioned that bot execution can lag during high market volatility periods. This can cause trades to execute less efficiently during heavy traffic. As of January 2025, some users have reported delays of 1-2 seconds during periods of high trading volume, which can lead to slippage.

Recent Updates

3Commas is constantly improving in response to user feedback. Recent updates include improved performance, new trading bot options, and better API connectivity. These updates help make the platform even more robust and reliable. A recent update in December 2024 included a complete overhaul of the user interface, which improved overall performance and made the platform more intuitive to use.

Conclusion

In conclusion, this 3Commas review shows the platform to be a powerful tool for automating cryptocurrency trading and portfolio management. Its features, including SmartTrade, diverse trading bots, and integration with TradingView, make it a powerful platform. While there are drawbacks, like pricing and the learning curve of some advanced features, it provides good value for those looking to automate their trading and take back valuable time.

If you want to streamline your crypto trading experience, 3Commas is worth considering. You can try the free trial to see its benefits firsthand.

Try 3Commas today and automate your crypto trading like a pro!

Disclaimer: Cryptocurrency trading involves risk. Past performance is not indicative of future results. This review is for informational purposes only and should not be considered financial advice.

Pingback: What is Binance App? A Comprehensive Guide CoinFxPro Trading Tools

Pingback: Cryptocurrency Trading Strategies: A Comprehensive Guide CoinFxPro